Mastering Investments with the S&P 500 Index

When it comes to investing, there are numerous indices that serve as benchmarks for different sectors and market segments. Among these, the S&P 500 Index stands out as one of the most significant and influential indices worldwide. In this article, we will explore the purpose and importance of the S&P 500 Index in investing, its history, how it works, and why it has become a staple in the financial world.

Outline:

1. Introduction

2. Understanding the S&P 500 Index

3. How the S&P 500 Index Works

4. Significance in the Investing Landscape

5. Advantages of Investing in S&P 500 Index Funds

6. Risks and Limitations of the S&P 500 Index

7. How to Invest in the S&P 500 Index

8. Why the S&P 500 Is Important in Investing

9. Historical Performance of the S&P 500 Index

10. Investing in the S&P 500

11. Understanding S&P 500 Index Volatility

12. S&P 500 Index and Economic Indicators

13. Key Considerations for Investors

14. The Role of the S&P 500 in Economic Analysis

15. Footnote

16. FAQs

Introduction

The S&P 500 Index is a widely recognized and essential component of the financial world. In this article, we will explore what the S&P 500 Index is, delve into its significance in the investing landscape, and understand why it holds such importance for investors.

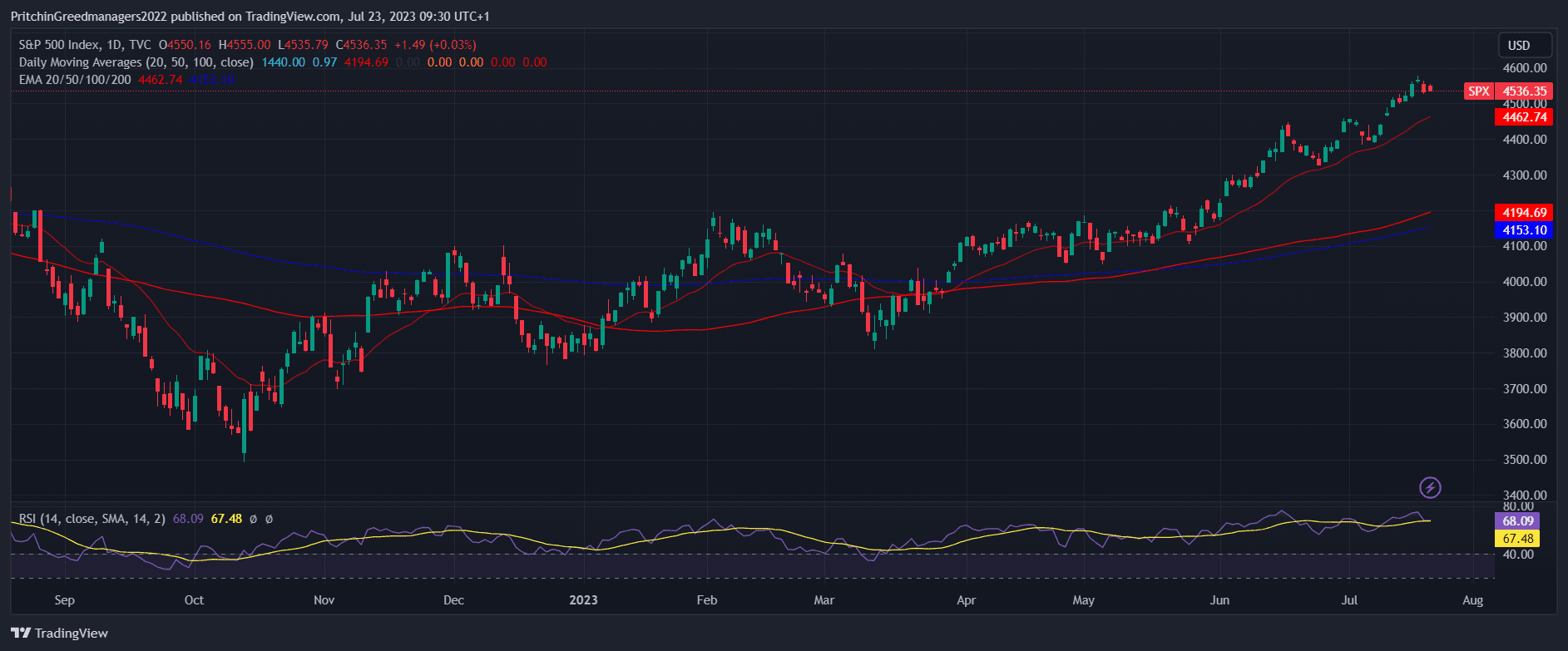

Image source from trading view

Understanding the S&P 500 Index

· Origins and History

The S&P 500 Index, often simply referred to as the S&P 500, traces its roots back to 1923 when Standard & Poor's (S&P) introduced the index. Initially comprising 233 companies, the index has since evolved into one of the most prominent benchmarks for the U.S. stock market.

· Composition and Methodology

Today, the S&P 500 Index includes 500 of the largest publicly-traded companies in the United States. These companies span various sectors and industries, making the index a diverse representation of the U.S. economy. The index's composition is periodically reviewed and adjusted to ensure its relevance.

· Key Companies Represented

The S&P 500 Index features some of the most influential companies globally. Names like Apple, Microsoft, Amazon, and Alphabet (Google) are among the top holdings. These giants play a significant role in driving the index's overall performance.

How the S&P 500 Index Works

· Selection Criteria

The selection process for the S&P 500 components involves a committee that considers various factors, including the company's market capitalization, liquidity, sector representation, and financial viability. Only companies that meet specific eligibility criteria are included in the index, ensuring that it reflects a diverse representation of the U.S. economy.

· Market Cap Weighting

The S&P 500 is a market capitalization-weighted index, meaning that companies with larger market capitalizations have a more substantial impact on the index's performance. This approach ensures that the index reflects the relative size and significance of each included company within the broader market.

