DXY Reverses: US Dollar Retreats to 102.50 - 20-07-2023

US Doller Index Analysis

Key Points: -

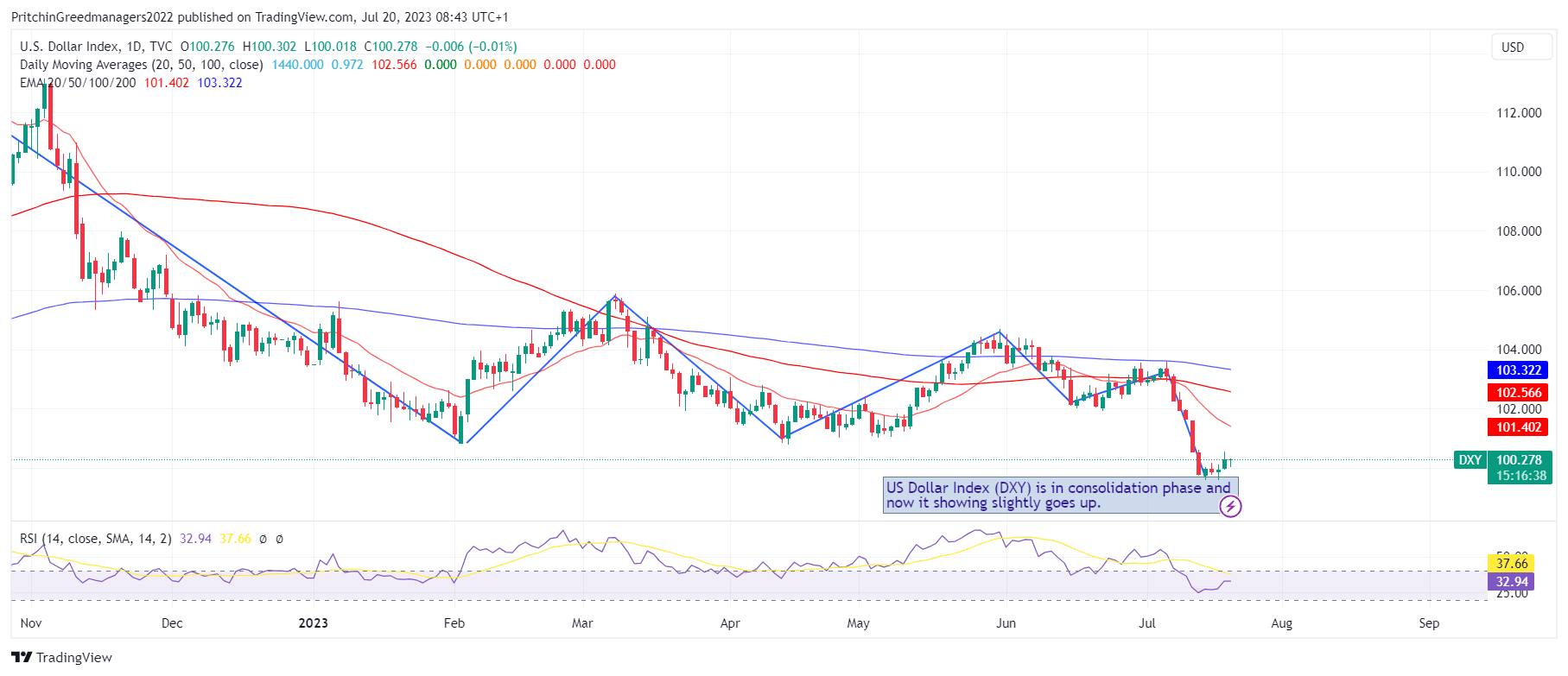

- The US Dollar Index is consolidating its first weekly gain in four sessions, trading near its intraday low.

- The US Dollar receives support from cautious optimism surrounding global growth concerns, as well as risk-positive news from China and Russia.

- Market participants are closely watching upcoming US inflation data, the US Bank Stress Test results, and central bankers' speeches from the ECB Forum for clearer directions in the market.

Today's Scenario: -

The US Dollar Index (DXY) is facing selling pressure, leading to a pullback from its recent weekly gains around 102.70 during the early Monday morning in Asia. The consolidation in the US Dollar's value against six major currencies comes amid slightly positive market sentiment and preparations for upcoming top-tier US data and key central bankers' speeches.

The uncertainty surrounding Russian President Vladimir Putin's power in Moscow and hopes of significant stimulus from China have contributed to cautious optimism and weighed on the US Dollar. There are concerns about Putin's grip on power after heavily armed Russian mercenaries withdrew from Rostov, which halted their advance on Moscow but raised questions about the situation.

Ning Jizhe, a high-ranking Chinese official, flagged concerns about the need for additional stimulus to bolster the Chinese economy, leading to some optimism in the markets. However, some major investors have paused their optimism in China, and hawkish comments from Fed officials, along with relatively positive US data, have kept the DXY buyers hopeful.

The mixed US S&P Global PMIs for June have led to discussions about potential rate hikes, with some Fed officials suggesting two more this year. This has impacted sectors like services, which are sensitive to changes in borrowing costs.

Despite the positive headlines from China and Russia, the US Dollar Index bulls remain hopeful, with potential risks arising from US inflation data and central bankers' speeches at the European Central Bank (ECB) Forum and US Bank Stress Test results.

Overall, the DXY's performance will continue to be influenced by economic data, central bank actions, geopolitical developments, and market sentiment.

Diagram of US Dollar Index (DXY): -

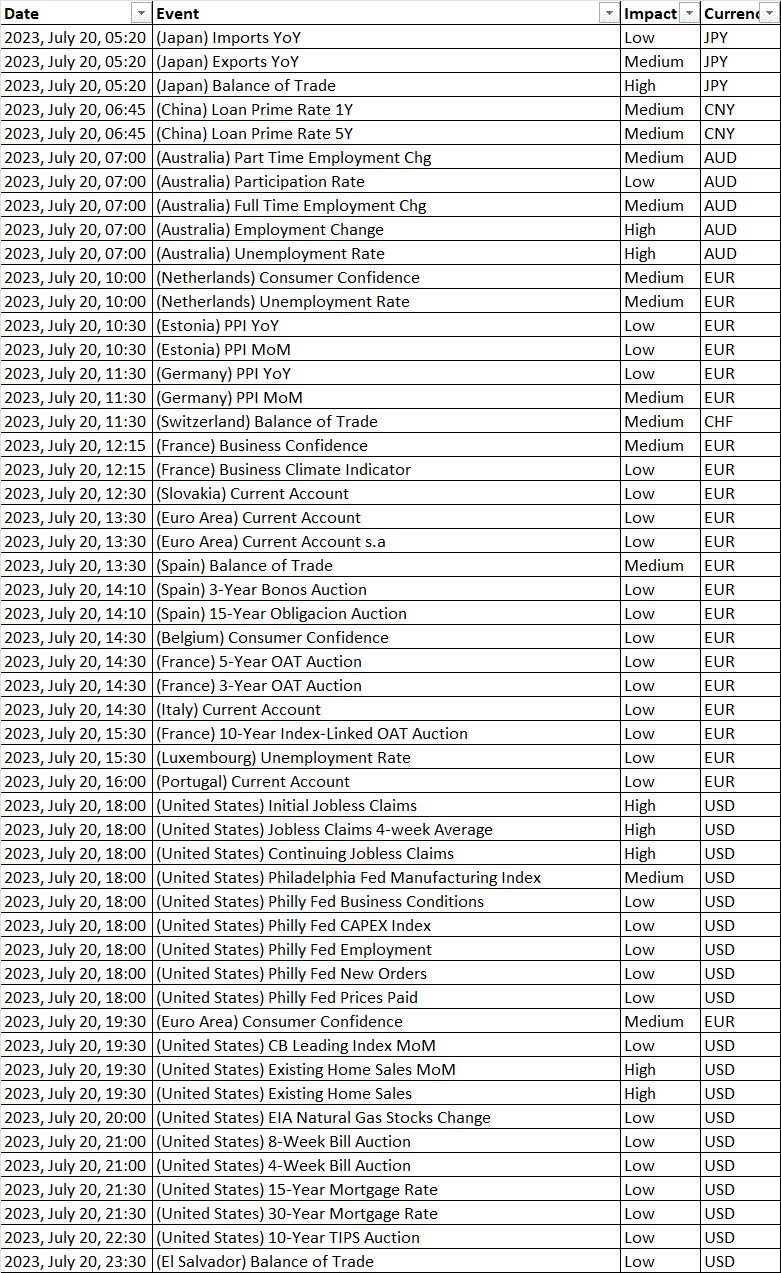

Economic Events : -

Buy Scenario: -

On the upside, the first resistance level at 100.84 could act as a barrier to any upward movement, as it is considered a pullback resistance. Additionally, there is an intermediate resistance at 100.53, which is recognized as a swing high resistance.

Investors should closely monitor price action around these support and resistance levels to gauge the DXY's future direction. Till we do not advise to buy US Dollar Index.

Sell Scenario: -

The DXY chart shows a bearish momentum, indicating the potential for further downward movement towards the first support level at 99.42. This level is significant as it is an overlap support and may attract buying interest. Additionally, there is an intermediate support at 99.65, which is a multi-swing low support. Till we do not advise to sell in US Dollar Index

Support and Resistance Level: -

Support Resistance

S1 99.95 - R1 100.57

S2 99.62 - R2 100.87

S3 99.32 - R3 101.20

Discussion