Review of FP Markets: Regulations, Trading Platforms, Instruments, Pros, and Cons

FP Markets is a globally recognized forex broker that offers an array of trading platforms, including MT4, MT5, and Iress, as well as competitive spreads and high leverage options. In this comprehensive review, we delve into key aspects such as fees, minimum deposits, account registration, and customer support to help you decide if FP Markets is the right choice for your trading needs.

Company Background

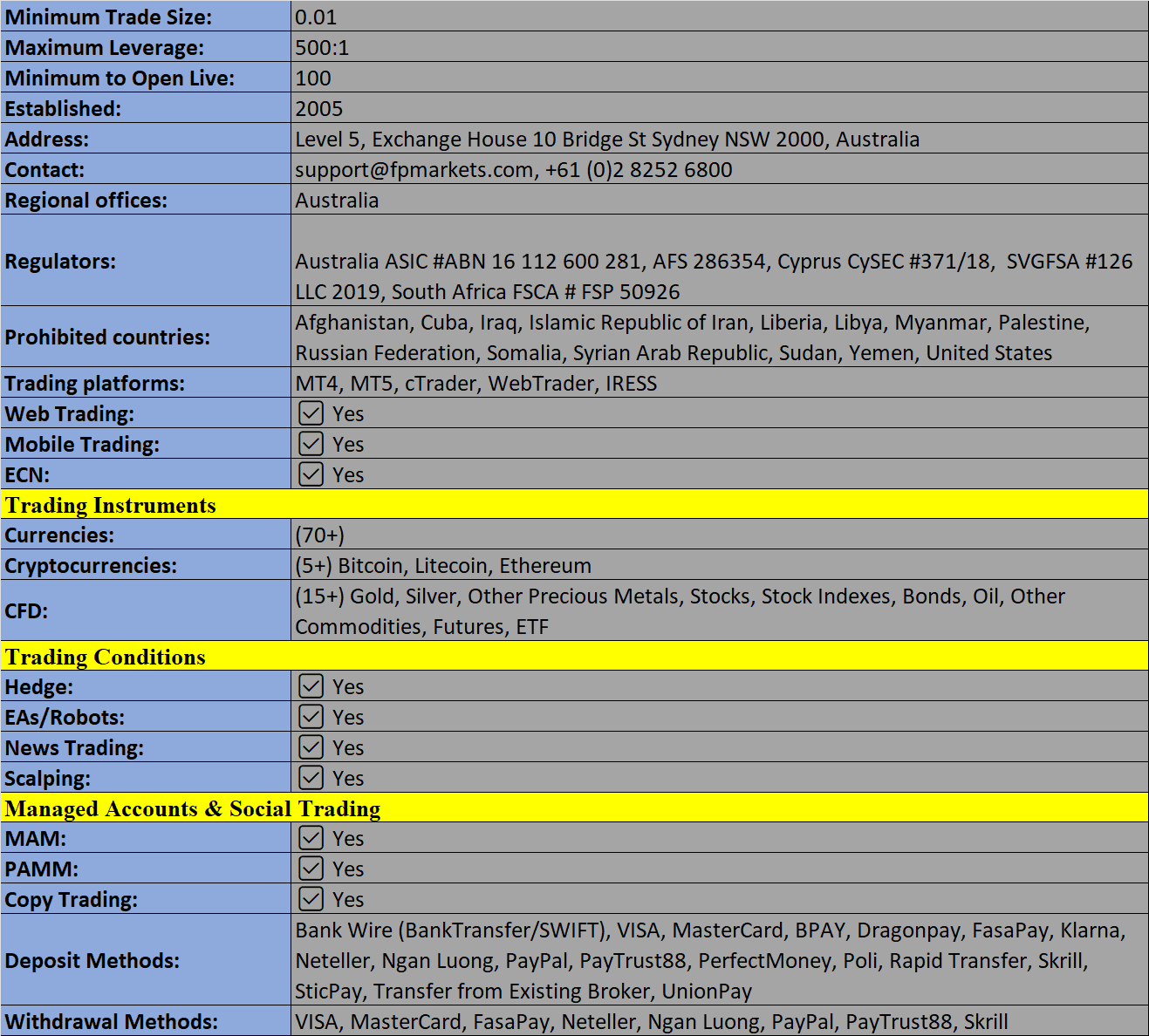

FP Markets is an Australian broker established in 2005. It holds regulatory licenses from the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). With headquarters in Sydney and an additional entity registered in Saint Vincent and the Grenadines, FP Markets serves clients from around the world, spanning regions like India, Malaysia, Europe, and the UK.

Diverse Instrument Offering

FP Markets stands out with an extensive product lineup of over 13,000 instruments, encompassing forex, share CFDs, indices, commodities, and cryptocurrencies. Traders of all experience levels can opt for either ECN or DMA pricing models, equipped with a wide range of trading tools to enhance their strategies.

Trading Platforms

FP Markets provides a variety of trading platforms to suit different preferences:

- MetaTrader 4 (MT4): This industry-leading platform offers powerful features, including over 50 pre-installed technical indicators, real-time pricing, and access to Expert Advisors (EAs). MT4 is compatible with both Windows and Mac operating systems.

- MetaTrader 5 (MT5): As the successor to MT4, MT5 offers advanced charting capabilities, more than 80 technical indicators, and enhanced strategy testing for automated trading. Traders can manage up to 100 charts simultaneously.

- MetaTrader WebTrader: This web-based platform allows for convenient trading from anywhere with an internet connection. It offers one-click trading, real-time price quotes, and seamless data synchronization across all platforms.

- IRESS: FP Markets also offers three IRESS platforms: IRESS Viewpoint, IRESS Trader, and IRESS Investor. These platforms are equipped with technical indicators, real-time quotes, advanced order management, and live streaming news. IRESS Viewpoint is the latest version of IRESS Trader, while IRESS Investor caters to investors employing hedging strategies.

Markets

FP Markets covers a wide spectrum of markets, including:

- Forex: With over 60 currency pairs, including majors, minors, and exotics.

- Cryptocurrencies: Trade popular cryptocurrencies such as Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and Ripple.

- Share CFDs: Access more than 10,000 shares across four continents.

- Indices: Choose from 12 global indices, including FTSE 100 and NASDAQ.

- Commodities: Trade commodity CFDs, including Brent Crude Oil.

- Precious Metals: Trade gold and silver in spot markets.

FP Markets offers a dedicated share CFD directory providing comprehensive information on each stock CFD, aiding traders in making informed decisions.

Spreads & Commissions

FP Markets boasts competitive spreads, starting from 0 pips on major pairs like EUR/USD with the Raw account. Standard account holders can expect spreads around 1.19 pips. Indices also offer competitive spreads, beginning at 0.31 for the FTSE 100 on both account types.

Fees are incorporated into the spreads for the Standard MetaTrader account, while IRESS accounts have more complex commission structures. Detailed fee breakdowns can be found on the broker's website, including swap rates for overnight positions.

Leverage

FP Markets offers leverage of up to 1:500 on both Standard and Raw accounts. The broker provides margin calculators and tables for various global exchanges, ensuring transparency in margin requirements.

Payment Methods

Depositing and withdrawing funds with FP Markets is hassle-free, with over 10 flexible funding options, all free of fees. Accepted methods include credit/debit cards, bank transfers, BPay, Poli, PayPal, Neteller, Skrill, PayTrust, Ngan Luong, FasaPay, Online Pay, and Broker to Broker.

Deposits are generally instant, except for bank transfers, BPay, and broker to broker transfers, which may take up to 1 business day. Withdrawals are also efficient, processed within 1 business day, with various withdrawal fees depending on the chosen method.

Demo Account

FP Markets offers traders the opportunity to register for a 30-day demo account on either the MetaTrader 4 or Iress platforms. This serves as an invaluable training tool for those looking to familiarize themselves with the trading environment before committing real capital. Traders can even open demo accounts on both platforms simultaneously.

Regulation

FP Markets is a fully regulated broker under ASIC and CySEC oversight. These regulatory bodies ensure compliance with industry standards and the protection of client funds. External audits by BDO Australia further enhance the broker's reputation. It's worth noting that FP Markets does not offer negative balance protection under the Australian entity.

Additional Features

FP Markets offers a wealth of educational resources and trading tools suitable for traders of all levels, including e-books, Virtual Private Server (VPS) options, video tutorials, a live trader dashboard, articles, blogs, Myfxbook copy trading, Autochartist MetaTrader plugin, share CFD directory, trader's toolbox for MT4, economic calendar, and a forex calculator.

Account Types

Choose between Standard or Raw accounts in the MetaTrader platforms, with a reasonable minimum deposit of A$100. The maximum leverage is 1:500, and the Standard account is commission-free, while the Raw account charges a $3 commission per lot.

For more professional traders, FP Markets offers Standard, Platinum, or Premier accounts in the Iress platforms, with varying minimum deposits and commission structures. Equity CFD margin requirements start at 3% across all three accounts. The broker also provides Islamic swap-free options and PAMM/MAM trading accounts.

Trading Hours

Trading hours vary depending on the asset class. For forex currency pairs, trading is available 24 hours a day with a brief two-minute break between 23:59 and 00:01 GMT. Metals and cryptocurrencies trade from 01:00 to 23:59 GMT daily, with a shorter window on Fridays (01:00 to 23:57 GMT). Equities/stocks have their respective opening hours.

Customer Support

FP Markets offers customer support from Monday to Saturday (AEDT) and Sunday to Friday (GMT). Reach out to their support team via email, contact number, or live chat, available in 12 languages. User reviews attest to the reliability and helpfulness of the support team, though they cannot provide tax advice.

Trader Security

FP Markets prioritizes trader security with 128-bit SSL encryption on the MetaTrader platforms and the option to enable two-factor authentication (2FA) for added protection. All funding and payment methods comply with industry regulations.

Verdict on FP Markets

FP Markets delivers an exceptional trading experience with competitive spreads and a choice between ECN and DMA accounts. The availability of MT4, MT5, and Iress platforms caters to traders of all levels, while the extensive offering of forex, equity CFDs, futures, and cryptocurrencies provides ample trading opportunities. FP Markets also stands out with its user-friendly client portal, fast sign-up process, and excellent customer service.

Advantages of FP Markets

- Regulated by ASIC and CySEC, ensuring credibility.

- Competitive spreads available on both Standard and Raw accounts.

- Abundance of additional tools and features, including educational resources, Myfxbook, and Autochartist.

- Versatility with MT4, MT5, and Iress trading platforms.

- Extensive asset selection.

- Bespoke copy trading platform.

- High leverage up to 1:500.

- Comprehensive educational resources.

- Favorable customer reviews.

- User-friendly client portal with fast sign-up.

Disadvantages of FP Markets

- Subscription fee of $55 on IRESS accounts.

- Withdrawal fees for certain payment methods.

- Not available for US customers.

- No ETFs offered.

- No welcome bonuses.

- US clients not accepted.

Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion