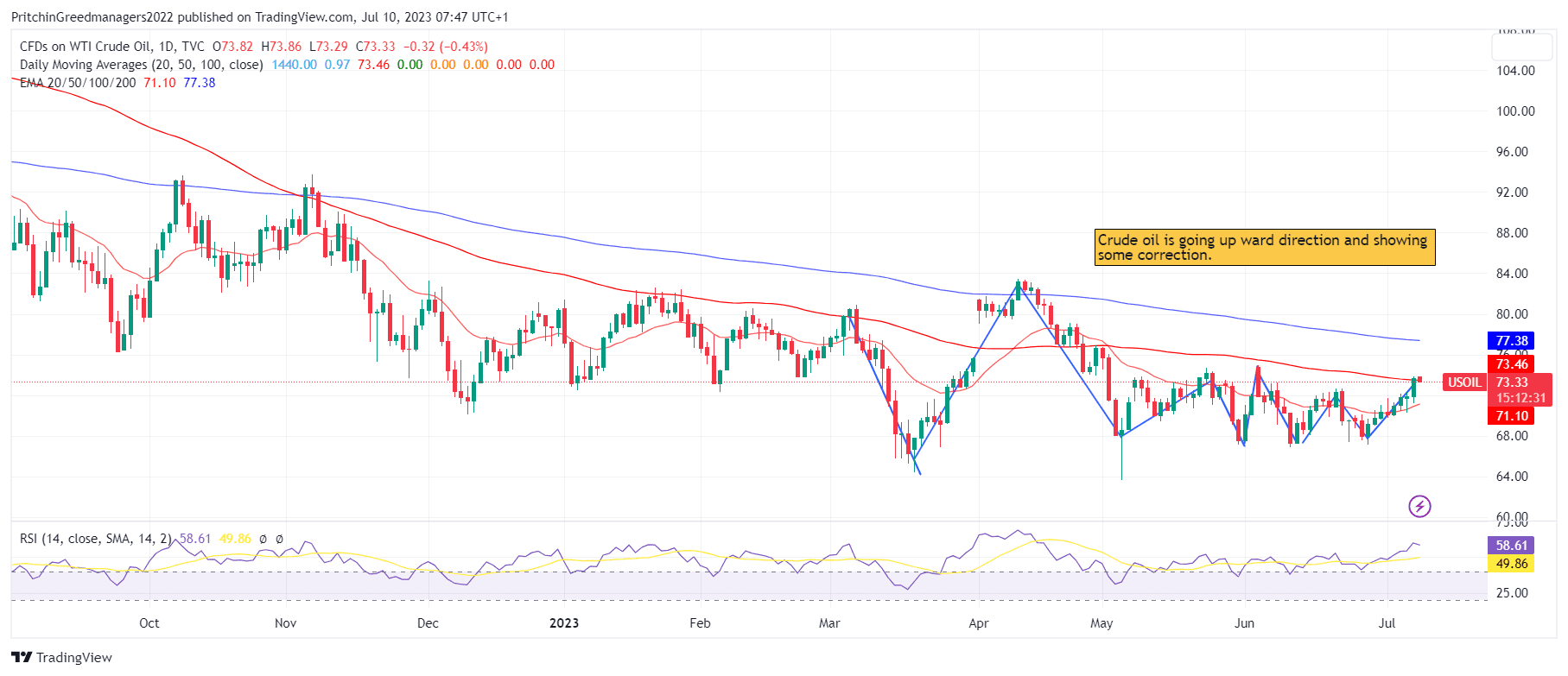

WTI Crude Oil Lures Buyers, Finds Support at 73.30 as on 10-07-2023

WTI Crude Oil (US Oil) Analysis

Key Points

- In the early Asian session, there is a noticeable increase in buyers for WTI crude oil around the $73.30 level.

- The agreement between Saudi Arabia and Russia to cut oil supply implies a positive outlook for WTI oil prices.

- The potential rise in global interest rates may result in economic growth deceleration and a subsequent decline in oil demand.

Today's Scenario: -

During the Asian trading hours on Monday, Western Texas Intermediate (WTI), the US crude oil benchmark, sees an influx of buyers near the $73.30 level. WTI crude oil is currently trading at $73.65, representing a modest 0.04% increase for the day. However, despite the recent output cuts by Saudi Arabia and Russia, concerns over tightening monetary policy by the Federal Reserve (Fed) and escalating trade tensions between the US and China may limit the potential upside for black gold.

According to the Energy Information Administration (EIA) report released on Thursday, US inventories witnessed a larger-than-expected decline of 1.5 million barrels in the week ending June 30. This indicates an improvement in oil demand, particularly during the high-demand summer season.

In the upcoming OPEC outlook, expected to be published later this month, the Organization of Petroleum Exporting Countries (OPEC) is likely to maintain an optimistic view on oil demand growth for the next year. The outlook suggests a slowdown compared to this year, but still predicts an above-average increase, as reported by Reuters.

Additionally, both Saudi Arabia and Russia, the world's largest oil exporters, have recently announced fresh output cuts. When combined with the reductions made by OPEC+ and its allies, the total cut amounts to approximately 5 million barrels per day (bpd), accounting for about 5% of global oil demand. These developments contribute to a positive outlook for WTI oil prices.

Nevertheless, concerns persist regarding the potential economic slowdown and decreased oil demand due to higher global interest rates. Market participants, as indicated by the CME Group's FedWatch Tool, are highly certain that the US Federal Reserve (Fed) will raise rates by 25 basis points (bps) during the July 25-26 policy meeting. The current odds for the rate increase stand at 92.4%, surpassing last week's 86.8%.

Furthermore, the Chinese government's announcement of new restrictions on the export of minerals used in semiconductors and solar panels poses a headwind for WTI crude oil.

Another contributing factor to consider is the softening of both the Consumer Price Index (CPI) and the Producer Price Index (PPI) in China during June. This raises concerns about the economic slowdown in the world's second-largest economy.

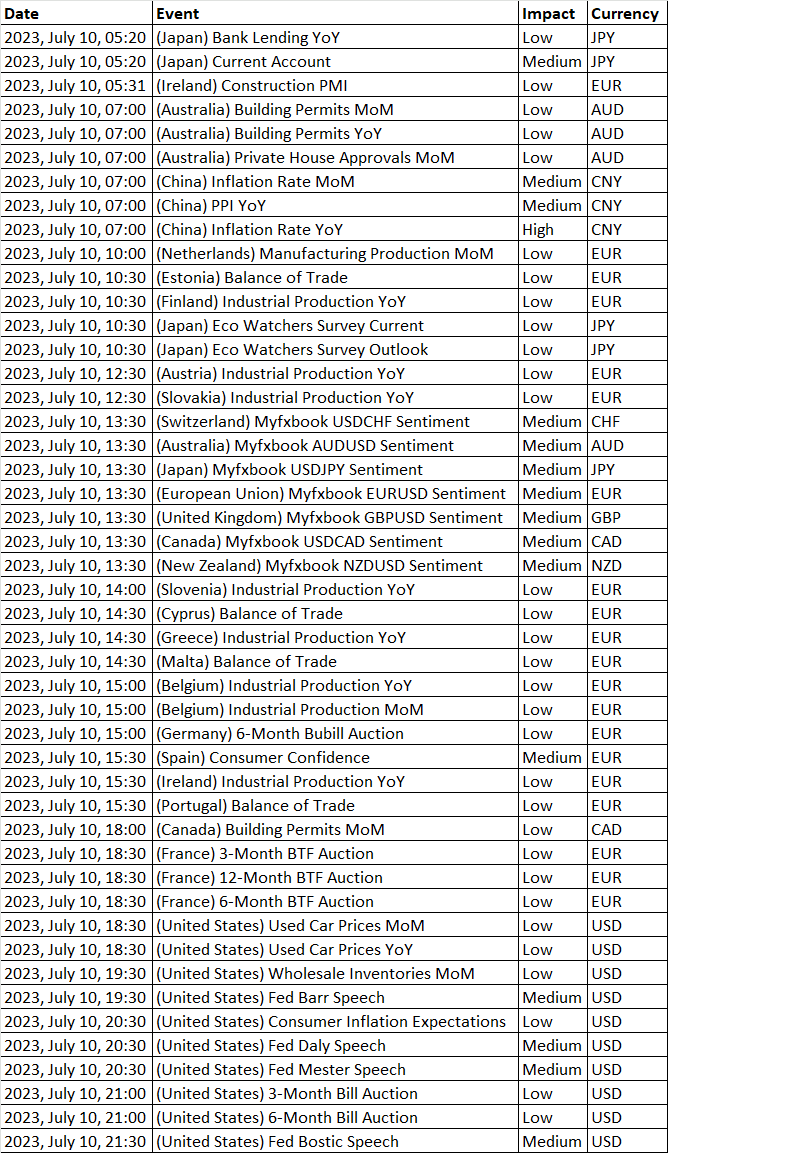

Looking ahead, the market will closely monitor the release of Crude Oil Inventories, Baker Hughes' oil rigs count, and CFTC positioning data later in the week. Additionally, the US Consumer Price Index (CPI), the Producer Price Index (PPI), and the US University of Michigan Preliminary Consumer Sentiment (July) will be published, potentially exerting a significant impact on the USD-denominated WTI price.

Diagram of WTI Crude Oil (US Oil): -

Economic Events: -

Buy Scenario: -

WTI crude oil it remains above both the 200-4H and 50-4H moving averages, indicating a bullish trend. Additionally, the 50-4H moving average is poised to surpass the 200-4H moving average, further validating the strong uptrend. The 14-4H RSI reading of 65.20 suggests the presence of bullish momentum, although buying pressure has slowed down as the market nears the overbought level of 70.

Key support levels are identified between $67.37 and $68.31, while resistance levels are observed between $74.73 and $75.06. Traders should closely monitor the price's ability to break through the resistance zone to confirm a stronger bullish trend.

Till we do not advise to buy in WTI US oil.

Selling Scenario: -

The sentiment surrounding WTI Crude Oil is currently cautiously bullish. The price in the 4-hour timeframe stands at $73.36, slightly below the previous close, indicating a minor bearish inclination. Till we did not advise to sell WTI Crude oil.

Support and Resistance Level: -

Support Resistance

S1 71.94 - R1 74.57

S2 70.26 - R2 75.53

S3 69.31 - R3 77.21

Discussion