· Rebalancing

The index is regularly rebalanced to maintain its accuracy and relevance. Companies may be added or removed based on changes in their market capitalization and overall performance. Rebalancing is typically done on a quarterly basis.

Significance in the Investing Landscape

· Benchmark for the U.S. Stock Market

The S&P 500 Index serves as a benchmark, allowing investors to gauge the overall performance of the U.S. stock market. It is a yardstick against which other investments, such as mutual funds and individual stocks, can be compared.

· Widely Followed by Investors

Many professional investors and fund managers closely monitor the S&P 500 Index. Its movements often influence investment decisions, making it an essential reference point for financial professionals and individual investors alike.

· Comparison with Other Market Indices

Investors often compare the S&P 500 Index with other market indices like the Dow Jones Industrial Average (DJIA) and the Nasdaq Composite. Each index has its unique characteristics, providing valuable insights into different aspects of the market.

Advantages of Investing in S&P 500 Index Funds

· Diversification Benefits

By investing in the S&P 500 Index, investors gain exposure to a wide range of companies and industries, reducing the risk associated with holding individual stocks.

· Low-Cost and Easy Access

Investors can access the S&P 500 through various financial products like exchange-traded funds (ETFs) and mutual funds, which often come with lower fees compared to actively managed funds.

· Long-Term Performance

Over the long term, the S&P 500 Index has shown consistent growth, making it an attractive option for investors with a focus on capital appreciation.

Risks and Limitations of the S&P 500 Index

· Concentration in Certain Sectors

As the index is market-cap-weighted, companies with larger market capitalizations have a more substantial impact on its performance. This results in a concentration of certain sectors in the index, which can expose investors to sector-specific risks.

· Market Volatility

Like any other investment, the S&P 500 Index is susceptible to market volatility. Market downturns can impact the index's value, leading to potential losses for investors.

· Currency Risks for International Investors

For international investors, fluctuations in currency exchange rates can influence the index's returns when converted to their local currency.

How to Invest in the S&P 500 Index

Investors have several options to gain exposure to the S&P 500 Index:

· Exchange-Traded Funds (ETFs)

ETFs that track the S&P 500 Index are a popular choice for their low expenses and ease of trade on stock exchanges.

· Mutual Funds

Mutual funds focused on mirroring the index's performance allow investors to access the S&P 500 through professional management.

· Index-Tracking Strategies

Some investors choose to replicate the index's performance by directly purchasing the constituent stocks in proportion to their weights in the index.

Why the S&P 500 Is Important in Investing

· Broad Market Representation

The S&P 500 is often referred to as a barometer of the U.S. stock market due to its extensive coverage of 500 leading companies from various sectors. As a result, it provides investors with a broad representation of the overall health and performance of the U.S. economy.

· Performance Benchmark

Many investors use the S&P 500 as a benchmark to assess the performance of their investment portfolios. Comparing portfolio returns to the index's performance helps investors gauge how well their investments are performing relative to the broader market.

· Portfolio Diversification

Including the S&P 500 in an investment portfolio can contribute to diversification, spreading risk across a wide range of companies and industries. Its diverse composition makes it a core holding for many long-term investors seeking stable returns.

· Historical Returns

Over the years, the S&P 500 has delivered competitive and consistent returns, making it an attractive investment option for individuals and institutions alike. Historical data reveals that the index has outperformed many other market indices over the long term.

Historical Performance of the S&P 500 Index

· Major Milestones and Trends

The S&P 500 has experienced various milestones throughout history, including bull markets, bear markets, and significant market events.

· Bull and Bear Markets

Understanding these historical trends can provide insights into potential future performance and cyclical patterns.

Investing in the S&P 500

· Exchange-Traded Funds (ETFs)

One of the most popular ways to invest in the S&P 500 is through ETFs. These funds aim to replicate the performance of the index, and investors can buy and sell ETF shares on stock exchanges throughout the trading day.

· Mutual Funds

Mutual funds that track the S&P 500 also offer a convenient way for investors to gain exposure to the index. These funds pool money from multiple investors and invest in a diversified portfolio of S&P 500 constituents.

· Individual Stocks

For those interested in building a custom portfolio, investing in individual stocks of S&P 500 companies is an option. However, this approach requires careful research and monitoring of individual stocks.

Understanding S&P 500 Index Volatility

· Factors Influencing Volatility

Multiple factors, such as economic indicators, geopolitical events, and investor sentiment, can contribute to the index's volatility.

· Strategies for Managing Volatility

Investors can employ various strategies to mitigate the impact of volatility on their portfolios.

S&P 500 Index and Economic Indicators

· Correlation with Economic Health

The S&P 500's performance is often indicative of the overall economic health of the United States.

· Impact of Economic Events on the Index

Major economic events can cause significant movements in the index, affecting investor sentiment and market conditions.

Key Considerations for Investors

· Risk Management

As with any investment, risk management is crucial when investing in the S&P 500. Diversifying across asset classes and investment styles can help mitigate potential downturns.

· Market Fluctuations

Investors should be prepared for market fluctuations, as the S&P 500 can experience periods of volatility. A long-term perspective and disciplined investment approach can help navigate these fluctuations.

· Long-Term Perspective

The S&P 500 is well-suited for long-term investors who aim for steady growth over time. Short-term market movements should not deter long-term investment strategies.

The Role of the S&P 500 in Economic Analysis

Apart from its significance in investing, the S&P 500 also serves as an essential tool for economists and analysts to gauge the overall health of the U.S. economy. Changes in the index's performance can offer valuable insights into economic trends and market sentiment.

Footnote

In conclusion, the S&P 500 Index plays a critical role in the world of investing and finance. Its long and storied history, combined with its broad market representation, make it a preferred choice for investors seeking exposure to the U.S. equity market. As a reliable performance benchmark and a diversification tool, the S&P 500 continues to be a cornerstone in many investment portfolios.

FAQs

1. What is the S&P 500 Index?

- The S&P 500 Index is a benchmark representing 500 of the largest publicly-traded companies in the United States.

2. Why is the S&P 500 important for investors?

- It serves as a reference point for the U.S. stock market's performance and is widely followed by investors.

3. How can I invest in the S&P 500 Index?

- Investors can gain exposure to the index through ETFs, mutual funds, or by replicating its performance through individual stock holdings.

4. What are the risks of investing in the S&P 500?

- Risks include sector concentration, market volatility, and currency risks for international investors.

5. Should I invest in the S&P 500 or pick individual stocks?

- The choice depends on your risk tolerance, investment goals, and time horizon. Both approaches have their advantages and disadvantages.

Discussion