XBTFX Review: Unveiling Regulations, Trading Platforms and Broker Features

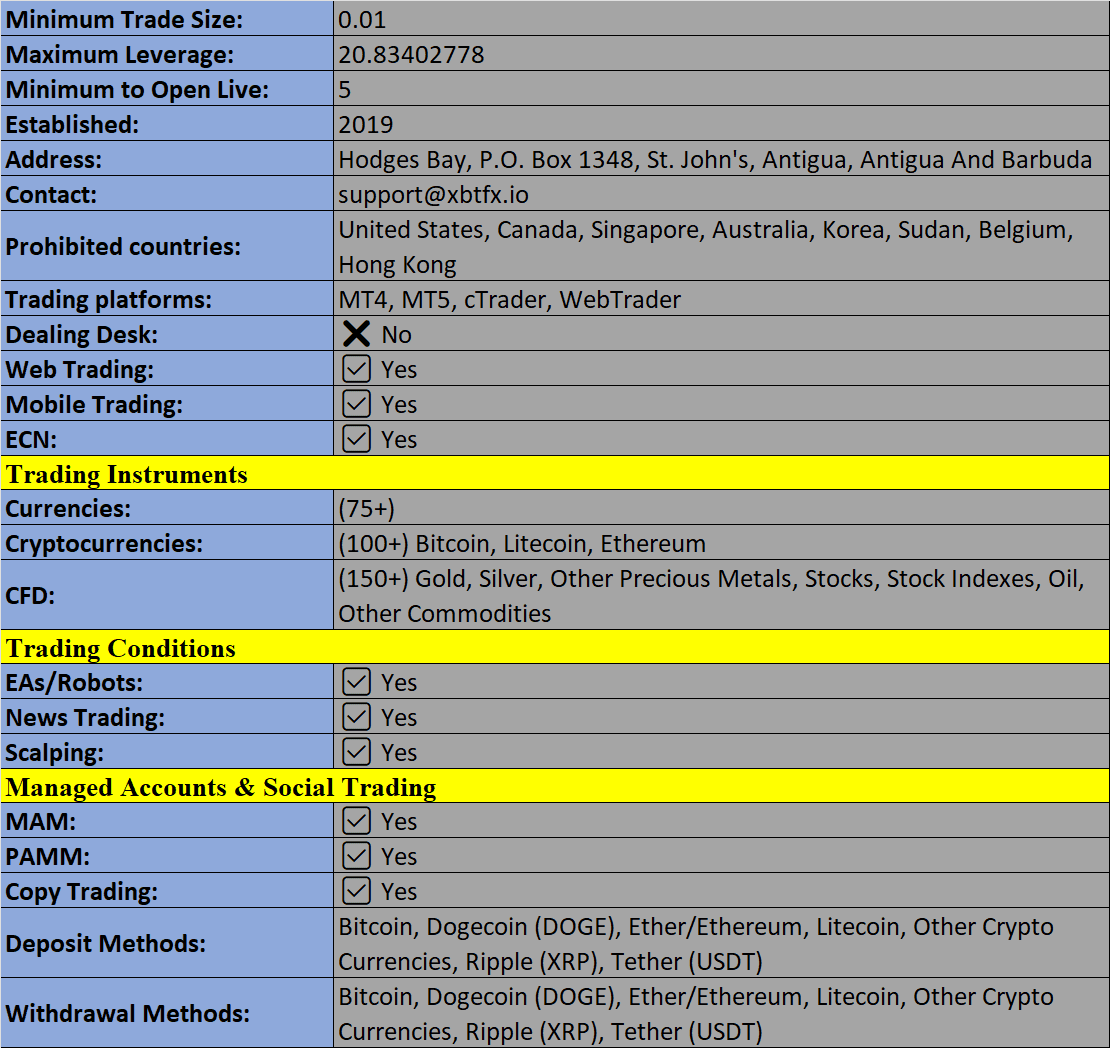

XBTFX, established in 2019, stands as a cryptocurrency-based CFD and forex broker operating offshore. This 2023 XBTFX review delves into various aspects of the broker, including its fee structure, leverage options, minimum deposit requirements, and the range of available assets.

Introduction to XBTFX

XBTFX LLC was founded with the goal of bridging the gap between cryptocurrencies and traditional forex brokers, emphasizing transparency, usability, and an array of features. Leveraging cutting-edge technologies, low-latency connectivity, and ample liquidity, the broker has swiftly grown since its inception, now boasting over 20 employees across four office locations.

However, it's worth noting that XBTFX is registered in St. Vincent and the Grenadines and operates without adhering to any regulatory restrictions. Consequently, its services are not accessible to residents of various global jurisdictions, including the United States, Canada, Singapore, Australia, Belgium, and North Korea.

Trading Platforms

Clients of XBTFX have access to three prominent trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms cater to both novice and advanced traders and can be accessed through web browsers or downloaded onto desktop, mobile, and tablet devices.

- MetaTrader 4 (MT4):

- User-friendly interface for forex traders.

- Comprehensive features, including historical data, multiple timeframes, hedging, live news streams, and more.

- Supports automated trading, custom charts, various order types, and expert advisors.

- MetaTrader 5 (MT5):

- Enhanced version of MT4 with additional features and improved efficiency.

- Offers 21 timeframes, trading robots, live news streams, and advanced market depth.

- Features a built-in economic calendar, multi-threaded strategy tester, and more.

- cTrader:

- Provides intuitive charting, level II pricing, and supports automated strategies through C# API.

- Offers fast trade executions with multiple order processing support.

- Supports trading with various cryptocurrencies.

It's advisable to utilize a demo profile to acquaint yourself with the cTrader platform and its features before investing real funds.

Asset Range

XBTFX presents clients with investment and trading opportunities across five asset classes:

- Forex: Offers 75+ major, minor, and exotic currency pairs, including EUR/GBP and GBP/USD.

- Commodities: Includes precious metals and energies like Silver, Gold, and Oil.

- Indices: Features 12 stock indices of major economies, such as NASDAQ, FTSE 100, and S&P 500.

- Stocks: Encompasses 100+ major companies from various regions, including Amazon, ING Group, BNP Paribas, and Nestle.

- Cryptocurrencies: Provides access to 25+ digital-fiat currency pairs, including BTC/USD, ETH/USD, LTC/USD, and BNB/USD.

Fees

XBTFX's fee structure varies depending on the account type, with the ECN profile incurring additional fees on top of spreads.

Standard Account:

- Cryptocurrency: No commission

- Forex, Commodities & CFDs: No commission

- Stock CFDs: US stocks $0.10, EU, Asia, and Russia stocks 0.45% (per share)

ECN Account:

- Cryptocurrency: 0.075%

- Forex, Commodities & CFDs: $3.50 per lot/side

- Shares CFDs: US stocks $0.10, EU, Asia, and Russia stocks 0.45% (per share)

Exchange fees apply, and real-time cryptocurrency swap quotes are available on the dashboard interface.

Leverage

XBTFX offers varying leverage levels depending on the asset being traded, with no capping restrictions due to its lack of regulatory oversight. Traders must exercise caution as leverage can magnify losses. Leverage options include:

- Stock CFDs: 1:5

- Index CFDs: 1:50

- Commodities: 1:20

- Crypto Majors: 1:25

- Crypto Extended: 1:5

- Forex: Up to 1:500 (varies based on chosen leverage during account creation)

- Metals: Up to 1:500 (varies based on chosen leverage during account creation)

Mobile Apps

MetaTrader 4 and 5 are available as mobile applications compatible with iOS and Android devices, providing access to a wide range of features, including analytical tools, customizable charts, and graphs on the go.

Payment Methods

Deposits:

- Minimum deposit requirements start at $5 in cryptocurrency equivalents.

- XBTFX accepts ten cryptocurrency coins and four stable coins, including Bitcoin, Ethereum, Ripple, Binance Coin, and Tether.

- Deposits are free, but processing times vary based on blockchain confirmation times.

Withdrawals:

- Withdrawals are also free and aim to be processed within the same working day.

- Note that limits apply for traders who have not completed the know-your-customer (KYC) account verification, including a daily withdrawal limit of $10,000 in equivalent digital currency.

Demo Account

XBTFX offers demo accounts on both MT4 and MT5 platforms. These are invaluable tools for practicing trading strategies, exploring platform features, and gaining experience without risking real capital. Opening a demo account requires a simple online registration.

Regulation & Licensing

XBTFX operates as an offshore entity without regulatory compliance. It is registered in St. Vincent and the Grenadines, governed solely by the SVG Limited Liability Companies Act. This lack of regulation may raise concerns, particularly regarding capital protection in the event of insolvency or unfair practices.

Additional Features

XBTFX's website includes educational sections and a news page featuring analysis and announcements suitable for both new and experienced investors. The content is supplemented with graphs, video material, and imagery, covering topics ranging from asset price predictions to trading basics.

Account Types

XBTFX offers two account types:

Standard Account:

- Suitable for traders who prefer zero commissions with fees embedded in spreads.

- Available on MT5 only, with spreads starting from 1 pip.

- Offers Islamic account option, micro-lot trading, and a $5 minimum deposit requirement.

ECN Account:

- Suited for scalpers and short-term traders.

- Available on both MT4 and MT5, with spreads starting from 0.01 pip.

- Allows micro-lot trading and has a $5 minimum deposit requirement.

Account registration can be swiftly completed online, with two levels of KYC compliance available.

Opening Hours

XBTFX follows standard office hours and offers 24-hour trading on weekdays. However, trading hours may vary by instrument, with some markets restricted based on exchange schedules. Cryptocurrency trading is available 24/7.

Customer Support

XBTFX offers multiple contact options, including email, an integrated helpdesk, and engagement via social media platforms like Facebook and Twitter. Additionally, a "Knowledge Base" FAQ section is available on the website for quick reference.

Safety & Security

XBTFX prioritizes security with password-protected member areas, encryption of personal data, and cold storage of client funds. The broker actively monitors its systems to prevent hacking and scams and partners with Cloudflare for DDoS protection. Two-factor authentication (2FA) and wallet whitelist functionality are available for added profile security.

XBTFX Verdict

In summary, XBTFX offers a range of services that cater to cryptocurrency-based trading enthusiasts. It provides industry-standard platforms, robust security measures, demo accounts, and free crypto deposits and withdrawals. However, its lack of regulatory oversight may deter some traders, particularly those involved in forex and CFD trading. Caution is advised when investing in these instruments due to the absence of protection and compensation schemes, although the broker's security standards remain commendable.

Advantages of XBTFX:

- ECN profile

- Demo account

- Extensive asset selection

- Cryptocurrency funding options

- Access to cryptocurrency markets

- Compatibility with MT4, MT5, and cTrader

- Free deposits and withdrawals

- Strong wallet protection protocols

Disadvantages of XBTFX:

- Unregulated

- Not available to US clients

- No fiat account funding

- Limited global availability

- No telephone support option

Broker details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion