FXPIG Review: Regulations, Trading Platforms, Instruments, Pros, and Cons

Are you in search of a direct access forex broker that offers an unconventional trading experience? Look no further than FXPIG. In this comprehensive review, we will delve into various aspects of FXPIG, including its regulation, commission structure, PAMM accounts, and more. By the end, you'll have a clear understanding of whether FXPIG is the right choice for your trading needs.

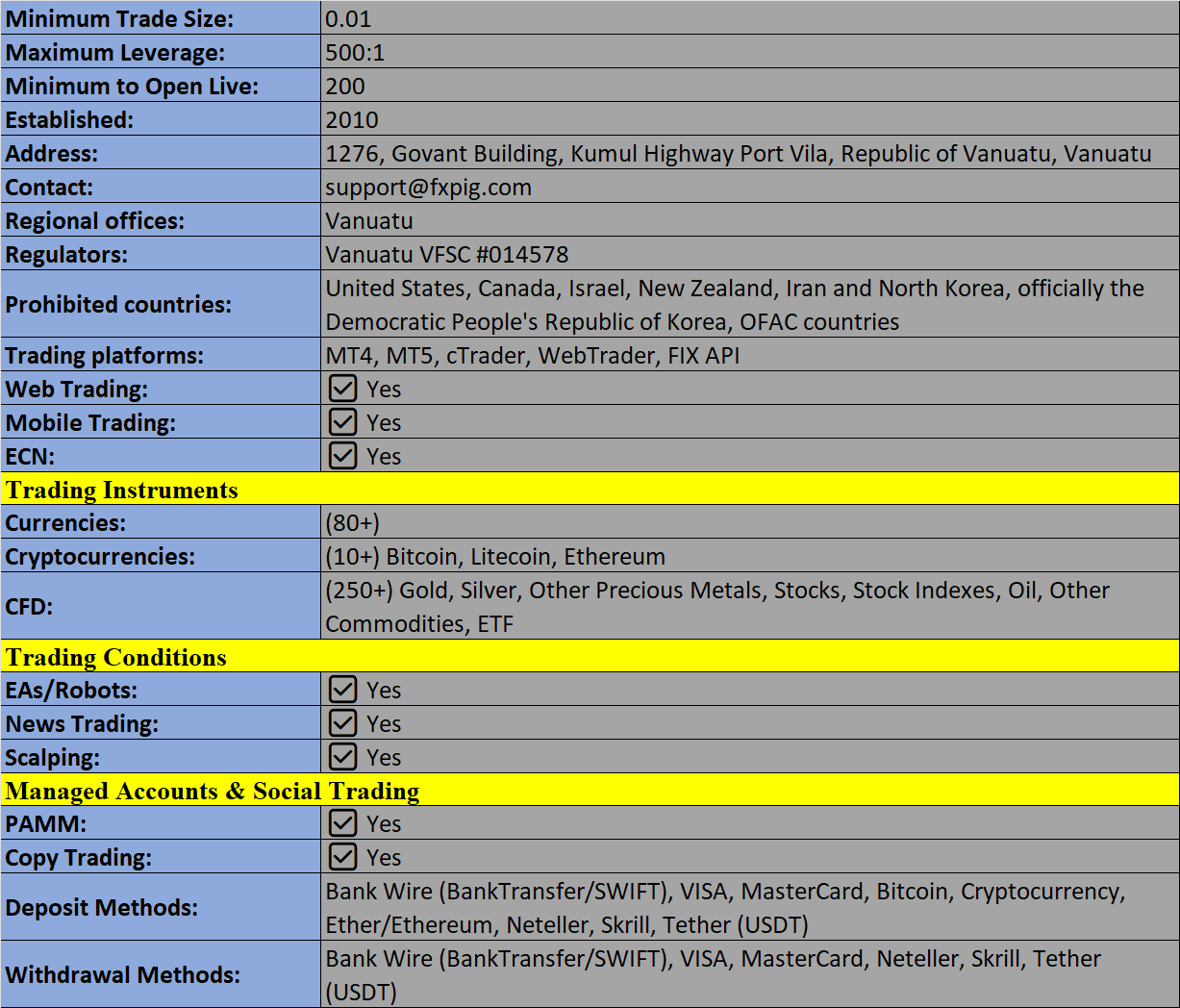

FXPIG Company Details

FXPIG, officially known as Prime Intermarket Group Asia Pacific Ltd, was established in New Zealand in 2010. The company holds a license issued by the Vanuatu Financial Services Commission (VFSC). What sets FXPIG apart is its distinctive and light-hearted brand, which aims to provide traders with a fun and interactive trading experience.

Trading Platforms

FXPIG offers a variety of trading platforms to cater to different preferences and needs:

- MetaTrader 4 (MT4): FXPIG enhances the MT4 platform by offering features such as Level II market depth data, hedging on all feeds, unlimited open orders, genuine Straight Through Processing (STP) with no B-book or dealer plugins, and the ability to set up the API in just 5 minutes. MT4 is compatible with Windows PCs and can be easily downloaded from the broker's website.

- cTrader WebTrader: A newer and arguably more advanced platform, cTrader is web-based, allowing users to trade from anywhere with an internet connection. It offers features like direct chart trading, Native Fix 4.4 accessibility, smart stop-out capabilities, visual deal mapping on charts, asynchronous order processing, and automatic move to breakeven and trailing stops.

- FIX API: FXPIG offers FIX 4.4 access to all clients with no minimum volume requirements or monthly brokerage costs. Unlike MT4 and cTrader, FIX API allows for direct trading over the FIX API connection, resulting in quicker order execution times. This platform is ideal for experienced traders and can be accessed from the account area.

Markets

FXPIG is a multi-asset broker, providing access to a wide range of markets, including:

- Stocks (150+)

- Forex pairs (80+)

- Indices CFDs (10+)

- Precious metals (10+)

- Cryptocurrencies CFDs (10+)

- Energies

Spreads & Commissions

Competitive spreads make FXPIG an attractive choice for cost-conscious traders. Spreads on major forex pairs start at 0.2 pips for EUR/USD, around 0.9 pips for GBP/USD, and 0.6 pips for EUR/GBP. Commissions vary depending on the account type:

Raw+Commissions Account Type:

- Standard: $4 per lot per side on FX, metals, commodities, 0.35% on stocks and cryptos, zero fees for Indices CFDs.

- Premiere: $3 per lot per side on FX, metals, commodities, 0.30% on stocks and cryptos, zero fees for Indices CFDs.

- Pro: $2 per lot per side on FX, metals, commodities, 0.25% on stocks and cryptos, zero fees for Indices CFDs.

All-In Account Type:

- Standard: No commission on FX, metals, commodities, 0.35% on stocks and cryptos, zero fees for Indices CFDs.

- Premiere: No commission on FX, metals, commodities, 0.30% on stocks and cryptos, zero fees for Indices CFDs.

Leverage

FXPIG offers flexible leverage options:

- Up to 500:1 for major and minor FX pairs, gold, and silver.

- 100:1 for exotic FX pairs.

- 20:1 for single stocks.

- 10:1 for cryptocurrencies.

- 100:1 for indices CFDs.

- 200:1 for crude oil.

The margin call is set at 100%, and the stop-out level is 50%.

Mobile Apps

FXPIG provides mobile apps for both the MT4 and cTrader platforms, available for iOS and Android devices. These apps offer the same features as their desktop and web counterparts, allowing traders to stay connected on the go.

Payment Methods

To get started, a minimum deposit of $200 is required. FXPIG supports various deposit and withdrawal methods, including:

Deposit Methods:

- Bank wire

- Visa credit card

- Skrill

- Neteller

- Bitcoin

- Uphold

Withdrawal Methods:

- Bank wire

- Visa credit card

- Skrill

- Neteller

- Bitcoin

- Uphold

Demo Account

FXPIG offers a demo account for traders who want to practice before transitioning to a live account. Users can open as many demo accounts as they like on the MT4, FIX API, and cTrader platforms.

Regulation & Licensing

FXPIG operates under the regulatory framework provided by the Vanuatu Financial Services Commission (VFSC).

Additional Features

FXPIG provides traders with various additional features, including:

- An Education page with blogs, articles, and videos to help both new and seasoned traders.

- A Market Analysis page to stay informed about market trends.

- Useful trading tools like calculators for stop loss, take profit, margin, SWAP, commissions, and more.

- Social trading through Myfxbook.

Account Types

Traders can choose from three different account types: Standard, Premiere, and Pro, each with its own set of features. Additionally, there are two pricing models available: All-In and Raw+Commissions.

The minimum deposit to open a live account at FXPIG is $200, and accounts are available in multiple currencies, including USD, EUR, GBP, JPY, AUD, and CAD. The minimum order size is 0.01 lot, and traders can trade up to 100 lots per click.

FXPIG also offers several PAMM accounts, such as D.O.O.R., Volta, ONDA, and FXTitan.

Trading Hours

Forex trading with FXPIG is open 24 hours a day, five days a week, from 5 pm EST on Sunday until 4 pm EST on Friday. For specific trading hours of indices and commodities, you can refer to the broker's website.

Customer Support

FXPIG offers responsive customer support through various channels:

- Skype: chat.fxpig

- Email: support@fxpig.com

- Online contact form (available on the Contact page)

- Live chat (located in the bottom right-hand corner of the website)

During testing, the live chat service yielded quick responses from helpful support staff.

User Security

User security is a priority for FXPIG. MetaTrader 4 is secured with 128-bit Secure Sockets Layer (SSL) encryption and two-factor authentication. cTrader ensures client data security through cTrader ID (cTID) credentials, which are stored on dedicated servers.

Pros and Cons

Pros:

- Access to 'Smart Trading Tools' such as correlation matrix, sentiment data, and an economic calendar.

- Free demo account with entry into trading contests and cash prizes up to $800.

- Two pricing models catering to different trading goals and experience levels.

- Responsive customer support via live chat, telephone, and email.

- Genuine STP trading with ultra-fast execution speeds.

- Availability of MT4, MT5, cTrader, and FIX API.

- A wide range of forex pairs with low spreads.

Cons:

- Regulatory oversight from the VFSC may be perceived as weak.

- Educational resources and market research offerings are below average.

- No swap-free account option.

In summary, FXPIG offers a unique and engaging trading experience. Traders can benefit from award-winning liquidity, competitive spreads, responsive customer support, and access to the popular MT4 and cTrader platforms. If you're seeking a fun and distinct approach to trading, FXPIG might be the right choice for you.

FXPIG Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion