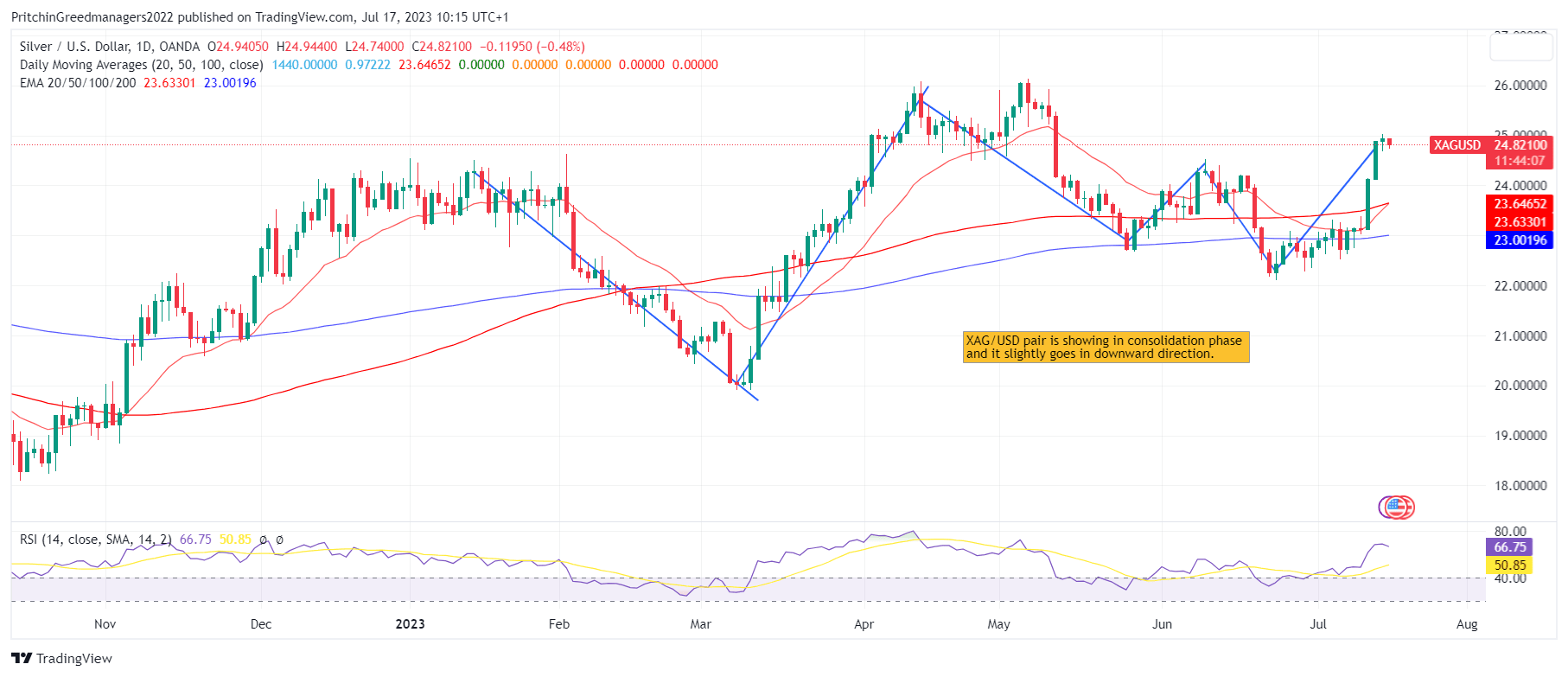

Positive Momentum Ahead: Silver Price Analysis - 17-07-2023

Sliver (XAG/USD) Analysis

Key Points: -

- The XAG/USD, or silver against the US Dollar, concludes the week with marginal gains around the $25.00 region, extending its winning streak to six consecutive days.

- Silver is poised to end the week with an impressive 8% increase, marking a substantial gain.

- The decline in the US Dollar's value halted as positive University of Michigan (UoM) data and a slight recovery in US yields provided some support.

Today's Scenario: -

The Silver Price (XAG/USD) rebounded from its intraday low, trimming its first daily loss in three days to hover around $24.90 during Monday's Asian session. Despite a corrective bounce in the US Dollar, the precious metal remains near a two-month high, primarily driven by optimistic signals from the options market.

Notably, the one-month risk reversal (RR) for the Silver price, which measures the spread between call and put options, witnessed its largest weekly gain in two months, reaching 0.540 in the latest reading. Furthermore, the daily RR has also experienced a two-day winning streak, ending Friday's North American session at approximately 0.1000, indicating traders' optimism in XAG/USD.

In addition to the options market signals, the Silver Price's upward movement is supported by a combination of mixed sentiment and concerns surrounding the Federal Reserve's potential policy pivot, as indicated by last week's US inflation data.

However, the market is currently consolidating amid the two-week blackout period for US central bank policymakers ahead of the late July monetary policy meeting. This relatively sluggish start to the week presents a challenge for XAG/USD bulls.

Diagram of XAG/USD (Silver): -

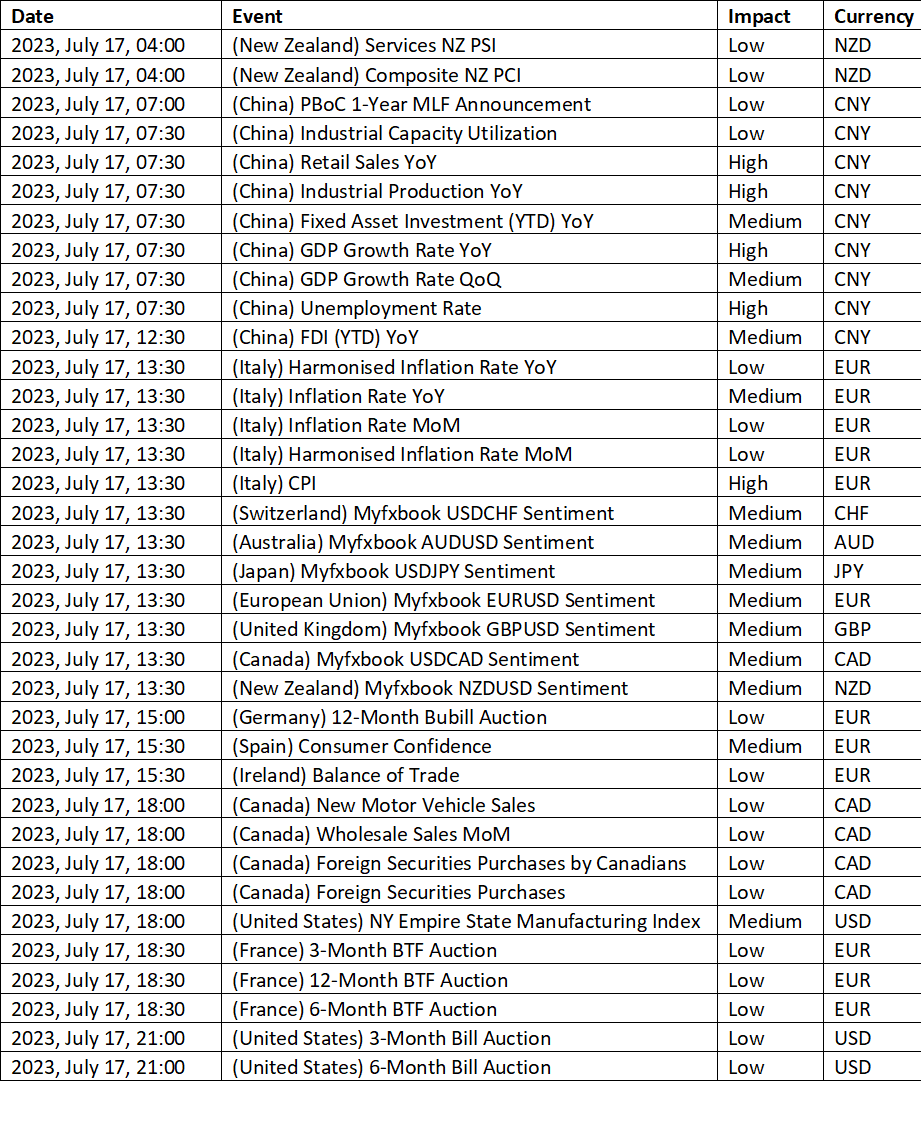

Economic Events: -

Buy Scenario: -

The EMA50 supports the continuation of the expected bullish wave on the intraday and short-term basis, noting that breaking 24.60 and holding below it will stop the positive scenario and put the price under the correctional bearish pressure again.

The expected trading range for today is between 24.40 support and 25.15 resistance. Till we did not recommend buying Silver (XAG/USD).

Sell Scenario: -

Silver price shows some bearish bias to approach testing the key support 24.60, affected by stochastic negativity, and the price needs to consolidate above this level to keep the bullish trend scenario active, which its next targets located at 25.50 followed by 26.07. Till we do not advise selling silver (XAG/USD).

Support and Resistance Level: -

Support Resistance

S1 23.43 - R1 24.15

S2 22.97 - R2 24.40

S3 22.72 - R3 24.86

Discussion