Review of RannForex: Trading Platforms and Broker Features

RannForex, established in 2013 and headquartered in Saint Vincent and the Grenadines, is a well-established forex and CFD broker with a noteworthy reputation in the industry. In this comprehensive review, we will delve into the key features that set RannForex apart from other brokers, including its trading platforms, account types, leverage options, deposit/withdrawal methods, and available trading instruments.

Unique Trading Account

One of RannForex's standout features is its special trading account that grants access to liquidity in the cryptocurrency markets from none other than Binance, the world's largest crypto exchange by trading volume. This unique account, known as MT5.CRYPTO.FUT, is denominated in Tether (USDT) and requires no minimum deposit. However, it does come with a minimum volume requirement of 5 USDT and a competitive commission rate of 0.08% for one side.

PAMM Account

RannForex offers another distinctive account type - the PAMM account. This account utilizes liquidity from AMTS Invest, a PAMM marketplace well-regarded in the Russian forex trading community. PAMM stands for Percentage Allocation Management Module, which enables the pooling of funds from various investors, managed by a single trader acting as a fund manager.

Standard Trading Accounts

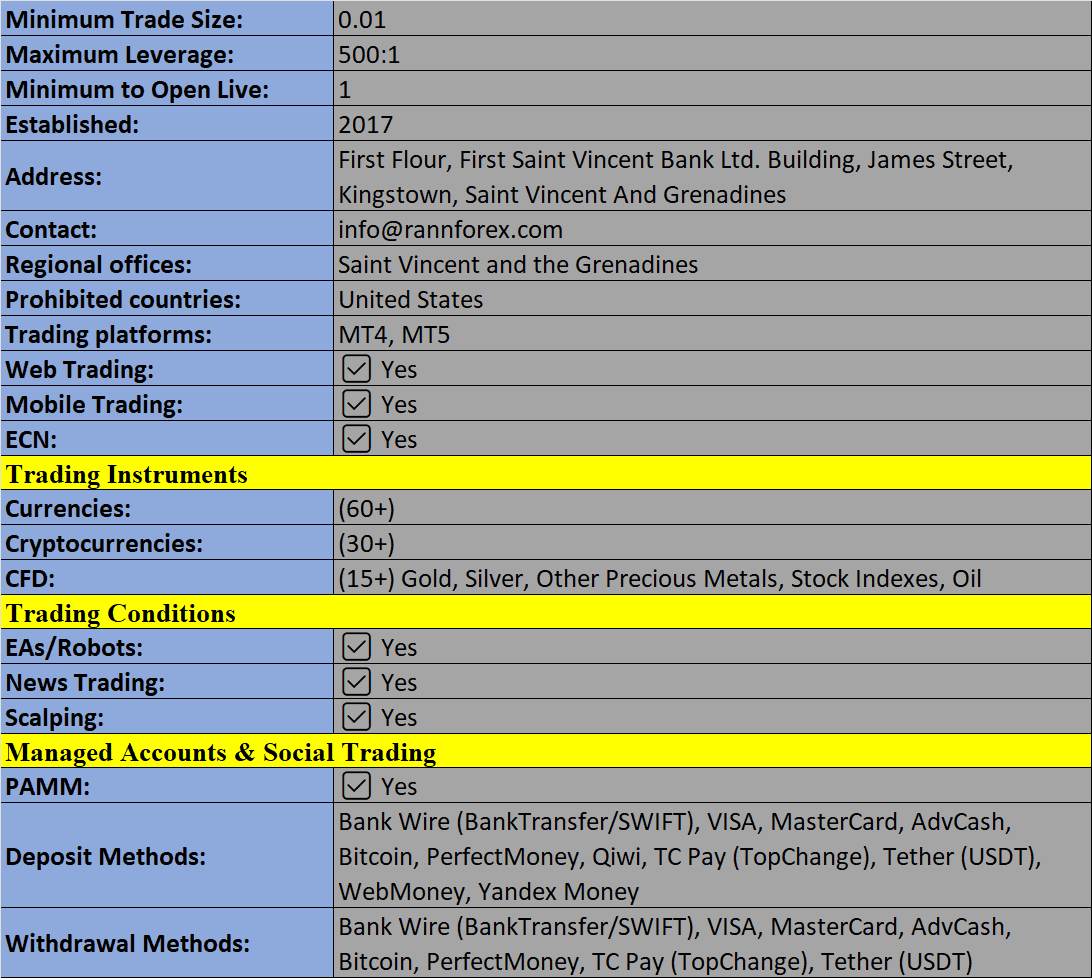

In addition to its special account types, RannForex provides three standard trading accounts:

· MT5.PRO and MT4.PRO: These are commission-based accounts.

· MT5.ECN: This is a commission-free account.

All these accounts offer maximum leverage of 1:500, except for the crypto account, which has a leverage limit of 1:20.

Deposit and Withdrawal Methods

RannForex's deposit and withdrawal methods differ slightly from other brokers. While it accepts e-wallet services like AdvCash, Perfect Money, and TC Pay, it does not support credit cards or traditional bank transfers. Instead, clients can use crypto deposits through Binance Pay in USDT, direct USDT transfers to the broker's wallet, or Bitcoin (BTC) via the third-party payment processor Mercuryo. Most funding methods result in immediate account credits, but the broker advises that on-chain crypto deposits may take a few hours to reflect.

Available Trading Instruments

RannForex provides a diverse range of trading instruments, including:

· Several hundred cryptocurrency pairs through the dedicated crypto trading account.

· Over 60 forex pairs.

· CFDs on precious metals, oil, and natural gas.

· A selection of major stock indices as CFDs, though individual stocks are not available.

Trading Platforms

RannForex offers access to two renowned trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are highly respected in the forex trading community, providing robust charting tools and an extensive array of technical indicators and trading strategies.

Pros:

· Functional personal account.

· Detailed trading conditions.

· Free access to MetaTrader.

· Five years of industry experience.

Cons:

· Limited payment methods, lacking bank cards and transfers.

· Potentially less rigorous verification process.

· Limited global popularity.

· Absence of liability safeguards.

In summary, RannForex boasts a solid industry track record and an appealing range of offerings for traders. However, it's crucial to note that RannForex is an offshore-registered forex broker without government regulation, which introduces certain risks, such as bankruptcy. Therefore, we strongly advise conducting thorough due diligence before depositing funds with any offshore forex broker.

RannForex Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion