XTB Review 2023: A Top-Tier Broker's Pros and Cons

Hey there, folks! Today, we're diving into the world of XTB, a top-tier online CFD broker that's been making waves. If you're into trading forex, shares, indices, commodities, cryptocurrencies, and more, you'll want to stick around because this is your comprehensive guide to all things XTB. Buckle up; it's going to be an exciting ride!

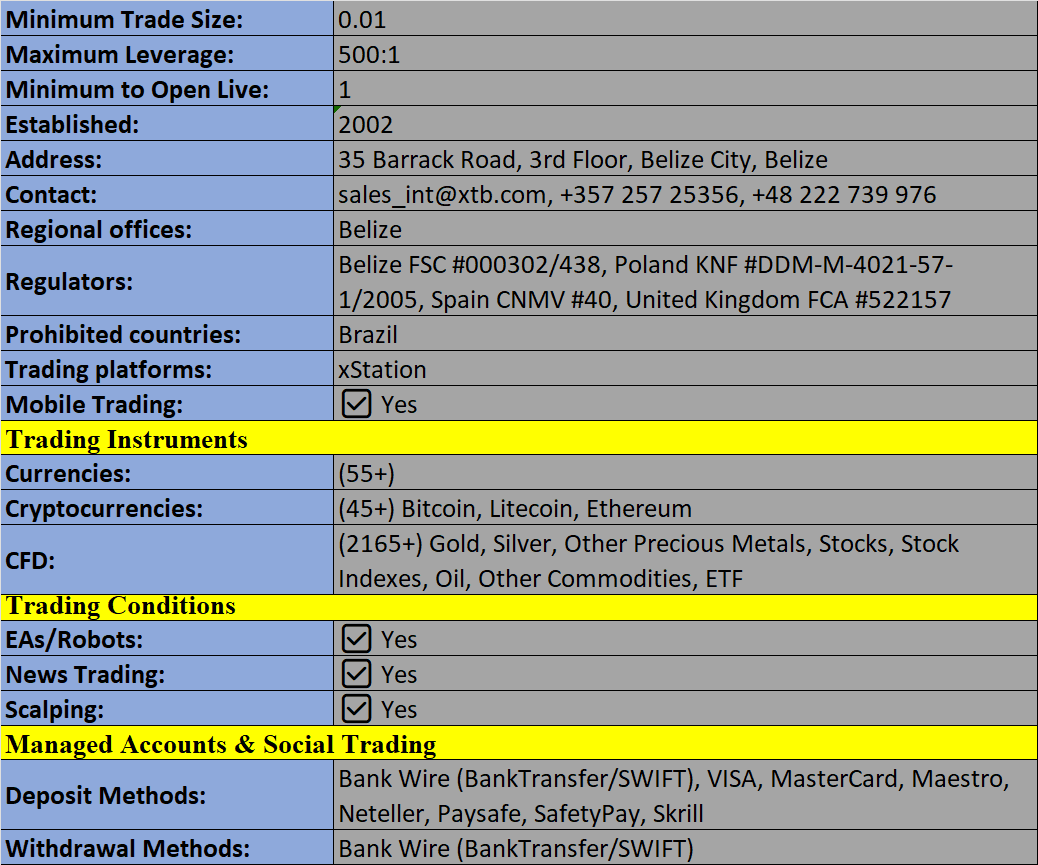

Company Details:

XTB is no newbie to the game. Established in 2002, it's one of the heavy hitters in the stock exchange business, with a presence in 13 countries. The UK, Poland, Germany, and France are just a few of the places they call home. Over the last two decades, more than 500,000 trading accounts have been opened with these guys. Impressive, right? They've built quite the reputation for their transparency and lightning-fast execution. In fact, they've bagged some prestigious awards along the way, including the coveted #1 EMEA Bloomberg spot for FX accuracy. You've got to admit; that's a big deal. They're also keeping things legit with regulation from the Cyprus Securities & Exchange Commission (CySEC) and the UK Financial Conduct Authority (FCA). It's safe to say they've got their ducks in a row.

The Trading Platform:

xStation 5

When it comes to trading platforms, XTB doesn't mess around. They've got xStation 5, and it's a winner. In fact, it was voted as the 'Best Trading Platform 2016' by the Online Personal Wealth Awards. What sets it apart? Well, it offers lightning-fast execution, usually around 85 milliseconds - that's quick! Plus, they've got a free market audio commentary – something you'd normally pay for with other brokers. And don't get me started on their advanced trading calculator; it's like your trading sidekick. It calculates everything you need to know about your trades on the fly. Need help? They've got a treasure trove of video tutorials, a stocks screener, sentiment heatmaps, and real-time performance stats. You'll know exactly where your trading strengths and weaknesses lie. xStation 5 isn't picky; it's available on your desktop, tablet, mobile, and even your smartwatch. Plus, they've got a bunch of cool tools for traders of all experience levels. It's user-friendly and packed with features - what more could you ask for?

Web Trader:

Not a fan of downloading heavy software? No problem. XTB's Web Trader platform lets you access xStation 5 right from your web browser, no downloads required. Whether you're on Chrome, Firefox, Safari, or Opera, they've got you covered. The platform plays nicely with various devices, including Windows and Mac. It's all about making your life easier.

But, here's the kicker: Since 2022, you can't open accounts on the MT4 platform with XTB anymore. If you're a fan of MT4, that might be a bummer.

Assets & Markets:

XTB goes big on diversity, offering over 5,800 instruments across six categories:

- Forex: They've got 57 currency pairs in their arsenal, including all the major ones and even some minors and exotics.

- Shares: Get your CFD trading game on with over 1,500 shares from companies worldwide. They've got everything from the United States to the UK, Poland, Portugal, Spain, Switzerland, France, and Finland. Plus, you can start with just €10.

- Indices: Over 20 indices from all corners of the globe are up for grabs, including the US, Germany, and China.

- ETFs: Fancy speculating on 1,850 global stock CFDs with no trading limits? XTB's got your back.

- Commodities: Trade popular stuff like gold, silver, oil, wheat, and more. You'll be spoiled for choice.

- Cryptocurrencies: For the crypto enthusiasts, they've got big names like Bitcoin (BTC), Litecoin (LTC), Ripple (XRP), and Ethereum (ETH). Sorry UK folks, cryptocurrencies are not on the menu for you.

The only downside? No futures or options trading here. Bummer, right?

Spreads & Fees:

Let's talk money. XTB offers competitive rates for all. Back in February 2022, they turned heads by introducing 0% commission trading for Standard account holders. The catch? Fees are baked into the spreads. If you opt for a Pro account, you'll face some commission charges, and it varies depending on your base currency. Margin trades might also land you an overnight swap charge based on your overall exposure. But here's the good news: setting up an account is free, and there are no annoying minimum deposit requirements. Just one thing to note - they'll hit you with a 0.5% currency conversion fee if your trades are in a different currency than your account. Keep that in mind.

XTB Account Types:

Variety is the spice of life, and XTB gets it. They offer a Basic, Standard, and Pro account. Starting with the XTB Standard account, it's free to set up, and spreads kick off at 0.35 pips. The minimum order size is 0.1 lots, and leverage is capped at 1:30. Trading with the Basic and Standard accounts won't cost you any commission, and they're all about automated trading. Need an Islamic account? They've got that too. Be aware that account options may differ by country, so be sure to check out their official site for what's on the menu in your location.

Registration Process:

Ready to dive into the world of XTB? The registration process is straightforward. As with all regulated brokers, they have to do their 'KYC' thing - you know, 'know your customer' and all that jazz. It's all in the name of safety. You'll find the 'Create Account' button on their website, painted in a friendly green. Fill in your personal deets like your name, phone number, and national insurance number. Then, pick your trading platform, account type (Basic, Standard, or Pro), language, and currency. The final piece of the puzzle is verifying your ID. Grab your passport, driver's license, or identity card - any of those will do. You can even snap a pic of your ID proof with your phone. It's all about keeping it clean and up-to-date. Once you've aced this, you're ready to hit the trading floor. Piece of cake!

Mobile App:

Trading never sleeps, and neither does XTB. They've got a slick mobile app that lets you trade from the palm of your hand. You can access over 5,400 global financial markets on the go. Whether you're on Android, Windows, iOS, or tablets, XTB's mobile app has your back. It's not just for placing orders; you get full access to account management features, charts, and all the tools you need for real-time trading. Plus, their market analysis and news updates are top-notch. And here's a bonus: they've got a famous football legend, José Mourinho, dishing out tips on financial markets and managing stress. It's like having a superstar coach for your trading journey.

Payment Option

Deposits:

Depositing your trading funds is a breeze with XTB. They accept credit/debit cards like Visa, Mastercard, and Maestro, along with e-wallets such as Skrill and Paysafe. Plus, wire transfers are in the mix, but only in the country where your account is registered. Most deposits get processed instantly, so you won't have to twiddle your thumbs. The best part?

XTB doesn't hit you with deposit fees, except for Paysafe, which tags on a 2% charge. Just a heads up - if you're transferring in a different currency than your account's base, you might encounter exchange rate charges. The currencies they accept are EUR, USD, GBP, and HUF.

Withdrawals:

Withdrawals are a piece of cake. If you put in a request before 1 pm GMT, it gets processed the same day. For requests made after 1 pm, you'll have to wait until the next business day. This applies to GBP, EUR, and domestic HUF withdrawals. Your cash goes straight to your nominated bank account, but you'll need to hand over some documentation. The good news is that most withdrawals don't come with any fees. There's a small catch, though - small sums might get charged. If you want the full lowdown on the charges, check out their official website.

XTB Leverage:

The amount of leverage you can get depends on where you're trading from and the local regulations. For our UK friends, you'll be dealing with XTB Limited UK, and that means a maximum leverage of 1:30. If you're in the EU, under CySEC regulation, the same 1:30 leverage is in play. Non-EU residents have more wiggle room with leverage available up to 1:500. It's a bit of a numbers game, depending on where you call home.

Demo Account:

If you're new to trading or just want to test the waters, XTB has your back with a free demo account. It's available for four weeks and comes loaded with 100k in virtual funds. You'll have access to a whopping 2,100+ CFD markets, covering forex, indices, commodities, and shares. Need help or have questions? Their support is on standby 24/7, from Sunday to Friday.

Regulation & Reputation:

When it comes to being legit and trustworthy, XTB has got you covered. They're regulated by several financial agencies in different parts of the world, including the FCA, CySEC, and the Belize International Financial Services Commission. They also sport the authorization of the Polish Securities and Exchange Commission, supervised by the Polish Financial Supervision Authority. The list goes on, making it pretty clear that they're sticking to the rules.

Education Resources:

XTB is all about helping you up your trading game. They've got a ton of educational materials, many of them free. You'll find training videos, online articles, and tools for live webinars. There's even a free trading library download, perfect for beginners. But wait, there's more! They've got a 'Trading Academy' divided into four categories: Basic, Intermediate, Expert, and Premium. It covers everything from fundamental to technical analysis. Plus, they've partnered with none other than football legend José Mourinho, who's ready to share his wisdom about financial markets and dealing with stress.

Trading Alerts:

Want to stay on top of the action? You can opt in for mobile trade alerts from a true industry expert. They'll keep you in the loop with real-time updates via WhatsApp, including breaking news and key technical levels. XTB even hosts Trading Clubs in their Canary Wharf, London headquarters. It's a great way to meet fellow traders in person and dive deep into trading strategies and live market analysis.

Customer Support:

Got a question or need help? XTB's got you covered with an experienced customer service team available 24/5. You can reach them via phone, email, or live chat. And here's a nice touch - they assign an account manager to assist with anything account-related. They speak your language too, with support available in a wide range of languages. The one caveat is that XTB can't operate in the United States due to local regulations.

Safety & Security:

Your safety is paramount to XTB, and they've got the measures to prove it. They offer access authorization via password, fingerprint, or code only. All connections between XTB services and mobile apps are fully encrypted. Plus, they've got multi-factor authentication for an extra layer of protection. They're always working to beef up their network infrastructure, adopting new technologies to guarantee your safety and security. To top it off, they're regulated by some of the world's leading bodies, so you can trust that they're holding themselves to a high standard of operation.

Pros

- Variety: With 5,800+ instruments covering major markets, there's something for everyone.

- Education: They offer plenty of free educational resources, ideal for beginners.

- Regulation: They're regulated by FCA, KNF, CySEC, and IFSC - you're in safe hands.

- Support: A 24-hour support team is on hand Sunday to Friday.

- Awards: XTB has earned multiple industry awards, cementing its reputation.

- Cashback: High-volume traders can enjoy cashback rebates.

- Leverage: Global traders can access leverage up to 1:500.

- Fractional Shares: They've got 3,000+ fractional shares available.

- Account Options: They offer flexible account options to suit your needs.

- Mobile Alerts: Keep up with mobile trading alerts.

- Competitive Spreads: Starting from just 0.1 pips.

Cons

- Single Platform: They offer just one trading platform.

- No US Clients: Sorry, folks in the United States, this one's not for you.

- Limited Instruments: Their instrument portfolio is mostly focused on CFDs.

In summary, XTB is a powerhouse in the trading world. With access to over 5,800 instruments across major markets, they've got something for everyone. Their award-winning xStation 5 platform is a game-changer, and their flexible account options make it easy for traders of all kinds. If you're in the UK or EU, you're in luck. Just remember, they're not available to US clients. With the backing of several regulatory bodies, trustworthiness is practically their middle name. So, if you're on the hunt for a reliable, well-regulated broker with a ton of perks, XTB could be just what you're looking for.

XTB Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion