Reviewing PU Prime: A Comprehensive 2023 Analysis of Trading Platforms, Instrument Variety, and Pros and Cons

In the dynamic realm of online trading, PU Prime stands as a global giant, providing access to over 800 instruments and innovative copy trading services. As we delve into the details of our 2023 review, we'll explore the regulatory framework, diverse account types, fees structure, customer support avenues, and much more. Let's embark on this journey to uncover whether opening a live account with PU Prime is the right move for you.

Unveiling PU Prime

PU Prime, an accolade-laden CFD broker, has earned the trust of more than 400,000 traders globally. Offering nearly 1000 products with industry-leading trading costs, the broker's commitment to exceptional customer service has fueled its rapid ascent in the financial landscape. Boasting multilingual services and a 24-hour support team of over 300 professionals, PU Prime has received accolades such as Fastest Growing Broker and Best Mobile Trading App in 2022.

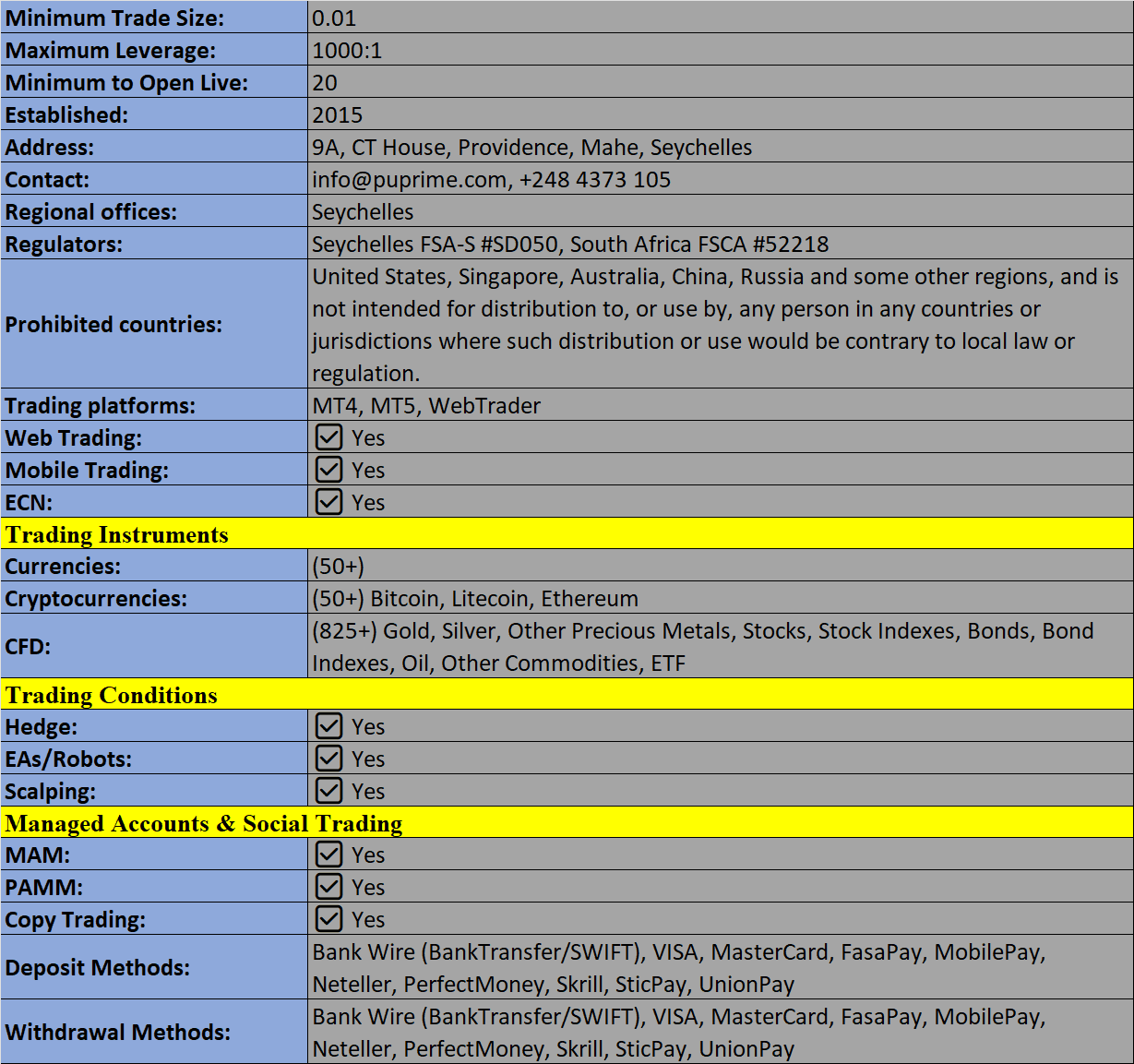

In 2023, the broker continued its winning streak, securing titles like Best Trading Account for Beginners and Excellent Trading Resources Online Broker LATAM. Operating on a no dealing desk model, PU Prime ensures superior pricing, minimal outages, and extensive liquidity. Regulated by the Financial Sector Conduct Authority of South Africa (FSCA) and the Seychelles Financial Services Authority (FSA), PU Prime is a beacon of trustworthiness.

Trading Platforms

PU Prime offers a trifecta of trading platforms, each catering to diverse preferences and needs.

PU Prime Mobile App

Compatible with both Android and iOS, the mobile app provides a seamless trading experience with features such as full dealing functionality, risk management tools, charting tools, exclusive in-app promotions, and a user-friendly interface.

Web Trader

Accessible on Windows, MAC, and Linux, the Web Trader terminal offers convenient trading via major web browsers. With features like multiple chart types, real-time quotes, and reliable data protection, it provides a versatile trading experience.

MetaTrader 4 and MetaTrader 5

Globally recognized, both platforms offer distinct features like multiple chart types, one-click trading, real-time market news, and an array of technical indicators. Traders can download these terminals for free on desktop and mobile devices, ensuring a comprehensive trading toolkit.

Product Offerings

PU Prime stands out with its expansive range of assets across global markets:

- Commodities: Speculate on energies, agriculture, and precious metals.

- Indices: Trade global indices, including Dow Jones, Nasdaq, and S&P 500.

- Forex: Over 40 currency pairs, majors, and minors.

- Shares: CFDs of top companies like Amazon, VISA, Tesla, and IBM.

- ETFs: Diversify with exchange-traded funds.

- Bonds: Trade sovereign bonds, including US Treasury notes and UK Gilts.

Fee Structure

Fees vary between account types, with the Prime and ECN solutions offering the tightest spreads. Spreads can go as low as 0 pips during highly liquid times. Notably, PU Prime doesn't charge commissions on Pacific Union Standard account trades. However, a $7 commission per side applies to the majority of trading instruments under the Prime account, with the ECN account having a $1 commission per side and a $10,000 minimum deposit.

Leverage

PU Prime offers flexible leverage, reaching up to 1:1000 on the Pro account. Traders should exercise caution with higher leverage, implementing risk management strategies to navigate the larger trade sizes it allows.

Mobile Trading

The proprietary mobile app from PU Prime ensures that traders can access full features on the go. With fast execution speeds, global market news, multi-account management, and 24/7 customer support, it's a robust tool for the modern trader. Additionally, MetaTrader 4 and MetaTrader 5 are available as mobile apps, extending the desktop platform's functionality to mobile devices.

PU Social: A Social Trading Innovation

Introduced in 2022, the PU Social trading application enables clients to follow the positions and strategies of top traders. This presents an exciting opportunity for new traders to learn from experienced counterparts. For seasoned traders, the PU Social app could serve as a supplementary revenue stream, allowing them to charge a subscription or commission on profitable trades.

Payments Options

PU Prime offers a variety of deposit options, each with its own processing time and maximum limits. Notably, the broker provides a rebate of up to $20 for third-party charges imposed during deposits. Withdrawals are generally free, with some methods incurring small charges from third-party service providers.

Demo Trading

Traders can utilize PU Prime's free demo account to practice execution, navigate platform features, and test strategies risk-free. With access to up to $100,000 in virtual funds, this is an invaluable tool for both beginners and experienced traders.

Deals & Promotions

As of now, PU Prime is enticing traders with several financial incentives, including a $50 no deposit bonus and a 50% Credit Bonus up to $10,000. Additionally, a refer-a-friend scheme allows traders to earn up to $150 for each successful referral. As promotions can have restrictions, it's advisable to review terms and conditions before diving in.

Regulatory

Operating under the regulation of the Seychelles FSA, FSCA, and SVGFSA, PU Prime provides a secure trading environment. The broker ensures negative balance protection and segregated client funds, aligning with the standards set by top-tier authorities like the FCA.

Addtional Features

Our review uncovered PU Prime's commitment to enhancing the trading experience. The broker provides various analysis tools, daily news posts, market reports, technical analysis, and educational content. Online webinars led by industry experts, an economic calendar, currency converter, and keyword glossary further contribute to a comprehensive trading ecosystem.

Types of Accounts

PU Prime caters to diverse trading preferences with its range of account types:

- Standard Account: $50 minimum deposit.

- Prime Account: $1000 minimum deposit, ideal for experienced traders.

- Cent Account: $20 minimum deposit, suitable for testing strategies and new traders.

- Pro Account: $50 minimum deposit.

- ECN Account: $10,000 minimum deposit, offering raw spreads directly from the interbank market.

For Muslim traders, PU Prime offers Islamic variations on Standard, Prime, and Cent accounts, adhering to Sharia law.

Trading Hours and Customer Support

With 24-hour trading times from Monday to Friday, PU Prime ensures accessibility. Customer support is available through various channels, including live chat, an online contact form, global address finder, email, and telephone.

Security Measures

PU Prime prioritizes security, with password-protected trading areas and encrypted data transmission. The MT4 and MT5 trading terminals adhere to industry-standard data privacy and incorporate dual-factor authentication.

Verdict on PU Prime

In summary, PU Prime emerges as a formidable player in the online trading arena. Boasting industry-recognized platforms, a diverse range of assets, competitive fees, and innovative features like the PU Social app, it offers a compelling package for traders. While it lacks tier 1 regulatory oversight, PU Prime compensates with robust security measures and a commitment to client fund protection. As with any trading platform, prospective users are advised to conduct thorough research and consider their individual needs before making a decision.

Pros and Cons

Pros:

- Industry-recognized MT4 and MT5 platforms and mobile apps.

- Extensive range of assets with nearly 1000 instruments across six asset classes.

- Competitive fees, with Prime account spreads starting at 0.4 and a $7 commission.

- Client safeguards with segregated funds and negative balance protection.

- Innovative PU Social app with copy trading capabilities.

- Demo account with virtual funds.

- Swap-free Islamic account.

- Multilingual customer service.

Cons:

- Lack of tier 1 regulatory oversight.

- Relatively high $40 minimum withdrawal and handling fee for withdrawals under $100.

- Standard account spreads are mediocre.

PU Prime Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion