Daily Analysis For EUR/USD 12-06-2023

EUR/USD Analysis

Key Points: -

· The EUR/USD currency pair garners interest from buyers, causing its decline from a peak reached over a two-week period to come to a halt.

· The limited increase in the value of the USD restricts the upward movement of the currency pair due to the absence of significant factors driving market sentiment.

· Traders also exhibit hesitancy in anticipation of the upcoming US Consumer Price Index (CPI) release scheduled for Tuesday and the Federal Open Market Committee (FOMC) meeting taking place on Wednesday.

Today's Scenario: -

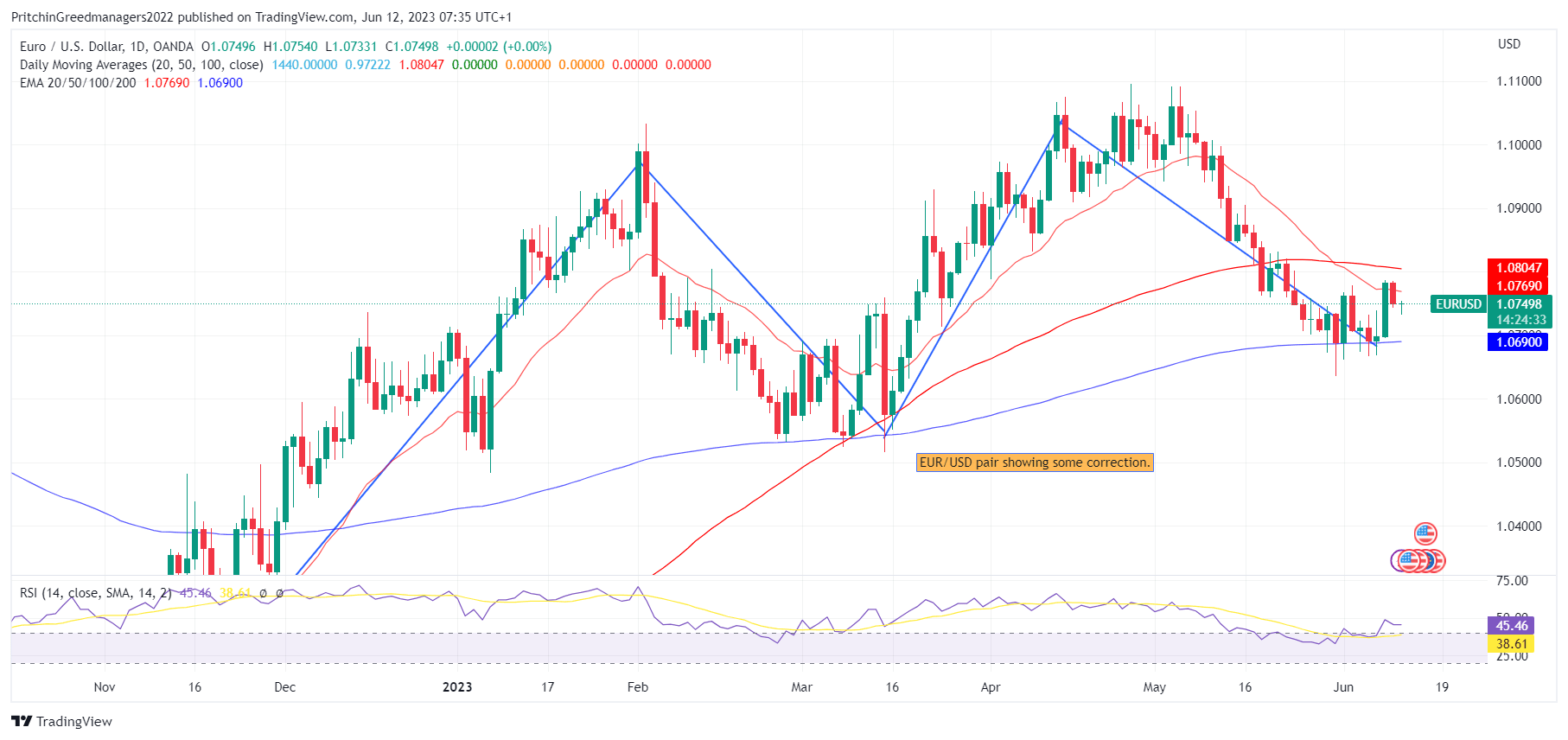

The EUR/USD pair shows signs of recovery, gaining a few pips from its lowest point during the Asian session. Currently, it appears to have halted its decline after reaching a two-week high on Friday. Trading just below the mid-1.0700s, the spot prices remain relatively unchanged for the day. Traders are exercising caution and refraining from taking aggressive positions as they enter a crucial week.

The upcoming release of the latest US consumer inflation figures on Tuesday, followed by the highly anticipated FOMC monetary policy decision on Wednesday, will provide further insights into the Federal Reserve's short-term policy outlook. These events will play a significant role in determining the next direction for the US Dollar (USD) and will likely impact the EUR/USD pair.

Meanwhile, a slight increase in US Treasury bond yields has supported the USD's rebound from its lowest level since May 24, but uncertainty surrounding the Fed's rate-hike trajectory is preventing further appreciation of the USD. Additionally, expectations of additional rate hikes by the European Central Bank (ECB) continue to provide support for the EUR/USD pair.

It is important to note that recent dovish statements from several Fed officials have reinforced market expectations of a pause in the US central bank's year-long tightening cycle. However, surprise rate hikes by the Reserve Bank of Australia (RBA) and the Bank of Canada (BoC) last week indicate that the battle against inflation is not yet over, increasing the likelihood of further tightening by the Fed.

In fact, Fed fund futures suggest that the market is pricing in the possibility of another 25 basis points increase at the July FOMC meeting. A stronger US CPI reading this week would further solidify these expectations. Given the current fundamental backdrop, it is advisable to exercise caution when taking intraday positions as there are no significant economic releases from either the Eurozone or the US that could significantly impact the market.

Diagram of EUR/USD: -

Economic Events: -

Date Event Impact Currency

4:15 (New Zealand) Electronic Retail Card Spending YoY Low NZD

4:15 (New Zealand) Electronic Retail Card Spending MoM Low NZD

5:20 (Japan) PPI YoY Low JPY

5:20 (Japan) PPI MoM Low JPY

5:31 (Ireland) Construction PMI Low EUR

10:30 (Finland) Current Account Low EUR

11:30 (Japan) Machine Tool Orders YoY Low JPY

12:30 (Slovakia) Construction Output YoY Low EUR

13:30 (China) Total Social Financing Low CNY

13:30 (China) New Yuan Loans Low CNY

13:30 (China) M2 Money Supply YoY Low CNY

13:30 (China) Outstanding Loan Growth YoY Low CNY

13:30 (Switzerland) Myfxbook USDCHF Sentiment Medium CHF

13:30 (Australia) Myfxbook AUDUSD Sentiment Medium AUD

13:30 (Japan) Myfxbook USDJPY Sentiment Medium JPY

13:30 (European Union) Myfxbook EURUSD Sentiment Medium EUR

13:30 (United Kingdom) Myfxbook GBPUSD Sentiment Medium GBP

13:30 (Canada) Myfxbook USDCAD Sentiment Medium CAD

13:30 (New Zealand) Myfxbook NZDUSD Sentiment Medium NZD

15:15 (European Union) EU Bond Auction Low EUR

15:15 (European Union) 15-Year Bond Auction Low EUR

18:30 (Ecuador) Balance of Trade Low USD

18:30 (France) 3-Month BTF Auction Low EUR

18:30 (France) 12-Month BTF Auction Low EUR

18:30 (France) 6-Month BTF Auction Low EUR

20:30 (Kosovo) Inflation Rate YoY Low EUR

20:30 (United States) Consumer Inflation Expectations Low USD

21:00 (United States) 6-Month Bill Auction Low USD

21:00 (United States) 3-Year Note Auction Low USD

22:30 (United States) 3-Month Bill Auction Low USD

22:30 (United States) 10-Year Note Auction Low USD

23:30 (United States) Monthly Budget Statement Medium USD

Buy Scenario: -

On the upside, a recovery in the EUR/USD would require breaking the bearish pattern of the rising wedge. This would entail surpassing the resistance level at 1.0790, followed by the psychological barrier at 1.0800 to convince Euro buyers.

However, it is worth noting that there are multiple stop levels around 1.0830 and 1.0845-50, which were established in late May. These levels may pose challenges for buyers before they can take control of the Euro pair, till we do not advise to buy EUR/USD currency pair.

Sell Scenario: -

The EUR/USD pair is experiencing a decline and has reached a new intraday low, trading near 1.0745. This comes after a slight loss from the previous day, continuing the bearish trend that started four weeks ago, despite a temporary upward correction that occurred over the past week.

Notably, there are indicators suggesting further downside potential for the Euro pair. The MACD indicator is showing a potential bearish cross, and the RSI (14) has reversed from overbought levels, moving towards the 50.0 mark. These factors contribute to the bearish bias for the EUR/USD.

However, there is a significant support area that may impede the decline. The 50-period Simple Moving Average (SMA) coincides with the bottom line of the rising wedge pattern, which is located around 1.0720. Breaking through this level might prove challenging for the bears.

If the support at 1.0720 is breached, the next pause point for the downward move could be the previous weekly low near 1.0670. Beyond that, the bears may target the yearly low from May around 1.0635. Ultimately, the confirmation of the rising wedge pattern would suggest a potential target around 1.0570 for the Euro bears. Till then we do not advise selling EUR/USD.

Support and Resistance Level: -

Support Resistance

S1 1.0733 - R1 1.0775

S2 1.0717 - R2 1.0801

S3 1.0690 - R3 1.0817

Discussion