Rate Worries Ripple Across Europe: Stocks Plummet on Hawkish Fed Minutes

European stocks experienced a decline following the release of the Federal Reserve's hawkish minutes from their last policy meeting. Early corporate earnings reports also influenced investor sentiment.

At 8:07 a.m. in London, the Stoxx 600 was down 0.9%, with all sectors showing a decline. However, utilities outperformed other sectors.

Among individual stocks, Hunting Plc saw a significant surge of 14% after reporting that its trading performance exceeded management expectations. The company's revenue and operating profit surpassed the targets set at the beginning of the year. On the other hand, Currys Plc tumbled 8.3% as its full-year revenue met the average analyst estimate. Chr. Hansen Holding A/S remained relatively unchanged after narrowing its organic revenue forecast for the entire year.

After a strong rally of nearly 9% in the first half of the year, European equities started July with declines due to concerns about faltering economic growth impacting corporate earnings, alongside persistent inflation. The released minutes from the Fed's meeting on Wednesday indicated a pause in interest rate increases in June, with expectations of a future hike later this month.

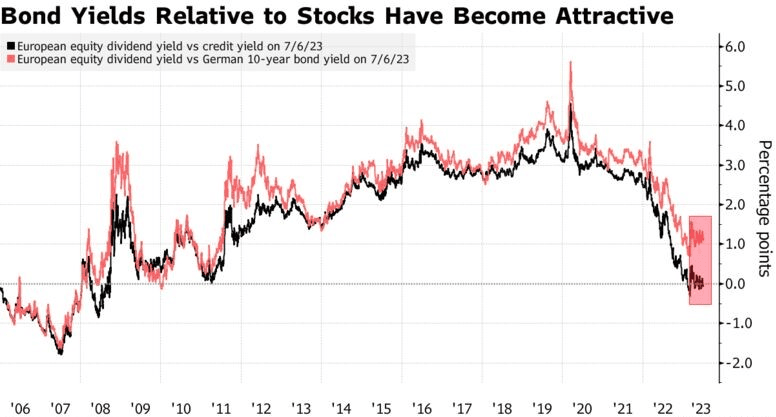

Image source from Bloomberg:

Additionally, stocks face increased competition from bond markets, which offer higher returns with fewer risks.

However, some positive sentiment was supported by data showing a rebound in German factory orders in May, suggesting that the manufacturing slump in Europe's largest economy may be easing as it emerges from a recession.

The focus now shifts to the second-quarter earnings season. Joachim Klement, Head of Strategy, Accounting, and Sustainability at Liberum Capital, expects to see more profit downgrades but believes that they won't lead to a major setback in European markets. Investor sentiment is improving, and many stocks have reached oversold levels, leading to the anticipation of a short-term bounce in the coming weeks before the earnings season begins in earnest.

In terms of sectors, European oil stocks could see activity on Thursday following Exxon's announcement that lower natural gas prices and refining margins will impact second-quarter earnings by approximately $4 billion compared to the previous three months.

Discussion