Daily Analysis For USD/CHF 19-06-2023

USD/CHF Analysis

Key Points: -

· Amidst lackluster market conditions, the USD/CHF pair is holding onto modest gains, as bullish momentum remains subdued.

· The US Dollar is gradually advancing, although sentiment appears somewhat subdued due to concerns surrounding the Federal Reserve.

· Immediate movements are constrained by the holiday observed in US stock and bond markets, resulting in a mix of catalysts.

· Clear directions for the market will heavily rely on significant events such as the SNB Interest Rate Decision, Fed Chair Powell's Testimony, and the release of US PMIs.

Today's Scenario: -

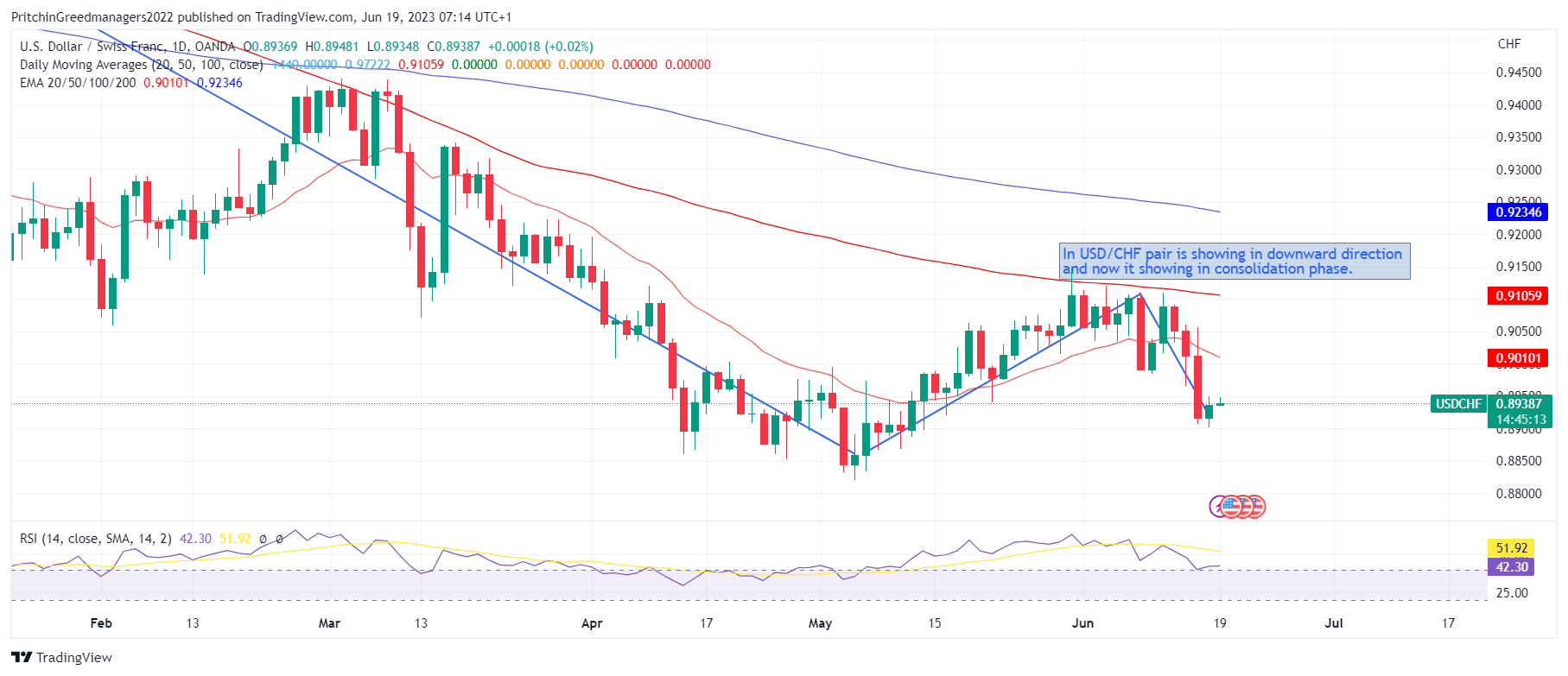

As Monday's European session begins, the USD/CHF pair remains defensive around the 0.8940-45 level, retracing its bounce from a five-week low seen in the previous day. The market appears indecisive, reflecting the impact of the US Juneteenth holiday and a cautious sentiment ahead of the upcoming monetary policy meeting by the Swiss National Bank (SNB).

The holiday in US stocks and bond markets, along with mixed concerns surrounding the Federal Reserve (Fed) and SNB, are influencing traders of the USD/CHF pair in the absence of significant events. The US Dollar gains support from hawkish comments made by Fed policymakers and the latest report submitted by the central bank to Congress. Meanwhile, expectations of further rate hikes from the SNB weigh on the Swiss Franc (CHF).

SNB Governor Thomas Jordan emphasized the importance of achieving price stability by bringing Swiss inflation to an appropriate level. He expressed readiness to raise rates prior to an inflationary surge. Conversely, Richmond Fed President Thomas Barkin cautioned against excessive rate hikes, fearing a potential economic slowdown. Despite this, Barkin acknowledged the Fed's ability to effectively manage the resilient US economy, leading to a rise in 2-year Treasury bond yields and a recovery in the US Dollar. Other Fed officials, including Chicago Fed President Austan Goolsbee and Federal Reserve Governor Christopher Waller, also conveyed slightly hawkish tones, contributing to the rebound of the DXY from its multi-day low. Furthermore, the Fed's Monetary Policy Report to the US Congress, released on Friday, highlighted elevated inflation and a tight labor market in the United States.

It is important to note that recent news of multiple banks revising down China's growth forecasts has dampened market risk appetite and influenced the USD/CHF price.

Additionally, mixed US data and hopes for further stimulus from China, coupled with reduced tensions between the US and China during recent diplomatic talks, have contributed to a risk-off sentiment and limited upside for the USD/CHF bulls.

Looking ahead, the closure of US markets, combined with pre-SNB anxiety, is expected to constrain the USD/CHF movements. While a 0.25% rate hike by the SNB is anticipated, surprises cannot be ruled out, potentially prompting selling pressure on the pair. However, Fed Chair Jerome Powell's upcoming bi-annual Testimony has the potential to reinforce a hawkish stance, challenging the sellers. Furthermore, preliminary PMIs for June will play a crucial role in determining short-term market direction.

Diagram of USD/CHF: -

Economic Events : -

Date Event Impact Currency

04:00 (New Zealand) Services NZ PSI Low NZD

04:00 (New Zealand) Composite NZ PCI Low NZD

05:30 (United States) Juneteenth None USD

09:05 (Japan) 52-Week Bill Auction Low JPY

13:30 (Australia) Myfxbook AUDUSD Sentiment Medium AUD

13:30 (Switzerland) Myfxbook USDCHF Sentiment Medium CHF

13:30 (Japan) Myfxbook USDJPY Sentiment Medium JPY

13:30 (European Union) Myfxbook EURUSD Sentiment Medium EUR

13:30 (United Kingdom) Myfxbook GBPUSD Sentiment Medium GBP

13:30 (Canada) Myfxbook USDCAD Sentiment Medium CAD

13:30 (New Zealand) Myfxbook NZDUSD Sentiment Medium NZD

13:30 (Euro Area) ECB Survey of Monetary Analysts Low EUR

15:00 (Germany) 12-Month Bubill Auction Low EUR

16:00 (Portugal) Current Account Low EUR

16:30 (Euro Area) ECB Lane Speech Low EUR

17:10 (Euro Area) ECB Schnabel Speech Low EUR

18:00 (Canada) PPI YoY Low CAD

18:00 (Canada) PPI MoM Low CAD

18:00 (Canada) Raw Materials Prices YoY Low CAD

18:00 (Canada) Raw Materials Prices MoM Low CAD

18:30 (France) 3-Month BTF Auction Low EUR

18:30 (France) 12-Month BTF Auction Low EUR

18:30 (France) 6-Month BTF Auction Low EUR

19:30 (United States) NAHB Housing Market Index Medium USD

23:30 (Euro Area) ECB Guindos Speech High EUR

Buy Scenario: -

The USD/CHF pair remains biased towards a downward trajectory but is currently consolidating near the 0.8900 level. During the session, the pair experienced a decline from around the 61.8% Fibonacci Retracement (FR) level towards the 78.6% FR level. However, it failed to breach the 0.8900 mark, which would have increased the likelihood of further losses and a potential test of the year-to-date low at 0.8819.

As the USD/CHF rebounds towards the 61.8% FR level at 0.8949, buyers will need to overcome this hurdle to drive rates towards the psychological level of 0.9000. If successful, the next resistance levels for the pair would be the 50% FR at 0.8983, followed by the 0.9000 mark. Till we do not advise to buy USD/CHF.

Sell Scenario: -

On the contrary, if the USD/CHF drops below 0.8900 and breaches the 78.6% FR level, it would expose the year-to-date low at 0.8819. This downward movement aligns with the indications from oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC), which suggest the path of least resistance favors further downside potential. Till we do not advise to sell USD/CHF.

Support and Resistance Level: -

Support Resistance

S1 0.8911 - R1 0.8959

S2 0.8882 - R2 0.8978

S3 0.8863 - R3 0.9007

Discussion