InstaForex Review: A Leading Forex Broker

InstaForex Review: A Leading Forex Broker

Established in 2007, InstaForex is a highly regarded online brokerage firm known for its global presence and commitment to delivering exceptional trading solutions. Operating from its headquarters in Russia, InstaForex extends its brokerage services to clients across more than 260 countries worldwide. The broker has built a strong reputation by offering outstanding trading conditions and pioneering innovations in the financial industry.

Diverse Trading Instruments

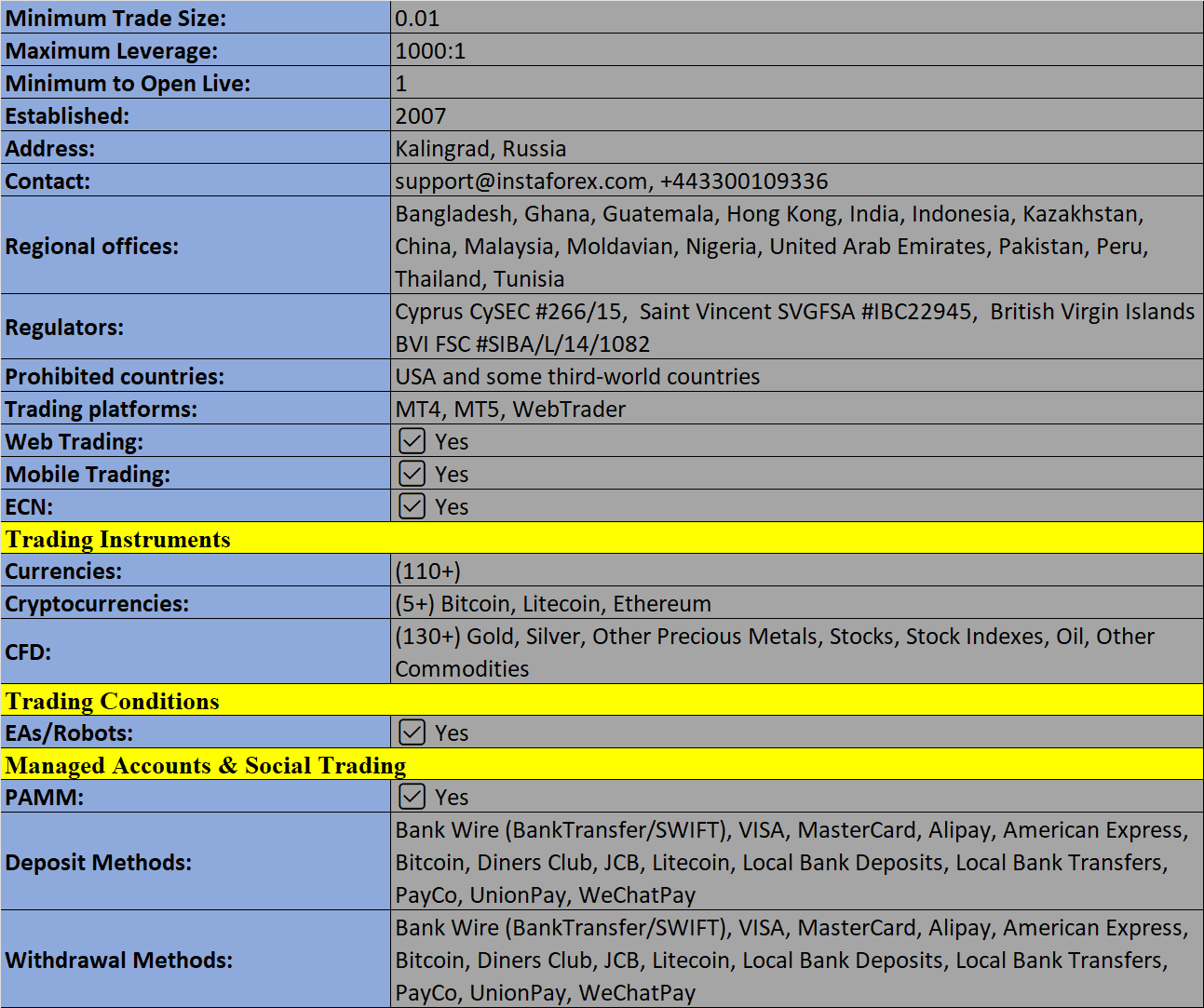

InstaForex caters to a wide range of trading preferences, providing access to various financial instruments, including Forex, stocks, and cryptocurrencies. As a reputable entity, InstaForex adheres to regulatory standards set by authorities like the Belize International Financial Services Commission (IFSC) and the Cyprus Securities and Exchange Commission (CySEC).

Robust Trading Platforms

InstaForex offers its clients access to the widely acclaimed MetaTrader 4 and MetaTrader 5 trading platforms, available on both desktop and mobile devices. These platforms empower traders with essential tools and features for effective trading. The broker also provides multiple payment options, including bank transfers, credit/debit cards, and e-wallets, ensuring convenience and flexibility for clients.

Unique Features

InstaForex distinguishes itself with its high leverage offerings, which can reach an impressive 1:1000. Furthermore, the broker acknowledges the global diversity of its clientele by offering support in multiple languages, accommodating traders who prefer to communicate in their native languages.

Customer Service Excellence

InstaForex boasts a commendable customer service rating, scoring 4.1 out of 5. Positive reviews highlight the broker's prompt and helpful customer support team, available around the clock through various channels, including live chat, email, and phone. Traders also appreciate the user-friendly trading platform and the valuable educational resources provided by InstaForex. However, some users have noted room for improvement in the withdrawal process, which occasionally experiences longer-than-expected waiting times. Additionally, a few customers faced challenges with account verification and depositing funds. In summary, InstaForex's customer service is effective overall, with opportunities for enhancement in certain areas.

Trading Account Variety

InstaForex offers a diverse selection of trading accounts tailored to cater to traders of all experience levels, from novices to seasoned professionals. These account types are designed to align with varying trading styles and preferences, granting access to different trading instruments:

- Standard Account: Ideal for beginners and those seeking a low-risk trading environment, this account type requires a minimum deposit of just $1 and offers fixed spreads from 3 pips.

- Eurica Account: Similar to the Standard account but with no spreads, this account charges a commission on trades and welcomes beginners with a minimum deposit of $1.

- Cent Account: Designed for traders working with smaller amounts, this account features a $1 minimum deposit and lot sizes as low as 0.0001 of a standard lot, with spreads starting at 3 pips.

- Standard-ECN Account: Offering variable spreads from 0.8 pips and requiring a minimum deposit of $1,000, this account caters to those seeking an advanced trading environment with access to ECN liquidity.

- Pro-Standard Account: Geared toward experienced traders, this account type offers variable spreads from 1.3 pips and requires a minimum deposit of $10,000.

- Pro-Eurica Account: Similar to the Pro-Standard account but without spreads, this account charges commissions on trades and mandates a minimum deposit of $10,000.

- ECN Account: Delivering direct interbank liquidity access and variable spreads from 0.0 pips, this account type requires a minimum deposit of $1,000, making it accessible to more experienced traders.

Flexible Trading Denominations

InstaForex offers traders the flexibility to denominate their trading accounts in various base currencies, including AUD, USD, GBP, EUR, SGD, CAD, and CHF. While PLN denomination is not currently available, the availability of multiple base currencies allows traders to choose the one that best suits their needs, helping them avoid unnecessary conversion fees. It's crucial to consider the impact of the chosen base currency on margin and trading costs when setting up an account.

Corporate Overview

InstaForex is a well-established brokerage firm providing trading services to clients worldwide. Founded in 2007, the company is headquartered in Russia, with additional offices in Asia and Europe. InstaForex is privately held and is not a publicly traded entity or a bank.

The broker operates under the regulatory oversight of reputable organizations, including the International Financial Services Commission of Belize, the Cyprus Securities and Exchange Commission, and the Securities Commission of Malaysia. Clients can easily verify the broker's licenses by checking the respective regulator's website using the entity name "InstaForex Companies Group." InstaForex's services are available to clients globally, except for residents of the United States, Japan, and select other countries where the broker lacks authorization to operate.

InstaForex offers various account types denominated in AUD, USD, EUR, and RUB, among other currencies. Clients have the choice between a standard account with a minimum deposit of $1 or a Eurica account with an even lower minimum deposit of $0.

Client Protection

InstaForex prioritizes the safety and security of its clients' funds. To this end, client funds are held in segregated accounts. Additionally, InstaForex participates in the Financial Commission, an independent external dispute resolution organization that provides a neutral platform for resolving disputes between traders and brokers. As a member of the Financial Commission, InstaForex contributes to the Compensation Fund, providing clients with insurance coverage of up to €20,000 per client in case the broker fails to comply with a judgment in favor of the client. The company has also implemented advanced security measures, including two-factor authentication and SSL encryption, to safeguard client information and transactions.

Wide Range of Trading Instruments

InstaForex offers a diverse array of trading instruments, encompassing Forex trading (Spot or CFDs), Cryptocurrency (Physical and CFD), U.S. Stock Trading (Non-CFD), and International Stock Trading (Non-CFD). The broker accommodates automated (algorithmic) trading strategies and hedging while not imposing mandatory stop-loss and take-profit requirements. Although the exact number of tradable symbols is not disclosed on the website, InstaForex ensures that traders have access to a comprehensive range of assets.

Varied Account Options

InstaForex caters to traders with different financial capabilities by offering accounts with varying minimum deposits, ranging from $1 to $1,000. Clients can deposit and withdraw funds through a range of methods, including ACH or SEPA transfers, PayPal, Skrill, Visa/Mastercard (Credit/Debit), Bank Wire, and cryptocurrencies. While specific information on commissions and fees is not provided on the website, InstaForex furnishes traders with a selection of trading tools, including the InstaForex MobileTrader for on-the-go account management and the MT4 and MT5 trading platforms, which feature an array of technical analysis tools and indicators.

Advantages of Trading with InstaForex:

- Diverse offering of 2,500+ trading instruments, including non-standard assets like InstaFutures and synthetic securities.

- Passive investment opportunities, including PAMM accounts and a copy trading service.

- Innovative technological solutions, such as InstaSpot (P2P spot trading), OYS account, Stock Basket, and more.

- European regulation and participation in the IFC compensation fund, guaranteeing insurance coverage up to €20,000.

- Comfortable trading conditions, with a minimum deposit as low as $1 and leverage up to 1:1000 for clients of the FSC-regulated broker.

Disadvantages of InstaForex:

- Stringent conditions for retail European traders due to regulatory restrictions.

- Potential delays of up to 15 seconds between a trade executed by a trader and the one copied to the investor's account in the social trading service.

- Spreads are high

Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion