Daily Analysis For USD/JPY 12-06-2023

USD/JPY Analysis

Key Points: -

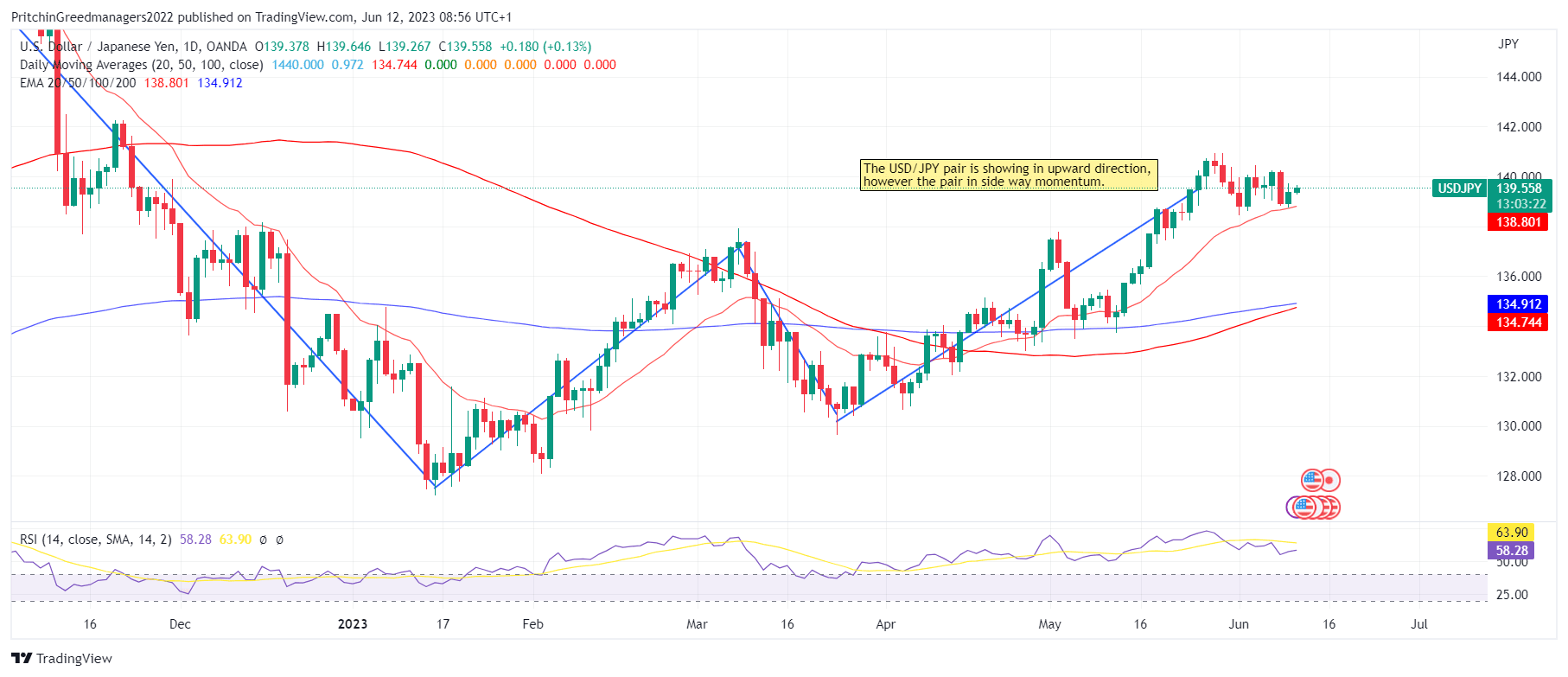

· The USD/JPY pair continues to climb for the second consecutive day, although the potential for further upside appears limited.

· The Japanese Yen is weighed down by expectations that the Bank of Japan (BoJ) will maintain its dovish stance, which acts as a favorable factor.

· A modest strengthening of the US Dollar further provides support and contributes to the slight intraday increase.

· Traders may exercise caution and avoid placing new bets ahead of significant central bank events scheduled for this week.

Today's Scenario: -

As Tokyo opens on Monday, the USD/JPY pair is experiencing mild losses around 139.30, consolidating the gains made in the previous day. This reflects the cautious sentiment prevailing in the market ahead of significant data and events scheduled for this week, including the monetary policy meetings of the Bank of Japan (BoJ) and the US Federal Reserve (Fed), as well as the release of US inflation data.

It is worth noting that the recent decline in the risk-sensitive pair does not align with disappointing inflation indications from Japan and dovish comments from a BoJ official.

In terms of economic data, Japan's Producer Price Index (PPI) for May declined for the fifth consecutive month, coming in at 5.1% YoY compared to the previous reading of 5.8% and market expectations of 5.5%. Additionally, the monthly figures fell short of Yen traders' expectations, recording a -0.7% MoM outcome, contrary to the forecast of -0.2% and the previous reading of 0.2%.

On the other hand, BoJ Deputy Governor Masazumi Wakatabe emphasized that there will be no changes to the BoJ's monetary policy during this week's meeting, stating, "Don't expect a change from BOJ at this week's meeting."

Meanwhile, the US Dollar Index (DXY) has faced declines in the past two weeks, hovering indecisively around 103.56 most recently. Weaker US economic indicators for May, including disappointing employment figures and downbeat US activity numbers, have weighed on the US Dollar. Notably, the latest United States Initial Jobless Claims reached the highest level since September 2021, while US ISM Services PMI, S&P Global PMIs, and Factory Orders also revealed softer outcomes for May. These factors have dampened the hawkish sentiment towards the Federal Reserve, consequently pressuring the US Dollar.

Amidst these developments, US Treasury bond yields have struggled to extend their upward trajectory from the previous week, while S&P500 Futures have managed to mirror the gains of Wall Street. This dynamic should provide some support to the USD/JPY pair due to its status as a risk barometer.

Looking ahead, the USD/JPY pair may witness limited intraday movements on Monday due to a light economic calendar. However, Tuesday's US inflation data will be crucial for traders of the Yen pair as they seek clearer directional cues. It is anticipated that both the BoJ and the Fed will maintain their current monetary policies, but there is a high probability of a hawkish pause from the Fed. Therefore, any surprises or reaffirmation of a hawkish bias by Jerome Powell could revive the bullish sentiment for the USD/JPY pair.

Diagram of USD/JPY: -

Economic Events: -

Date Event Impact Currency

04:15 (New Zealand) Electronic Retail Card Spending YoY Low NZD

04:15 (New Zealand) Electronic Retail Card Spending MoM Low NZD

05:20 (Japan) PPI YoY Low JPY

05:20 (Japan) PPI MoM Low JPY

05:31 (Ireland) Construction PMI Low EUR

10:30 (Finland) Current Account Low EUR

11:30 (Japan) Machine Tool Orders YoY Low JPY

12:30 (Slovakia) Construction Output YoY Low EUR

13:30 (China) Total Social Financing Low CNY

13:30 (China) New Yuan Loans Low CNY

13:30 (China) M2 Money Supply YoY Low CNY

13:30 (China) Outstanding Loan Growth YoY Low CNY

13:30 (Switzerland) Myfxbook USDCHF Sentiment Medium CHF

13:30 (Australia) Myfxbook AUDUSD Sentiment Medium AUD

13:30 (Japan) Myfxbook USDJPY Sentiment Medium JPY

13:30 (European Union) Myfxbook EURUSD Sentiment Medium EUR

13:30 (United Kingdom) Myfxbook GBPUSD Sentiment Medium GBP

13:30 (Canada) Myfxbook USDCAD Sentiment Medium CAD

13:30 (New Zealand) Myfxbook NZDUSD Sentiment Medium NZD

15:15 (European Union) EU Bond Auction Low EUR

15:15 (European Union) 15-Year Bond Auction Low EUR

18:30 (Ecuador) Balance of Trade Low USD

18:30 (France) 3-Month BTF Auction Low EUR

18:30 (France) 12-Month BTF Auction Low EUR

18:30 (France) 6-Month BTF Auction Low EUR

20:30 (Kosovo) Inflation Rate YoY Low EUR

20:30 (United States) Consumer Inflation Expectations Low USD

21:00 (United States) 6-Month Bill Auction Low USD

21:00 (United States) 3-Year Note Auction Low USD

22:30 (United States) 3-Month Bill Auction Low USD

22:30 (United States) 10-Year Note Auction Low USD

23:30 (United States) Monthly Budget Statement Medium USD

Buy Scenario: -

if the pivot level holds and upside momentum strengthens, it suggests that buyers are actively pursuing the USD/JPY pair. This could generate the necessary momentum to challenge the resistance level at 139.82 (R1). It's important to be cautious of potential counter-trend sellers when the price tests this level for the first time.

In summary, there is a bias towards the upside, and the outcome of the news events on Tuesday or Wednesday will likely determine whether it is favorable to buy on a pullback towards a value area or to chase strength driven by news releases. Till we did not advise to buy in USD/JPY.

Sell Scenario: -

The USD/JPY pair has been trading within the range of 139.82 (R1) and 139.29 (PIVOT) for the past three weeks. This indicates a lack of clear direction from investors and suggests an upcoming period of increased volatility. Traders are awaiting a catalyst that could potentially come from this week's Consumer Price Index (CPI) report or the Federal Reserve's interest rate decision.

The midpoint of the range, at 139.38, is currently a key level that the Forex pair is hovering around, indicating neutral momentum.

Considering the main trend is upward, buyers are likely to enter the market on a pullback towards the 139.29 (PIVOT) level as they search for value. However, if this level fails to hold, it could trigger a short-term decline towards 138.86 (S1). Till we did not advise to sell the position in USD/JPY.

Support and Resistance Level: -

Support Resistance

S1 138.86 - R1 139.82

S2 138.33 - R2 140.26

S3 137.89 - R3 140.79

Discussion