Reviewing Fullerton Markets: Platforms, Trading Instruments, Pros, and Cons

Venturing into the expansive world of Fullerton Markets unveils a panorama of international forex brokerage services. This holistic review navigates through the intricate web of offerings, ranging from the coveted MT4 download to the bespoke PipProfit! application. Our exploration encompasses a comprehensive spectrum, delving into spreads, and regulatory facets. Come, let us determine whether Fullerton Markets beckon you to embark on a trading odyssey.

Fullerton Markets Unveiled

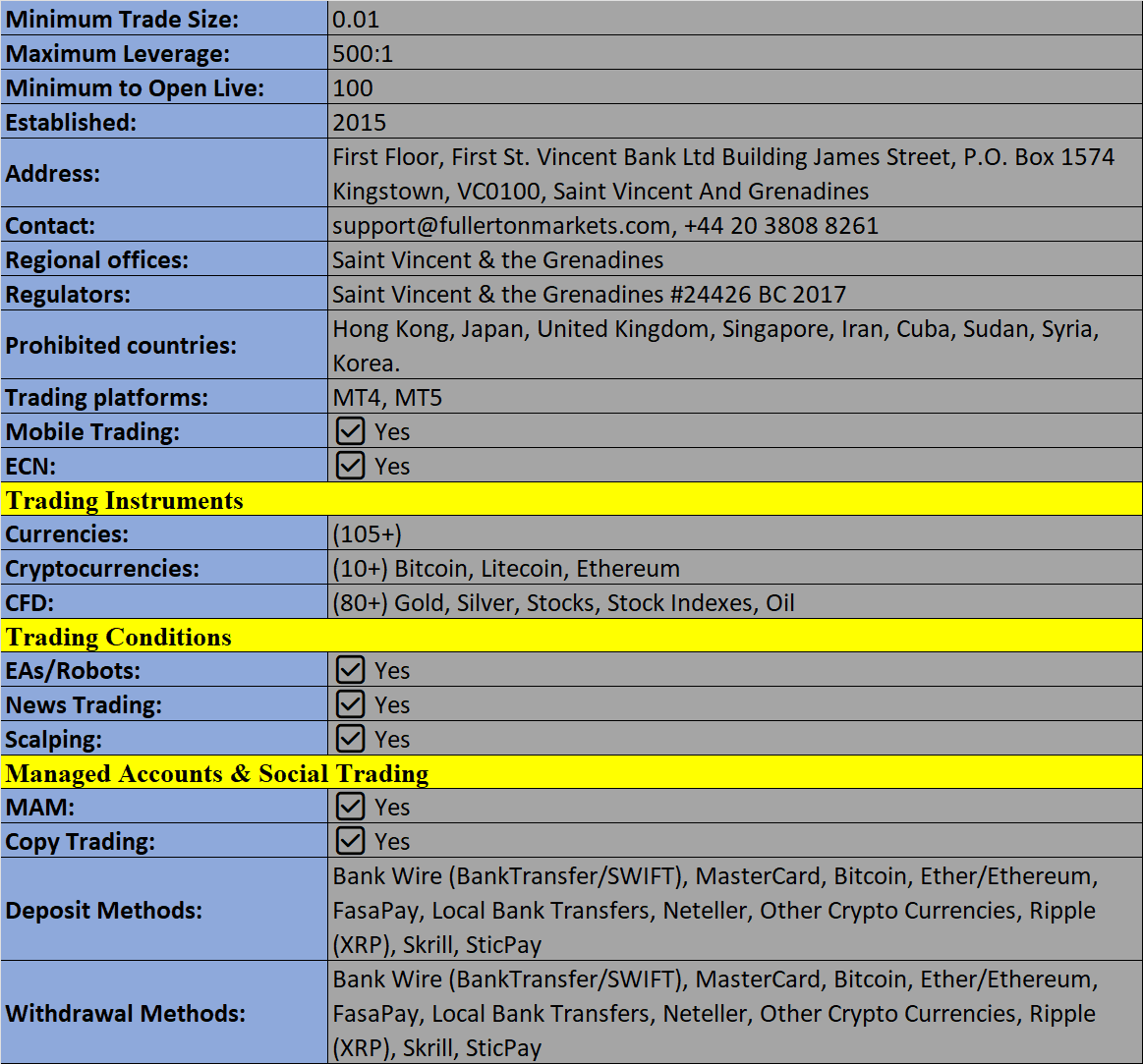

Once a fledgling entity hailing from New Zealand in the year 2016, Fullerton Markets International Limited has now unfurled its sails in the serene waters of Saint Vincent and the Grenadines. Steering this ship is the astute CEO, Mario Singh, headquartered in Singapore.

At the heart of Fullerton Markets lie three guiding principles - the safeguarding of funds, the swiftness of execution, and a blueprint for wealth creation. Their accolades, garnered since 2017, stand as testament to their prowess. Additionally, they've secured notable sponsorships, including one with the illustrious New Zealand Hurricanes rugby team.

Trading Platforms:

Enter the realm of Fullerton Markets, and you're greeted with an array of trading platforms, a trader's utopia.

MetaTrader 4: The ever-reliable MT4 platform awaits traders of all calibers. Its hallmark is the user-friendly interface, complemented by a plethora of features, including one-click trading and advanced charting tools. Over 50 customizable indicators and graphical elements empower technical analysis enthusiasts. Nine diverse timeframes cater to intricate price scrutiny, spanning from a mere minute to a comprehensive month. The realm of automated trading thrives with the support of Expert Advisors (EAs), capable of historical data-backed back-testing. It's imperative to note that the download of MT4 is a privilege reserved for registered account holders, accessible through the client terminal - the Fullerton Suite.

MetaTrader 5: Embark on a more advanced journey with the potent MT5 platform. An evolution beyond MT4, it unfurls an arsenal of advanced trading tools. Twenty-one distinct timeframes offer varied perspectives, accompanied by six pending order types, an integrated economic calendar, and a spectrum of color schemes. Fullerton Markets instruments find their canvas here, and traders are bestowed with the gift of automated trading bots and copy trading functionality. MT5's reach extends from the broker's website to the mobile app, available for download from respective app stores.

A Glimpse of Tradable Assets

The repertoire of tradable assets at Fullerton Markets spans across several dimensions:

• Forex: Embrace the fluctuations of 11 sought-after currency pairs, including the ever-volatile EUR/USD and GBP/USD.

• Indices: Eight indices beckon, including the prestigious FTSE 100.

• Metals: Gold and silver shine in their exclusivity.

• Crude Oil: The arena of US crude oil unfolds its canvas.

It must be noted that this review's pen felt a pang of disappointment at the limited array of products. Those yearning for a broader market embrace might find solace elsewhere.

Spreads & Commission: A Duality

Fullerton Markets presents a dual offering when it comes to spreads:

Variable Spreads: Majestic currency pairs, such as the EUR/USD, open their arms to variable spreads, commencing from a modest 0.3 pips. However, it's imperative to point out that the broker's presentation of contract specifications warrants refinement, especially considering the conspicuous absence of spread disclosure for other assets.

ECN Spreads: While variable spreads bask in the spotlight sans commission, ECN spreads bear a flat fee of $10 per lot for forex instruments.

Leverage: Tailored to Your Ambitions

Leverage at Fullerton Markets is a customizable entity, scaling heights in alignment with your account balance:

• 1:10 – 1:100 – Above $25,000

• 1:10 – 1:200 – Up to $25,000

• 1:10 – 1:300 – Up to $10,000

• 1:10 – 1:400 – Up to $5,000

• 1:10 – 1:500 – Up to $2,000

For intricate margin calculations, consult the broker's website.

Mobile Apps:

Fullerton Markets extends its dominion to the realm of mobile applications with the exclusive PipProfit! app. While not designed for trading, it serves as a gateway to a treasure trove of market news, event updates, and trading data. Educational resources, including market analysis and economic insights, await exploration. Additionally, you can seamlessly manage deposits and withdrawals within the client terminal. This app extends its embrace to both iOS and Android devices.

Payment Methods:

The path to funding your ventures at Fullerton Markets offers an array of options, all necessitating a minimum deposit of $100 (or its currency equivalent). Accepted currencies include USD, EUR, and SGD. The channels available encompass:

• Bank Wire

• Credit Card

• Sticpay (Visa/Mastercard)

• Cryptos (Bitcoin, Ripple, etc)

• Fast Transfer (Exclusive to Singapore)

• E-wallets (Neteller, Skrill, Fasapay)

• Local Transfer (Malaysia, Vietnam, Thailand, Indonesia, Philippines, China)

Processing times vary, spanning around 2 to 5 working days for bank wire and a swift 1 working day for credit cards and e-wallets. Remarkably, the broker bears the mantle of covering all processing fees.

Withdrawals:

Withdrawals come with varying minimum amounts, which can be unearthed on the website. In most cases, Fullerton Markets generously shoulders the processing fees, with the exception of withdrawals via bank wire, Singapore fast transfer, and local transfers in the Philippines, which may incur intermediary fees.

An additional feather in their cap is the provision of a prepaid Mastercard for VIP clients, a versatile tool for transactions and profit utilization.

Demo Account:

Aspiring traders are greeted with a demo account on the MT4 platform, as well as the CopyPip platform. The default virtual balance in the MT4 demo stands at 10,000 units, but the realm of customization allows users to tailor their deposit amounts within the platform. Do heed the ticking clock; the demo gracefully retires after 30 days of inactivity.

Deals & Promotions:

Fullerton Markets extends a warm embrace with enticing bonus deals. Notable amongst them is the "Stay At Home" bonus for CopyPip account enthusiasts, rewarding a generous 10% credit bonus on deposits exceeding $100. The "Infinity" bonus, offering a cascading series of deposit bonuses, stands as a beacon of allure, though it's only accessible to a select few in the Asian fold. Details unfurl within the terms and conditions.

Regulation Status:

Fullerton Markets International Ltd nestles as an offshore entity in Saint Vincent and the Grenadines. While it bears no regulatory mantle, it unfurls the Fullerton Shield, a triple-tiered fortress of protection. This citadel encompasses segregated bank accounts, Independent Custodian Protection, and Professional Indemnity and Crime Insurance. For those seeking the finer print, a treasure trove of information on Fullerton Shield resides within the FAQs.

In a remarkable display of commitment, Fullerton Markets also extends the cloak of negative balance protection, available upon request via the Fullerton Suite.

Additional Features:

At Fullerton Markets, clients unearth an assortment of additional gems. The realm of social and copy trading unveils itself through CopyPip, complemented by the versatile PipProfit! app, an oasis of educational riches. Blogs and video tutorials beckon from the website, accompanied by an international holiday notice board.

A noteworthy facet that sets Fullerton Markets apart is its altruistic endeavor - the Fullerton Foundation. This unique page chronicles a tapestry of community projects across Asia, an embodiment of their commitment to making a difference.

Account Types:

Simplicity reigns supreme in the realm of account types, with a solitary live account beckoning. However, within this simplicity lies choice, allowing clients to opt between variable spreads and ECN spreads. The journey commences with a minimum deposit of $100, and the smallest trade size unfolds at 0.01 lots. The standard account ushers you into the domain of Fullerton Markets, bestowing the MT4 platform download, the tapestry of copy trading, and an array of market analysis features.

For those with a preference, Islamic swap-free accounts await upon request.

Trading Hours:

The forex markets sway to a timeless rhythm, awakening on Monday at 00:00 and retiring on Friday at 24:00 (GMT+3). Metals and crude oil echo this pattern, from Monday to Friday, between 01:00 and 24:00 GMT+3. As for indices, their tempo varies, and the specifics can be uncovered on the broker's website.

Customer Support:

Support stands vigilant, available 24/5 through the online contact form or the expeditious live chat service, a tested paragon of swiftness and assistance. Alternatively, an email lifeline and a telephone number offer alternative conduits:

• Email – support@fullertonmarkets.com

• Telephone – +44 20 3808 8261

Fullerton Markets' citadel stands at First Floor, First St. Vincent Bank Ltd Building, James Street, P.O. Box 1574, Kingstown, VC0100, St. Vincent and the Grenadines.

Security:

Security forms the bedrock, with MT4 following the established protocols. Secure Sockets Layer (SSL) encryption safeguards data exchange, augmented by the option to activate two-factor authentication upon login.

Advantages of trading with Fullerton Markets:

• The company's website offers an array of complimentary trading tools.

• In most instances, the broker shoulders the commission for deposits and withdrawals.

• Investment programs stand as a testament to their commitment.

• Negative balance protection is a comforting presence.

• Round-the-clock support service stands at the ready.

Disadvantages of Fullerton Markets:

• The broker operates without third-party regulation.

• Bonus programs are unavailable for traders who activate negative balance protection.

• Islamic account holders are precluded from opening MAM accounts.

Fullerton Markets beckons with the allure of an exceptional MT4 platform download, coupled with the treasures of the PipProfit! app and the CopyPip service. Yet, a longing for a more diverse range of tradable products lingers, and the call for greater transparency in spreads and trading fees resonates. Bearing in mind the absence of regulatory oversight, alternative brokers may beckon as the preferred harbors for some.

Fullerton Markets Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion