Daily Analysis For EUR/USD 19-06-2023

EUR/USD Analysis

Key Points: -

· The EUR/USD is currently hovering near a five-week high following a substantial weekly gain, marking its strongest performance since January.

· Amid a slow session and positive market sentiment, the European Central Bank (ECB) takes a more hawkish stance compared to the Federal Reserve (Fed), instilling hope among Euro buyers.

· Despite hawkish comments from the Fed, mixed data from the United States and the potential for a policy pivot by the central bank outweigh such talks, favoring bullish momentum for the EUR/USD.

· With the Juneteenth holiday, both the US stock and bond markets remain closed, leading to limited market activity and potential constraints on market movements.

Today's Scenario: -

EUR/USD continues to trade near 1.0950, with buyers seeking further indications while maintaining control at levels not seen in over a week. The Euro pair experienced its most significant surge since early January during the previous week, as the European Central Bank (ECB) adopted a more hawkish stance compared to the Federal Reserve (Fed). The Euro bulls were also supported by a combination of mixed US data and diminishing concerns of an economic slowdown. However, it is worth noting that Friday's positive US data and hawkish signals from the Fed tested the resilience of EUR/USD buyers at levels not seen since early May, before the subsequent lack of action at the top.

The observance of the Juneteenth holiday in the US, coupled with a light economic calendar, restricts immediate movements in the EUR/USD, even as recent headlines regarding China maintain market optimism and exert downward pressure on the US Dollar.

In related news, US Secretary of State Antony Blinken and Chinese Foreign Minister Qin Gang held candid and constructive talks on Sunday, discussing differences ranging from Taiwan to trade. However, the two parties seemed to have little consensus, except for agreeing to continue the dialogue and arranging a future meeting in Washington, according to Reuters. Furthermore, the South China Morning Post (SCMP) quoted the China State Council, signaling positive developments for market sentiment. The Council revealed that it has considered a series of macroeconomic policies aimed at boosting effective demand, strengthening the real economy, and mitigating risks in key areas.

On the other hand, German Chancellor Olaf Scholz faces a delicate balancing act during this week's German-Chinese government consultations in Berlin, as reported by Reuters. The news also indicates that the German leader is striving to maintain good relations with Germany's largest trading partner while adhering to a G7 commitment to reduce risk exposure to Beijing.

Last Friday, the preliminary readings of the University of Michigan (UoM) Consumer Sentiment Index (CSI) for June showed improvement, while US inflation expectations eased, tempering the strength of the US Dollar bulls. Furthermore, recent comments from Fed policymakers, who have adopted a more hawkish stance, have posed challenges for EUR/USD bulls.

The latest US Federal Reserve (Fed) Monetary Policy Report to the US Congress, published on Friday, stated that inflation in the US is well above target and the labor market remains tight, as reported by Reuters. The report also mentioned considerable uncertainty regarding the outlook for the funds rate.

Additionally, Richmond Fed President Thomas Barkin cautioned that further rate hikes could pose a risk of a more significant economic slowdown. However, he also noted that the Fed has ample room to take measures to moderate the resilient US economy. This triggered an increase in the 2-year Treasury bond yields to 4.75% and provided support for the US Dollar.

In other news, Federal Reserve Governor Christopher Waller remarked on Friday that the US economy is still performing strongly, adding that the US banking system appears to be calm, as reported by Reuters.

Meanwhile, despite mostly negative data in the Eurozone and Germany, the ECB's 0.25% rate hike and its readiness to raise rates further in July allowed the Euro to overlook these concerns. This week's preliminary PMI data for June will be crucial in providing clear direction. If the activity data shows signs of easing, the EUR/USD may experience the anticipated pullback. It will also be important to monitor Fed Chair Powell's testimony, as recent concerns regarding the possibility of the July rate hike being the last from the US central bank have weighed on the US Dollar.

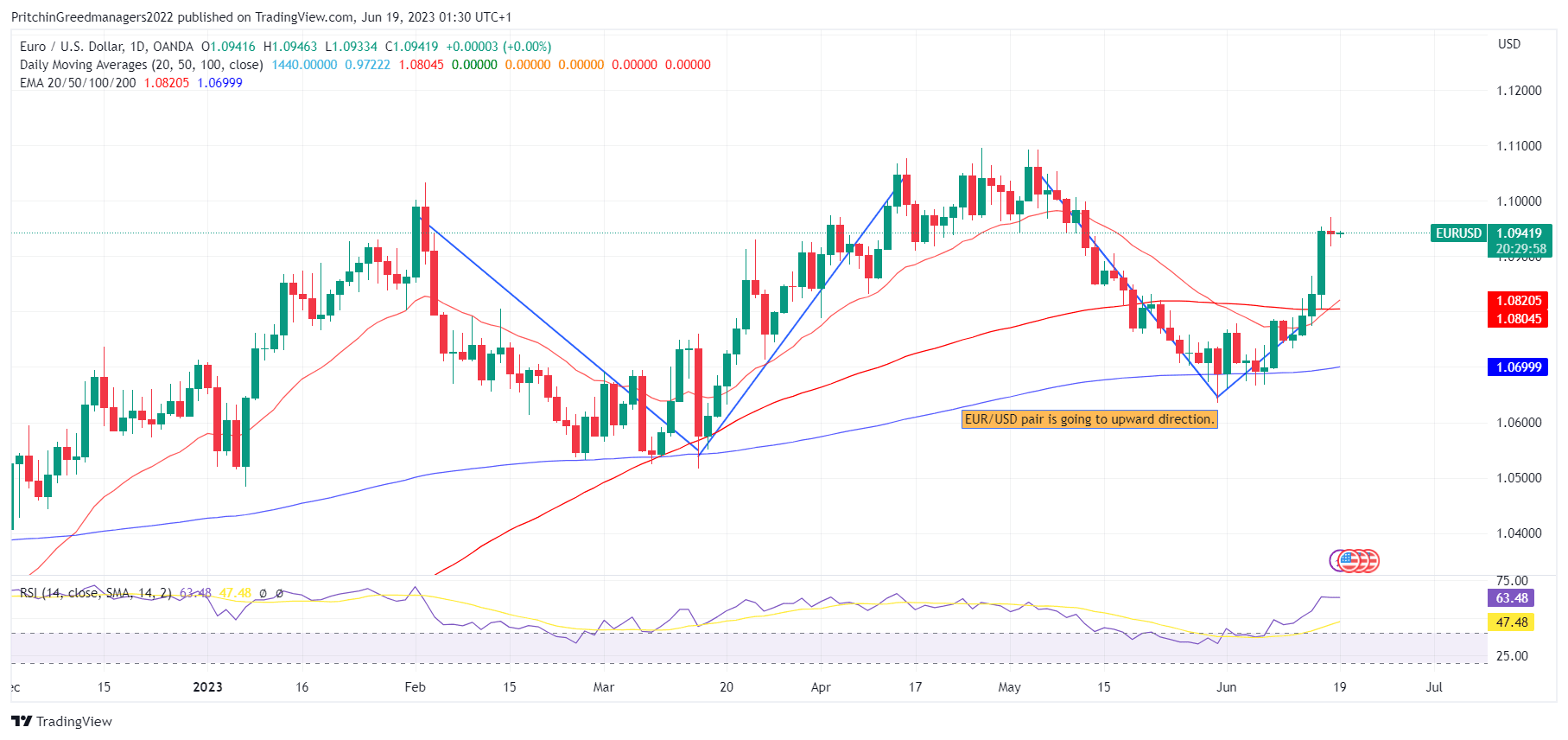

Diagram of EUR/USD: -

Economic Events: -

Date Event Impact Currency

04:00 (New Zealand) Services NZ PSI Low NZD

04:00 (New Zealand) Composite NZ PCI Low NZD

05:30 (United States) Juneteenth None USD

09:05 (Japan) 52-Week Bill Auction Low JPY

13:30 (Australia) Myfxbook AUDUSD Sentiment Medium AUD

13:30 (Switzerland) Myfxbook USDCHF Sentiment Medium CHF

13:30 (Japan) Myfxbook USDJPY Sentiment Medium JPY

13:30 (European Union) Myfxbook EURUSD Sentiment Medium EUR

13:30 (United Kingdom) Myfxbook GBPUSD Sentiment Medium GBP

13:30 (Canada) Myfxbook USDCAD Sentiment Medium CAD

13:30 (New Zealand) Myfxbook NZDUSD Sentiment Medium NZD

13:30 (Euro Area) ECB Survey of Monetary Analysts Low EUR

15:00 (Germany) 12-Month Bubill Auction Low EUR

16:00 (Portugal) Current Account Low EUR

16:30 (Euro Area) ECB Lane Speech Low EUR

17:10 (Euro Area) ECB Schnabel Speech Low EUR

18:00 (Canada) PPI YoY Low CAD

18:00 (Canada) PPI MoM Low CAD

18:00 (Canada) Raw Materials Prices YoY Low CAD

18:00 (Canada) Raw Materials Prices MoM Low CAD

18:30 (France) 3-Month BTF Auction Low EUR

18:30 (France) 12-Month BTF Auction Low EUR

18:30 (France) 6-Month BTF Auction Low EUR

19:30 (United States) NAHB Housing Market Index Medium USD

23:30 (Euro Area) ECB Guindos Speech High EUR

Buy Scenario: -

On the contrary, a daily close above the 23.6% Fibonacci retracement level around 1.0960, as well as the previous day's peak near 1.0970, would limit the short-term upside potential for EUR/USD.

Following such a breakthrough, the presence of multiple resistance levels near 1.1000 could challenge Euro bulls before potentially directing them towards the March 2022 high, situated close to 1.1185, till we do not advise to buy EUR/USD currency pair.

Sell Scenario: -

It is important to consider that the Juneteenth holiday in the US, along with the bearish spinning top candlestick on the daily chart of the EUR/USD pair and the overbought RSI (14) line, have recently favored Euro bears.

In light of this, the currency pair appears poised to decline towards a horizontal support zone that has been in place for nine weeks, residing around 1.0910-1.0900.

However, the presence of bullish signals from the Moving Average Convergence Divergence (MACD) and the support provided by the 50-day moving average (DMA) around 1.0880 could potentially challenge the bearish sentiment in EUR/USD.

Should the Euro pair fall below 1.0880, the possibility of a decline towards the 50% and 61.8% Fibonacci retracement levels of the March-April rally, located near 1.0800 and 1.0735 respectively, cannot be ruled out. Till then we do not advise selling EUR/USD.

Support and Resistance Level: -

Support Resistance

S1 1.0915 - R1 1.0968

S2 1.0890 - R2 1.0996

S3 1.0862 - R3 1.1021

Discussion