Reviewing ACY Securities 2023: A Dive into Regulations, Platforms, Trading Instruments, and the Pros and Cons

Established in the vibrant forex and CFD landscape in 2013, ACY Securities stands as a formidable broker hailing from the shores of Australia. The unique distinction lies in its dual regulatory framework, providing a global gateway to an extensive array of over 2,200 assets. This diverse portfolio is accessible through two of the most sought-after day trading platforms: MT4 and MT5. Delve into our comprehensive 2023 review to unravel the intricacies of ACY Securities, covering fees, assets, licensing, security, and beyond.

ACY Securities:

The saga of ACY Securities unfolds in the dynamic realm of Melbourne, Australia, where it originated as ACY Capital in 2013, spearheaded by the visionary CEO, Jimmy Ye. A pivotal moment came in 2014 when ACY set sail for Sydney, forming a strategic alliance with OANDA, the world's 5th largest forex enterprise. This partnership paved the way for ACY to offer a spectrum of services, including professional forex market tutorials, real-time analysis, and personalized trading training.

The shift to Sydney marked the commencement of ACY's global expansion, establishing offices in China and various Asian countries. The year 2018 witnessed a strategic move, with the acquisition of Synergy Financial Markets (SynergyFX), a prominent Australian forex dealer, catapulting ACY's customer base to a global scale.

Now rebranded as ACY Securities, adorned with a clear and minimalist logo, the company channels its energy into technological prowess. It boasts an extensive product line, encompassing FX, stocks, indices, ETFs, and commodities. Distinguishing itself as an ECN broker with no dealing desk (NDD), ACY Securities taps into interbank liquidity from 16 of the world's premier banks and financial institutions.

The accolades amassed over the years echo the company's credibility, with the most recent feather in its cap being the 'Best Multi-Asset Broker in Australia in 2020,' bestowed by the esteemed tech magazine Technology Era.

Navigating the ACY Securities Terrain

Embarking on the ACY Securities journey involves a strategic four-step process:

- Open An Account: Navigate to the top right-hand corner, click the "Open An Account" button, and select your country and account type.

- Verify Your Account: Complete a comprehensive six-page registration form and upload pertinent ID documentation.

- Fund Your Account: Choose from an array of methods to load your account.

- Begin Trading: Dive into the realms of stocks, forex, commodities, or ETFs.

Trading Platforms

ACY Securities leverages the ubiquitous MetaTrader 4 and MetaTrader 5 platforms, revered by millions of traders worldwide. These platforms, tailored for desktop, web, and mobile use, deliver a robust user experience. The MetaTrader app, available for Android (APK) and Apple (iOS) devices, further enhances accessibility.

The feature-rich MT4 supports multiple order types, offering users access to 24 analytical tools, 30 inbuilt technical indicators, and various chart types. On the other hand, MT5, the successor to MT4, retains the essence while introducing global stocks, additional chart time frames, more order types, advanced technical indicators, DOM level II pricing, an economic calendar, and a multi-currency strategy tester.

Diverse Account Offerings

ACY Securities presents three distinct account types, catering to varied trader needs. Each type boasts leverage rates of up to 1:500 (subject to location). The minimum trading volume stands at 0.01 lots, and accounts can be denominated in USD, AUD, EUR, GBP, NZD, CAD, or JPY.

- Standard Account: A minimum deposit of $50, variable spreads, with fees incorporated into the spread.

- ProZero Account: Commencing with a $200 deposit, ProZero accounts flaunt ultra-low spreads starting at 0.0 pips.

- Bespoke Account: Tailored for high-volume, professional traders, requiring a minimum deposit of $10,000, with spreads starting at 0.0 pips.

- Islamic Accounts: For those seeking a swap-free Islamic account, a simple contact to ACY Securities customer support transforms a Standard account into a halal-compliant haven.

Demo Account

Whether honing your platform proficiency or experimenting with risk-free trading strategies, ACY Securities provides a dynamic demo account. Laden with $100,000 in virtual funds, this account serves as a training ground for 30 days, seamlessly transitioning to a live account whenever you're ready.

Fee, Spread and Commission

Delving into the fee dynamics, ACY Securities offers competitive, variable spreads contingent on account type, assets, and market conditions. ProZero and Bespoke accounts showcase minimal spreads, plummeting to 0.0 pips. Standard accounts, while devoid of commissions, embed fees within the spread. ProZero accounts incur a commission charge of USD 6/AUD 8.5 for forex and metals, while Bespoke accounts reduce this to USD 5/AUD 7. Indices remain commission-free.

ACY Securities ensures fee-free withdrawals within Australia thrice a month, with subsequent transactions attracting a USD 25 fee. For international bank transfers, a USD 25 service charge looms. Skrill imposes a 3% merchant fee per withdrawal. Deposits, however, remain free for Australians, with international users potentially encountering charges for international bank transfers.

ACY Securities Trading Instrument

The ACY Securities canvas unfurls an extensive array of over 2,200 CFDs, spanning forex, metals, indices, commodities, ETFs, and shares.

- Shares: MT5 users relish access to 800+ global shares, encompassing the NYSE, Nasdaq, and ASX, featuring stalwarts like Apple, Amazon, BHP, and Commonwealth Bank.

- ETFs: Over 75 ETF CFDs grace the platform, representing diverse sectors such as oil, technology, and energy.

- Forex: With CFDs on over 60 FX pairs, including majors and crosses, ACY Securities opens doors to the vast and liquid realm of the forex market.

- Commodities: From crude oil to precious metals, ACY Securities allows trading across a spectrum of popular commodities.

- Indices: ACY Securities extends access to a plethora of stock index CFDs, mirroring global indices like S&P500, Dow Jones, Nasdaq, Dax, FTSE, Euro Stoxx, Hong Kong 50, Nikkei, China A50, and S&P ASX 200.

Leverage

Leverage emerges as a powerful tool, amplifying the impact of your investments. ACY Securities presents varying leverage options, reaching up to 1:500 based on account type and location. The breakdown unveils:

- TFs: 1:5

- Stocks: 1:5

- Forex: 1:30

- Indices: 1:20

- Commodities: 1:10

- Precious Metals: 1:20

Deposits & Withdrawals

Navigating the financial terrain, ACY Securities facilitates diverse payment methods for its global clientele. Wire transfers, credit cards, debit cards, Skrill, Doku Wallet, POLi, PayPal, Neteller, FasaPay, Perfect Money, Trustly, and China UnionPay form the arsenal. Deposits are fee-free for Australians, but international bank transfers may incur charges. Bank transfers take 2-3 business days, while card withdrawals stretch to 3-5 business days.

Withdrawals unfold through the Client Portal (Cloud Hub), with requests before 14:00 AEST processed the same day. Post-14:00 AEST requests might linger until the next business day. Users relish three free withdrawals monthly to Australian banks, with additional withdrawals or international transfers incurring a USD 25 service charge. Skrill imposes a 3% merchant fee per withdrawal.

Safeguarding and Regulating the ACY Realm

Nestled in Chatswood, NSW, Australia, ACY Securities, a privately owned entity, bears dual licenses. ACY AU, regulated by the Australian Securities and Investments Commission (AFSL 403863), caters to Australian clients. Simultaneously, ACY LLC operates under the St. Vincent and the Grenadines Financial Services Authority (SVGFSA), serving the international clientele, adhering to local laws and regulations.

Client funds reside in segregated accounts with AAA-rated banks: the Commonwealth Bank Australia and HSBC. Rigorous audits ensure compliance with regulatory requirements. The ACY Securities FSG and PDS are accessible upon request or registration.

Customer Support

ACY Securities boasts a 24/5 customer support orchestra, harmonizing assistance in multiple languages. Contactable via phone, email, or live chat, the support team stands ready in the website's lower right corner. Contact details span Taiwan, Australia, and international lines, reflecting the brand's commitment to global accessibility.

- Email: support@acy.com

- Taiwan: 02 5594 4927

- Australia: 1300 729 171

- International: +61 2 9188 2999

- China Mainland: 950 4059 5638

The support team's friendly, helpful, and patient demeanor shines through, amplified by the brand's social media presence on Facebook, Twitter, Instagram, LinkedIn, and YouTube.

ACY Education: Empowering Traders

ACY Securities houses an education portal, a treasure trove offering forex learning resources for traders at all levels. Market analysis, webinars, market news, forex e-books, and 60+ forex trading tutorials enrich the educational landscape.

Bonuses and Beyond: ACY Securities Promotions

The ACY Securities saga continues with enticing promotions and bonuses. A 60% welcome bonus for initial deposits up to $500 beckons, along with the tantalizing Level Up Reward Program, offering up to $0.50 per lot traded.

In a unique twist, depositing $50K into your trading account and meeting minimum volume requirements opens the door to a limited-edition signed & framed Tim Cahill jersey, a testament to ACY Securities' alliance with soccer player and brand ambassador Tim Cahill.

ACY Securities Verdict

In the vast expanse of brokerage options, ACY Securities emerges as a regulated stalwart, etching a reputation grounded in reliability. From its Australian roots to global recognition and a plethora of awards, the company delivers a high standard of service globally. An expansive asset catalog, educational initiatives, and ECN market access form the pillars of its offering. However, international clients may grapple with the specter of charges on withdrawals.

Pros and Cons

Pros:

- ACY Securities' regulation by the top-tier ASIC, complete with negative balance protection and segregated client funds, instills confidence.

- The flexibility to choose between industry-renowned MT4 and MT5 terminals, coupled with additional tools like Capitalise.ai, resonates with discerning traders.

- A rich repertoire of 15+ commission-free payment methods, aligning with top competitors, enhances convenience.

- Responsive 24/5 customer support, featuring local and international telephone numbers, coupled with live chat support, adds a layer of accessibility and assistance. The extensive range of over 2,200 CFD instruments caters to diverse trading preferences, all accompanied by competitive fees.

- The suite of analyst insights and educational content, comprising market analysis, webinars, and over 60 forex trading tutorials, stands as a comprehensive resource aiding informed trading decisions.

Cons:

- The international entity's regulation by the St Vincent and the Grenadines Financial Services Authority may raise concerns for traders seeking the same safeguarding measures as the ASIC-regulated branch.

- Crypto enthusiasts might find a void, as digital currencies are conspicuously absent from ACY Securities' offerings.

In summary, ACY Securities emerges as a formidable force in the brokerage landscape, blending regulatory robustness with a diverse product range and educational support. While certain nuances might give pause to international traders, the overall package reflects a commitment to transparency, accessibility, and trader empowerment. As the financial landscape continues to evolve, ACY Securities holds its ground as a reliable ally for traders navigating the complexities of the market.

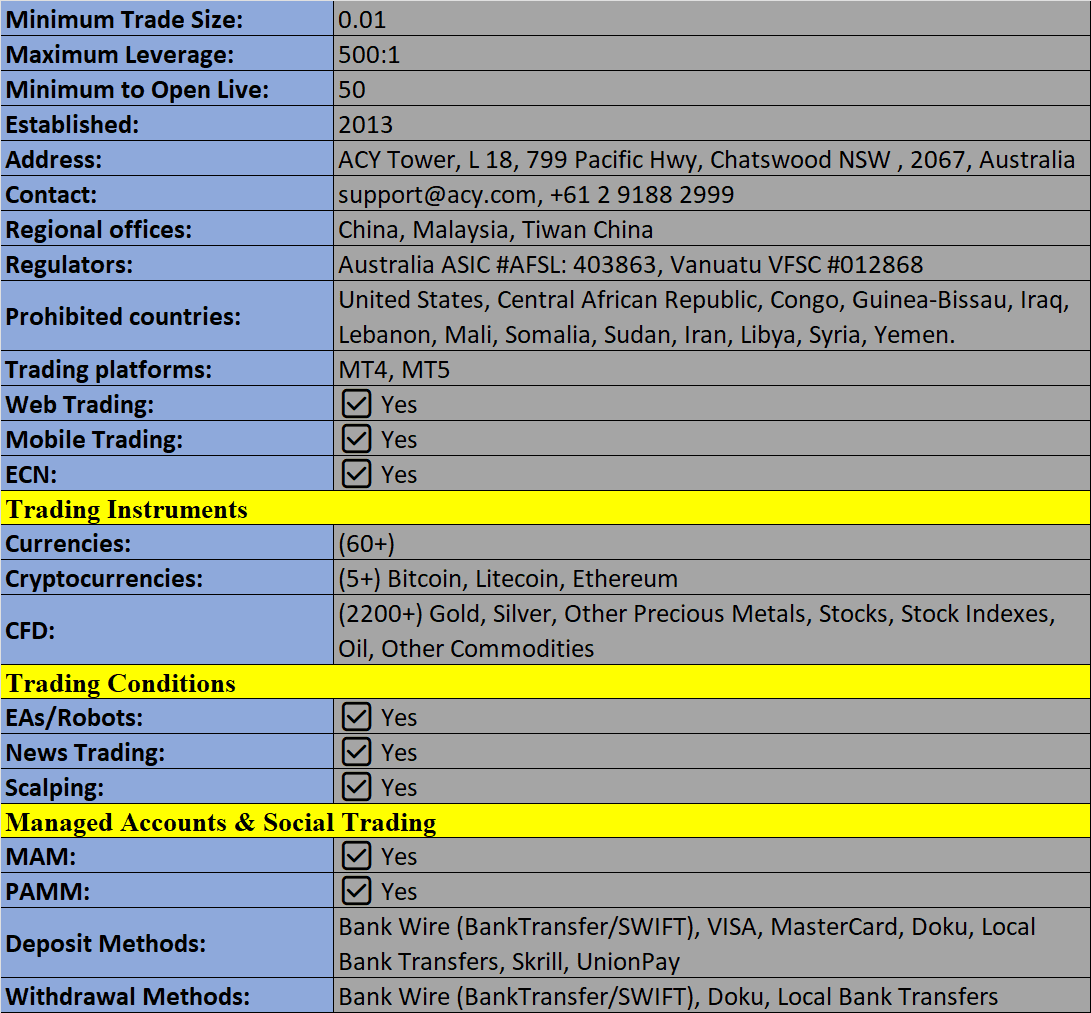

ACY Securities Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion