Review of Capital Street FX: Trading Platforms, Instrument Variety, Pros, and Cons

Are you in pursuit of a multi-asset broker that can supercharge your trading game? Look no further, as Capital Street FX is here to revolutionize your trading experience in 2023. In this comprehensive review, we will delve into Capital Street FX, uncovering its account types, minimum deposit requirements, bonuses, and other standout features. Let's embark on this exciting journey into the world of Capital Street FX.

Opportunities in Capital Street FX:

Capital Street FX, a dynamic broker, specializes in Contracts for Difference (CFDs), offering a staggering 1000+ instruments to bolster your trading portfolio. At the heart of Capital Street FX lies the ActTrader platform, a robust foundation for traders worldwide. But that's not all; Capital Street FX takes customer support to the next level, providing assistance around the clock. Let's dive deeper into the specifics of this exceptional broker.

Key Takeaways

- Leverage Mastery: Capital Street FX unleashes the power of leverage with ratios reaching an impressive 1:3500.

- Global Inclusivity: US traders are warmly welcomed to join the Capital Street FX family.

- Bonuses and Safety Nets: Enjoy deposit bonuses and risk-free trades that can amplify your gains.

- Mauritian Assurance: Operating under an offshore license from FSC Mauritius, Capital Street FX assures traders of its trustworthiness.

- Varied Spreads: While basic accounts offer wide spreads, higher-tier accounts provide more competitive options.

- Platform Insights: Uncover the platform choices and their suitability for your trading strategies.

Assets & Markets

Capital Street FX opens the gateway to a world of possibilities through leveraged CFD trading across a vast spectrum of assets. With over 1000 instruments at your disposal, spanning multiple markets and regions, the choices are virtually limitless.

- Forex: For Forex enthusiasts, Capital Street FX enables speculation on 70+ major, minor, and exotic currency pairs, including GBP/USD, EUR/AUD, and CAD/JPY.

- Crypto currency: Dive into the cryptocurrency craze with 14 popular digital currencies, including Bitcoin, Ethereum, Dogecoin, and Ripple.

- Commodity : Invest in 17 soft and hard commodities, ranging from precious metals to agriculture and energy resources.

- Bond : Speculate on government bonds, such as 5-year US T-notes and Japanese Government bonds.

- Index : Venture into the world of global indices with 21 options, including the S&P 500, DAX 30, and FTSE 100.

- ETF: Gain access to 21 exchange-traded funds, featuring the MSCI Emerging Markets Index Fund, FTSE China 25 Index Fund, and S&P 500 VIX Short Term Futures ETN.

- Stock: Trade over 80 company stocks, including renowned names like Apple, Morgan Stanley, and Meta.

Notably, Capital Street FX boasts a reasonably fast execution speed, with an average response time of just 0.1 seconds.

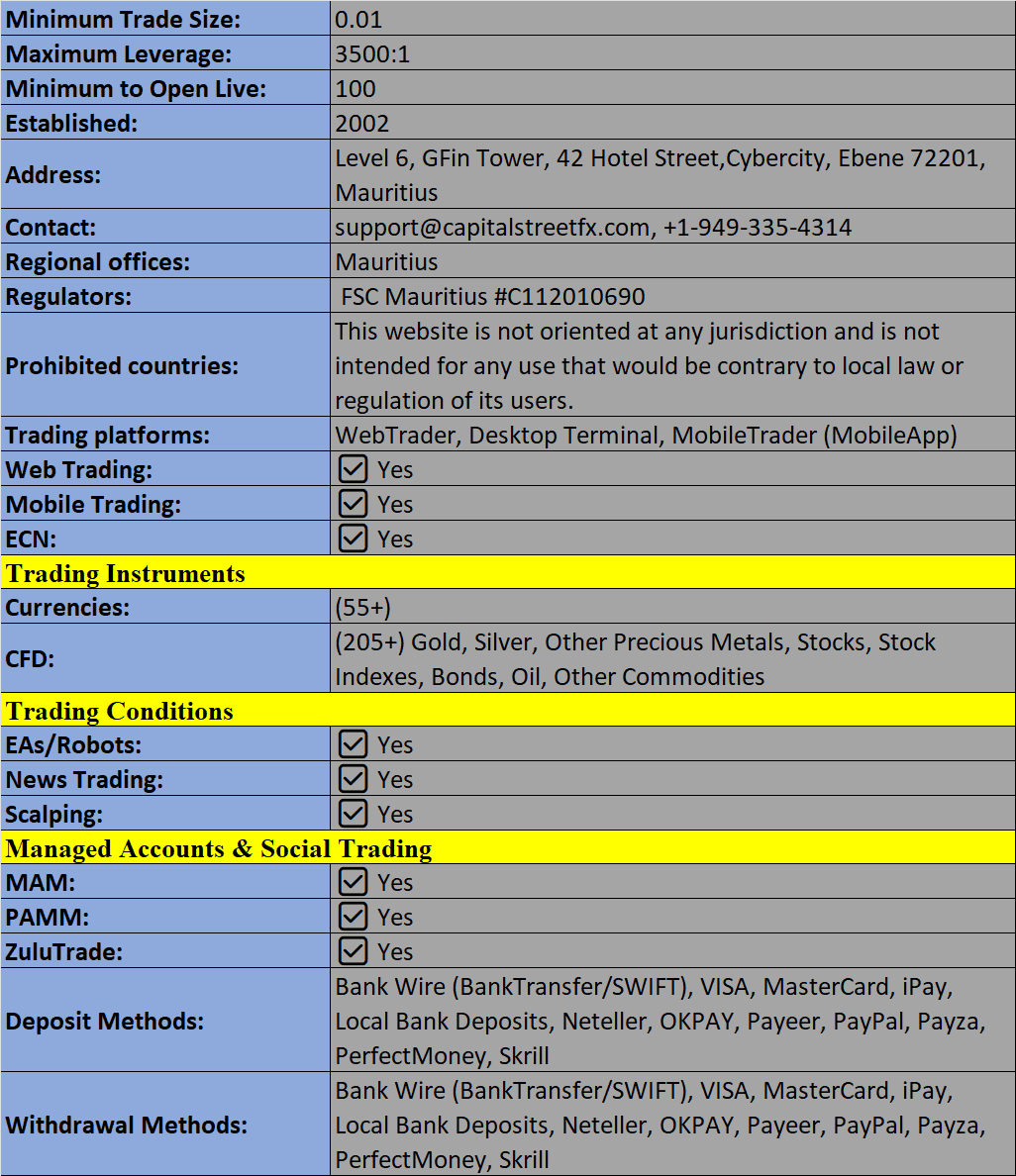

Capital Street FX: Fee Structure and Account types

In the world of trading, fees are a critical consideration. Capital Street FX caters to traders with varying needs by offering a range of account options.

- Basic Account: Experience STP execution, commission-free trading, spreads from 2.5 pips, and leverage up to 1:2500. With a modest $100 minimum deposit, this account is an excellent entry point.

- Classic Account: Enjoy STP execution, commission-free trading, spreads from 2 pips, and leverage up to 1:3000. A $200 minimum deposit opens the doors to this account.

- Professional Account: Designed for serious traders, this account features STP execution, commission-free trading, spreads from 1.5 pips, leverage up to 1:3500, and a $1000 minimum deposit. It also offers telephone trading, bonuses, promotions, and access to a personal account manager.

- VIP Account: The VIP experience includes ECN execution, spreads from a mere 0.1 pips, a $10,000 minimum deposit, telephone trading, bonuses, promotions, access to a personal account manager, and the ability to open 400 orders at once. However, please note a $15 commission fee for currency trading, with leverage up to 1:100.

The Gateway to Capital Street FX

Are you ready to embark on your trading journey with Capital Street FX? Registering for an account is a breeze:

- Navigate to the 'Accounts' section in the top menu and select 'Open An Account.'

- Fill out the online application form or opt for quick registration through your Facebook or Google account.

- Click 'Next Step' to proceed.

- Account credentials will be sent to the email address you've registered.

- Log in to the client cabinet to kickstart your trading adventure.

It's important to remember that before you can trade or deposit, proof of identity and address documents are required.

Deposits and Withdrawals

Capital Street FX offers a plethora of deposit methods, catering to both traditional and crypto-savvy traders.

Deposit Options:

- AdvCash

- Utrust Pay

- Perfect Money

- Bank wire transfers

- Visa/Mastercard credit and debit cards

- Cryptocurrency, including Bitcoin, Ethereum, Tether, and USD Coin

Minimum deposit requirements vary, starting as low as $100 for the basic account. Capital Street FX does not impose deposit fees, although third-party banking charges may apply. It's worth noting that all deposit solutions are instant, except for bank wire transfers, which may take up to seven working days.

Deposit Process

Making a deposit at Capital Street FX is a straightforward process:

- Log in to the Capital Street FX portal.

- Click on the 'Deposit Funds' icon.

- Choose your preferred payment method.

- Follow the on-screen instructions.

- Depending on the chosen payment type, you may be redirected to an external site.

- Confirm the deposit to fund your trading account.

Withdrawals

When it comes to withdrawals, Capital Street FX processes them exclusively to the original payment method. While most withdrawal requests are handled within 24 hours during regular working days, the timeline may vary based on the payment method chosen. Do keep in mind that withdrawals submitted on weekends and bank holidays may take a bit longer.

The Capital Street FX Platform:

At Capital Street FX, traders engage with the renowned ActTrader platform, available as a desktop application or web-based solution compatible with major browsers. ActTrader offers a multitude of features tailored for day traders, including custom charts, access to trading bots, and one-click trading.

Additional highlights of the ActTrader platform:

- Level II quotes

- 13 graphical objects

- 30 technical indicators

- Aggregated market depth data

- Netting and hedging permitted

- Line, bar, area, and candlestick charts

- Automated trading with strategy backtesting

- 11 chart timeframes, ranging from one minute to one month

One-click trading is the quickest way to open an order; simply right-click on a chart, select 'bid' or 'ask,' and your position will be initiated instantly. To close a position, choose the 'Trade' icon in the top menu and select 'Close Position.'

Mobile Application

For traders on the move, Capital Street FX offers a mobile-compatible app for both iOS and Android devices. This app delivers the same functionality and stability as the desktop and browser-based solutions. Keep an eye on real-time price quotes, receive live financial news, and analyze multiple charts, all while on the go. The mobile app ensures that all order types and execution modes available on the desktop software are at your fingertips. However, do note that the Capital Street FX mobile app may require some adjustment if you're accustomed to MT4 and MT5.

Demo Account

Capital Street FX understands the importance of a risk-free environment for learning and honing your trading skills. That's why they provide a demo account loaded with $10,000 in virtual funds. Should you require additional funds, the broker's customer support team is ready to assist. Given the complexity of the platform and the importance of risk management, a demo account is the ideal starting point for new traders.

Regulation & Licensing

Capital Street FX operates under a Full Services Securities Dealer license, issued by the Financial Services Commission of Mauritius (FSC), with license number C112010690. While this license is reassuring, it's essential to acknowledge that it may not offer the same level of regulatory protections as brokers registered with authorities like CySEC, FCA, or SEC.

Nevertheless, Capital Street FX goes the extra mile to provide negative balance protection and segregate client funds.

Bonuses & Promotions

Capital Street FX tantalizes traders with various financial incentives and bonus rewards. These perks include a risk-free trade for new account registrants and deposit bonuses ranging from 150% to a whopping 900%. But, there's a twist – withdrawing bonus credits can be a tad tricky. The fine print in the broker's terms and conditions stipulates that customers must execute a specified number of lots equal to one-fifth of the bonus amount before requesting a withdrawal.

For instance, if you deposit $5000, earn a 650% reward, and receive a $32,500 bonus, you would need to trade 6500 lots (32,500/5) to be eligible for withdrawal.

Additional Features

Capital Street FX stands out with its rich assortment of supplementary tools and resources. Traders can tap into trading signals, an economic calendar with forecasts, daily and weekly technical analysis reports, and a 'trade ideas' forum covering various asset classes and market news. Learning materials are categorized into basic, intermediate, and advanced concepts.

For those seeking education and guidance, Capital Street FX offers step-by-step platform user guides, dashboard tutorials, and comprehensive Q&As within the 'Help' section of the broker's website.

Customer Support

One of the shining aspects of Capital Street FX is its 24/7 customer support available in over 20 languages. Reach out through telephone, live chat, or email for assistance. The FAQ section on the broker's website is a treasure trove of valuable information, covering fund transfers, account registration, trading conditions, and more.

Ready to embark on your trading journey with Capital Street FX? Here's how to get in touch:

- Telephone: +1(949) 391 1002

- Email: support@capitalstreetfx.com

- Live Chat: Find it at the bottom right of all webpages.

- Online Contact Form: Access it via the 'Contact Us' webpage.

- Office Address: Capital Street Intermarkets Limited, Level 2, Hennessy Tower, Pope Hennessy Street, Port Louis, Republic Of Mauritius

For the latest updates and promotions, you can also connect with Capital Street FX on social media platforms like Facebook and Twitter.

Safety and Security

Established in 2008, Capital Street Group has earned its reputation, serving 26,000 registered customers across 108 countries with a monthly trading volume of $100 billion. The broker operates under a Full Services Securities Dealer license from the Financial Services Commission of Mauritius (FSC).

While Capital Street FX prioritizes the safety of its clients' funds through SSL certificates and 256-bit encryption, it's important to acknowledge the offshore nature of the broker.

Trading Hours

Trading knows no boundaries at Capital Street FX, with its markets open 24 hours a day from Monday to Friday. The investment window closes at 5:20 pm (Eastern Daylight Time, UTC–4) on Fridays and reopens at 6 pm on Sundays. For specific trading hours, consult the platform interface under the 'Non-Trading Interval' column.

Pros and Cons

Pros

- Comprehensive range of investment opportunities

- Low minimum deposit requirements

- Access to a demo account for risk-free practice

Cons

- Regulatory oversight may not be as robust as some other brokers

- The absence of MetaTrader integration

- Limited support for copy trading

Capital Street FX emerges as a promising choice for traders in search of diverse trading instruments and a reliable platform. While it offers competitive conditions for top-tier accounts, the presence of high leverage and withdrawal fees, alongside relatively weak regulatory oversight, are aspects that bear consideration. As a result, some traders may explore alternative options that align more closely with their preferences.

Capital Street FX Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion