TeleTrade Review 2023: A Trusted Forex Broker with Pros and Cons

TeleTrade is the ideal choice for traders who appreciate a wide selection of trading instruments and prefer to trade using either their PC or a mobile app. Whether you're a newcomer to trading or an experienced trader, this broker offers something valuable for everyone.

Established back in 1994, TeleTrade has built a solid reputation in the world of forex trading. Their dedication to excellence earned them the prestigious 2018 Traders Union Award for Best Broker in Europe. Notably, TeleTrade is a proud member of the Association of Forex Dealers, a respected self-regulatory organization within the financial industry. Further strengthening their commitment to transparency and trust, the company operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC, 158/11).

Who is TeleTrade?

TeleTrade stands as a prominent forex broker known for its user-friendly trading platforms, including MT4, MT5, and Web Trader. This broker offers a diverse range of trading options, spanning over 65 forex currency pairs, gold, silver, CFDs, indices, energies, stocks, ETFs, bitcoin, and other cryptocurrencies. This impressive array of assets ensures plenty of choices for personal investment and trading strategies.

Advantages of Trading with TeleTrade

- Stringent Regulation: TeleTrade operates in a well-regulated environment, fostering trust and security for traders.

- Award-Winning Excellence: The company's 2018 Traders Union Award for Best Broker in Europe underscores their commitment to quality service.

- Choice of Platforms: TeleTrade provides both MT4 and MT5 platforms, catering to traders with various preferences.

- Advanced Copy Trading: The platform offers advanced copy trading options, allowing users to replicate the strategies of successful traders.

- International Presence: Being part of an international group adds to their global credibility.

- Diverse Financial Instruments: TeleTrade offers a wide range of financial instruments, including forex, metals, stocks, cryptocurrencies, indices, and energies.

- No Dealing Desk (NDD) Environment: Traders can benefit from the NDD trading environment, reducing the risk of conflicts of interest.

- Competitive Conditions: TeleTrade offers competitive and attractive trading conditions, making it appealing to traders of all levels.

- Digital Demo Account: The demo account sign-up process is fully digital, with no expiration date and an unlimited virtual deposit, allowing for risk-free practice.

- Commission-Free Trading: Variable spreads come with commission-free trading, making it cost-effective for traders.

- Islamic Account: TeleTrade caters to diverse trading needs by offering Islamic accounts.

- Segregated Client Funds: The company follows best practices by using segregated client funds, enhancing security.

Disadvantages of TeleTrade

- Fixed Spread Accounts: TeleTrade does not offer fixed spread accounts, which some traders may prefer for stability.

- No United States Clients: Unfortunately, TeleTrade does not accept clients from the United States.

- Lack of Trading Bonuses: Unlike some competitors, TeleTrade does not offer trading bonuses for loyal customers.

- Competitive Pricing: Some users may find the overall pricing at TeleTrade less competitive compared to other brokers.

- No Micro Trade-able Lots: The absence of micro trade-able lots may limit options for traders with smaller capital.

- Mediocre Leverage: TeleTrade provides leverage levels that some traders may consider to be moderate.

- High Minimum Initial Deposit: The minimum initial deposit requirement is relatively high, which may deter some potential traders.

In summary, TeleTrade is a well-established broker with a strong regulatory framework and a wide range of trading options. However, potential users should consider their specific trading needs and preferences when evaluating this broker.

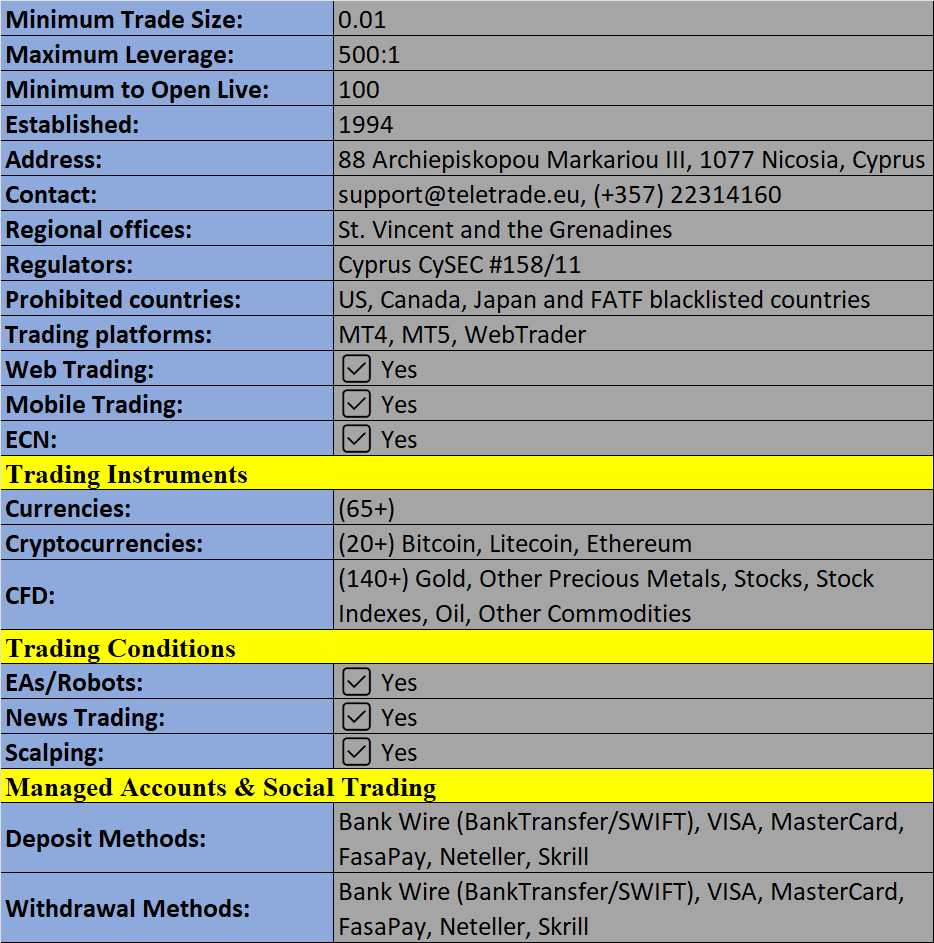

Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion