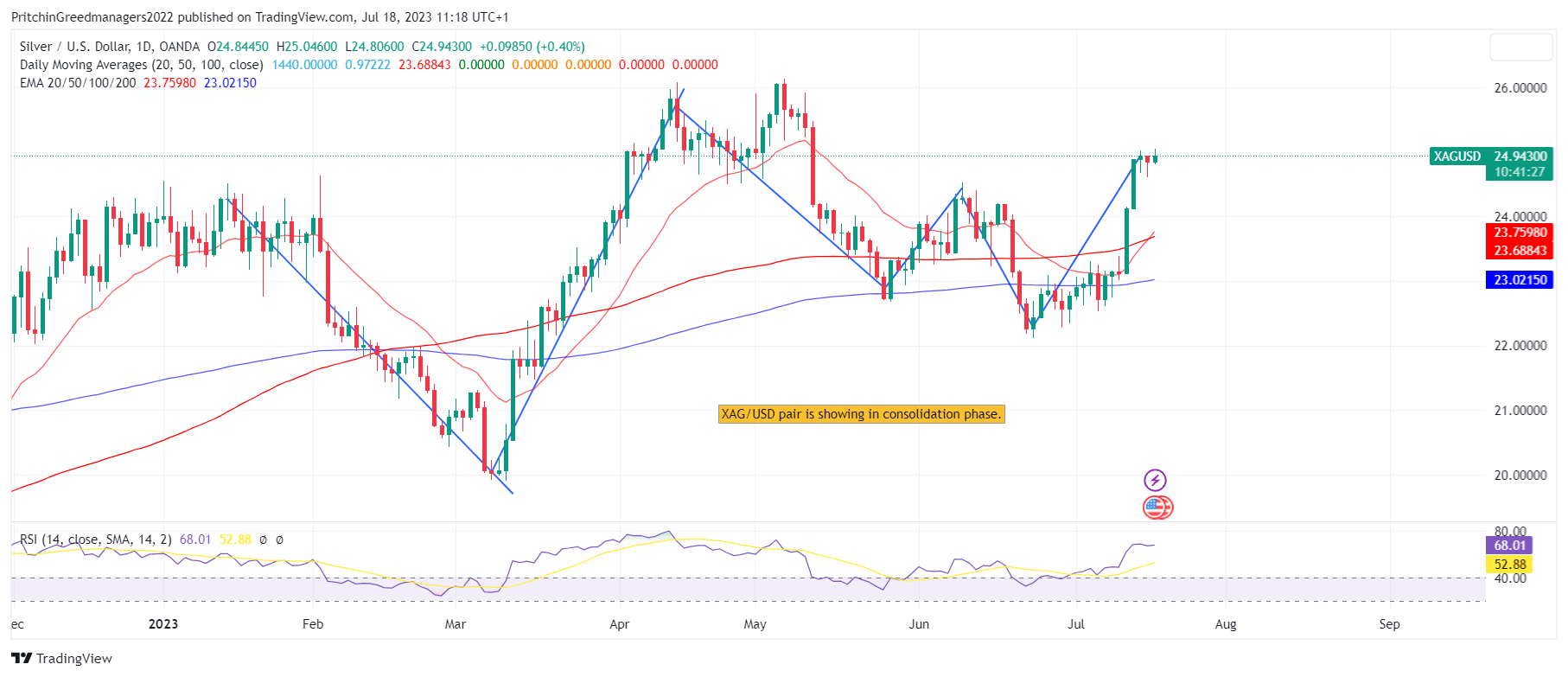

Silver Price Analysis: XAG/USD Bulls Maintain Control 18-07-2023

Sliver (XAG/USD) Analysis

Key Points: -

· Silver reached a new two-month high on Tuesday but did not see continued upward momentum.

· The current technical setup favors bullish traders and indicates potential for further gains in the price of silver.

· If there is a significant downward correction, it is more probable that buyers will step in and limit the extent of the decline.

Today's Scenario: -

Silver experienced renewed buying interest on Tuesday, leading to a climb that reached a peak surpassing the two-month mark. However, it continues to face challenges in gaining acceptance or building on the momentum above the psychologically significant level of $25.00. Nevertheless, based on the technical setup, the current indications suggest that the path of least resistance for silver is to the upside.

The sustained breakout observed last week, breaking through the static barrier at the $24.50-$24.60 range, which also aligns with the 61.8% Fibonacci retracement level of the decline experienced between May and June, served as a fresh trigger for bullish traders. Additionally, the fact that oscillators on the daily chart remain in positive territory further validates this outlook, supporting the potential for further near-term appreciation in the XAG/USD pair.

Diagram of XAG/USD (Silver): -

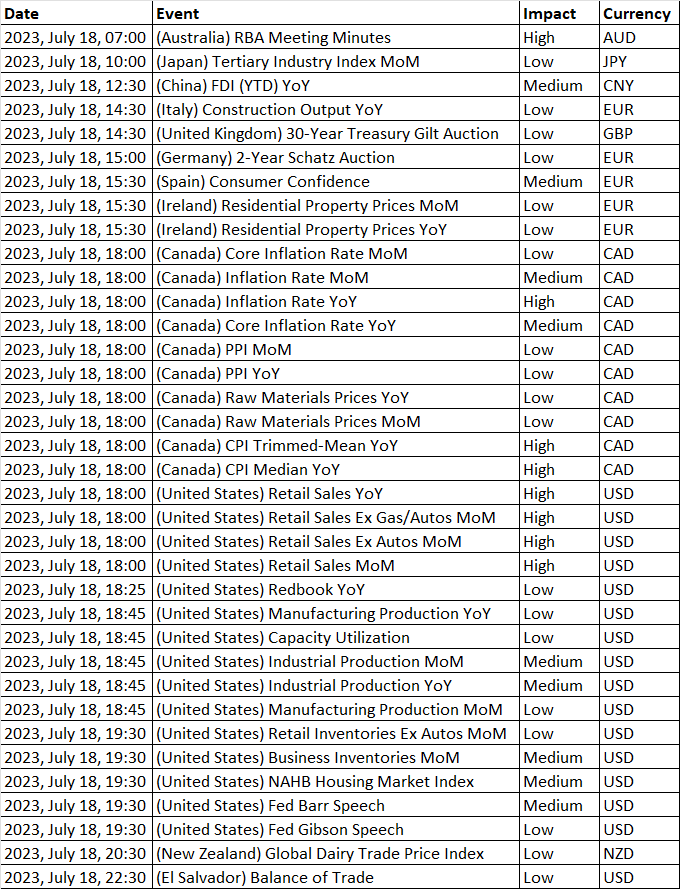

Economic Events: -

Buy Scenario: -

The upward movement in XAG/USD (silver against the US dollar) could potentially extend further towards the region of $25.50-$25.55. If the price surpasses this level, the pair might aim to reclaim the round figure of $26.00 and then challenge the year-to-date peak in the range of $26.10-$26.15, which was reached in May. Sustained buying activity would set the stage for an extension of the recent rebound from the vicinity of the $22.00 mark, which represents a three-month low reached in June. Till we did not recommend buying Silver (XAG/USD).

Sell Scenario: -

On the other hand, the immediate downside is protected by the resistance breakpoint at $24.50, corresponding to the 61.8% Fibonacci retracement level. If this level is breached, XAG/USD could slide towards testing the $24.00 mark. Further support levels are located near the $23.65-$23.60 area and the $23.20-$23.15 zone. A significant break below the round figure of $23.00 would invalidate the positive outlook and shift the bias in favor of bearish traders. Till we do not advise selling silver (XAG/USD).

Support and Resistance Level: -

Support Resistance

S1 24.65 - R1 24.99

S2 24.46 - R2 25.14

S3 24.31 - R3 25.34

Discussion