Understanding the Economic Calendar: Your Key to Financial Awareness, What it is, How it Works, FAQs

Introduction

An economic calendar is a vital tool for traders and investors seeking to stay informed about economic events that can potentially impact the financial markets. It serves as a comprehensive schedule of important economic data releases, such as GDP reports, employment figures, and central bank announcements. By providing this information, an economic calendar helps market participants make well-informed decisions and anticipate potential market movements.

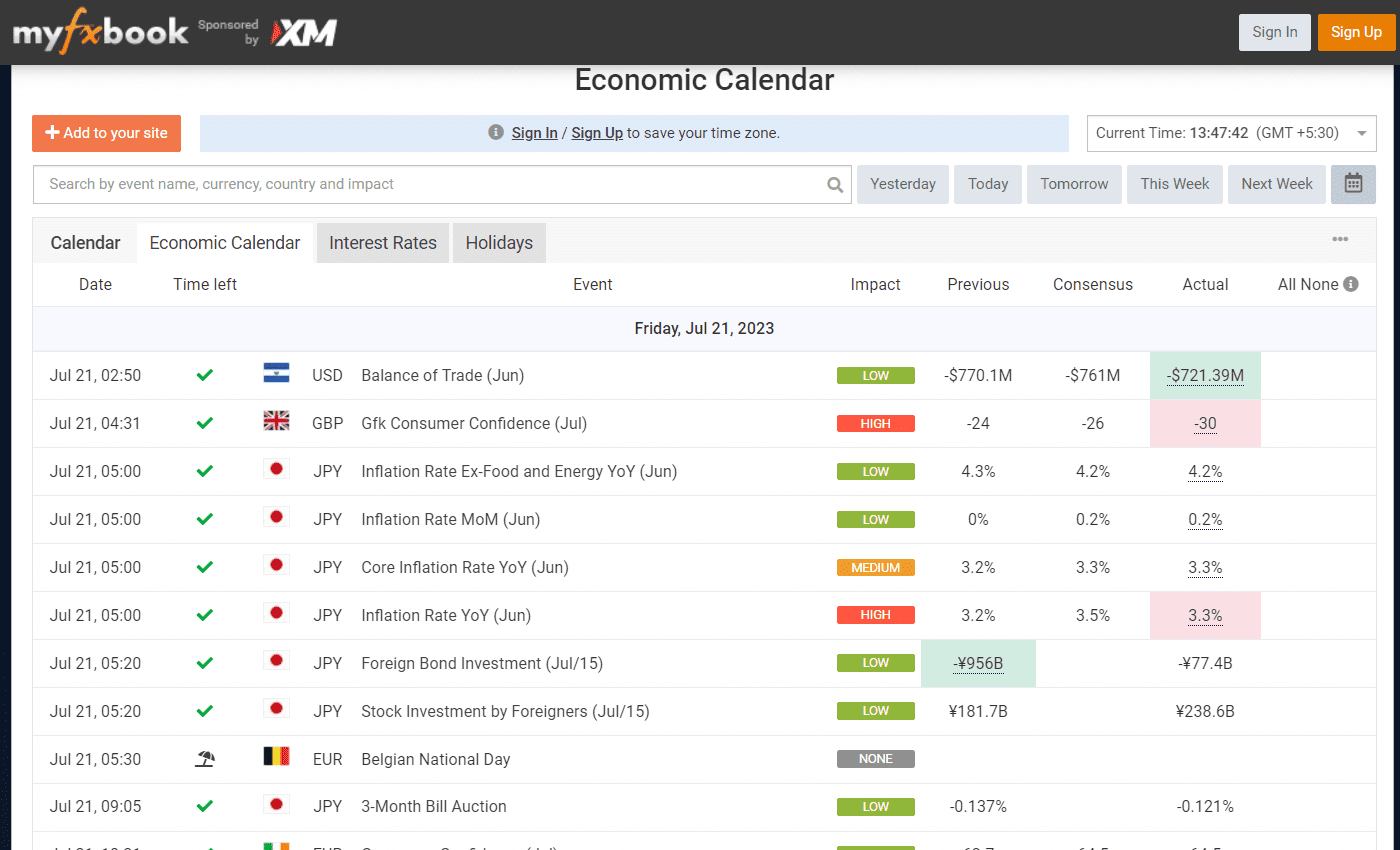

Source from myfxbook

Definition of an Economic Calendar

An economic calendar is a tool that displays scheduled economic events, including economic indicators, policy decisions, and other crucial announcements, organized by date and time. It serves as a centralized source of information that allows traders and investors to efficiently track upcoming events that may influence financial markets.

Importance of an Economic Calendar

Having access to an economic calendar is crucial because it helps market participants align their trading and investment strategies with significant economic events. By staying informed of these events, traders and investors can be prepared for potential market volatility and make timely decisions to capitalize on opportunities or take protective measures.

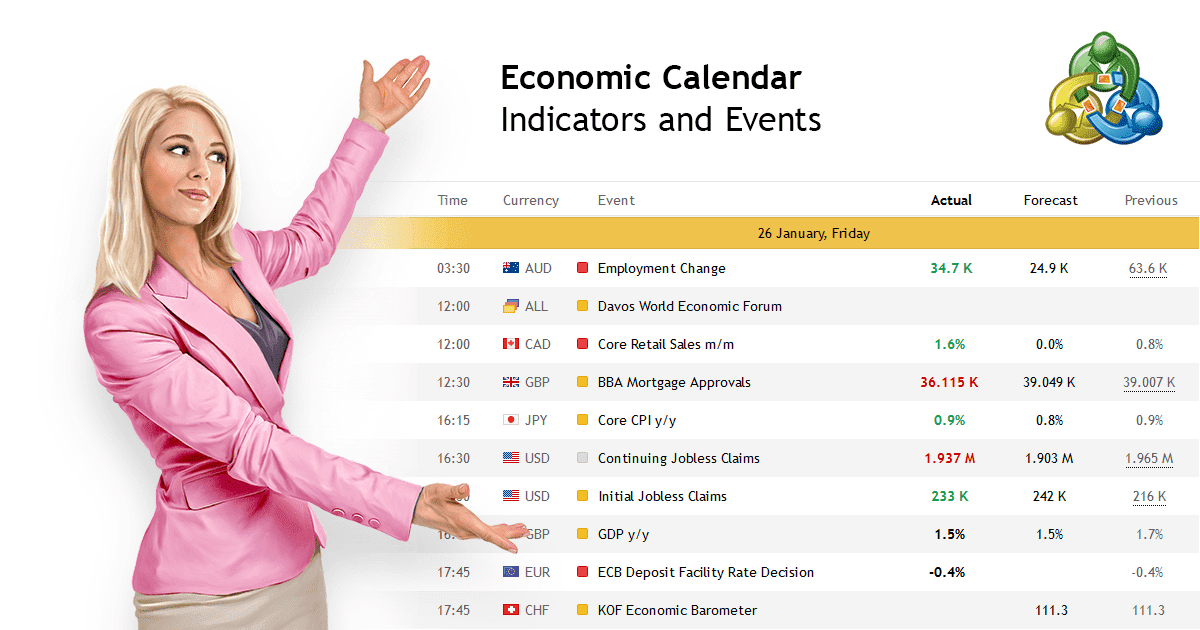

Source from MT5

What is an Economic Calendar?

- Explanation of an Economic Calendar

An economic calendar is essentially a tool that provides a detailed overview of upcoming economic events, both domestic and international. It categorizes events based on their relevance and impact on the financial markets. Traders and investors can refer to an economic calendar to determine which events are of high importance and likely to affect various asset classes.

- Purpose and Functionality

The primary purpose of an economic calendar is to help market participants anticipate how economic events and indicators can potentially influence market sentiment and asset prices. By tracking events such as interest rate changes, employment reports, or geopolitical developments, traders and investors can adjust their positions accordingly.

An economic calendar also serves as a reference tool for evaluating historical data and identifying patterns or trends over time. It allows users to compare the impact of previous events on the market, aiding in the assessment of potential future outcomes.

How it Helps Traders and Investors

An economic calendar plays a crucial role in helping traders and investors make informed decisions in the financial markets. Here's how it benefits them:

- Timing of Trades: Traders rely on economic calendars to time their trades effectively. By knowing the schedule of important economic events, they can avoid placing trades during periods of high volatility and uncertainty.

- Market Analysis: Investors use economic calendars to analyze the potential impact of upcoming economic data releases on their investment portfolios. This analysis helps them adjust their investment strategies based on the anticipated market movements.

- Informed Decision-Making: Economic calendars provide traders and investors with crucial information about economic indicators, government reports, and central bank decisions. This data-driven approach allows them to make decisions based on concrete information rather than speculation.

- Anticipating Market Reactions: By studying historical data and market consensus figures, traders can anticipate how the market might react to specific economic events. This foresight allows them to position themselves to take advantage of potential market movements.

- Risk Management: Economic calendars assist traders in implementing risk management strategies. By being aware of high-impact events, traders can adjust their position sizes or set stop-loss levels to protect their capital from unexpected market fluctuations.

- Understanding Market Sentiment: Economic events often reflect the overall health of an economy. Traders and investors can gauge market sentiment by monitoring how the market reacts to positive or negative economic indicators.

- Currency Trading: Forex traders heavily rely on economic calendars to plan their trades in the foreign exchange market. Economic indicators such as GDP, inflation, and employment data significantly influence currency pairs' exchange rates.

- Stock Analysis: Investors use economic calendars to be aware of earnings reports, economic data releases, and other events that may impact stock prices. This helps them make informed decisions about buying, holding, or selling stocks.

- Cryptocurrency Market: Economic calendars are increasingly relevant in the cryptocurrency market, where events like regulatory announcements and technological upgrades can have a significant impact on digital asset prices.

- Avoiding Surprises: Economic calendars help traders and investors avoid unexpected surprises. By staying informed about scheduled economic events, they can be prepared for potential market fluctuations and react accordingly.

- Long-Term Planning: Investors use economic calendars for long-term planning. By knowing when critical economic reports are due, they can strategize their investments for the upcoming months or quarters.

- Portfolio Diversification: Economic calendars aid in diversifying investment portfolios. Understanding how different economic events impact various asset classes allows investors to balance risk and potentially enhance returns.

An economic calendar is an indispensable tool for traders and investors, providing them with timely information about economic events and indicators. This knowledge empowers them to make educated decisions, manage risks effectively, and stay ahead in the ever-changing landscape of financial markets.

How to read the economic calendar?

Reading an economic calendar is essential for understanding and interpreting the scheduled economic events and indicators that can influence financial markets. Here's a step-by-step guide on how to read an economic calendar:

- Select a Reliable Economic Calendar: Choose a reputable economic calendar from trusted financial news websites or financial platforms. Look for one that offers real-time updates and covers the economic events relevant to your trading or investment interests.

- Check the Date and Time: The economic calendar displays events in chronological order. Pay attention to the date and time of each event, as they are crucial for planning your trading strategies.

- Identify the Event: Each entry in the economic calendar represents a specific economic event or data release. This could include central bank meetings, employment reports, GDP releases, inflation data, and more.

- Understand the Indicator: Familiarize yourself with the economic indicators mentioned in the calendar. These indicators provide information about the health and performance of an economy.

- Impact Rating: Most economic calendars assign an impact rating to each event. High-impact events are more likely to cause significant market volatility, while low-impact events may have minimal effects.

- Forecast vs. Actual: Economic calendars often include market consensus figures or forecasts for each event. These represent the market's expectations. After the event, the actual data is updated in the calendar. Compare the actual results with the forecast to assess market reactions.

- Market Relevance: Determine the relevance of each event to the financial markets you are interested in. Certain indicators have a stronger impact on specific assets like currencies, stocks, or commodities.

- Prepare for Volatility: High-impact events can lead to increased market volatility. Be prepared for price fluctuations and consider risk management strategies.

- Cross-Reference with Other Sources: While economic calendars are generally reliable, it's a good practice to cross-reference the information with other trusted financial news sources to ensure accuracy.

- Stay Informed: Keep track of real-time updates as they occur. Economic events can sometimes have unexpected outcomes, and staying informed helps you adapt your trading or investment approach.

- Understand Market Sentiment: Learn how the market reacts to specific economic events over time. Understanding market sentiment can help you anticipate potential market movements.

- Consider Historical Data: Analyze historical data of past events to observe patterns and correlations between economic indicators and market movements.

By following these steps and regularly using an economic calendar, you can enhance your understanding of economic events, make informed trading decisions, and stay ahead in the dynamic world of finance.

How Does an Economic Calendar Work?

An economic calendar functions as a comprehensive schedule of upcoming economic events, data releases, and financial indicators that can potentially impact the global economy and financial markets. It serves as a valuable tool for traders, investors, and financial professionals to stay informed about critical events that could influence their trading strategies, investment decisions, and overall market sentiment. Here's how an economic calendar works:

- Data Compilation: Economic calendars gather data from various reliable sources, including government agencies, central banks, financial news outlets, and reputable economic research institutions. These sources provide information on scheduled economic events and data releases well in advance.

- Chronological Organization: The data is organized in chronological order based on the date and time of each event. This allows users to quickly find and anticipate upcoming economic events.

- Event Descriptions: Each entry in the economic calendar includes a brief description of the economic event or indicator. It may provide details such as the event's name, data type (e.g., GDP, inflation rate, employment data), and the country or region to which the event pertains.

- Impact Rating: Economic calendars often assign an impact rating to each event. This rating indicates the potential influence the event may have on the financial markets. Events with higher impact ratings are more likely to cause significant market movements.

- Market Consensus: Economic calendars frequently include market consensus figures or forecasts for certain economic indicators. These figures represent the market's collective expectations for the upcoming data release. They serve as benchmarks against which the actual data will be compared.

- Real-Time Updates: To maintain accuracy and relevance, economic calendars provide real-time updates. As soon as an economic event occurs and the data is released, the calendar is promptly updated to reflect the actual figures.

- Interpreting the Data: Traders and investors use economic calendars to interpret the data provided. They analyze the actual data released compared to the market consensus and historical figures. Deviations from expectations can lead to market volatility and potential trading opportunities.

- Market Impact: Economic events can have varying impacts on different financial markets. For example, an interest rate decision by a central bank may heavily influence currency exchange rates, while employment data can affect stock prices and market sentiment.

- Decision-Making Tool: Traders and investors use the economic calendar as a decision-making tool to plan their trades and investment strategies. By being aware of upcoming events, they can adjust their positions, hedge against potential risks, or stay on the sidelines during periods of high volatility.

- Wide Coverage: Economic calendars cover a wide range of indicators and events, including GDP releases, inflation data, employment reports, central bank meetings, retail sales figures, and more. This comprehensive coverage allows users to monitor various aspects of the global economy.

Overall, an economic calendar is a vital resource for anyone involved in financial markets. It empowers users with timely information, enhances their understanding of economic trends, and aids in making well-informed decisions in an ever-changing economic landscape.

Key Components of an Economic Calendar

- Major Economic Indicators

An economic calendar presents a vast array of economic indicators, each providing insights into different aspects of the economy. Some of the key indicators include gross domestic product (GDP), consumer price index (CPI), nonfarm payrolls (NFP), manufacturing and services PMI (Purchasing Managers' Index), and central bank interest rate decisions. Understanding these indicators and their implications is essential in comprehending the overall economic landscape.

- Impact Ratings and Significance

To help traders and investors assess the potential impact of an event or indicator, economic calendars often assign impact ratings or significance levels. These ratings can range from low to high, with high-impact events having the greatest potential to cause market volatility. By considering the impact ratings, market participants can prioritize events that are most likely to trigger substantial market movements.

- Understanding Market Expectations

In addition to providing information on upcoming events, economic calendars also include market expectations. This data reflects the consensus forecasts of economists, analysts, and market participants regarding the expected outcomes of specific events or indicators. By comparing actual results with market expectations, traders and investors can gauge the potential market reaction.

Using an Economic Calendar for Trading and Investment

- Strategies for Forex Traders

Forex traders heavily rely on economic calendars to plan their trading strategies. For instance, before entering a trade, forex traders often assess the economic calendar to identify events that may impact the currency pairs they trade. By being aware of potential market-moving events, forex traders can strategically position themselves to take advantage of possible price fluctuations.

- Implications for Stock Investors

For stock investors, an economic calendar is a valuable resource for understanding macroeconomic trends that can impact the stock market. By considering upcoming events such as earnings releases, economic reports, or major policy decisions, investors can adjust their portfolios accordingly and capitalize on potential market opportunities.

- Utilizing the Calendar in Cryptocurrency Markets

Cryptocurrency traders and investors also find economic calendars useful in their decision-making process. By tracking events such as regulatory announcements, technological advancements, or market integration developments, cryptocurrency market participants can gain insights into potential price movements and adjust their strategies accordingly.

Benefits and Limitations of Economic Calendars

- Advantages of Staying Informed

Utilizing an economic calendar offers several benefits. Firstly, it allows traders and investors to stay informed about critical events that can impact the markets, making it easier to plan and execute trades effectively. Additionally, it helps market participants avoid unexpected market reactions and adjust their positions accordingly. Economic calendars also enable traders and investors to track the overall health of the economy and its potential impact on asset prices.

- Potential Drawbacks and Risks

While economic calendars are valuable tools, it is important to recognize their limitations. Economic events can sometimes deviate from market expectations, resulting in unexpected market reactions. Moreover, economic calendars may not capture all potentially market-moving events, especially unforeseen geopolitical developments or natural disasters. Therefore, it is crucial for traders and investors to combine economic calendar analysis with other forms of market research and risk management strategies.

How to Interpret Economic Calendar Data

- Analyzing the Data Points

When interpreting economic calendar data, it is essential to understand the significance of each event or indicator. For instance, positive employment data may indicate a robust economy, potentially leading to increased consumer spending and investment. On the other hand, negative data in key indicators like inflation can signal economic weakness and affect monetary policy decisions.

- Identifying Market Trends

By continuously monitoring economic calendar data, market participants can identify significant trends that may impact the financial markets. For example, a series of interest rate cuts might indicate a central bank's effort to stimulate the economy, potentially leading to increased investor optimism and higher asset valuations.

Popular Economic Calendars

- Overview of Top Platforms

Several economic calendar platforms provide comprehensive information to traders and investors. Some of the popular platforms include Investing.com, myfxbook, Forex Factory, and DailyFX. These platforms offer a user-friendly interface, real-time updates, and a wide range of economic events and indicators, catering to the diverse needs of market participants.

- Features and Comparison

While different economic calendar platforms offer similar functionalities, they may have unique features that appeal to specific traders or investors. For instance, some platforms provide customizable alerts or integrate additional tools, such as technical analysis indicators or sentiment analysis. Market participants should explore different platforms to find the one that best aligns with their trading or investment strategies.

FAQs about Economic Calendars

What is the best economic calendar?

- Several economic calendar platforms are commonly regarded as the best in the market, including Investing.com, myfxbook, Forex Factory, and DailyFX. The choice of the best platform depends on individual preferences, user experience, and the range of events and indicators covered.

How often are economic calendars updated?

- Most economic calendars are updated frequently to ensure users have access to the most recent and accurate information. This frequency depends on the platform and the specific events being tracked. In some cases, updates may occur in real-time, allowing traders and investors to stay informed of the latest developments.

Can economic calendars predict market movements?

- While economic calendars provide valuable information about upcoming events and indicators, they cannot predict market movements with certainty. Market reactions can be influenced by a wide range of factors, including geopolitical events, investor sentiment, or unexpected developments. Economic calendars serve as a tool to help traders and investors make informed decisions but should not be relied upon as the sole predictor of market movements.

Are there free economic calendar options?

- Yes, there are free economic calendar options available. Many reputable platforms offer basic economic calendar features without charging a fee. However, certain advanced functionalities or premium subscriptions may require a paid subscription.

How reliable are economic calendars?

- Economic calendars source information from reputable government agencies, central banks, and financial institutions, ensuring a high level of reliability. However, unexpected changes or revisions in economic data can occur, which may result in deviations from market expectations. It is important for traders and investors to cross-check information from multiple sources and employ risk management strategies to mitigate potential risks.

Footnote

In Summary, economic calendars play a crucial role in guiding traders and investors towards well-informed decision-making. By providing comprehensive schedules of upcoming economic events and indicators, economic calendars support market participants in anticipating market trends, managing risks, and capitalizing on potential opportunities. Utilizing economic calendars can significantly enhance one's understanding of the financial markets and contribute to more effective trading and investment strategies. It is highly recommended that traders and investors incorporate economic calendars into their daily routine to stay ahead in the dynamic world of finance.

Discussion