TradeTime Review: Unraveling the Key Aspects of This Forex Broker

In the world of online financial services, TradeTime emerges as a prominent player, specializing in forex trading and a variety of tradeable assets. In this comprehensive review, we'll delve into various aspects of this brokerage, ranging from its regulatory status and pricing to the login process. Let's uncover the truth about TradeTime and determine whether it's a reliable and legitimate choice for traders.

Exploring TradeTime:

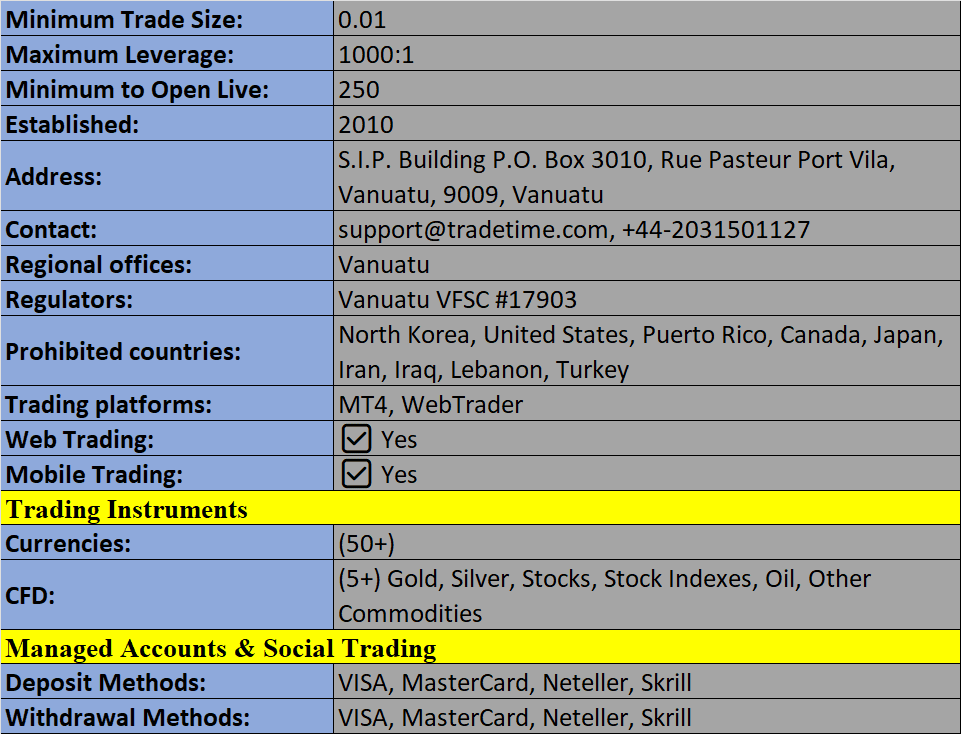

TradeTime, also known as Capital Process Ltd, is a registered entity operating in Bulgaria. The brokerage asserts its regulation by the Vanuatu Financial Services Commission, boasting a track record that extends back to 2010. With several customer service offices strategically positioned around the globe, including Australia, Spain, Sweden, and the UK, TradeTime appears to offer a global presence.

TradeTime's Diverse Tradeable Instruments

TradeTime caters to traders of all levels by providing access to a broad spectrum of over 490 tradeable instruments. This extensive offering is accessible through two user-friendly platforms and customizable trading accounts, tailoring the experience to individual preferences.

Trading Platform:

TradeTime stands out with its proprietary trading platform, known for its remarkable speed of execution, advanced charting tools, customizable indicators, and integrated trading signals. However, it's worth noting that automated trading or Expert Advisors aren't supported on this platform, which may be a consideration for some users seeking automation.

MetaTrader 4 (MT4):

For those who prefer the familiarity of MetaTrader, TradeTime also offers the award-winning MetaTrader 4 (MT4) platform. This versatile platform comes with a rich set of features, including:

- 30 built-in technical analysis indicators

- Automated trading and Expert Advisors

- Multiple order execution options

- Advanced real-time charting capabilities

- Choice of 9 different timeframes

- Convenient one-click trading functionality

MT4 can be conveniently downloaded directly from the broker's website, ensuring easy access for traders.

TradeTime's Array of Markets

TradeTime's trading universe encompasses a wide range of markets, making it an attractive choice for diverse trading interests. These markets include:

Shares: With TradeTime, you can trade more than 400 global shares, including popular options like Adidas, Facebook, and Google.

Currencies: The forex market is at your fingertips with over 60 currency pairs available, including EUR/GBP and GBP/USD, along with the ever-intriguing cryptocurrency, Bitcoin.

Commodities: TradeTime offers an array of commodities, from oil to precious metals and even coffee.

Indices: Select from seven of the world's most prominent indices, such as the FTSE100, DAX40, and Dow Jones, to diversify your trading portfolio.

Spreads, Commissions, and Leverage

Spread

TradeTime's pricing structure is an essential consideration for traders. The broker's spreads, while extensive, might raise some eyebrows. For major forex pairs, spreads commence at 3.3 pips for EUR/USD and 4.3 pips for EUR/GBP. Achieving tighter spreads, like 2.2 pips for EUR/USD or 1.8 pips, would necessitate initial investments of at least $5,000 or $11,000, respectively.

Commission

For those seeking competitive spreads, the ECN account stands out, offering a mere 0.6 pips for EUR/USD with a commission of $1.80. However, this lower spread also requires a significant initial investment of $5,000.

When it comes to trading shares, a minimum investment of $5,000 applies across the board, with a commission of $1.50 per share.

Leverage

TradeTime allows traders to harness leverage, with a maximum of 1:300 for currencies. Leverage rates of 1:75 are available for indices, shares, and commodities, with the possibility to request an increase to 1:400.

Traders can conveniently access a margin calculator on the broker's website to gauge their potential risk.

Mobile Trading with TradeTime

For traders on the move, TradeTime offers the MT4 mobile app, ensuring access to essential features like customizable charts, financial news, and push notifications. This app is compatible with both iOS and Android devices, readily available on their respective App Stores.

Payment Methods and Accessibility

TradeTime permits a minimum deposit of $500 via credit/debit cards and bank transfers. While the website hints at alternative payment methods, specific details remain elusive, and attempts to reach customer support for clarification were fruitless. This scarcity of information concerning deposit and withdrawal methods may give traders pause.

Demo Account:

TradeTime provides traders with a demo account, allowing them to gain practical experience before transitioning to a live account. Setting up a practice account is straightforward, requiring personal details and a selection of the preferred account currency.

Deals & Promotions:

TradeTime lures in traders with a $27 no deposit welcome bonus. However, caution is advised as the terms and conditions surrounding this bonus are shrouded in uncertainty. Traders might encounter difficulties when attempting to withdraw the bonus or any associated returns.

Regulation & Licensing Concerns

While TradeTime emphasizes aspects of regulation, fund segregation, and security, it is unsettling that concrete evidence of regulatory oversight from entities like the VFSC or the Bulgarian Financial Services Commission (FSC) remains absent.

Considering this, concerns may arise about TradeTime's legitimacy and trustworthiness. To err on the side of caution, it is advisable to explore more established providers, notably those regulated by organizations like the FCA and CySEC.

Additional Features: Tools and Services

TradeTime differentiates itself by offering a suite of valuable additional features, including:

Diverse Calculators: Traders can access a range of calculators, covering margin, pips, currency conversion, and more.

Trading Signals Service: TradeTime provides traders with trading signals to aid in their decision-making process.

Financial Blog: Stay informed with the broker's financial blog, which offers insights and updates on the financial markets.

CFD Calendar: Traders can consult the CFD calendar to stay up-to-date with important events and their potential market impact.

Account Types:

TradeTime exclusively offers custom accounts, allowing users to personalize their trading experience based on their desired deposit amount and asset interests. The minimum deposit unlocks access to currency and commodity trading, while the maximum leverage across accounts is set at 1:400.

Trading Hours:

With TradeTime, traders can engage in the market 24 hours a day, five days a week. However, specific market availability may vary according to global time zones:

- Sydney: 10:00 pm - 7:00 am GMT

- London: 11:00 pm - 8:00 am GMT

- Tokyo: 11:00 pm - 8:00 am GMT

- New York: 12:00 pm - 9:00 pm GMT

Customer Support:

TradeTime offers multiple channels for customer support, including:

- Email: support@tradetime.com

- Live Chat: Accessible in the bottom right-hand corner of the website

- Telephone: +44 203 150 1127 (UK)

International numbers are also available for residents of Australia, New Zealand, Spain, Sweden, Switzerland, and France. It's worth noting, however, that during our assessment, the live chat feature did not connect to a human representative, which could be a drawback for those who value efficient and prompt customer support.

Security Measures:

TradeTime takes data security seriously, employing 256-bit GeoTrust encryption and housing its servers in SAS-70 certified data centers. The company also states its commitment to insuring and segregating client funds in separate bank accounts, enhancing the safety of traders' assets.

Benefits and Drawbacks

Advantages of TradeTime:

- Customizable accounts

- Access to the widely acclaimed MT4 trading platform

- Availability of 6 daily signals

- A diverse selection of 60+ currencies

- Leverage of up to 1:400

Drawbacks of TradeTime:

- High spreads and commissions

- Unclear regulation and licensing

- Limited educational resources

- Concerning online reviews

In summary, TradeTime's lack of verified regulation, coupled with high trading fees, raises concerns about its authenticity. These concerns are echoed by other online reviews. Given the persistent lack of information regarding trading conditions and the limited educational resources available, traders may wish to exercise caution and explore alternatives from more reputable providers.

TradeTime Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion