Ingot Brokers Review 2023: Pros, Cons, Fees, and Trading Platforms

Ingot Brokers, a versatile multi-asset forex and CFD brokerage, caters to day traders of all skill levels. It presents clients with access to trading opportunities across eight diverse asset classes on the MT4 and MT5 platforms or through the broker's exclusive copy trading platform. This comprehensive review will delve into Ingot's account types, customer support, typical spreads, deposit and withdrawal methods, and more.

Exploring Ingot Brokers

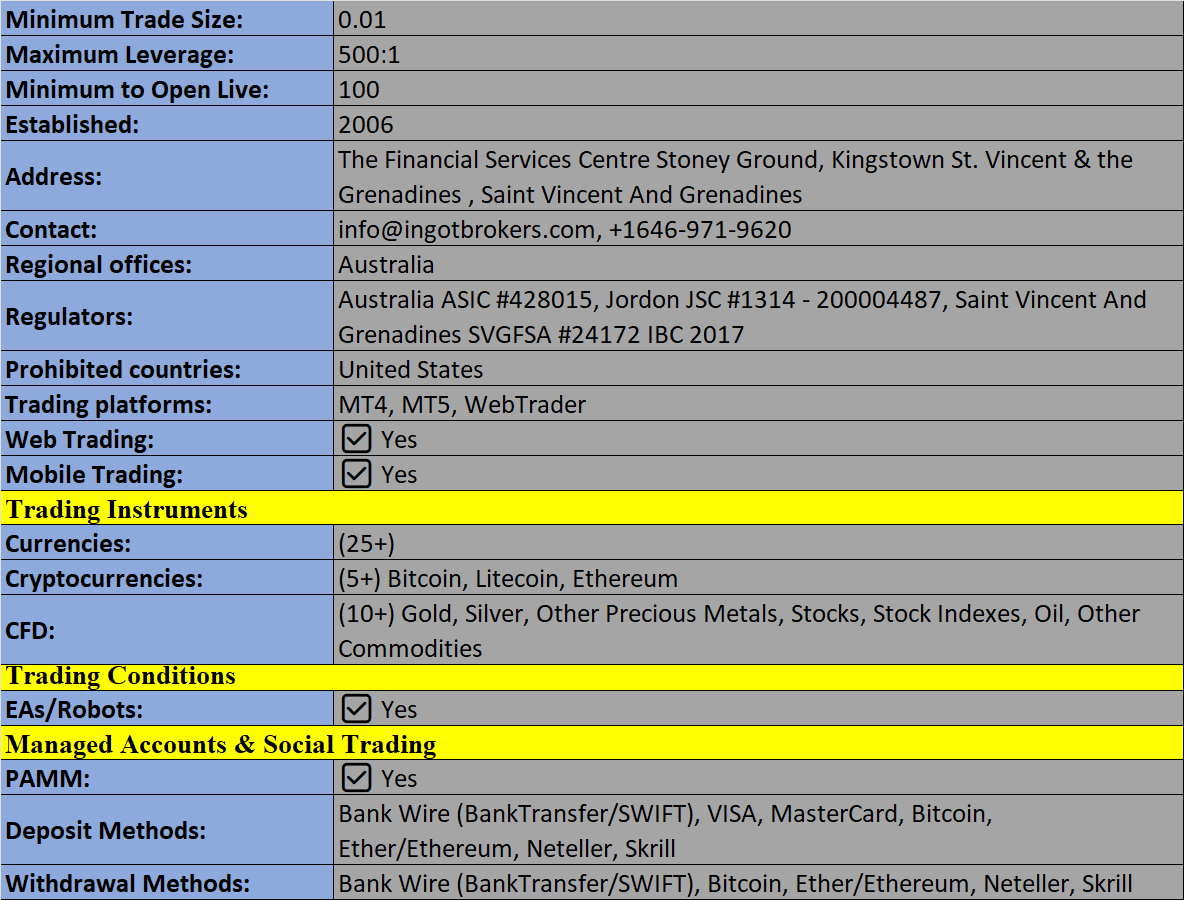

Ingot Brokers was established in 2006 and operates through five global entities:

- Ingot Financial Brokerage Ltd – Regulated by the Jordan Securities Commission (JSC)

- Ingot Global Ltd – Regulated by the Financial Services Authority of Seychelles (FSA)

- Ingot Africa Ltd – Regulated by the Capital Markets Authority of Kenya (CMA)

- Ingot RSA (Pty) Ltd – Regulated by the Financial Sector Conduct Authority in South Africa (FSCA)

- Ingot Brokers (Australia) Pty Ltd – Regulated by the Australian Securities and Investment Commission (ASIC)

Ingot offers an impressive array of over 1000 trading instruments spanning stocks, indices, ETFs, cryptocurrencies, and forex. Additionally, they provide 24/5 customer support, ensuring a seamless experience for new users who can kickstart their journey in just three simple steps.

Trading Platforms

Ingot offers both the popular MetaTrader terminals, MT4 and MT5. These platforms can be downloaded for free on desktop devices or accessed through major web browsers. The multi-asset platforms offer advanced trading features suitable for both beginners and experienced traders, with MT5 offering more sophisticated options.

MetaTrader 4 (MT4)

The MT4 platform boasts interactive and customizable charts, 30 built-in technical indicators, and nine different timeframes. Additionally, it offers four pending order types and three order execution modes. Notably, it provides access to automated trading through Expert Advisors (EAs) for forex, stocks, indices, and commodity CFDs.

MetaTrader 5 (MT5)

MT5 is an all-in-one cutting-edge multi-asset terminal, allowing day traders to access all instruments. It features an integrated economic calendar, MQL5 programming language, and one-click trading directly from charts and graphs. Users benefit from 21 timeframes, six pending order types, and 38 in-built technical indicators.

Placing a Trade on Ingot's Platforms

The process of placing a trade on Ingot's MT4 and MT5 platforms is straightforward:

- Log in to your client dashboard and open the MT4 or MT5 web trader, or download the platform to your desktop device.

- Search for your desired asset using the drop-down menu or search bar.

- Select 'new order' or initiate a trade directly from the chart.

- Choose the order type from the dropdown list (e.g., pending order or market execution).

- Enter the position size in standard lots.

- Decide whether you want to 'buy' or 'sell.'

- Confirm the order.

Ingot Brokers Copy Trading

Ingot also provides a tailored copy trading terminal, which is particularly beneficial for beginners. This platform enables users to evaluate the success rates of experienced traders before emulating their trades. It offers an opportunity for passive income generation and portfolio diversification while learning from seasoned traders. It's important to note that this platform may not be available in all jurisdictions.

Assets and Markets

Ingot Brokers extends over 1000 trading instruments, encompassing:

- Currency Pairs: Trade over 30 major, minor, and exotic currency pairs, including EUR/USD, USD/JPY, GBP/USD, and AUD/CAD.

- Cryptocurrencies: Take positions across 25 digital currency USD crosses such as BTC/USD, ETH/USD, DOT/USD, and DOG/USD.

- Stocks: Invest in leading US, EU, and UK companies via stock CFDs, including Tesla Motors, Meta, Nike, HSBC, and BNP Paribas.

- ETFs: Trade 40+ exchange-traded funds (ETFs) such as the UltraShort S&P 500 ETF, PowerShares QQQ ETF, and the Vanguard Total Bond Market ETF.

- Indices: Speculate on eight of the world's largest stock indices via spot or futures contracts, including DJ30, S&P500, ASX200, and FTSE100.

- Commodities: Trade agriculture, energies, and precious metals, including spot and futures contracts on WTI Crude Oil, Brent Crude Oil, Gold, Silver, and Platinum. Users can also trade soft and grain commodities such as coffee, sugar, and cocoa during select months of the year.

CFDs and futures contracts are available for nearly all products, ensuring a diversified trading experience.

Understanding Ingot's Fees

Spreads and fees vary depending on the account type, instrument, and trading entity. Currency conversion fees may apply when depositing, withdrawing, or transferring funds in a currency different from your account denomination. These fees are executed by the broker at the current exchange rate. Swap rates are also applicable for positions held overnight. Fortunately, Ingot does not impose account maintenance fees or inactivity charges.

Account Types Across Entities

Ingot offers a range of account types across its entities, each tailored to different trading preferences and requirements. Here's a glimpse of some of the key account types:

Ingot Brokers (Australia) Pty Ltd

- Standard, Standard Plus, and Prime accounts: These offer commission-free investing with spreads starting from 1 pip.

- Prime ROW profile: It provides the tightest, raw spreads from 0.0 pips with a commission of $7 per round lot turn.

Ingot Brokers Global Ltd

- Professional Account: Commission-free investing with spreads from 1 pip and a minimum deposit requirement of $100.

- ECN Account: It features tight raw spreads from 0 pips, a $7 commission per round lot, and a minimum deposit requirement of $100.

- Prime Account: Offering tight raw spreads from 0 pips, a $5 commission per round lot, and a minimum deposit requirement of $25,000.

Ingot Financial Brokerage Ltd

- Starter Pack Account: Commission-free investing with floating spreads and a minimum deposit requirement of $10.

- Professional Account: Commission-free investing with floating spreads and a minimum deposit requirement of $100.

- ECN Account: Featuring raw spreads from 0 pips, a $7 commission per round lot, and a minimum deposit requirement of $100.

Ingot RSA (Pty) Ltd

- Cents Account: Commission-free investing with floating spreads and a minimum deposit requirement of $10.

- Pro Account: Commission-free investing with floating spreads and a minimum deposit requirement of $100.

- ECN Account: Floating spreads, a $7 commission per round lot, and a minimum deposit requirement of $100.

Ingot Africa Ltd

- Cents Account: Commission-free investing with floating spreads and a minimum deposit requirement of $10.

- Pro Account: Commission-free investing with floating spreads and a minimum deposit requirement of $50.

- ECN Account: It offers floating spreads, a $7 commission per round lot, and a minimum deposit requirement of $100.

Leverage Opportunities

Ingot Brokers offers leverage up to 1:500, though it's important to note that specific jurisdictions may impose restrictions on leverage. For instance, retail investors under the ASIC-regulated entity have a maximum leverage of 1:30, introduced in 2021.

Mobile Trading

Both MetaTrader platforms are available for free download on portable devices such as iPhone, iPad, and Android (APK). These apps seamlessly integrate between desktop and mobile, allowing you to access your full trading history, account management details, and market analysis on the go. You can open and close positions with a single click, customize charts for smaller screens, create watchlists, access historical pricing charts, and set real-time alerts.

Payment Methods

Ingot accepts a variety of payment methods, including bank wire transfers, credit/debit cards, cryptocurrencies, and e-wallets. The broker does not charge deposit fees, but third-party charges may apply for some methods. All funds are deposited into an e-wallet, acting as an intermediary between the MetaTrader terminal and your chosen payment method. Payment methods may vary between countries. Here's a brief guide on depositing funds via bank wire transfer:

- Log in to the Ingot client portal.

- Select 'Funds Management' via the menu on the left-hand side.

- Click on 'Deposit Funds' and then 'Wire Transfer.'

- Complete the relevant details in the deposit window.

- Review and monitor the transfer status in the 'Account Transactions' window.

For withdrawals, Ingot follows AML regulations, requiring retail traders to withdraw funds to the same method used for deposits and in the same currency. A minimum withdrawal of $500 applies for bank wire transfers, while cryptocurrencies have a $25 minimum and Skrill/Neteller have a $10 minimum. Some withdrawal methods may incur third-party charges, including a 1% fee for Bitcoin and Ethereum. Processing times vary, with bank wire transfers taking up to five working days, while cryptocurrency and e-wallet fund removals typically require two working days. Here's a guide on withdrawing funds from Ingot Brokers:

- Log in to the client portal.

- Click on 'Funds Management' in the menu on the left-hand side.

- Select 'Withdraw Funds.'

- Complete the withdrawal details, including the payment method and value.

- Select 'Request,' and the withdrawal will be processed once verified by the Ingot team.

Demo Accounts

Ingot offers demo accounts on both the MT4 and MT5 terminals. These accounts come with an expiry date, with 30 days for MT4 practice accounts and 14 days for MT5 accounts. However, clients can open an unlimited number of practice accounts under the same email address, offering ample opportunity to refine their trading skills. Existing clients can access demo accounts via the client portal, while new clients can sign up for a free demo account on the broker's main webpage.

Deals and Promotions

Ingot typically does not offer financial incentives or bonus rewards for new or existing clients. This includes welcome deposit bonuses and customer referral rewards.

Regulation and Licensing

Ingot Brokers is committed to providing global trading services while adhering to regulatory standards. The brokerage operates through five entities, each regulated by the respective authorities:

- Ingot Financial Brokerage Ltd: Authorized and regulated by the Jordan Securities Commission (JSC).

- Ingot Global Ltd: Regulated by the Financial Services Authority of Seychelles (FSA) with a Securities Dealer License (SD117).

- Ingot Africa Ltd: Holds a Non-Dealing Online Foreign Exchange Broker License from the Capital Markets Authority (CMA) of Kenya, license number 173.

- Ingot RSA (Pty) Ltd: Authorized and licensed by the Financial Sector Conduct Authority (FSCA) in South Africa as a financial services provider, FSP number (51008).

- Ingot Brokers (Australia) Pty Ltd: A registered Australian Financial Services License holder, regulated by the Australian Securities and Investment Commission (ASIC).

These entities comply with various regulatory requirements, including negative balance protection and the segregation of client funds in top-tier banks.

Additional Features

Ingot Brokers equips day traders with valuable tools to enhance their trading experience. These include an integrated economic calendar, a currency conversion calculator, and a position-based trade calculation tool with bid/ask price inputs. Additionally, when logged into the client dashboard, users can access a wealth of market analysis features, such as a stocks heatmap, a market screener, a central bank calendar, and a company earnings calendar.

For those seeking to deepen their trading knowledge, Ingot offers an educational hub comprising videos and articles suitable for beginners and intermediate investors. Topics covered include the psychology of trading, an introduction to commodities, forex charting, and fundamental analysis.

Choosing the Right Account Type

Ingot Brokers provides a range of account types across its entities, catering to various trading styles. These accounts can be tailored to your specific trading preferences, allowing you to choose the one that suits you best. From standard accounts to raw spread profiles, swap-free accounts, and multi-account management (MAM) solutions, Ingot ensures a diverse selection to accommodate every trader's needs.

Opening an Account

To start your trading journey with Ingot Brokers, follow these simple steps:

- Visit the broker's website at ingotbrokers.com.

- Select 'Start Trading' or 'Open A Trading Account.'

- Complete the registration details.

- Access the client portal, select 'Verification,' and complete all required fields.

- Create a MetaTrader profile by choosing 'Accounts' via the menu on the left side.

- Click on 'Trading Accounts' and then 'Open A Trading Account.'

- Enter your desired specifications and select 'Submit.'

- Once your live account has been reviewed and approved, you will receive an email confirmation.

- Deposit funds and start trading.

Account verification is essential to deposit funds and initiate trading. All retail investors must pass a client eligibility test to demonstrate their trading skills and basic knowledge. Ingot's team typically reviews account applications within 40 minutes of submission, from Monday to Friday.

Navigating Trading Hours

Ingot's trading hours align with market opening times. For instance, the stock and forex markets are open 24 hours a day, from 5 PM (ET) on Sunday to 4 PM (ET) on Friday. It's important to note that the MT4 and MT5 terminals are set by default to EET/EEST server time and cannot be changed.

Customer Service

Ingot Brokers provides multilingual customer support available 24/5 through various channels, including telephone, email, live chat, and an online contact form. Contact details may vary depending on the entity. The broker also offers a comprehensive FAQ section with detailed guidance and support.

Security & Safety

Ingot Brokers prioritizes fund protection, KYC (Know Your Customer), AML (Anti-Money Laundering) compliance, and data privacy. The MetaTrader platforms feature encrypted data exchanges to ensure security. Users can also implement two-factor authentication for added protection against unauthorized logins.

Pros and Cons

Pros

- Free demo account

- MetaTrader 4 platform integration

- Low minimum deposit for new traders

- Copy trading service with passive income opportunities

- Multiple payment methods, including bank cards and wire transfers

- Strong regulatory oversight with licenses from ASIC and FSCA

- Full range of investments, including forex, stocks, and cryptocurrencies

Cons

- No welcome bonuses

- Relatively high commission on raw spreads accounts

- Deposit and withdrawal fees for some funding methods

- Complex array of account types, some with limited asset selections

Ingot Brokers is a reputable online brokerage offering a broad range of trading instruments, a choice of trading platforms, and a copy trading service. The competitive fees and multiple regulatory licenses are positive indicators of trustworthiness. Overall, Ingot Brokers is a suitable choice for day traders of all experience levels and trading styles.

Ingot Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion