USD/CAD Analysis: Balancing Act Above 1.3200, Lack of Conviction 17-07-2023

USD/CAD Analysis

Key Points: -

· The USD/CAD pair has experienced a recovery and is currently pausing near the 1.3220 level.

· Market expectations suggest that the Federal Reserve (Fed) will adopt a less aggressive stance in terms of tightening monetary policy following its July meeting.

· Policymakers at the Bank of Canada (BoC) have expressed their outlook that inflation will gradually ease from 3% next year, moving closer to the target of 2%.

· Market participants will closely observe the release of the Canadian Consumer Price Index (CPI) scheduled for Tuesday.

Today's Scenario: -

The USD/CAD pair has made a recovery and is holding above the 1.3220 level in the early Asian session after reaching its lowest point since September 2022. Market participants will continue to digest the latest US inflation data and keep a close watch on the upcoming Canadian Consumer Price Index (CPI), scheduled for release on Tuesday. It's important to note that the Federal Reserve (Fed) blackout period is scheduled for July 25-26.

The preliminary reading of the University of Michigan's Consumer Confidence Index has shown an increase from 64.4 in June to 72.6, surpassing the market's expectations of 65.5.

Furthermore, one-year and five-year consumer inflation expectations have risen to 3.4% and 3.1%, respectively, compared to the previous figures of 3.3% and 3%. Additionally, US consumer prices have increased by 3.0% on a yearly basis, down from the previous 4.0%, and the Producer Price Index (PPI) has shown a reading of 0.1%, down from 0.9% previously.

These data indicate that inflationary pressures in the US economy are easing, which may lead the Federal Reserve (Fed) to adopt a less aggressive approach to tightening monetary policy after the expected interest rate hike in the upcoming meeting on July 26. According to the CME FedWatch Tool, it is anticipated that the Federal Funds Rate (FFR) will remain within the range of 5.25% to 5.50% throughout 2023.

Meanwhile, the Bank of Canada (BoC) recently raised the benchmark interest rates by 25 basis points (bps) to 5.0% in its July policy meeting. BoC Governor Tiff Macklem stated that further interest rate hikes are necessary to slow down economic demand growth and alleviate price pressures. He also mentioned that the BoC expects inflation to be around 3% next year before returning to the 2% target.

Looking ahead, market participants will be closely watching the Canadian Consumer Price Index (CPI), scheduled for release on Tuesday. Additionally, the US Empire State Manufacturing Index and Retail Sales data will be released later in the week, providing further opportunities for trading around the USD/CAD pair.

Diagram of USD/CAD: -

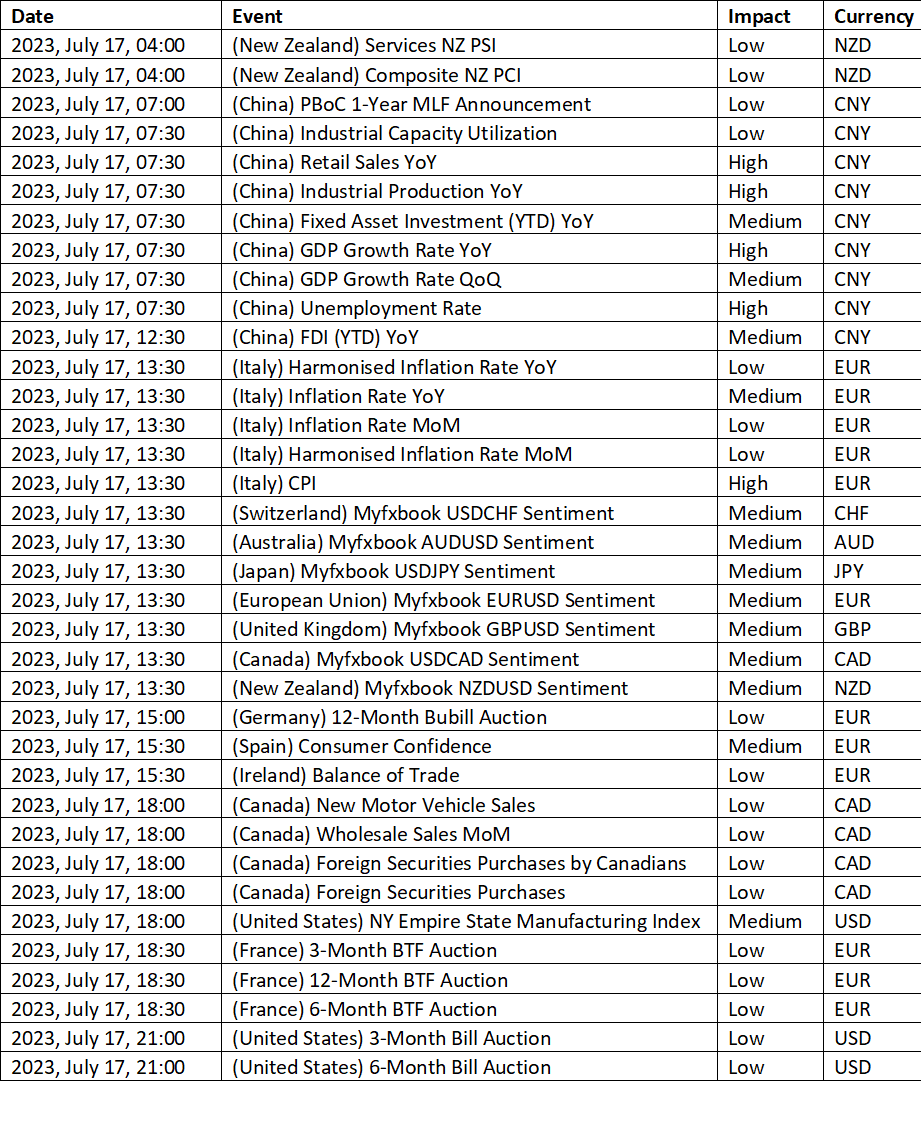

Economic Events: -

Buy Scenario: -

On the upside of USD/CSD pair, the terms of resistance, the first level at 1.3223 could pose a challenge to any upward movement in the price. This resistance level is justified by an overlap resistance and a 38.20% Fibonacci retracement. If the price manages to surpass this resistance, it might encounter the second resistance level at 1.3388, which is characterized by a swing high resistance. This level could have a notable impact on determining the future trend of the pair. Till we do not advise to buy USD/CAD.

Sell Scenario: -

The USD/CAD pair is currently displaying a bearish momentum, indicating the potential for a bearish reaction from the first resistance level, followed by a subsequent decline towards the first support level.

The first support level is situated at 1.3107 and is supported by a swing low, which is expected to provide a strong foundation for the price. If the price breaks below this level, the second support level at 1.2983 might come into play. This support level is reinforced by an overlap support and a 78.60% Fibonacci projection, making it a significant level of potential support. Till we do not advise to sell USD/CAD.

Support and Resistance Level: -

Support Resistance

S1 1.3131 - R1 1.3265

S2 1.3045 - R2 1.3313

S3 1.2997 - R3 1.3399

Discussion