FXChoice review 2023: Regulations, Platforms and Instruments

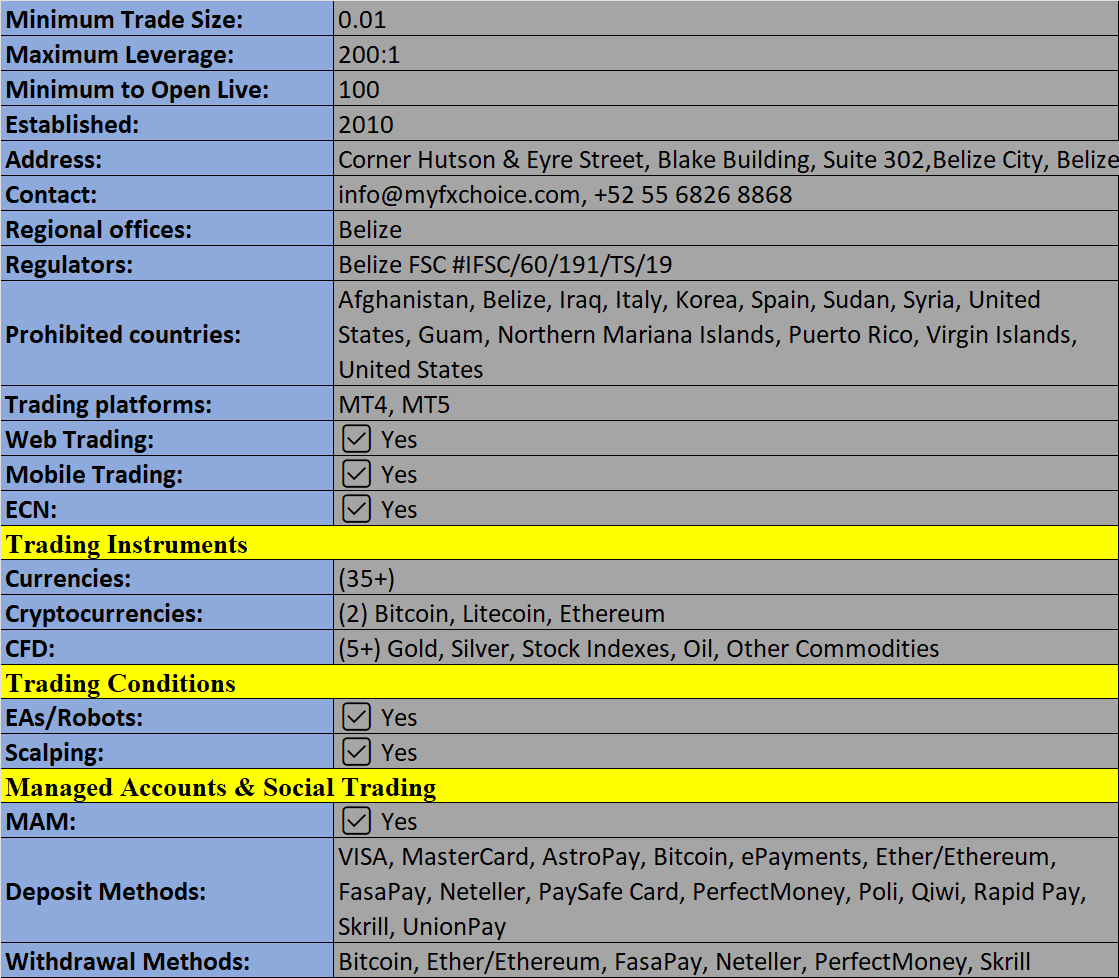

FXChoice, headquartered in Belize and regulated by the Financial Services Commission (FSC), has been a prominent ECN broker since its establishment in 2010. Over the past decade, it has served both individual and institutional traders, operating on a Non-Dealing Desk (NDD) model with a substantial daily trading volume exceeding 150,000.

Trading Platforms:

- MetaTrader 4 (MT4): Suitable for traders of all levels, MT4 offers a user-friendly interface with advanced charting tools, quick login, various timeframes, pending order types, Expert Advisors, and an extensive array of technical indicators.

- MetaTrader 5 (MT5): As the successor to MT4, MT5 provides enhanced features, including market depth view, access to more tradable assets, extra technical indicators, faster execution, and an improved interface.

- MetaTrader WebTrader: Available for both MT4 and MT5, the web terminal offers convenient trading without software downloads, featuring one-click trading (MT5 only), real-time quotes, customizable charts, and various timeframes.

Assets & Markets:

FXChoice offers CFD trading in four primary areas:

- Commodities: Trade on gold, silver, crude oil, and US Brent oil.

- Indices: Access six leading global indices, including US30 and UK100.

- Forex: Choose from 36 popular currency pairs, such as EUR/USD and GBP/USD.

- Stocks: Trade over 50 shares in well-known companies like Tesla and Apple.

- Cryptocurrencies: Engage in Bitcoin (BTC), Litecoin (LTC), and Ethereum (ETH) trading.

Note that FXChoice doesn't offer binary options or access to NASDAQ, USDTRY, or platinum.

Spreads & Commissions:

Spreads and fees at FXChoice are slightly higher compared to some competitors. Spreads start at 0.5 pips on the Classic Account with no commission, while the Pro Account offers spreads starting from zero pips with a $3.50 per side commission. This commission can decrease to $1.50 per side per $100,000 through the broker's Pips+ loyalty program. Detailed cost breakdowns, including swap fees, are available in a downloadable product guide. The minimum trade size is 0.01 lots.

Leverage:

FXChoice offers flexible leverage ranging from 1:25 to 1:200, surpassing the 1:30 cap commonly found at most CySEC-regulated brokers. Margin requirements, margin levels, and related information can be found in the contract specifications and the product guide.

Mobile Apps:

Mobile trading is convenient with MT4 and MT5 mobile apps, compatible with both iOS and Android devices. These apps offer functionality similar to desktop platforms, including push notifications and interactive price charts.

Payment Methods:

FXChoice supports a variety of deposit methods, including card payments, e-wallets, and cryptocurrencies like Bitcoin (BTC) and Ripple (XRP). The minimum deposit is $100, and accounts can be opened in various currencies. Some payment methods may involve processing charges, but details are available on the deposits and withdrawals page.

Demo Account:

FXChoice offers Classic MT4, Pro MT4, and Pro MT5 demo accounts, allowing users to practice with virtual funds in a risk-free environment. These accounts remain open for as long as needed but may expire after 90 days of inactivity.

Bonuses & Promotions:

FXChoice provides bonuses, including a 65% or 80% bonus for Bitcoin or other cryptocurrencies deposits, as well as a 50% welcome deposit bonus in the UK. The bonus percentage may vary depending on the account type.

Regulation & Licensing:

FXChoice Limited is regulated by the Financial Services Commission (FSC) and maintains segregated bank accounts to safeguard client funds. It does not accept clients from the United States but caters to clients from Canada to Nigeria.

Additional Features:

FXChoice offers various trading services, including the Myfxbook AutoTrade tool, Expert Advisors for MT4, MQL5 Trading Signals, and partnership with ZuluTrade for copy trading solutions. A VPS is available for investors who want to run their own software. The FAQ section provides technical information and video tutorials.

Account Types:

Traders can choose between two live account types: MT4 Classic and MT4/5 Pro, both requiring a $100 minimum deposit and featuring a 0.01 minimum lot size. The Pro account has a $3.50 commission and tighter spreads.

How To Sign Up & Start Trading:

Signing up for an FXChoice live account involves a straightforward process of registration, profile verification, and deposit. Clients can trade using the MT4 or MT5 platforms, available for download, or utilize the WebTrader platform.

Trading Hours:

Trading hours vary for different asset classes, with server times listed in GMT+3. Cryptocurrencies, gold, silver, and forex are available for trading throughout the week.

Customer Support:

FXChoice offers multiple support channels, including live chat, a ticket submission form, telephone support, and a callback request option. The broker's social media pages provide updates, news, and holiday hours.

Security Rating:

Client transactions are securely processed, employing SSL encryption for communication and password protection. MetaTrader platforms also offer two-factor authentication options.

FXChoice Verdict:

FXChoice is a reputable broker with demo accounts, third-party tools, and competitive leverage options. Its MetaTrader platforms cater to various trading strategies, making it suitable for both beginners and experts. However, it could expand its range of research tools and educational resources to better support traders in expanding their knowledge.

Advantages of trading with FXChoice:

- Competitive market spreads on popular currency pairs

- Regulated by the international regulator FSC

- Multiple passive income options, including partnership programs, copy trading, and MAM accounts

- Accepts Bitcoin deposits and withdrawals

- Allows hedging and scalping

- Offers MT4 and MT5 platforms for download

- Commission-free trading

- High leverage options

- Cryptocurrency trading

Disadvantages of FXChoice:

- No cent accounts available

- Withdrawals via Visa and Mastercard debit/credit cards are not supported

- Leverage is relatively low

- Customer support primarily in English

- Limited selection of commodities

- Regulatory oversight may be considered weak by some.

Broker Details

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion