Daily Analysis For USD/CHF 12-06-2023

USD/CHF Analysis

Key Points: -

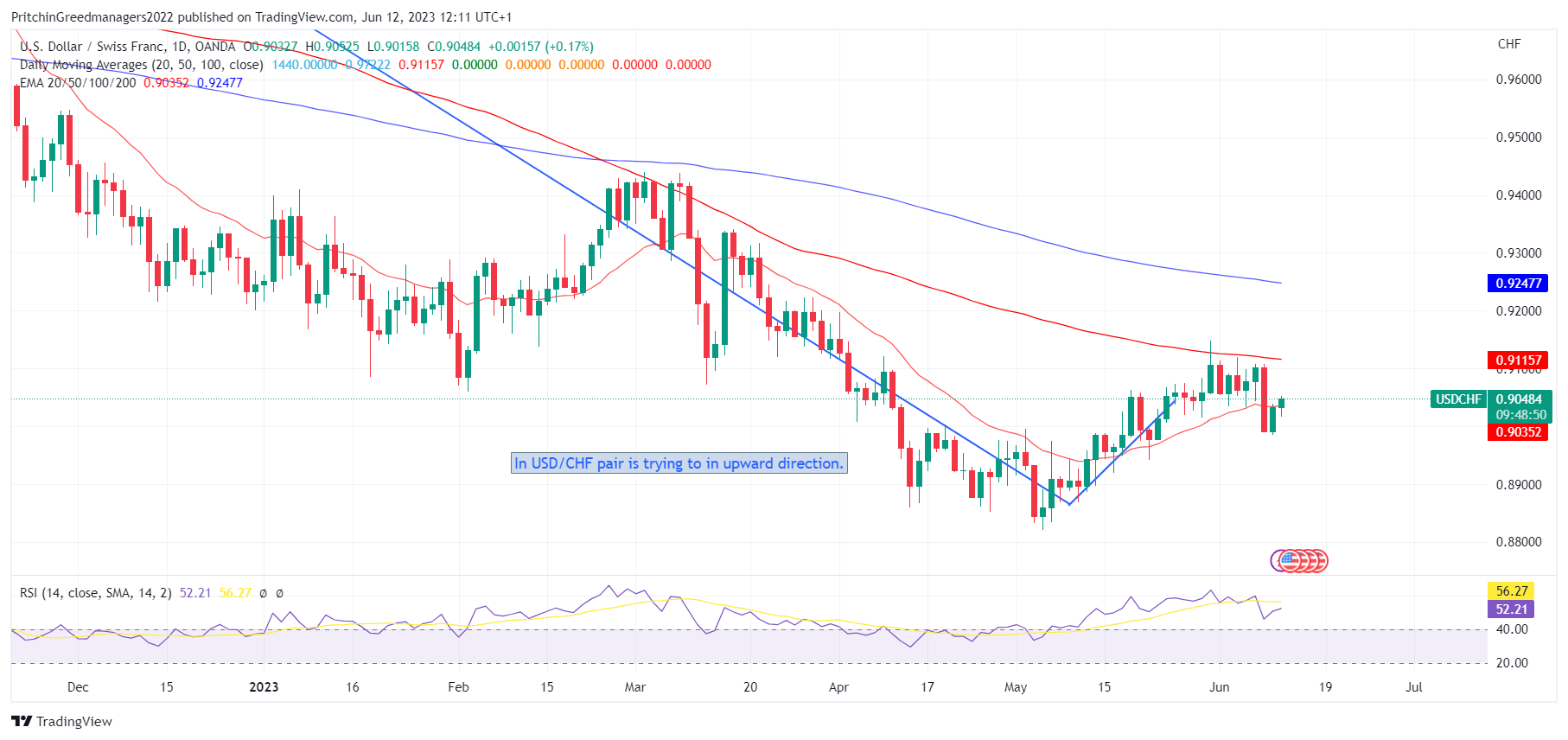

· The USD/CHF pair has encountered strong resistance levels above 0.9020 as the recent recovery in the US Dollar Index has reached its peak. The US Dollar Index refers to the value of the US dollar against a basket of other major currencies.

· The sell-off in the US Dollar Index is driven by investor expectations that the Federal Reserve may choose to refrain from raising interest rates in June. This sentiment has put pressure on the US dollar and impacted its strength against other currencies, including the Swiss franc.

· Despite the market expectations, the International Monetary Fund (IMF) maintains its belief that the Federal Reserve and other central banks around the world will continue with their plans to tighten monetary policy. Tightening monetary policy refers to actions taken by central banks to reduce the amount of money supply or increase interest rates in order to control inflation and maintain economic stability.

Today's Scenario: -

The USD/CHF pair has encountered strong resistance around the 0.9020 level after a recovery attempt during the late European session. The Swiss Franc has resumed its downward movement as the US Dollar Index (DXY) has retreated. The sell-off in the USD Index is driven by investor expectations that the Federal Reserve (Fed) may choose to skip hiking interest rates in June.

Market sentiment has turned positive as S&P 500 futures have fully recovered their earlier losses in Europe. This shift in mood is based on expectations that the Fed will adopt a neutral interest rate policy and pause interest rate increases for the first time in 15 months. Economists surveyed by Bloomberg anticipate that the Fed will maintain its policy stance through December, despite a strong US economy and persistent inflation.

In contrast to market expectations, the International Monetary Fund (IMF) has expressed support for global central banks to continue their policy tightening measures to address inflation. IMF spokesperson Julie Kozack emphasized the importance of central banks remaining committed to controlling inflation.

The USD Index has faced significant selling pressure after reaching near 103.60, as a potential unchanged policy stance by the Fed would limit the upside potential for the index. Meanwhile, US Treasury yields have continued to rise, with the yield on 10-year US Treasury bonds surpassing 3.76%.

When comparing the USD/CHF pair with the USD Index, it can be observed that the correction in the USD Index has been more pronounced than in the Swiss Franc. This may be attributed to the hawkish comments made by Swiss National Bank (SNB) Chairman Thomas J. Jordan. SNB Jordan emphasized the importance of achieving price stability and indicated that waiting for inflation to rise before raising interest rates would not be advisable. It is worth noting that the SNB has already raised interest rates to 1.50%.

Overall, the USD/CHF pair has faced strong resistance around 0.9020, driven by the retreat in the USD Index and market expectations of a possible pause in interest rate hikes by the Fed. The differing views between the IMF and market sentiment add further complexity to the outlook for the pair.

Diagram of USD/CHF: -

Economic Events : -

Date Event Impact Currency

4:15 (New Zealand) Electronic Retail Card Spending YoY Low NZD

4:15 (New Zealand) Electronic Retail Card Spending MoM Low NZD

5:20 (Japan) PPI YoY Low JPY

5:20 (Japan) PPI MoM Low JPY

5:31 (Ireland) Construction PMI Low EUR

10:30 (Finland) Current Account Low EUR

11:30 (Japan) Machine Tool Orders YoY Low JPY

12:30 (Slovakia) Construction Output YoY Low EUR

13:30 (China) Total Social Financing Low CNY

13:30 (China) New Yuan Loans Low CNY

13:30 (China) M2 Money Supply YoY Low CNY

13:30 (China) Outstanding Loan Growth YoY Low CNY

13:30 (Switzerland) Myfxbook USDCHF Sentiment Medium CHF

13:30 (Australia) Myfxbook AUDUSD Sentiment Medium AUD

13:30 (Japan) Myfxbook USDJPY Sentiment Medium JPY

13:30 (European Union) Myfxbook EURUSD Sentiment Medium EUR

13:30 (United Kingdom) Myfxbook GBPUSD Sentiment Medium GBP

13:30 (Canada) Myfxbook USDCAD Sentiment Medium CAD

13:30 (New Zealand) Myfxbook NZDUSD Sentiment Medium NZD

15:15 (European Union) EU Bond Auction Low EUR

15:15 (European Union) 15-Year Bond Auction Low EUR

18:30 (Ecuador) Balance of Trade Low USD

18:30 (France) 3-Month BTF Auction Low EUR

18:30 (France) 12-Month BTF Auction Low EUR

18:30 (France) 6-Month BTF Auction Low EUR

20:30 (Kosovo) Inflation Rate YoY Low EUR

20:30 (United States) Consumer Inflation Expectations Low USD

21:00 (United States) 6-Month Bill Auction Low USD

21:00 (United States) 3-Year Note Auction Low USD

22:30 (United States) 3-Month Bill Auction Low USD

22:30 (United States) 10-Year Note Auction Low USD

23:30 (United States) Monthly Budget Statement Medium USD

Buy Scenario: -

The USD/CHF pair continues to gain strength for the second consecutive day, rising to around 0.9045 during early Monday trading. The pair has rebounded from the key 200-period Simple Moving Average (SMA) last week and is currently showing mild bullish momentum, as indicated by the impending bull cross on the Moving Average Convergence Divergence (MACD) indicator.

With the pair maintaining its bounce from the key moving average and the positive signals from the MACD, there is a likelihood that the USD/CHF pair will extend its recent rebound towards the previous support line, which can be traced back to early May and is currently around 0.9080.

However, before gaining full control, buyers of the pair will face a challenge from a one-week-old ascending resistance line located near the psychological level of 0.9100.

If the pair manages to hold firm above 0.9100, there is a possibility of a rally towards the previous monthly high around 0.9150. Till we do not advise to buy USD/CHF.

Sell Scenario: -

On the downside, the pair's short-term decline is likely to find support near the 38.2% Fibonacci retracement level of the upside move from May to June, which is currently around 0.9020. The psychological level of 0.9000 will also act as a magnet for the pair's downside movement.

Further downside pressure on the USD/CHF pair will face additional support from the 200-period SMA around 0.8990, followed by the 50% Fibonacci retracement level near 0.8980.

If the bears gain control and push the pair below 0.8980, they will aim to challenge the yearly low reached in May around 0.8820. Till we do not advise to sell USD/CHF.

Support and Resistance Level: -

Support Resistance

S1 0.8998 - R1 0.9053

S2 0.8964 - R2 0.9074

S3 0.8943 - R3 0.9108

Discussion