OBRInvest Brokers: A Comprehensive Overview of Regulations, Platforms, Trading Instruments, Pros, and Cons

OBRInvest, a licensed brokerage firm, offers a comprehensive range of trading options, including forex, stocks, indices, commodities, and cryptocurrencies through Contract for Difference (CFD) trading. In this review, we'll provide you with an in-depth overview of OBRInvest, covering aspects such as fees, trading platforms, leverage, regulation, and more. Discover what OBRInvest brings to the table.

OBRInvest Overview

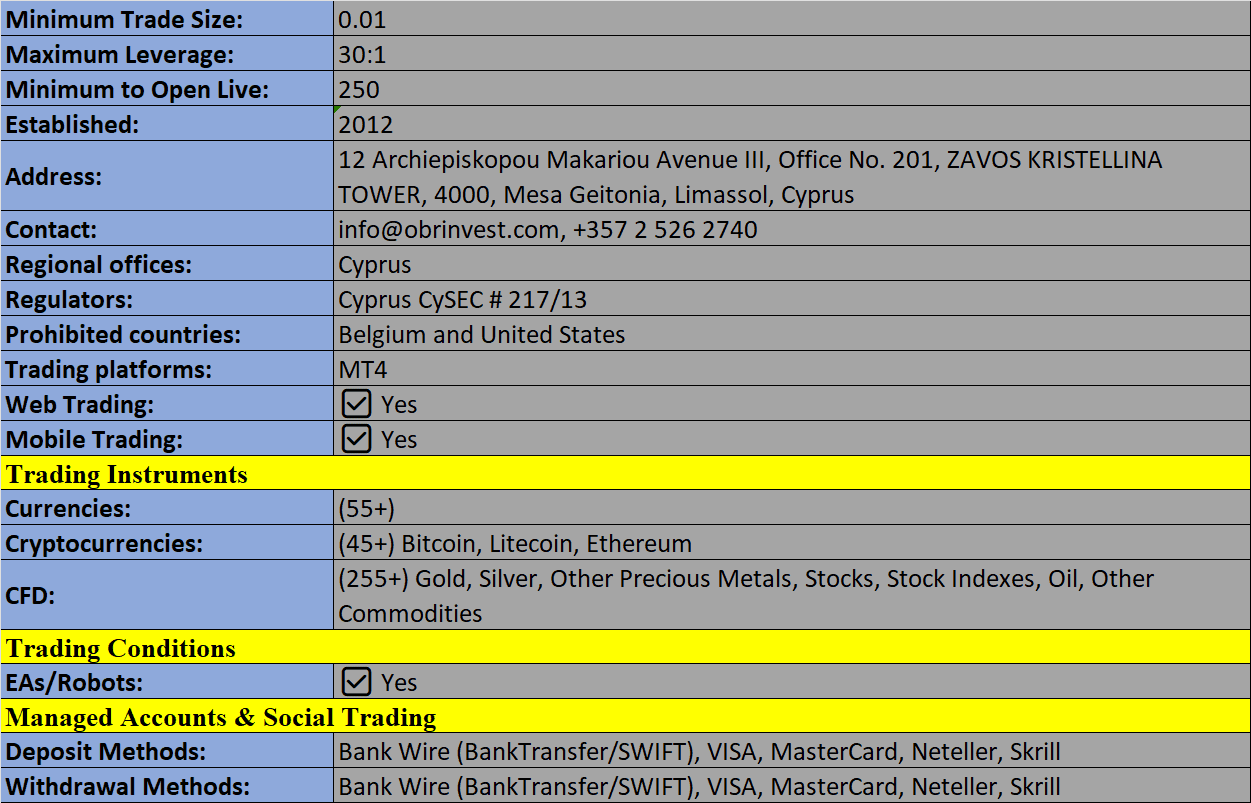

OBRInvest is owned and operated by OBR Investments Limited, established in 2012. With over 300 assets available for trading worldwide, OBRInvest caters to both institutional and private clients. The company operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC).

OBRInvest stands out by offering a user-friendly educational hub for beginners and accepting a wide range of popular deposit methods, including Visa, Mastercard, Skrill, Neteller, and Rapid Transfer.

Trading Platforms

- WebTrader: OBRInvest's WebTrader platform allows clients to trade directly through their web browsers without the need for software downloads. It provides a user-friendly charting view with essential market information for each asset. Clients can choose between market execution and advanced trades, complete with pending orders, take profit, and stop loss orders. WebTrader is particularly suitable for beginners, and platform tutorial videos are available to assist new investors.

- MetaTrader 4 (MT4): OBRInvest also offers the popular MetaTrader 4 platform, known for its one-click trading, intuitive interface, automated trading options, instant order execution, built-in custom indicators, mobile support (iOS and Android), advanced charting with nine timeframes, 23 analytical objects, and 30 integrated indicators. MT4 can be downloaded directly from the broker's website.

Assets & Markets

OBRInvest provides a diverse array of trading instruments, including:

- Forex: Featuring 55 forex pairs.

- Commodities: Offering the ability to diversify portfolios with precious metals, energies, and coffee.

- Stocks & Indices: Access to global indices and shares like Dow Jones, DAX 40, Amazon, and Intel.

- Cryptocurrencies: Including prominent cryptocurrencies such as Bitcoin, Ethereum, Ripple, Polkadot, and Tether.

Spreads & Commission

While premium account holders enjoy tighter spreads, OBRInvest's spreads may not be the most competitive, with the EUR/USD spread starting at 1.6 pips, higher than the industry average of around 1 pip. Basic account holders face even higher costs. Traders are advised to compare spreads at multiple brokers to ensure they receive competitive rates.

Leverage Review

OBRInvest offers leverage of up to 1:400 for professional clients and 1:30 for retail clients. However, it's essential for traders to exercise caution when using leverage, as it can amplify both profits and losses.

Mobile Trading

OBRInvest offers a mobile web platform, allowing clients to trade on the go. The mobile app, available for Android and iOS devices, receives positive reviews for its user-friendly interface and extensive functionality.

OBRInvest Payment Methods

Clients can conveniently deposit funds using credit cards, e-wallets, or bank wire transfers, all with no deposit fees. Withdrawals can be initiated through the live portal and may be subject to varying charges based on account type.

Demo Account

OBRInvest offers a demo account with 100,000 in virtual funds. This resource is highly recommended for clients to explore the trading platform, test strategies, and investigate available assets.

Deals & Promotions

Due to CySEC regulations, OBRInvest does not provide promotional bonuses or trading incentives.

OBRInvest Regulation

OBRInvest is owned and operated by OBR Investments Limited, a Cypriot Investment services firm authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 217/13. This regulatory authority is considered top-tier, instilling confidence in the broker's reliability. However, OBRInvest is not licensed with the ASIC or FCA, making it unavailable to traders from Australia and the UK.

Additional Features

OBRInvest offers a range of additional resources on its website, including a glossary, economic calendar, Trading Central for news and market analysis, Tip ranks for trading insights, and a cost calculator to estimate trading fees. The broker also provides webinars and eBooks on topics like technical analysis, margin, leverage, and trading strategies, accessible through the Education tab on their website.

OBRInvest Accounts

OBRInvest offers four account types, each offering progressively more competitive features. For retail clients:

- Basic: Minimum deposit of €250, with floating spreads starting at 3.0 pips for EUR/USD. One free withdrawal is allowed.

- Gold: Minimum deposit of €25,000, with floating spreads starting at 2.7 pips for EUR/USD. Clients can make one free withdrawal per month.

For professional clients:

- Platinum: Minimum deposit of €100,000, with floating spreads starting at 2.1 pips for EUR/USD. Clients can make three free withdrawals per month.

- VIP: Minimum deposit of €250,000, with floating spreads starting at 1.6 pips for EUR/USD. There are no withdrawal fees.

Trading Hours

Trading hours vary depending on the market and asset. Forex markets are open 24 hours a day, excluding weekends, while cryptocurrencies can be traded 24/7. Commodities, stocks, and indices typically trade Monday through Friday, with specific session details available in the account portal.

Customer Support

OBRInvest offers customer support in eight languages, including English and Spanish. You can contact them via phone, email, or the live chat function on their website.

Safety & Security

OBRInvest prioritizes the safety of client funds, employing a 128-bit SSL encryption certificate to secure all transactions. Additionally, stringent identity verification procedures are in place during registration and withdrawal processes, with compliance to EU GDPR data protection rules.

Pros:

- Regulatory Compliance: OBRInvest is a regulated broker, holding a license from CySEC, ensuring a secure trading environment.

- Risk-Free Learning: Sign up for a free demo account quickly, allowing you to practice and gain confidence in your trading strategies without risking real money.

- Robust Platforms: Benefit from the integration of MetaTrader 4 (MT4) and an intuitive web platform, offering versatile options for all types of traders.

- Diverse Investment Choices: Access a wide spectrum of investment opportunities, including popular cryptocurrencies, to diversify your portfolio.

- Convenient Deposits: Enjoy the convenience of multiple payment methods for deposits, all with no additional charges.

- High Leverage: Professional clients can leverage their positions up to 1:400, potentially increasing profit potential (but use with caution).

- Market Insights: Gain valuable insights with access to Trading Central, helping you make informed trading decisions.

Cons:

- Limited Geographic Availability: Unfortunately, OBRInvest is not accessible to clients from the US, UK, or Belgium, limiting its global reach.

- Withdrawal Fees: Basic account holders may encounter withdrawal fees, impacting the overall cost of trading.

- No Copy Trading: OBRInvest does not offer a copy trading platform, which can be a drawback for those interested in social trading.

- Inactivity Fee: Be aware of an €80 inactivity fee, which applies if your account remains dormant for an extended period.

OBRInvest caters to traders of all levels of experience and is known for its diverse asset offerings, popular trading platforms, demo accounts, and mobile trading options. The broker's CySEC regulation and commitment to client fund security instill trust among its users. However, it's essential to be mindful of the fee structure, as spreads may not be the most competitive, especially for basic account holders. Those in the Basic category may find more cost-effective brokers available.

OBRInvest Brokers Review

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion