Safe Haven Currencies: The Key to Financial Security in an Uncertain World

Introduction

In a world plagued with financial uncertainties, finding ways to safeguard one's wealth has become more critical than ever. Safe Haven Currencies emerge as a key strategy to protect our finances during times of economic instability and market fluctuations. This comprehensive guide explores the significance of Safe Haven Currencies, their benefits, and how they can provide financial security for investors and individuals alike.

What are Safe Haven Currencies?

Safe Haven Currencies are currencies that investors turn to in times of crisis or economic turbulence. These currencies typically retain or increase their value when other currencies and assets face devaluation or volatility. The appeal of Safe Haven Currencies lies in their ability to act as a hedge against potential losses, offering a sense of stability and security in uncertain times.

Why are Safe Haven Currencies Important?

Safe Haven Currencies play a pivotal role in portfolio diversification and risk management. As financial markets fluctuate due to geopolitical tensions, economic recessions, or global events, investors seek refuge in assets that tend to remain relatively stable. Safe Haven Currencies provide an avenue for preserving wealth and minimizing potential losses in such situations.

The Top Safe Haven Currencies

- Swiss Franc (CHF): The Swiss Franc is renowned for its stability and is often considered the ultimate Safe Haven Currency. Switzerland's robust economy, political neutrality, and strong financial system make the CHF an attractive choice for investors.

- United States Dollar (USD): As the world's primary reserve currency, the USD is a popular Safe Haven choice due to the economic strength of the United States. It tends to rise in value during global uncertainties.

- Japanese Yen (JPY): Japan's low-interest-rate policy and status as a net creditor nation contribute to the JPY's appeal as a Safe Haven Currency.

- Euro (EUR): The Euro, used by many European countries, benefits from the region's economic stability and is considered a reliable Safe Haven option.

Benefits of Investing in Safe Haven Currencies

- Risk Diversification: Safe Haven Currencies help spread risk across various assets, reducing the impact of adverse market conditions on a portfolio.

- Preserving Value: During times of inflation or economic instability, Safe Haven Currencies can retain or increase their value, acting as a store of wealth.

- Liquidity: Safe Haven Currencies are highly liquid, enabling investors to buy or sell them without significant price fluctuations.

- Global Acceptance: Leading Safe Haven Currencies are widely accepted worldwide, facilitating international transactions and investments.

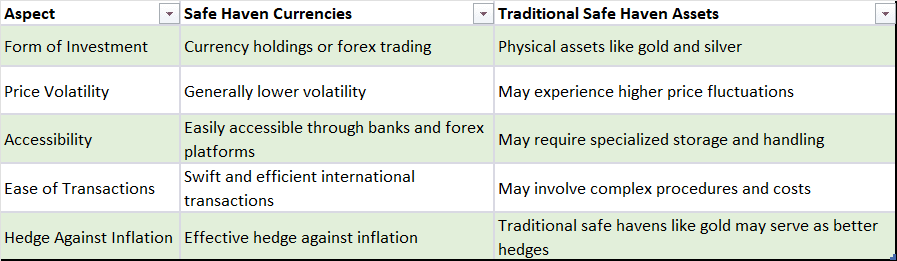

Safe Haven Currencies vs. Traditional Safe Haven Assets

How to Incorporate Safe Haven Currencies in Your Portfolio

To make the most of Safe Haven Currencies, consider the following strategies:

- Diversify Across Currencies: Allocate a portion of your portfolio to different Safe Haven Currencies to spread risk effectively.

- Stay Informed: Stay updated on global economic and geopolitical events to anticipate potential market fluctuations and act accordingly.

- Consult Financial Experts: Seek advice from financial experts to design a personalized portfolio strategy based on your financial goals and risk tolerance.

- Balance with Other Assets: Balance your Safe Haven Currency holdings with other investments to create a well-diversified portfolio.

Conclusion

In uncertain times, ensuring financial security is paramount. Safe Haven Currencies offer a reliable shield against economic volatility, allowing investors to preserve their wealth and achieve long-term financial stability. By incorporating these currencies strategically in your investment portfolio, you can navigate through uncertain waters with confidence and peace of mind.

FAQs

- What is the role of Safe Haven Currencies during economic crises?

Safe Haven Currencies act as a refuge for investors during economic crises, as they tend to retain or increase their value while other assets may experience devaluation.

- Why is the Swiss Franc considered the ultimate Safe Haven Currency?

The Swiss Franc's reputation as the ultimate Safe Haven Currency is due to Switzerland's stable economy, political neutrality, and strong financial system.

- Can individuals benefit from Safe Haven Currencies?

Yes, individuals can benefit from Safe Haven Currencies by diversifying their investment portfolio and using them as a hedge against market volatility.

- What are the key benefits of investing in Safe Haven Currencies?

Investing in Safe Haven Currencies offers risk diversification, wealth preservation, high liquidity, and global acceptance for international transactions.

- How can one incorporate Safe Haven Currencies in their investment strategy?

To incorporate Safe Haven Currencies effectively, individuals should diversify across different currencies, stay informed about global events, seek expert advice, and balance their holdings with other assets.

Discussion