US Consumer Confidence Reaches Two-Year High Fueled by Strong Job Market

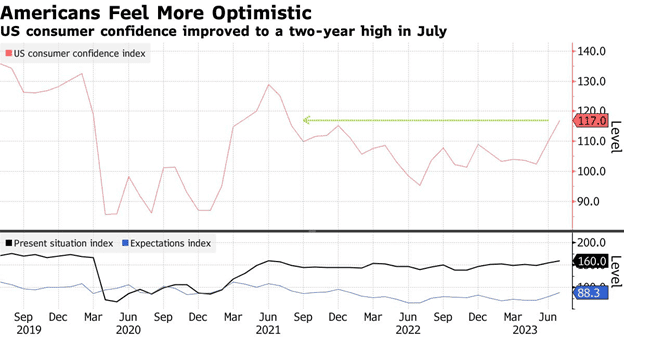

A positive signal to positive signs for the US economy, consumer confidence was up to an all-time high of two years in July. The index of the Conference Board, which is a crucial gauge of sentiment among consumers, increased by 7 points to 117, over and above economists' expectations, signaling a rise in positive sentiment among customers.

Strengthening Present and Expected Conditions

The present and expected conditions improved, contributing to the general increase in consumers' confidence. The index of conditions currently was at its highest since March 2020, indicating the optimism of consumers about the present economic conditions. In addition, the expectation gauge, which represents consumer sentiments about the economic outlook for the next 6 months, increased to its highest since the start of the prior year. Furthermore, the measure of inflation expectations slowed and further bolstered the positive optimism.

Source from bloomberg

Job Market Boosting Confidence

One of the main reasons for the rise in the confidence of consumers is the robust employment market in the US. Despite concerns about inflation, recent data on economic growth showed an energized job market and promising signs of change in the key inflation indicators. Pay increases are now in line with inflation, supplying households with the resources needed to maintain their spending habits.

Broad-Based Confidence Increase

This confidence increase in consumers is evident throughout all income and age categories. Lower-income consumers making less than $50,000 and higher-income customers earning over $100,000 had higher levels of confidence. This indicates that there is a broad optimism across all segments of the people.

Recession Fears Ease

Though some of the consumers voiced slight concern about the potential of an economic downturn, the general expectations of a recession have declined compared with earlier this year. The percentage of people who believe that a recession could be "somewhat" and "very likely" increased. However, it was below its recent highest point, which suggests a decline in the fear of a recession.

Improving Labor Market Outlook

It also showed optimism for the employment market. Consumers reported that job opportunities were "plentiful" in July, and the percentage of those who said jobs were difficult to locate decreased, achieving some of the low numbers in recent memory. Furthermore, expectations for consumers of the job market within six months showed improvements, further signaling their faith in the employment market's ability to endure.

Impact on Buying Plans

Concerning buying intentions In terms of purchasing intentions, the survey provided mixed outcomes. More respondents stated they planned to purchase homes and cars, which suggests potential growth within these areas. In contrast, the majority of consumers did not expect to buy major appliances such as fridges or washing machines.

The significant growth in US consumer confidence during July, climbing to a 2-year record, was driven by the booming job market and the ease of fears about inflation. As the employment market remains solid and inflation exhibits indicators of improvement, consumers are more positive regarding the economy's direction. Positive sentiment is prevalent across all income levels and age ranges, which suggests an overall increase in optimism. There are still some worries about the possibility of a recession, although they are less severe compared to earlier in the year. Observing consumer confidence levels will give important insights into the economy's future if the economy continues to improve.

Discussion