Review of Moneta Markets: A Comprehensive Look at Trading Opportunities with Pros and Cons

Moneta Markets is a well-established forex and CFD broker that has gained popularity among traders. With a diverse range of trading accounts, a lucrative deposit bonus, and an array of analytical tools, this review will delve into our experience testing the brokerage and provide insights into trading accounts, payment methods, investor safety, and more.

Trading Accounts

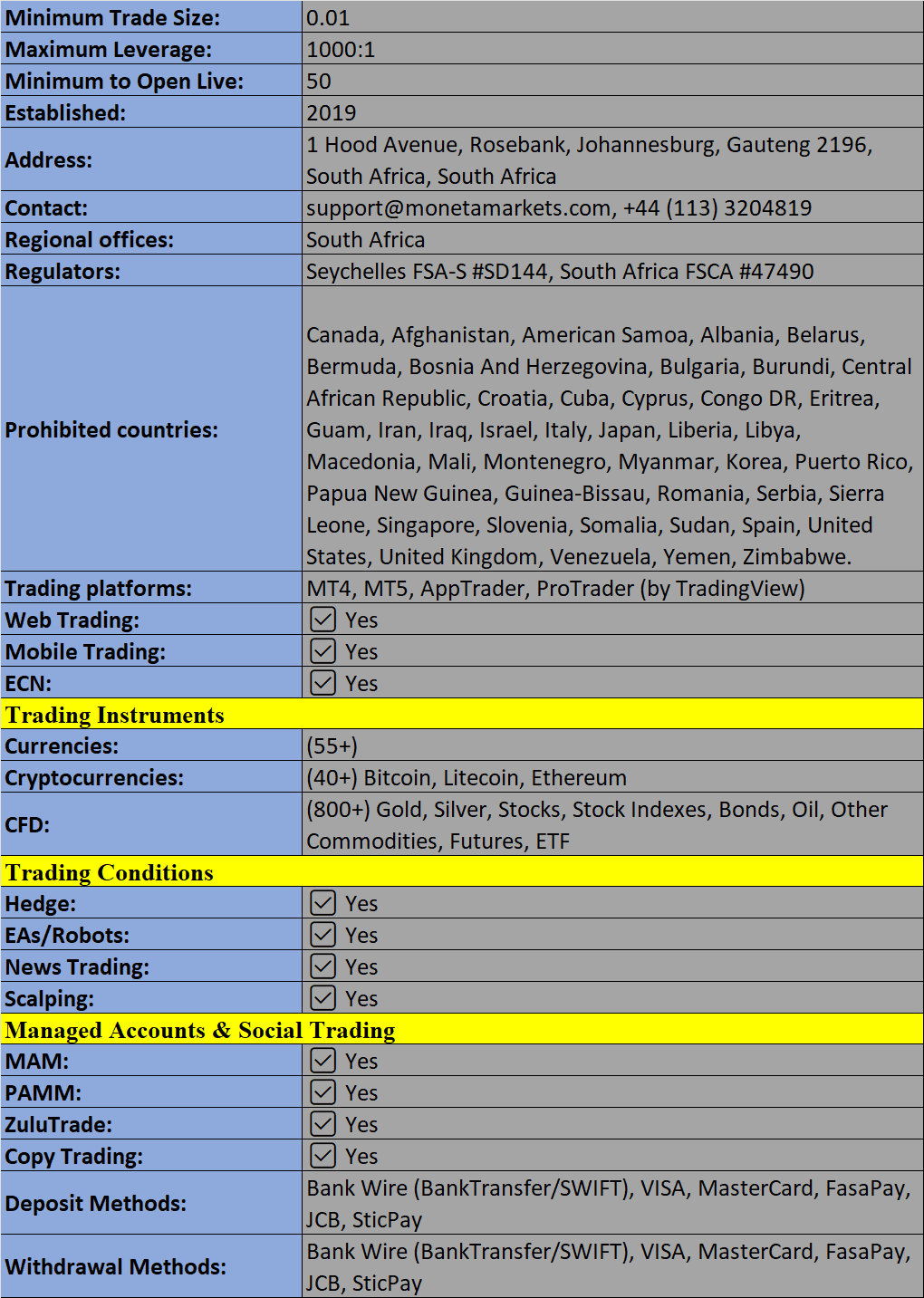

Moneta Markets offers three distinct trading accounts: Direct STP, Prime ECN, and Ultra ECN. The process of opening an account is straightforward, requiring completion of an online application form and provision of identity documentation. Account details and login credentials are then sent via email.

All three account profiles grant access to a wide variety of instruments and platforms, offering leverage of up to 1:1000 and a minimum trade size of 0.01 lots.

- Direct STP: Suitable for beginners, this account offers a 50% stop out level, hedging capabilities, no commission fees, spreads starting at 1.2 pips, and a low minimum deposit of $50.

- Prime ECN: Designed for scalpers and those using Expert Advisors (EAs), this account also features a 50% stop out level, hedging capabilities, ultra-low spreads starting from 0.0 pips, and a $3 commission per side. The minimum deposit requirement is $200.

- Ultra ECN: Geared towards high-volume day traders and professional investors, this account boasts a 50% stop out level, hedging capabilities, spreads starting from 0.0 pips, and a $1 commission per side. The minimum deposit for this account is $50,000.

Moneta Markets also offers a transparent PAMM solution for money managers, allowing an unlimited number of managed accounts. Islamic-friendly accounts, compliant with swap-free requirements, are also available through the swap-free form on the website.

Spreads & Commission

Moneta Markets offers competitive fees, with trading costs varying based on the account type and instrument. The broker provides the most attractive fees on its ECN accounts, offering spreads from 0.0 pips and a low round-turn fee per lot on most assets. For instance, during testing, the EUR/USD currency pair could be traded with spreads as low as 0.0 pips and a $3 commission.

Traders opting for the STP account will encounter slightly higher spreads compared to the ECN profile. For instance, the EUR/USD currency pair features an average spread of 1.56 pips due to the account's pricing model, but there are no commission fees.

Moneta Markets has notably reduced CFD commissions on all share CFDs, with US shares now commission-free and the minimum commission on UK and EU shares eliminated, replaced with a fee of 0.1% of the nominal value on all trades. This makes Moneta Markets an economical choice for stock trading. Additionally, gold and crypto trading products are available as swap-free options.

Payment Methods

Moneta Markets boasts a low minimum deposit requirement of $50 or its equivalent in other currencies, making it accessible to most beginners. Payment methods may vary depending on your account's base currency and your country of residence. The broker accepts nine account currencies, including USD, EUR, GBP, NZD, SGD, JPY, CAD, HKD, and BRL.

All deposit methods are commission-free, although third-party charges may apply. Notably, first-time deposits via bank card are limited to $1,000 AUD. Processing times are generally quick, with various options available:

- JCB – Instant processing

- Sticpay – Instant processing

- FasaPay – Instant processing

- Credit card (Visa & Mastercard) – Instant processing

- Cryptocurrency – Processing times depend on network confirmations

- International wire transfer – Allow two to five business days processing time

Local regional deposit methods may also be available. Withdrawals are processed promptly, taking one to three business days upon completion of the request form within the Client Portal, which compares favorably to other top-rated brokers. However, international bank wire transfers may incur a minimum fee of 20 units of your trading account's base currency.

Regulation & Licensing

Moneta Markets operates as a registered broker-dealer under three entities, each subject to different regulatory oversight based on your country of residence:

- Moneta Markets South Africa (Pty) Ltd is an authorized Financial Service Provider (FSP) regulated by the Financial Sector Conduct Authority (FSCA) of South Africa.

- Moneta Markets Ltd is regulated by the Financial Services Authority of the Seychelles and registered under Saint Lucia Registry of International Business Companies with registration number 2023-00068.

- Moneta Markets Pty Ltd is a corporate authorized representative (CAR no. 001298177) of AGC Capital Securities Pty Ltd, regulated by the Australian Securities & Investments Commission (ASIC).

While Moneta Markets provides certain retail trader safeguards, such as negative balance protection, it's worth noting that the broker is not supervised by top-tier regulators across all three entities. As a result, some retail traders may have fewer protections.

Assets & Markets

Moneta Markets impresses with its extensive market coverage, offering a total of 1,016 instruments. The selection of global stocks, currency pairs, and cryptocurrencies is particularly robust. Traders can access a wide range of assets, including:

- 56 forex and metals pairs, such as EUR/USD, GBP/USD, and XAU/USD

- 17 commodities, including natural gas, oil, and coffee

- 25 major indices, including the FTSE, Dow Jones, and Dax

- 43 crypto CFDs, including Bitcoin, Ethereum, and Ripple

- 504 US share CFDs, 138 EU share CFDs, 102 UK share CFDs, 50 Hong Kong share CFDs, and 50 Australian share CFDs

- 51 popular Exchange-Traded Funds (ETFs), such as VanEck Gold Miners, iShares Global Clean Energy, and Global X Blockchain ETF

- 6 bond CFDs, including UK Long Gilt Futures and the US 10-year T-Note Futures

Leverage

Moneta Markets offers one of the highest leverage levels available, reaching up to 1:1000. This significant leverage allows a $100 deposit to provide traders with purchasing power of $100,000. However, it's crucial to exercise caution when using high leverage, as it can amplify both profits and losses. Implementing appropriate risk management strategies is essential.

Leverage levels vary across different asset classes:

- Forex and precious metals: Up to 1:1000

- Indices: Up to 1:1000

- Energy commodities: Up to 1:500

- Soft commodities: Up to 1:50

- Share CFDs: Up to 1:33

Trading Platforms

Moneta Markets offers a range of trading platforms to cater to different trader preferences and experience levels.

- Pro Trader: This primary web platform, hosted by TradingView, provides an all-in-one solution that combines account management and trading within the same dashboard. Features include in-built market news and price alerts, over 50 drawing and technical analysis tools, more than 12 chart types, and 20 chart layouts. Stop Loss/Take Profit levels are displayed in pips, price, and dollar value simultaneously. The web platform is accessible via all major browsers after registering for an account.

- MT4 & MT5: Moneta Markets also offers the popular MetaTrader 4 and MetaTrader 5 platforms. These platforms offer advanced charting features, automated services, and built-in support. Suitable for active investors, these desktop and mobile platforms are user-friendly and provide access to comprehensive trading tools.

- Mobile Apps: MetaTrader 4 and MetaTrader 5 can be utilized on portable devices. These mobile apps enable day traders to access the same tools, features, and functionality found on the web trader or desktop platforms. Users can manage their accounts, open and close positions, monitor live global pricing, and view charts while on the move. Both applications are available for free download on iOS and Android devices. Moneta Markets also offers its bespoke AppTrader app, which provides an enhanced trading experience with full-screen charts, a wide range of indicators and drawing tools, and integrated news.

Demo Account

Moneta Markets provides a free STP or ECN demo account for day traders. However, it's worth noting that the practice profile is available exclusively on the MT4 and MT5 platforms, with the Pro Trader platform accessible only in live mode. This limitation may pose a challenge for new traders unfamiliar with Pro Trader's features. The demo account offered by Moneta Markets has a drawback, as it expires after 30 days, unlike some alternatives that provide unlimited demo accounts for ongoing strategy testing.

Bonuses & Promotions

Moneta Markets offers a compelling 50% Cashback Bonus, rewarding traders who deposit a minimum of $500 with 50% of bonus credits that can be converted into real cash when trading forex, oil, and gold. Cashback is automatically credited and can be monitored daily through the client portal. Additionally, Moneta Markets provides a free VPS for traders who deposit $500 and trade 5 forex lots per month, a valuable perk for those utilizing Expert Advisors (EAs) for continuous, uninterrupted trading.

Additional Features

Moneta Markets enhances the trading experience by offering a diverse range of useful trading tools, including daily technical and fundamental trade ideas, video tutorials, and webinars. The broker also integrates resources from Trading Central and NewsFactory to provide valuable market insights and news.

Other notable features include:

- Featured Ideas: Providing trading inspiration and opportunities.

- Market Buzz: Offering market sentiment analysis.

- Pro Economic Calendar: Keeping traders informed about important economic events.

- Technical Views: Providing technical analysis insights.

- Alpha Generation MetaTrader 4 and MetaTrader 5 EAs: Offering advanced trading algorithms.

- Market Masters: Over 100 video guides to enhance trading skills.

Customer Support

Moneta Markets takes pride in its award-winning multilingual customer support, available 24 hours a day, 7 days a week. Support can be accessed via email (support@monetamarkets.com), live chat (located in the bottom right-hand corner of each webpage), or telephone (UK: +44 113 320 4819, International: +61 2 8330 1233).

Additionally, a comprehensive FAQ section is available on the broker's website, covering topics such as deposits, withdrawals, platform support, and account registration.

Our tests revealed that customer service agents responded promptly, with an average response time of just a few minutes, and were able to assist with inquiries related to accounts, products, and platforms.

Company Details

Founded in 2019, Moneta Markets has emerged as a prominent broker and operates as a separate entity from Vantage International Group Limited (VIG). The broker holds regulatory oversight from FSCA, ASIC, and FSA.

Moneta Markets boasts a substantial client base, with over 70,000 live client accounts and an average monthly trading volume exceeding $100 billion across 1.5 million trades.

Trading Hours

Moneta Markets' trading hours vary by instrument, with FX pairs available for trading from 00:01 to 23:58 GMT+2 or GMT+3 during daylight savings time, and cryptocurrencies accessible from 00:00 to 24:00 GMT+2/3. Gold and silver markets are open from 01:00 to 23:59 GMT+2/3. Detailed opening times and a published calendar can be found on the broker's website.

Security & Safety

As a regulated CFD broker, Moneta Markets ensures the safety of client funds through segregation in top-tier accounts and regular third-party audits. When using Moneta Markets' software, it is advisable to employ security settings such as two-factor authentication (2FA) or one-time passwords (OTP) for enhanced security.

Moneta Markets Verdict

Moneta Markets impresses with its high leverage offerings, ECN and STP accounts, extensive trading tools, and a choice of trading platforms, including MetaTrader 4 and MetaTrader 5. The inclusion of a user-friendly CopyTrader app and a more advanced copy trading platform in ZuluTrade adds to its appeal.

Overall, Moneta Markets is a solid broker suitable for traders of all experience levels and trading strategies.

Pros

- ECN and STP trading accounts with competitive pricing.

- Regulated broker by ASIC, FSCA, and FSA.

- Extensive product portfolio with over 1,000 assets.

- Award-winning 24/7 customer support.

- User-friendly CopyTrader app for social investors.

- Access to MetaTrader 4 and MetaTrader 5.

- Welcome bonuses and trading promotions.

- Accessible minimum deposit of $50.

- Commission-free trading on US shares.

- Very high leverage up to 1:1000.

- Quick and digital account opening.

Cons

- Some educational materials require a $500 deposit.

- Offshore regulation may offer weaker legal safeguards for certain traders.

- Demo account expires after one month.

- Withdrawal fees may apply.

Moneta Markets Brokers Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion