Review of MTCook: A Comprehensive Look at Trading Opportunities with Pros and Cons

MTCook Financial, a boutique brokerage services provider, caters to a niche clientele seeking personalized financial services. While its limited product portfolio may raise concerns among investors, it's essential to prioritize a company's reputation when considering investments.

Owned by Atlantic Pearl Limited and now part of the Mt. Cook Group of Companies, MTCook Financial operates primarily in an agency model capacity. Its headquarters are in Sydney, Australia, with regulatory oversight from the Australian Securities and Investments Commission (ASIC). However, it's important to clarify the regulatory landscape.

ASIC is Australia's independent corporate regulator, serving Australian clients and enforcing financial services laws within the country. In South Africa, the Financial Sector Regulation (FSR) Act established the Prudential Authority (PA) and the Financial Sector Conduct Authority (FSCA) in 2017, rendering the South Africa Financial Services Board (FSB) obsolete. The regulation status of MTCook Financial under its new governing body remains uncertain.

MTCook Financial is also regulated by the Vanuatu Financial Services Commission (FSC) for its operations in Vanuatu, signifying its offshore regulated status. However, regulatory compliance alone doesn't guarantee a safe trading experience. Prospective investors should thoroughly examine the company's regulations, the regulatory body's details, and jurisdiction.

Trading Accounts at MTCook Financial

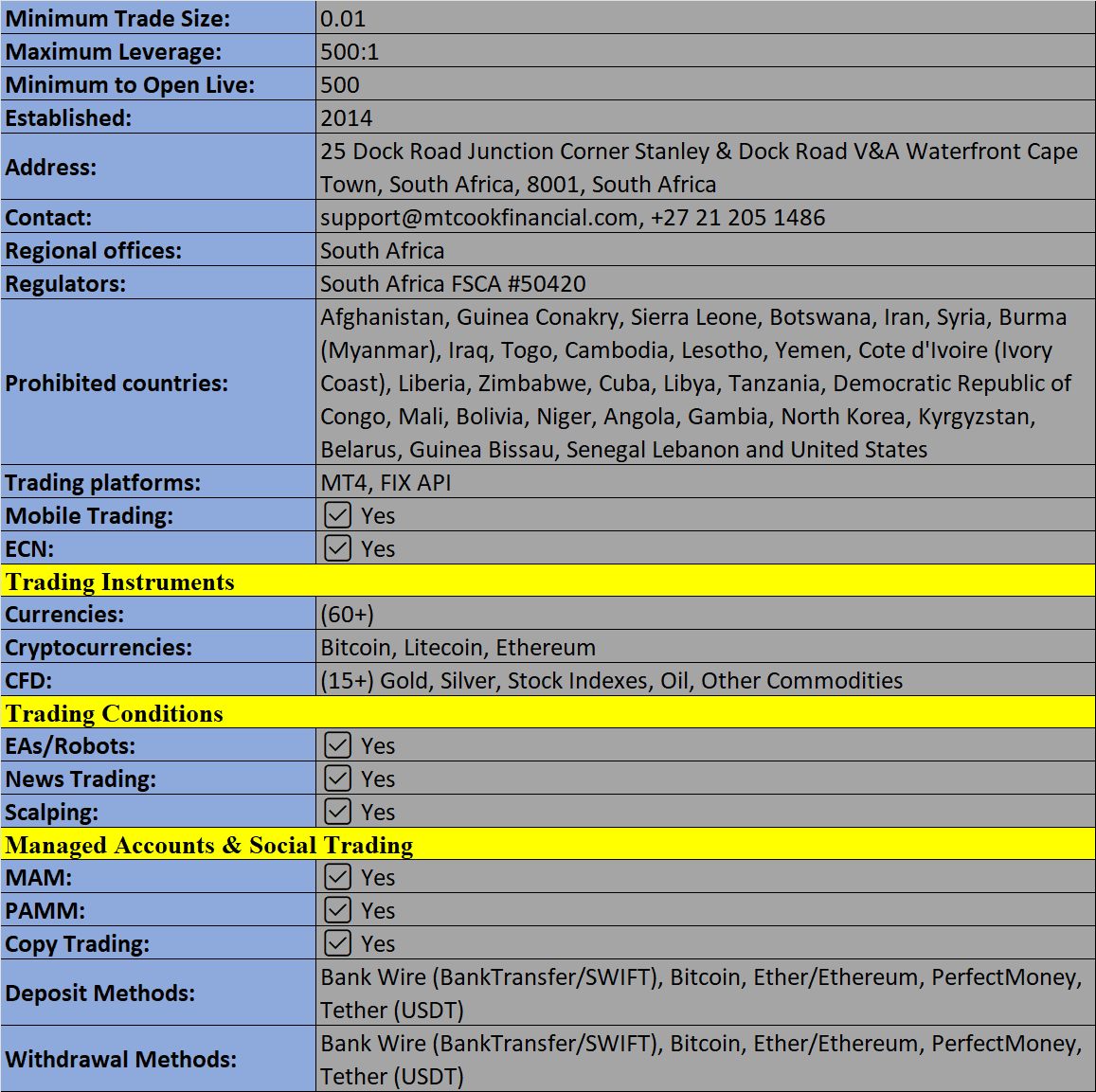

MTCook Financial offers limited trading account options, primarily providing a single account type that can be either STP or DMA. Notably, the minimum initial investment requirement is $5,000, a relatively high threshold compared to other agencies. Additionally, the maximum leverage of 1:100 can pose a higher risk, and potential profits may be limited. Tight spreads and commission fees based on trading trends further impact the trading experience.

The company also offers PAMM accounts with specialized account managers, but these come with high initial investment requirements and additional costs. As such, MTCook Financial primarily targets institutional and professional traders, making it unsuitable for beginners seeking to learn and implement their investment strategies.

MTCook Financial's Trading Platform

The company operates on the Meta Trader 4 (MT4) platform, a well-regarded choice for CFD, futures, and forex trading. MT4, developed by MetaQuotes Software Corporation, provides users with access to powerful analytical tools and allows customization through its built-in programming language. Its widespread usage ensures ease of transition between brokers, making it user-friendly for both experienced traders and newcomers. A demo account with full access further facilitates a user-friendly environment for beginners.

Social Trading Services

MTCook Financial offers two social trading services: Myfxbook's auto trade and Zulu. Myfxbook's auto trade requires a minimum investment of $1,000 but lacks options for filtering brokers. Users may also face additional commission charges from brokers, which aren't clearly presented on the platform.

Zulu trade introduces inconsistencies in signal providers, posing risks for users copying trades with demo accounts. The absence of vetting for signal providers and the platform's complexity, especially for novice traders, are notable drawbacks.

Modes of Payment

For deposits, MTCook Financial accepts bank wire, Neteller, and China Union Pay. However, withdrawing funds incurs a fixed fee of $25, a potential inconvenience for customers. Response times for withdrawals are comparatively slow, and the company offers limited options for deposit and withdrawal.

Customer Support

MTCook Financial claims to provide customer support via live chat, email, and phone for US and EU clients.

Social Media Presence and Website

Notably, MTCook Financial lacks an active presence on social media platforms, which is vital in the investment industry for building trust and engaging with customers. Online reputation and user feedback play a significant role in shaping investors' decisions.

Advantages of trading with Mt.Cook Financial:

- Diverse Asset Classes: Mt.Cook Financial offers five different asset classes for trading, providing a wide range of investment opportunities.

- Introducing Broker (IB) Program: The availability of an Introducing Broker partnership program allows for potential additional income streams and collaboration opportunities.

- Passive Investment Options: Investors can explore passive investment avenues by utilizing PAMM accounts, making it easier to diversify their portfolios.

- Multiple Deposit and Withdrawal Methods: Mt.Cook Financial supports five convenient deposit and withdrawal methods, offering flexibility to clients.

- Client Equity Protection: The broker ensures the safety of clients' equity through segregated accounts, providing added security.

- Various Account Types: With three types of ECN accounts and a DMA (Direct Market Access) account, traders can select the account type that best suits their needs.

- Social Trading Access: Mt.Cook Financial grants access to social trading, allowing clients to follow and learn from experienced traders.

Disadvantages of Mt.Cook Financial:

- Restricted Geographic Coverage: Mt.Cook Financial does not offer its services to clients from specific regions, including the U.S., Afghanistan, Botswana, Iran, and others, limiting its global reach.

- Mandatory Verification: Clients are required to undergo mandatory verification, which can be seen as an additional step in the registration process.

- Potential Withdrawal Delays: In cases where the broker's security service detects suspicious transactions, withdrawals may experience delays, potentially causing inconvenience to clients.

MTCook Financial caters to a specific segment of investors, primarily institutional and professional traders, with its high investment requirements and limited account options. Prospective investors should exercise caution, considering both the company's regulatory status and the potential challenges associated with its trading platform and social trading services. Additionally, the company's customer support and online presence warrant further scrutiny when evaluating its suitability for your investment needs.

MTCook Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion