XGlobal Markets 2023 Review: Unveiling Regulations, Platforms, Features and Expert Analysis

XGlobal Markets, an online brokerage specializing in forex and CFD trading via the MetaTrader 5 platform, is making waves in the financial world. Sporting multiple licenses and offering spreads as low as 0.4 pips, this broker stands tall in the trading arena. Dive into our comprehensive review of XGlobal Markets where we explore their mobile app, payment methods, customer service, and more. Let's unpack whether this platform is your ticket to enter the trading game.

Unveiling XGlobal Markets

Established in 2012 and headquartered in Cyprus, XGlobal Markets Ltd collaborates with MetaQuotes, presenting clients with robust trading utilities and a diverse range of online educational materials.

Regulatory Credentials

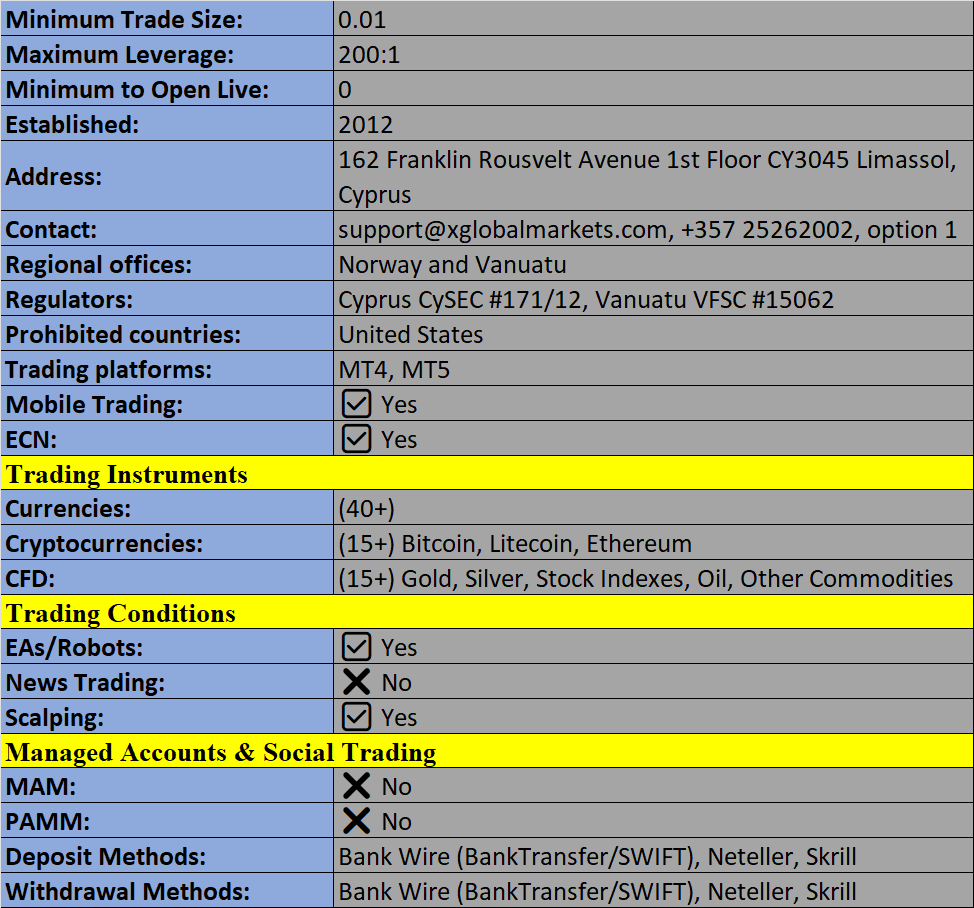

XGlobal Markets boasts regulation under the Cyprus Securities & Exchange Commission (CySEC) and holds registrations with the UK Financial Conduct Authority (FCA) alongside Germany’s Federal Financial Supervisory Authority (BaFin). These affiliations add credibility to their operations and ensure a secure trading environment.

Trading Platform MetaTrader 5:

XGlobal Markets furnishes the MetaTrader 5 (MT5) platform, an all-encompassing successor to the immensely popular MT4 system. Boasting an extensive array of features, the downloadable platform integrates leading technical indicators, automated trading capabilities through the MQL5 programming language, advanced charting tools, and an alert system for price level notifications. Furthermore, it includes a trading journal, in-depth contract specifications, and a trade copying service via the MQL signals.

Diverse Tradable Assets

With nearly 80 tradable instruments encompassing forex, CFDs, precious metals, energies, and indices, XGlobal Markets offers an assortment of opportunities. While featuring a commendable assortment, enhancing its repertoire with cryptocurrency trading could fortify its standing further.

Spreads, Commissions, and Leverage

Offering floating spreads commencing at 0.4 pips, XGlobal Markets maintains competitive minimum spreads on major pairs like EUR/USD and GBP/USD. Additionally, the brokerage levies $7.5 per lot commissions and imposes a €25 monthly inactivity fee for dormant accounts, along with a rollover fee post seven calendar days. Catering to both professional and retail traders, leverage levels stand at 1:200 for professionals and 1:30 for retail traders, adhering to ESMA regulations.

Mobile App Essentials

The XGlobal Markets mobile app caters to traders on-the-go, presenting real-time data, comprehensive account management, interactive chart trading, and an array of technical indicators. The app's user-friendly interface makes trading accessible via Android and iOS devices.

Payment Channels & Withdrawal Dynamics

The brokerage offers multiple payment methods, ensuring flexibility for deposits and withdrawals. While e-wallet transactions are swift, bank transfers might take a few days, and the minimum deposit requirement could be considered steep compared to competitors.

Demo Account and Additional Features:

XGlobal Markets provides a demo account for simulated trading experiences without risking capital, allowing users to explore the MT5 platform and automated trading features. The broker also boasts an extensive education section, offering online courses, training videos, and resources ideal for beginners.

Account Types and Trading Hours:

The broker offers a single live account, the Raw Spread account, with tight spreads, access to trading platforms, and customer support. Trading is available 24/5, allowing general account management even when trading is closed over the weekend.

Customer Support and Security:

XGlobal Markets' customer support is available 24/5 via live chat, telephone, and email, ensuring prompt assistance for withdrawal requests, technical issues, and complaints. The broker employs SSL encryption for data transmission and secures client information with a reliable backup solution.

Regulatory Assurance and Security Measures

Backed by stringent regulatory compliance and a robust security infrastructure, XGlobal Markets segregates client funds and maintains protocols for secure data handling.

XGlobal Markets the Verdict:

XGlobal Markets emerges as a reliable broker offering a solid trading platform, regulatory compliance, and educational resources. However, the absence of certain features like copy trading and cryptocurrencies might deter traders seeking more diverse options. Consider your preferences and trading goals before choosing XGlobal Markets as your trading partner.

Pros and Cons

Pros:

- Utilization of the MT5 platform

- Stringent CySEC regulation

- Low spreads and sizeable trade options

- Negative balance protection and swift market execution

Cons:

- Absence of copy trading and cryptocurrency options

- Limited product range

- Higher minimum deposit requirement

Final Thoughts

XGlobal Markets emerges as a solid choice for traders seeking a straightforward platform, an advanced trading interface, and a transparent fee structure. However, traders with more diverse trading preferences and a thirst for lower fees might explore alternative options.

With XGlobal Markets, the terrain appears promising, yet nuanced exploration reveals areas for improvement, nudging traders to weigh options according to their preferences and trading style.

XGlobal Markets Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion