Stocks Rise, Dollar Dips Ahead of US Inflation Data

Highlights:

- Wall Street Stocks Rise,

- Dollar and Treasury Yields Decline,

- Crude Oil Prices Surge

Global Shares Soar as Investors Await US Inflation Figures

Global shares saw a significant boost, and the value of the dollar declined on Tuesday as investors eagerly awaited the release of U.S. inflation data that could potentially impact the Federal Reserve's decision on interest rate hikes. Additionally, the expectation of China's efforts to bolster economic growth contributed to the rise in oil and other commodities.

Wall Street Stocks Gain Momentum

Wall Street experienced positive gains across its major stock indexes, reflecting the optimistic sentiment prevailing in the market. The Dow Jones Industrial Average (.DJI) surged by 0.93% to reach 34,260.82, the S&P 500 (.SPX) increased by 0.67% to settle at 4,439.25, and the Nasdaq Composite (.IXIC) rose by 0.55% to close at 13,760.70.

European Shares Contribute to Global Rise

The MSCI All-World index (.MIWD00000PUS) exhibited a rise of 0.85%, largely influenced by the gains observed in European shares. The STOXX 600 (.STOXX) recorded a gain of 0.72%, further adding to the positive momentum.

Federal Reserve Officials Hint at Additional Rate Hikes

Market participants analyzed recent statements from Federal Reserve officials, who indicated that inflation may necessitate further rate hikes. However, the central bank is approaching the end of its monetary policy tightening cycle.

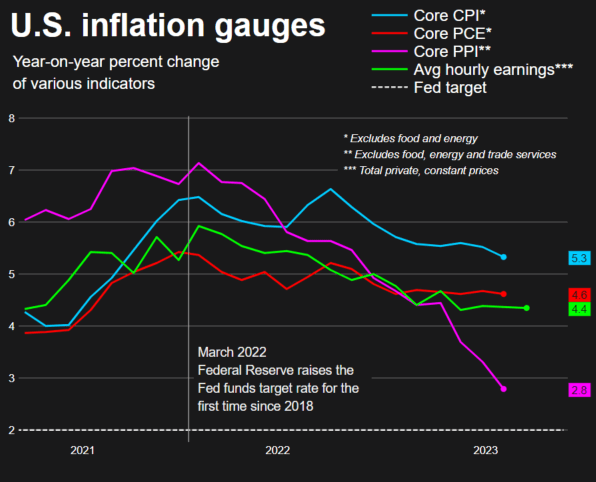

Inflation Expectations for June

Image source from Reuters

According to economists polled by Reuters, the consumer price index for June is anticipated to have increased by 3.1%, following a 4% rise in May (USCPNY=ECI). This projection indicates the lowest reading since March 2021. The core rate is expected to decline for the third consecutive month to 5% from 5.3%, although it remains more than double the Fed's 2% target.

Impact of Employment Report

The employment report released last week revealed that the number of workers added to non-farm payrolls in June was significantly lower than anticipated. This led to a decline in the value of the U.S. dollar but did not substantially alter rate expectations.

Market's Focus on Inflation Data

The impending inflation data release on Wednesday holds significant importance, despite occurring too late to affect the July meeting. A rate hike is highly probable, and only exceptionally weak inflation figures would likely alter this trajectory, as OANDA market strategist Craig Erlam stated.

Upcoming Second-Quarter Earnings

Investors will closely monitor the second-quarter earnings reports scheduled for this week. Major Wall Street institutions, including JPMorgan (JPM.N), Citigroup (C.N), and Wells Fargo (WFC.N), are among those expected to disclose their financial performance. Analysts predict a 6.4% decline in earnings for the second quarter compared to the previous year, based on IBES data from Refinitiv.

The Impact of Inflation

- Weakening Dollar: The dollar index, which measures the performance of the U.S. currency against a basket of other currencies, experienced a decline of 0.27% during the day (.DXY). This drop brought the index close to its lowest point in two months, aligning with the downward movement in U.S. Treasury yields.

- Other Currencies Respond: The dollar also weakened against the yen, reaching a two-month low and declining by approximately 0.7%. Meanwhile, sterling surged to a 15-month high following better-than-expected pay growth.

- The Favorable Fundamental Story for the Dollar: Currency strategists at Brown Brothers Harriman emphasized that the underlying factors favour the dollar despite recent pressures. They also mentioned that market participants still perceive significant risks of a second Fed rate hike later in the year.

- Investor Anticipation and Treasury Yields: In anticipation of Wednesday's inflation data release, longer-dated U.S. Treasury yields experienced a decline. Investors eagerly awaited further indications on whether price pressures were subsiding and if the Fed was nearing the conclusion of its rate-hiking cycle. The yield on the benchmark 10-year note dropped by 2.6 basis points to 3.980%, slipping below the 4% threshold set the previous day.

Commodities Gain Momentum

The expectation of a boost to China's economy positively impacted the price of crude oil, copper, and iron ore, among other industrial commodities.

Crude Oil Prices Surge

Crude oil prices experienced a notable surge on Tuesday, rising approximately 2%. This increase was fueled by a declining U.S. dollar, the hope for higher demand in developing nations, and supply cuts implemented by the world's leading oil exporters. Brent crude, which had struggled to overcome 18-month lows, reached $79.31, marking a 2.09% gain for the day. U.S. crude rose by 2.38% to $74.73 per barrel.

Gold Prices Reach Three-Week High

The price of gold scaled a near three-week high, reflecting positive market sentiment. Spot gold increased by 0.36% to reach $1,931.95 per ounce.

In Summary, global markets exhibited a positive trend as stocks rose and the dollar declined ahead of the release of U.S. inflation data. Investors were optimistic about the growth prospects, supported by favourable economic conditions and the anticipation of China's efforts to stimulate its economy. The upcoming inflation figures and second-quarter earnings reports are expected to provide further insights into the future trajectory of financial markets.

Discussion