Daily Analysis For AUD/USD 19-06-2023

AUD/USD Analysis

Key Points: -

· The AUD/USD pair is experiencing a correction after reaching its highest level since February on Thursday. This correction can be attributed to a modest recovery in the US Dollar (USD) from its multi-week low, which has prompted some profit-taking in the AUD/USD pair.

· The uncertainty surrounding the Federal Reserve's (Fed) stance on interest rate hikes may limit the losses for the pair. The market is uncertain about the timing and pace of the Fed's rate hikes, which could potentially cap the strength of the USD.

· Traders will closely monitor the developments in the USD and the Fed's monetary policy outlook for further guidance on the AUD/USD pair.

Today's Scenario: -

The AUD/USD pair starts the trading week with a stronger position, hovering around 0.6885 at the moment. The recent news concerning China, along with diminished expectations of a hawkish stance from the Federal Reserve, favor buyers of the Australian Dollar. However, the mixed US data from the previous week and the Juneteenth holiday in the United States are limiting immediate movements of the currency pair. The upcoming week includes key events such as the release of the Reserve Bank of Australia's (RBA) Monetary Policy Meeting Minutes, Fed Chair Jerome Powell's Semi-Annual Testimony, and preliminary readings of the Purchasing Manager Indexes (PMIs) for June in both the US and Australia.

Last week, the US Dollar Index (DXY) failed to benefit from the US Federal Reserve's pause in its rate hike trajectory. The US currency faced headwinds due to mostly disappointing economic data, which raised concerns about the country's economic performance. Additionally, the comparatively more hawkish stance of the European Central Bank (ECB) weighed on the US Dollar.

In contrast, the AUD/USD pair gained strength from robust Australian inflation figures and expectations of increased stimulus measures from China. Furthermore, news over the weekend suggesting an improvement in US-China relations and the anticipation of more stimulus from China, Australia's largest trading partner, bolstered the optimism among buyers of the Aussie pair.

Meanwhile, the preliminary readings of the University of Michigan (UoM) Consumer Sentiment Index (CSI) for June showed improvement, rising to 63.9 from the previous reading of 59.2 and surpassing market expectations of 60.0. However, year-ahead inflation expectations declined for the second consecutive month, reaching the lowest level since March 2021 at 3.3% in June, down from 4.2% in May, according to the UoM report. The five-year inflation forecasts showed little change at 3.0% compared to the anticipated 3.1% and the previous reading. Earlier, US retail sales and inflation data were underwhelming, raising concerns about the US economy's performance and putting pressure on the US Dollar.

On the geopolitical front, US Secretary of State Antony Blinken and Chinese Foreign Minister Qin Gang held talks on Sunday, describing them as candid and constructive. However, there were limited areas of agreement between the two sides, with plans for a future meeting in Washington. Additionally, positive signals emerged from the China State Council, as reported by the South China Morning Post (SCMP), indicating macroeconomic policies aimed at expanding effective demand, strengthening the real economy, and managing risks in key areas.

On the other hand, recent hawkish comments from Federal Reserve policymakers have posed challenges for AUD/USD bulls. The latest US Federal Reserve Monetary Policy Report to Congress highlighted that inflation in the US is well above the target, while the labor market remains tight. The report also mentioned the considerable uncertainty surrounding the outlook for the funds rate. Federal Reserve Bank of Richmond President Thomas Barkin cautioned against further rate hikes, as they could lead to a significant economic slowdown. However, Barkin also stated that the Fed has tools to manage the resilient US economy. These comments triggered a rise in 2-year Treasury bond yields to 4.75% and supported the US Dollar's recovery from its lows.

In addition, Federal Reserve Governor Christopher Waller mentioned that the US economy is still performing strongly and expressed confidence in the stability of the US banking system.

Considering these factors, Wall Street closed in positive territory, supporting mild gains in S&P500 Futures. Moreover, US Treasury bond yields rebounded on Friday, although without strong upward momentum, which provided support for the US Dollar and acted as a floor for the AUD/USD price.

Looking ahead, with a light economic calendar, the AUD/USD pair may experience gradual upside movement, while positive news sentiment keeps buyers hopeful. Market participants eagerly await the release of the RBA Minutes, Fed Chairman Powell's testimony, and the PMIs for June, which will likely influence market sentiment.

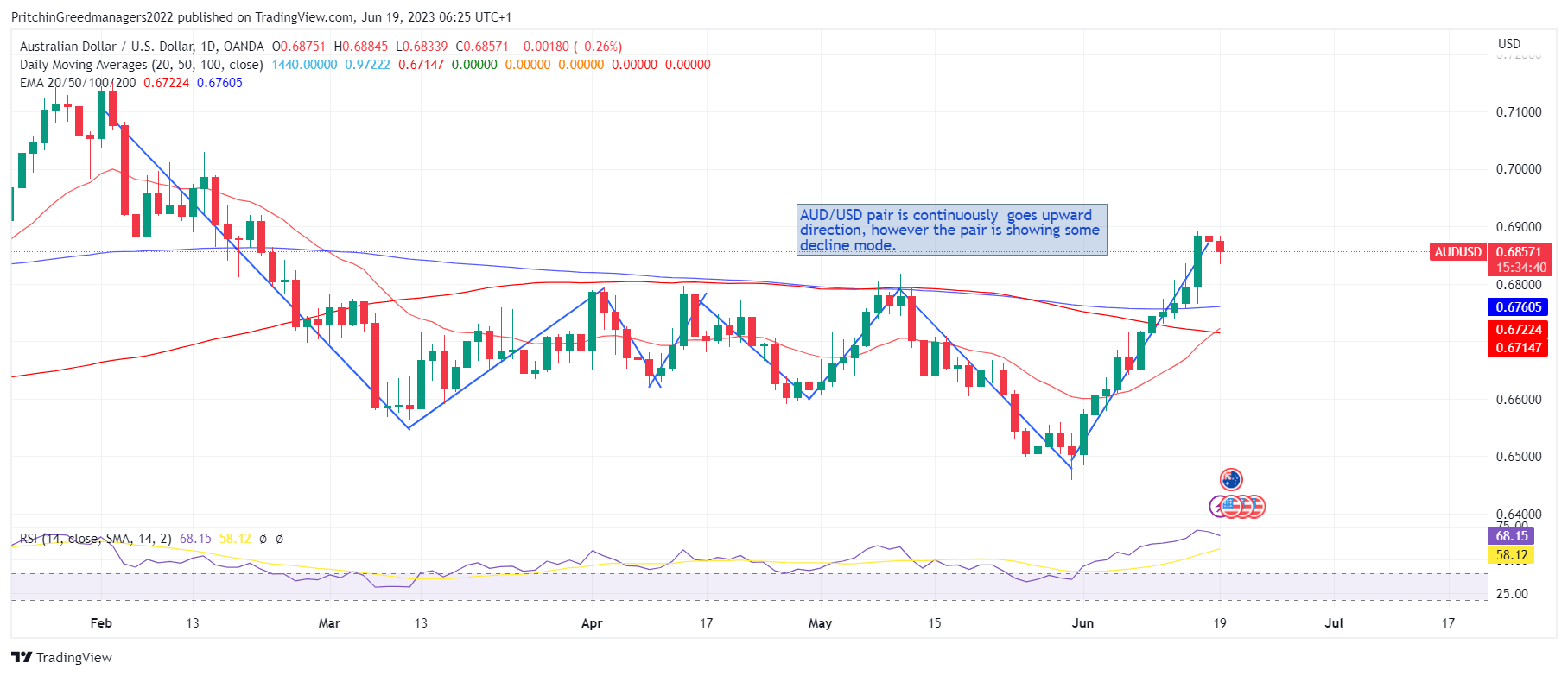

Diagram of AUD/USD: -

Economic Events: -

Date Event Impact Currency

04:00 (New Zealand) Services NZ PSI Low NZD

04:00 (New Zealand) Composite NZ PCI Low NZD

05:30 (United States) Juneteenth None USD

09:05 (Japan) 52-Week Bill Auction Low JPY

13:30 (Australia) Myfxbook AUDUSD Sentiment Medium AUD

13:30 (Switzerland) Myfxbook USDCHF Sentiment Medium CHF

13:30 (Japan) Myfxbook USDJPY Sentiment Medium JPY

13:30 (European Union) Myfxbook EURUSD Sentiment Medium EUR

13:30 (United Kingdom) Myfxbook GBPUSD Sentiment Medium GBP

13:30 (Canada) Myfxbook USDCAD Sentiment Medium CAD

13:30 (New Zealand) Myfxbook NZDUSD Sentiment Medium NZD

13:30 (Euro Area) ECB Survey of Monetary Analysts Low EUR

15:00 (Germany) 12-Month Bubill Auction Low EUR

16:00 (Portugal) Current Account Low EUR

16:30 (Euro Area) ECB Lane Speech Low EUR

17:10 (Euro Area) ECB Schnabel Speech Low EUR

18:00 (Canada) PPI YoY Low CAD

18:00 (Canada) PPI MoM Low CAD

18:00 (Canada) Raw Materials Prices YoY Low CAD

18:00 (Canada) Raw Materials Prices MoM Low CAD

18:30 (France) 3-Month BTF Auction Low EUR

18:30 (France) 12-Month BTF Auction Low EUR

18:30 (France) 6-Month BTF Auction Low EUR

19:30 (United States) NAHB Housing Market Index Medium USD

23:30 (Euro Area) ECB Guindos Speech High EUR

Buy Scenario: -

Looking at the EMAs and the 4-hourly chart, the EMAs sent bullish signals. The AUD/USD sat above the 50-day EMA, currently at $0.67718. The 50-day EMA pulled further away from the 200-day EMA, with the 100-day EMA widening from the 200-day EMA, delivering bullish signals.

A hold above the Major Support Levels and the 50-day EMA ($0.67718) would support a breakout from R1 ($0.6898) to give the bulls a run at R2 ($0.6921). Till we do not advise to buy AUD/USD.

Sell Scenario: -

However, a fall through S1 ($0.6854) would bring S2 ($0.6832) into view. An AUD/USD fall through the 50-day EMA ($0.67718) would signal a near-term bullish trend reversal. Till we do not advise to sell AUD/USD.

Support and Resistance Level: -

Support Resistance

S1 0.6854 - R1 0.6898

S2 0.6832 - R2 0.6921

S3 0.6809 - R3 0.6943

Discussion