IG Review 2023: Pros, Cons, and Asset Variety - Complete Analysis

In this comprehensive review of IG, an esteemed forex and CFD broker catering to over 310,000 clients globally, we delve into their trading platforms, commission structures, account fees, and leverage opportunities. Our experts provide valuable insights into the IG Group's offerings.

Trading Platforms: Unveiling Diverse Options

Our exploration of IG Markets revealed a multifaceted approach to trading platforms, featuring both their proprietary software and alternative third-party providers.

The platforms showcase essential market data, including share charts, stock prices, margin factors, and working order levels. However, while comprehensive, certain financial details such as dividend dates for stocks require external online searches.

The Power of Online Trading with IG

Under the vigilant guidance of the IG Index board and CEO, the proprietary terminal stands out as a pinnacle of excellence. Acknowledged as an industry-leading terminal, it has garnered accolades, including recognition in our esteemed awards.

This dynamic platform caters to spread betting and CFDs, boasting a user-friendly interface equipped with features like one-click trading, force open positions, extensive technical analysis tools, and robust risk management capabilities.

Accessible Resources for Clients

Clients enjoy access to a spectrum of resources, comprising:

- Real-time streaming of Reuters news

- Comprehensive economic calendar

- Insightful IG analyst articles

- Actionable trading signals

- Engaging IGTV content

Embracing a Revolutionary Trading Experience

This revamped article meticulously outlines IG's offerings in the forex and CFD trading landscape, highlighting their diverse trading platforms, advanced tools, and a wealth of resources for traders worldwide.

IG Markets provides a cutting-edge progressive web app (PWA) accessible across all devices, eliminating the need for users to download software from external app stores.

This web-based platform offers instantaneous access to market prices and spreads, complemented by guaranteed stops and limits, aiding in the management of profit and loss. The progressive web app stands as a robust, comprehensive alternative to the downloadable platform, ensuring a seamless trading experience.

ProRealTime

ProRealTime stands as an integral charting software seamlessly integrated into IG’s Markets proprietary platform. Ideal for traders seeking advanced technical analysis, it offers an extensive array of over 100 volume and other indicators, coupled with a fully customizable user interface.

Moreover, ProRealTime facilitates robot automated dealing directly on sophisticated charts. Users can craft algorithms using creation tools and conduct thorough backtesting against 30 years of historical data. Alternatively, investors have the option to utilize third-party strategies for their trading activities.

MetaTrader 4

MetaTrader 4, available to IG Index clients as a third-party platform, caters to investors across all experience levels. This system, equipped with 18 specialized app add-ons like IG Markets VPS, offers versatile trading options spanning forex, indices, commodities, and beyond. With support for over 2,000 indicators, including pivot points, the terminal ensures comprehensive analysis capabilities. Additionally, users can execute one-click dealing and implement trailing stops, enhancing their trading experience.

Moreover, MT4 can be accessed as a Chrome extension and a Windows app widget.

L2 Dealer

L2 Dealer, a direct market access (DMA) share trading platform, is available for free download and usage. This software boasts valuable monitoring tools such as watchlists and price alerts. Additionally, the L2 Dealer system enables direct chart investing and incorporates price-improvement technology, enhancing the trading experience for users.

Please note that the broker currently does not support OCO orders, although it does provide the option for limit orders. Advanced tools catered to tech-savvy investors at IG Markets encompass Java and Python capabilities, including REST and web API functionalities.

At IG Index, customers gain access to an extensive range of over 17,000 tradable assets, spanning various categories:

- CFDs: Available across multiple markets, including equities, currencies, hard and soft commodities.

- Shares: Share dealing covers a wide spectrum, incorporating over 13,000 of the world's largest companies like Tesla, Ocado, Blackberry Ltd, and Netflix.

- Commodities: Encompasses 35 ETFs, precious metals such as gold and silver, energies like brent crude oil and natural gas, and softs like sugar.

- Forex: Offers a diverse array of FX pairs, ranging from majors, minors to exotics like EUR/JPY, USD/JPY, USD/GDP, EUR/CHF, EUR/GBP, GBP/EUR, and GBP/USD.

- Spread Betting: A tax-free derivative, enabling speculation on forex, commodities, shares, and more, including Wall Street spread bets like 5-minute binaries.

- Indices: Speculative opportunities on major indices worldwide, including the US S&P 500, NASDAQ, Dow Jones, Germany’s DAX 40, Hang Seng, VIX index, UK’s FTSE 100, among others.

Additionally, IG Index presents options for trading bonds, call and put options, futures, interest rates, and cryptocurrencies like Bitcoin (BTC), Bitcoin Cash (BCH), Litecoin (LTC), and Ethereum (ETH). The platform also supports after-hours trading, enabling investment in the DAX and FTSE on Sundays.

Furthermore, IG Smart Portfolios offer managed portfolios designed to balance income, growth, and risk, tailored to individual trader preferences. These portfolios employ a diversified asset allocation strategy to achieve these objectives, ideal for investors with limited time for research and trading.

It's important to note that IG Index does not offer SPX; however, it provides access to assets such as the S&P 500, Malaysia 30, France 40, digital 100 binary options, Japanese markets like Nikkei, Canada Index ETF, Germany 30, Norway 25, Euro STOXX 50, and others, including nickel.

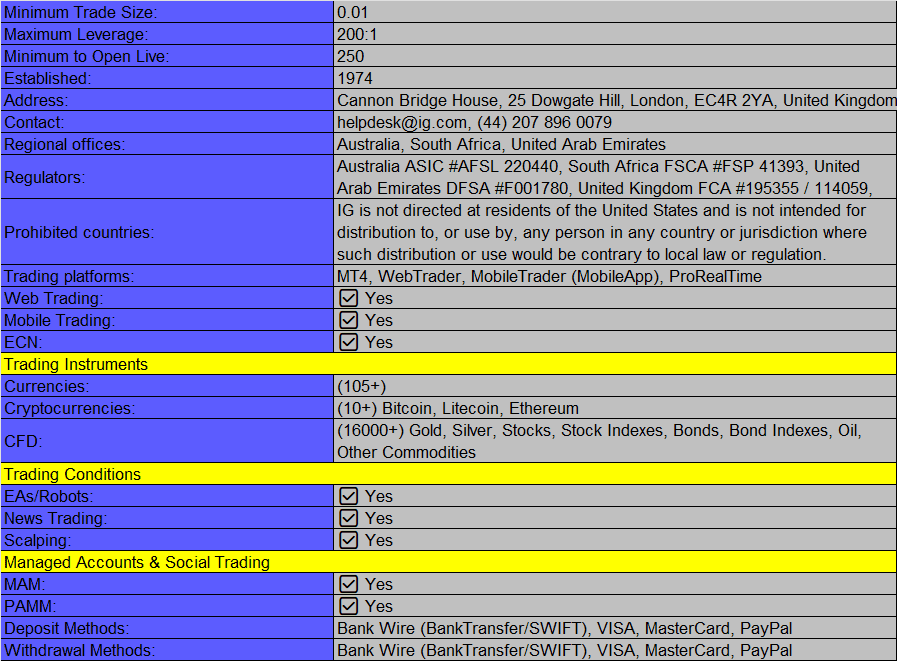

Spreads & Charges

At IG Index, competitive spreads kick off at 0.165 pips on major forex pairs like EUR/USD. For major indices such as the FTSE 100, spreads initiate at 1 point, while spot gold offers spreads starting from 0.3 pips.

Additional trading expenses include overnight rolling over charges, with specific details and regulations subject to potential changes available on the broker’s website. Dormant accounts face an inactivity fee of £12.

The minimum lot size stands at 0.1 contracts.

Leverage with IG IG presents leveraged trading opportunities for shares, indices, and forex. For retail clients, forex leverages up to 1:30, while indices and commodities offer leverage levels of 1:20.

IG Markets maintains transparency concerning the margin call process and leverage trading possibilities, offering a useful margin calculator on their website.

Trading on IG: A Quick Guide Navigating trades on the IG platform is swift and straightforward:

- Choose a market/asset to initiate the deal ticket, displaying current buy and sell prices, spread, and minimum trade size.

- Input trade parameters, specifying currency and closing conditions, while monitoring margin levels in the settings.

- Access the 'settings' section to input force open settings along with price and fill requirements.

- To open a position, head to the 'order' section, and for price alerts, navigate to the 'alert' tab.

Mobile Applications

IG Index boasts an award-winning mobile app for iPhone and iPad, complemented by an APK Android app compatible with devices operating on 5.0 or above.

Upon testing, our experts confirmed comprehensive trade management capabilities via the mobile app. Users can access a range of drawing tools, an economic calendar, and client sentiment indicators. Additionally, investors can set up SMS-based price alerts and signals and craft personalized watchlists effortlessly.

Customer Support via Mobile App

In case of any issues, customer support is conveniently accessible within the mobile app.

Payment Methods

Deposits: Facilitating deposits is a straightforward process. Traders have the flexibility to deposit funds through cards (VISA, MasterCard, debit, credit), bank wire transfers, and PayPal. Card and PayPal payments are swiftly processed, while bank wire transfers may take up to three

days for completion.

The minimum deposit required is £0, and the maximum daily deposit stands at £99,999. Notably, there are no limits for bank transfers.

Withdrawals: Withdrawals can be initiated through credit cards, bank transfers, and PayPal. To process withdrawals, navigate to the ‘live accounts’ tab and select ‘withdraw’.

Withdrawals to a card typically take between two and five working days. PayPal withdrawals are usually instant, while bank transfers initiated before midday often reflect on the same day. However, bank processing details may extend this period up to three days.

The minimum withdrawal amount is £100.

IG Demo Account

IG offers a complimentary training account, providing a virtual environment to test the platform under simulated market conditions. Once granted access with desktop login details for the demo account, users can trade across multiple markets, including forex and CFDs, utilizing £10,000 in virtual funds.

This feature is ideal for beginners, allowing them to initiate backtesting of investment strategies like hedging, comprehend the use of financial statements, identify profitable equity options, implement a tiered margin system, manage positions, and grasp the mechanics behind FTSE dividend payments, among other functionalities.

Bonuses & Promotions

At IG Index, occasional welcome bonuses have been offered in the form of sign-up offers, providing traders with free trading capital upon their initial deposit.

Presently, a referral bonus scheme is active, potentially crediting £100 to the referring account when the referred friend completes five qualifying trades. However, note that IG Markets' bonuses typically come with specific requirements regarding minimum deposits and maximum bet sizes. Therefore, it's advisable to review the bonus terms and conditions beforehand.

IG Overview & History

Originally established in 1974 and formerly known as IG Index, the company rebranded and is currently owned and operated by IG Markets Ltd. This UK-based online brokerage gained prominence for its CFD trading and financial spread betting services. In 2014, stockbroking was incorporated into its array of investment solutions.

Listed on the London Stock Exchange under IG Group plc since 2000, the company is now a constituent of the FTSE 250 Index. Operating across 20 countries, IG serves clients across five continents. The recent annual report of IG Group estimates the company's net worth at approximately £2.9 billion.

Under the umbrella of IG Group Holdings, additional brands include IG US, catering to USA clients. The IG Group also extends business and institutional solutions, alongside white label services. It's important to note that IG operates under a market maker model.

Regulation & Reputation

IG Markets Ltd holds licenses and operates under the regulation of the Financial Conduct Authority (FCA) in the United Kingdom. Moreover, regional offices of the brokerage comply with licensing and registration requirements in the countries where they operate. For instance, IG US is fully compliant in the United States.

Regarding IG's reputation, it stands as excellent, marked by over 47 years of competitive presence in the online trading sphere. The company has garnered numerous awards for its trading platforms, technological innovations, exceptional customer support, and more. Additionally, IG's trading analysts are frequently cited in the news as reliable sources of market analysis. Notably, negative balance protection is available for UK investors, providing coverage up to £85,000 in the event of broker insolvency.

Additional Features

IG Index garners positive customer reviews primarily due to its excellent suite of research tools. These include an economic calendar, seminars (sometimes held live in Geneva and Zurich), webinars, a weekly economic calendar, a comprehensive glossary of terms, video content, and more. The broker also offers a customizable screener for different assets, alongside trading signals based on pattern recognition technology.

The news section provided invaluable insights during events like Bitcoin forking, fluctuations in the Swiss franc against other currencies, UK general elections, Brexit, the EU referendum, and other political events, aiding in predicting IG Index live prices in the UK.

The IG client sentiment feature, notwithstanding the broker's size, remains a powerful tool even for contrarians. Additionally, IG Markets supports DailyFX, a blog-based news website offering trend insights and various other features. Traders benefit from an array of learning resources facilitating revenue growth and risk management. It's essential to note that Real Vision TV and Research services have been discontinued.

Trading Accounts

IG Markets caters to different retail trading accounts, depending on clients' preferred markets:

- CFD trading account

- Share dealing account

- Spread betting account

- IG Smart Portfolio account

- Stocks and shares ISA account

- IG Smart ISA Portfolio account

Each account grants full access to trading platforms, along with complimentary market data, learning resources, and 24/7 support. The IG Smart Portfolios offer a simplified avenue into managed funds, accompanied by applicable charges. Therefore, thorough comprehension of the user agreement is recommended.

Additionally, there exists a professional VIP account, allowing for higher leverage levels in exchange for reduced regulatory protection. To qualify for the professional premium account, traders must have executed 40 significantly leveraged trades per quarter for the past four quarters, possess a portfolio exceeding £50,000, and hold a minimum of two years' professional derivatives trading experience.

Trading Hours

IG Index operates 24 hours a day, starting from 23:00 GMT on Sundays (21:00 for forex) until 22:00 GMT on Fridays. For markets with non-continuous operation hours like shares and indices, refer to the 'market info' tab in the deal ticket for opening and closing times.

Trading hours are shortened during UK and US bank holidays. The broker remains closed on Christmas (no Xmas trading hours available), New Year's Day, and Easter Good Friday.

Additionally, if these bank holidays fall on a Monday, IG may remain closed the preceding Sunday night. It's worth noting that IG maintains a commendable track record of updating users about any alterations in their trading hours via their website.

Customer Support

The customer support team at IG Index remains available around the clock from 08:00 GMT on Saturdays to 22:00 GMT on Fridays. Users can reach out for queries related to IG Index slippage factors, nationality verification, or app-related issues.

Support is accessible in multiple languages via:

- Email address – newaccountenquiries.uk@ig.com

- Telephone contact number – 0800 195 3100

- Twitter – @IGClientHelp

The Community portal provides excellent peer support, offering forums, blogs, tutorial videos, and webinars. The extensive online trading community ensures assistance for a myriad of issues, including website downtimes, chart malfunctions, and understanding how to close an account, accompanied by explanations of key terms and conditions.

Furthermore, a transparent complaints process ensures efficient issue resolution.

Stay updated with the latest news through the broker's social media channels:

- YouTube

- IG Index LinkedIn

IG Index's head office is located at Cannon Bridge House, 25 Dowgate Hill, London, United Kingdom, postcode EC4R 2YA. Other IG Group locations include Hong Kong, Netherlands, Bermuda, South Africa, Singapore, and Australia.

Security

Employing industry-standard security protocols, IG ensures the safety of client information through 256-bit SSL (secure sockets layer) encryption. Furthermore, users have the option of implementing two-factor authentication during login. Combined with stringent regulatory oversight, IG operates as a secure, legitimate, and trustworthy broker, providing a reliable trading environment.

The broker adheres to procedures outlined by the Financial Ombudsman, maintaining a complaints form on their website.

Pros and Cons

Pros

- IG is an LSE-listed company with a transparent financial history and an outstanding track record.

- Access to over 17,000 assets spanning stocks, forex, commodities, baskets, futures, options, and more.

- Comprehensive educational materials, including an extensive library providing training and support for successful day trading.

- Users benefit from a wide array of charts, market news, client sentiment data, and analysis tools.

- Share dealing and ISAs cater to longer-term investing strategies.

- Account setup takes less than 5 minutes.

- 24/5 customer support available.

Cons

- Inactivity charge applicable.

- Absence of a copy trading platform.

IG Global Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion