OspreyFX Trading Review 2023: Platform, Leverage & Mobile Apps

OspreyFX stands as a prominent platform offering diverse opportunities for trading in CFDs across forex, cryptocurrencies, stocks, and commodities. Despite being unregulated, the broker operates as a licensed business in St. Vincent and the Grenadines. This review will provide an in-depth analysis of the advantages and disadvantages associated with choosing OspreyFX, encompassing account types, available financial assets, security measures against scams, and more.

Diverse Financial Assets at OspreyFX

While OspreyFX doesn’t confine its clients solely to the foreign exchange markets, it does provide ample opportunities across various asset classes. Although the selection might not be as extensive as some other platforms, it offers substantial prospects in currencies, indices, and cryptocurrencies.

Array of Financial Assets

The range of financial assets available at OspreyFX is quite diverse:

- Stocks: Shares from 10 EU and 27 US companies.

- Forex: A portfolio of 57 major, minor, and exotic currency pairs.

- Cryptocurrencies: Over 20 of the most prominent cryptocurrency tokens against the US dollar.

- Indices: Covering 13 global stock indices, including the Dow Jones US30 and FTSE 100.

- Commodities: Encompassing 9 hard and soft commodities, including energies and metals.

Trading Platforms: MT4 and MT5

OspreyFX provides access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both renowned for their suitability in forex and CFD trading. Each platform offers a distinct set of features and tools tailored to different trading needs and experiences.

MetaTrader 4 (MT4)

Renowned for its user-friendly interface, customizable dashboard, and a plethora of charting and analysis tools, MT4 remains a preferred choice for many traders globally.

MetaTrader 5 (MT5)

With a more advanced set of technical indicators and order types, MT5 suits traders seeking a more sophisticated trading environment and multi-asset capabilities.

Steps to Execute a Trade with OspreyFX

Trading on OspreyFX is a swift and straightforward process. To initiate a trade:

- Login and Platform Selection: Access your trading portal and choose your preferred trading platform.

- Asset Search: Use the navigation bar to find your desired asset and double click to select it.

- Order Placement: A new order window will appear; here, you can opt for instant execution or pending order.

- Order Details: Fill in the trade parameters such as volume in lots, stop-loss, and take-profit.

- Confirmation: Click the ‘buy’ or ‘sell’ button to confirm the trade. Note that verification is necessary, and funds need to be added before commencing trading.

Fee Structure and Spreads

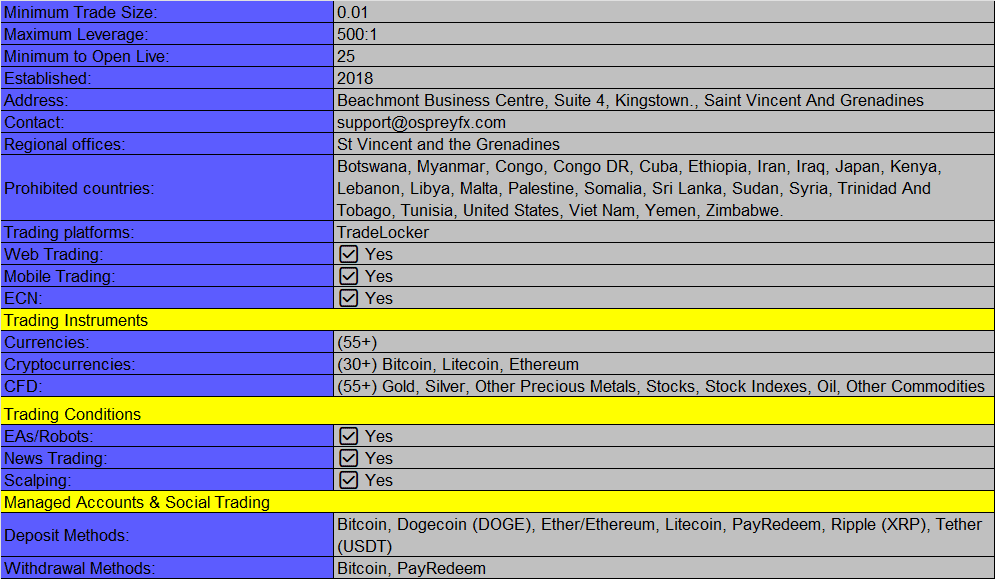

OspreyFX operates on an ECN pricing model, ensuring narrow spreads alongside a nominal commission. The breakdown of typical live spreads across various account types is as follows:

- Standard Account: Exhibits spreads of 0.8 pips with a $7 commission per lot.

- PRO Account: Offers typical spreads of 0.4 pips with an $8 commission.

- VAR Solution: Presents spreads starting at 1.2 pips with zero commission.

- Mini Account: Introduces spreads from 1.0 pip with a $1 commission per lot.

Payment Methods and Withdrawals

OspreyFX facilitates account funding and withdrawals through several popular payment methods, each with its associated fees and processing times. The available options encompass:

- Bank wire transfer

- Credit/debit card

- VLoad

- Bitcoin

- UPay

Withdrawal and Deposit Insights

Withdrawal times for any payment method typically extend to at least 24 hours, similar to other brokers. Bank transfers over $5,000 incur a $25 fee, whereas Bitcoin withdrawals are exempt from charges, excluding third-party bank fees. It's noteworthy that deposits and withdrawals must align with the trading account's registered name.

OspreyFX Account Types

OspreyFX offers a spectrum of account types, catering to varied preferences and trading styles:

- Standard Account

- PRO Account

- VAR Account

- Mini Account

Funded Accounts

Additionally, OspreyFX extends the provision of funded accounts through a structured program. These accounts allow users to trade on behalf of a company, with profits shared between the individual and the company. The process involves three pivotal steps:

- Purchase a Challenge Entry

- Verify Your Strategy

- Get Funded and Start Trading

Mobile Trading Applications

OspreyFX provides flexibility with mobile trading through the MT4 and MT5 mobile applications available for free on the App Store and Google Play Store. However, mobile trading might have limitations compared to desktop and web-based platforms, offering fewer advanced features and analysis capabilities.

Leverage Overview

OspreyFX offers leverage up to 1:500 across its asset range. While this can provide enhanced market exposure and profit potential, it's essential to use caution with margin trading. Leverage can amplify losses, possibly exceeding the capital in your account.

Demo Account & Bonuses

OspreyFX offers a comprehensive free demo account, providing users with virtual funds and supporting all types of trading available on the main account, including a 1:500 maximum leverage rate. Demo accounts are valuable for trying out a broker or strategy risk-free.

The platform also runs trading competitions and referral bonus schemes, detailed on the broker's website.

Regulation & Additional Features

OspreyFX, based in St. Vincent and the Grenadines, operates as a legally licensed business but is not a regulated forex broker. While regulation offers protective measures, being unregulated allows certain opportunities like uncapped leverage rates and increased client anonymity.

Beyond brokerage services, OspreyFX offers financial news, educational articles, and online calculators. The Forex Squad app provides free educational resources covering various trading topics.

Trading Hours & Company Details

Established in 2019, OspreyFX operates as an online brokerage from St. Vincent and the Grenadines. Catering to day traders, it offers technical analysis, variable account options, and high leverage rates.

As an ECN broker, OspreyFX electronically matches trade participants, ensuring transparent market data, deep liquidity, and tight spreads. However, being unregulated poses additional risks for traders.

Customer Support & Security Measures

OspreyFX provides 24/7 customer support through various channels, including live chat, email, and social media platforms. Despite being unregulated, the platform segregates client funds and implements KYC protocols and two-factor authentication for account security.

OspreyFX Summary

OspreyFX presents a range of trading instruments, mobile support, and competitive fee structures. The platform's funded account option and accessibility are commendable. However, limitations in educational resources, payment options, and regulatory status might deter some users.

Pros and Cons

Pros:

- Funded accounts up to $200k with 70/30 profit split

- Comprehensive investment range, including cryptocurrencies

- Integration with MetaTrader 4 and MetaTrader 5

- Multiple base currencies and fast order executions

- Tight spreads, low commissions, and high leverage

- 24/7 customer support

Cons:

- Lack of robust regulation

- Bank transfer deposit fees

- Non-acceptance of US clients

- Challenges in connecting with customer service via chatbot

OspreyFX Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion