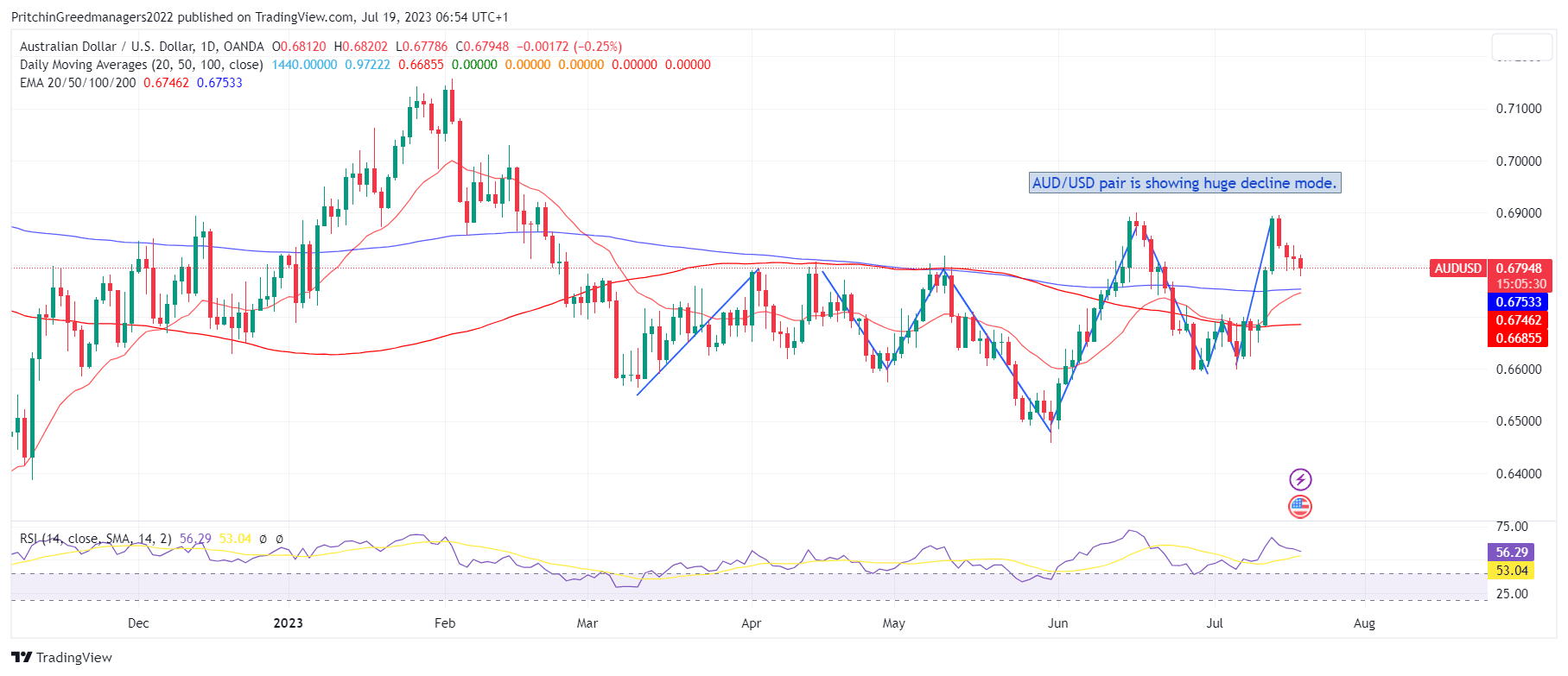

AUD/USD Outlook: Bears Eyeing 0.6740 Resistance amid US Dollar Strength- 19-07-2023

AUD/USD Analysis

Key Points: -

- On Wednesday, the AUD/USD pair maintains its position above the 0.6790 level.

- Investors are anticipating that the Federal Reserve (Fed) is nearing the completion of its policy tightening cycle.

- Market participants will closely monitor the progress in Sino-US relations.

- The Australian Employment Change and Employment Change reports are scheduled for release later this week.

Today's Scenario: -

The AUD/USD pair is experiencing a loss of momentum and is holding above the 0.6790 level as the European session begins on Wednesday. Currently trading around 0.6795, the pair has declined by 0.24% for the day. Investors are digesting the meeting minutes from the Reserve Bank of Australia (RBA) and closely monitoring the developments in Sino-US relations.

Following softer US inflation data and a slowdown in the labor market, market participants anticipate that the Federal Reserve (Fed) is approaching the end of its tightening cycle and will maintain interest rates after the expected 25 basis points hike in the July meeting. According to the CME Group FedWatch Tool, the markets have already priced in a 25 basis points rate increase in July, and the probability of another hike in December is approximately 20%.

Furthermore, data released on Tuesday revealed that US industrial production declined by 0.5% in June for the second consecutive month, falling short of market expectations of no change. Meanwhile, retail sales increased by 0.2% month-on-month in June, reaching $689.5 billion, but this figure was below the market consensus of a 0.5% gain.

Regarding the Australian Dollar, the RBA minutes released in Asia suggested that there may be a need for further policy tightening, although policymakers will reassess the situation at the August policy meeting.

In terms of US-China relations, China's defense minister, Li Shangfu, stated during a meeting with senior US diplomat Henry Kissinger in Beijing on Tuesday that the US should exercise sound strategic judgment when dealing with China. Market participants will closely monitor developments in Sino-US relations for potential market-moving events.

Looking ahead, market participants will focus on Australia's upcoming release of employment change and unemployment rate data on Thursday. Additionally, cues from US housing starts and unemployment claims will also be significant for the AUD/USD pair, as they can help determine the pair's future direction.

Diagram of AUD/USD: -

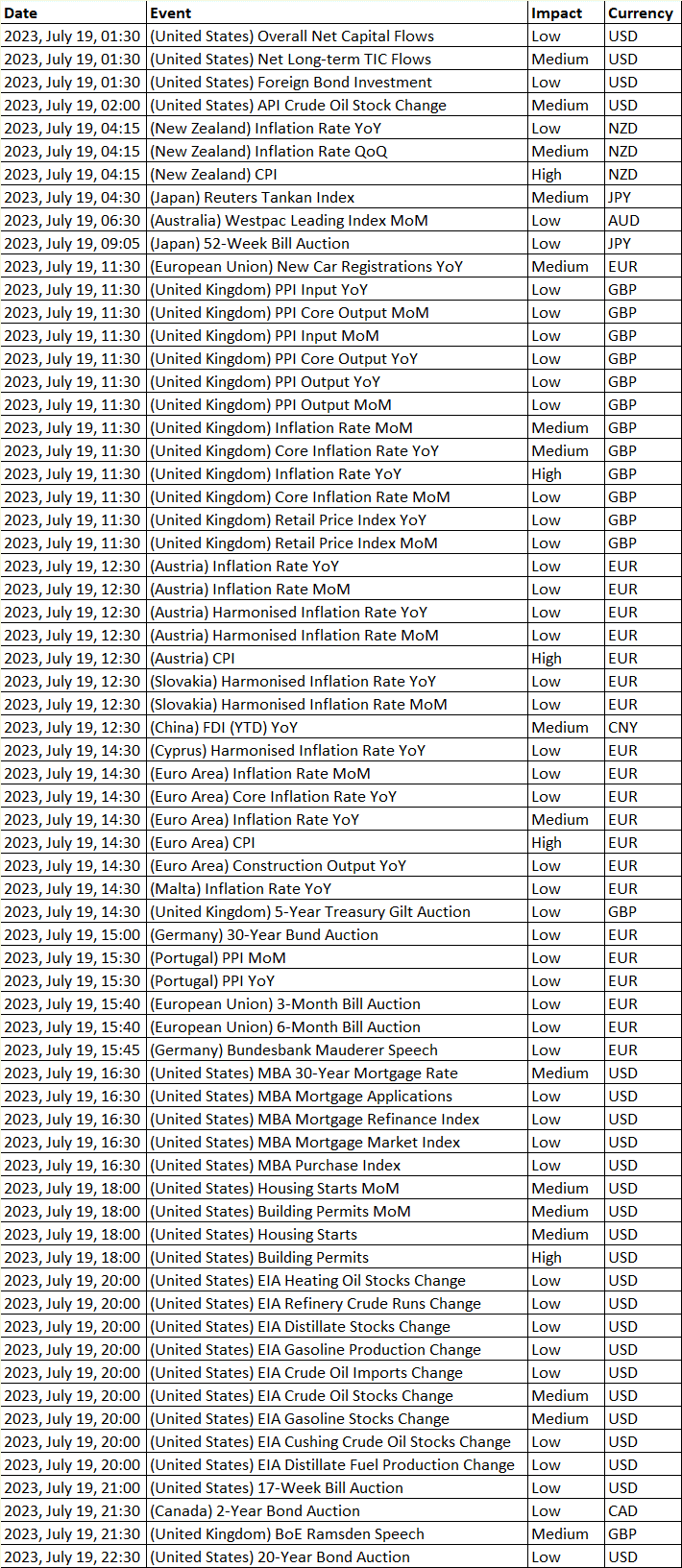

Economic Events: -

Buy Scenario: -

On the upside, any recovery above 0.6805 would be considered unimpressive unless the pair manages to surpass the weekly high near 0.6840.

Nevertheless, the presence of a double top bearish chart pattern around the psychological level of 0.6900 poses a significant challenge for the AUD/USD bulls, as overcoming this level would be necessary to restore market confidence in favor of further upside potential. Till we do not advise to buy AUD/USD.

Sell Scenario: -

The AUD/USD pair has declined to 0.6780, hitting its lowest level of the week during the early morning hours in Europe. This marks the fourth consecutive day of losses for the pair. The decline can be attributed to the overall strength of the US Dollar, despite positive data from Australia's Westpac Leading Index for June.

The pair has broken below a horizontal support zone that has been in place for a month, which now acts as immediate resistance in the 0.6800-0.6805 range. This break, combined with bearish signals from the Moving Average Convergence Divergence (MACD) indicator, is attracting sellers of the AUD/USD pair.

As a result, the pair is likely to revisit a horizontal area that encompasses various levels established since early June, located around 0.6740.

However, further downside movement for the AUD/USD pair may face significant obstacles at the 200-day Simple Moving Average (SMA) level near 0.6730 and a seven-week-old ascending support line around 0.6665. Till we do not advise to sell AUD/USD.

Support and Resistance Level: -

Support Resistance

S1 0.6788 - R1 0.6836

S2 0.6765 - R2 0.6861

S3 0.6740 - R3 0.6884

Discussion