Forex Trading: The General Term for Buying, Selling, and Exchanging Foreign Currencies

Hello, and welcome to the new world of Forex trading! If you've been curious about the complexities of purchasing, selling, or exchanging currencies in foreign exchange, You're in the right spot. In this comprehensive guide, we'll explore the entire aspect of Forex trading, from basic concepts to the most advanced strategies. Whether you're a beginning or a seasoned trader seeking to expand your knowledge, This article can provide useful information to help you get through the Forex market effectively.

Table Content

1. Understanding Forex Trading

2. The Fundamentals of Forex Trading

3. Advanced Strategies for Forex Trading

4. The Importance of Risk Management

5. Footnote

6. FAQs

Understanding Forex Trading

Forex trading, often referred to as forex trading, is the world's largest marketplace that allows for selling, buying, and trading currency. It's the basis of international investment and trade that allows individuals and businesses to transact across boundaries easily. The Forex market is open all day, all week, in which trillions of dollars are traded daily. We'll look into the most important elements in Forex trading:

1. What is Forex Trading?

The Forex market involves the simultaneous purchasing of a currency and selling the other. The currencies are traded as pairs like EUR/USD or GBP/JPY. The exchange rate for the two pairs fluctuates based on different factors such as economic indicators, geopolitical developments, and market sentiment.

2. How Does Forex Trading Work?

It is important to note that the Forex market is not centralized, which means there's no central exchange. Instead, trade is conducted via over-the-counter (OTC) through the network that includes financial institutions, banks, brokers, and individual traders. The most traded currencies are the US Dollar (USD), Euro (EUR) as well as Japanese JPY (JPY), British Pound (GBP) as well as others.

3. Why is Forex Trading Popular?

The Forex market has many benefits, which makes it the preferred option for all traders. There are many benefits, including the ability to leverage, high liquidity, low transaction costs, and the possibility of profiting from declining and rising markets.

The Fundamentals of Forex Trading

For a successful career when it comes to Forex trading, knowing the basic concepts is essential. We'll take a look at the fundamentals:

1. Currency Pairs and Exchange Rates

They are classified into three types, including major pairs and minor and exotic pairings. Major pairs include the most frequently traded currencies, as well as minor pairs made up of less well-known currencies paired with larger ones. The exotic pairs include currencies of small economies or those that are emerging.

The exchange rate is the price of one currency versus the other and is affected by indicators of economic growth and market conditions.

2. Market Participants

The Forex market is a place for a variety of participants, which include central banks, corporate banks, commercial banks, hedge funds, and even individuals who trade. Each player plays its own influence on the market's dynamics.

3. Fundamental Analysis

Fundamental analysis is a process of looking at the economic indicators, policies of governments, and geopolitical developments to anticipate the course of currencies. This helps traders make educated decisions on the basis of the latest economic information and news announcements.

4. Technical Analysis

Technical analysis is based on historical data on price and chart patterns to forecast the future direction of price fluctuations. The traders use technical indicators to detect the trends that could lead to entrance or exit locations.

5. Risk Management

Controlling risk is a key aspect when it comes to Forex trading. Strategies like setting stop-loss or take-profit orders, sizing positions, and diversification aid traders to ensure their capital.

Advanced Strategies for Forex Trading

When you are confident in your trading skills by experimenting with advanced strategies, you can improve your profit. We'll look at some of the most popular strategies:

1. Carry Trading

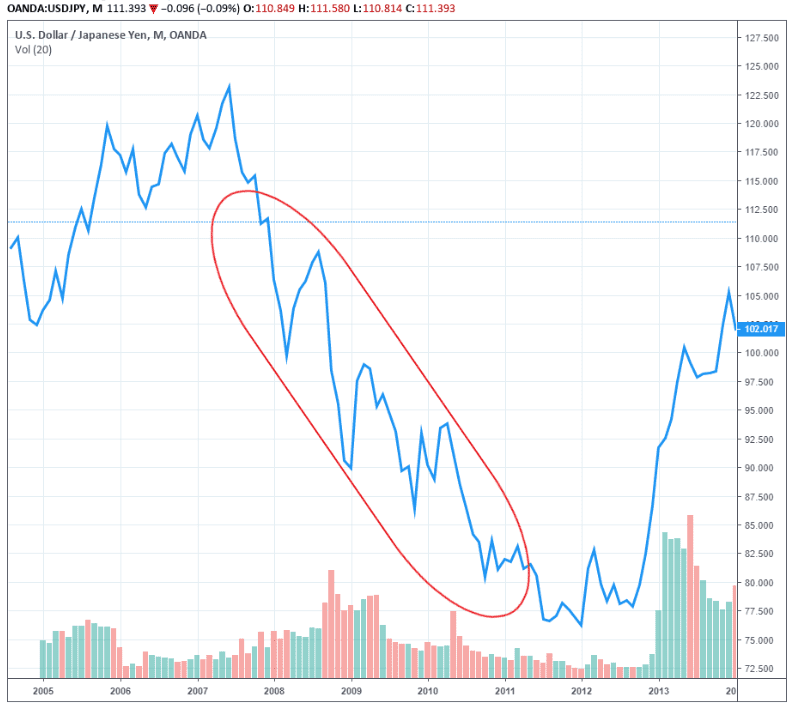

Carry trading involves borrowing money using a low-interest currency while investing in a better-paying currency. Investors seek to benefit from the difference in interest rates between the two currencies.

Source from trading view

2. Breakout Trading

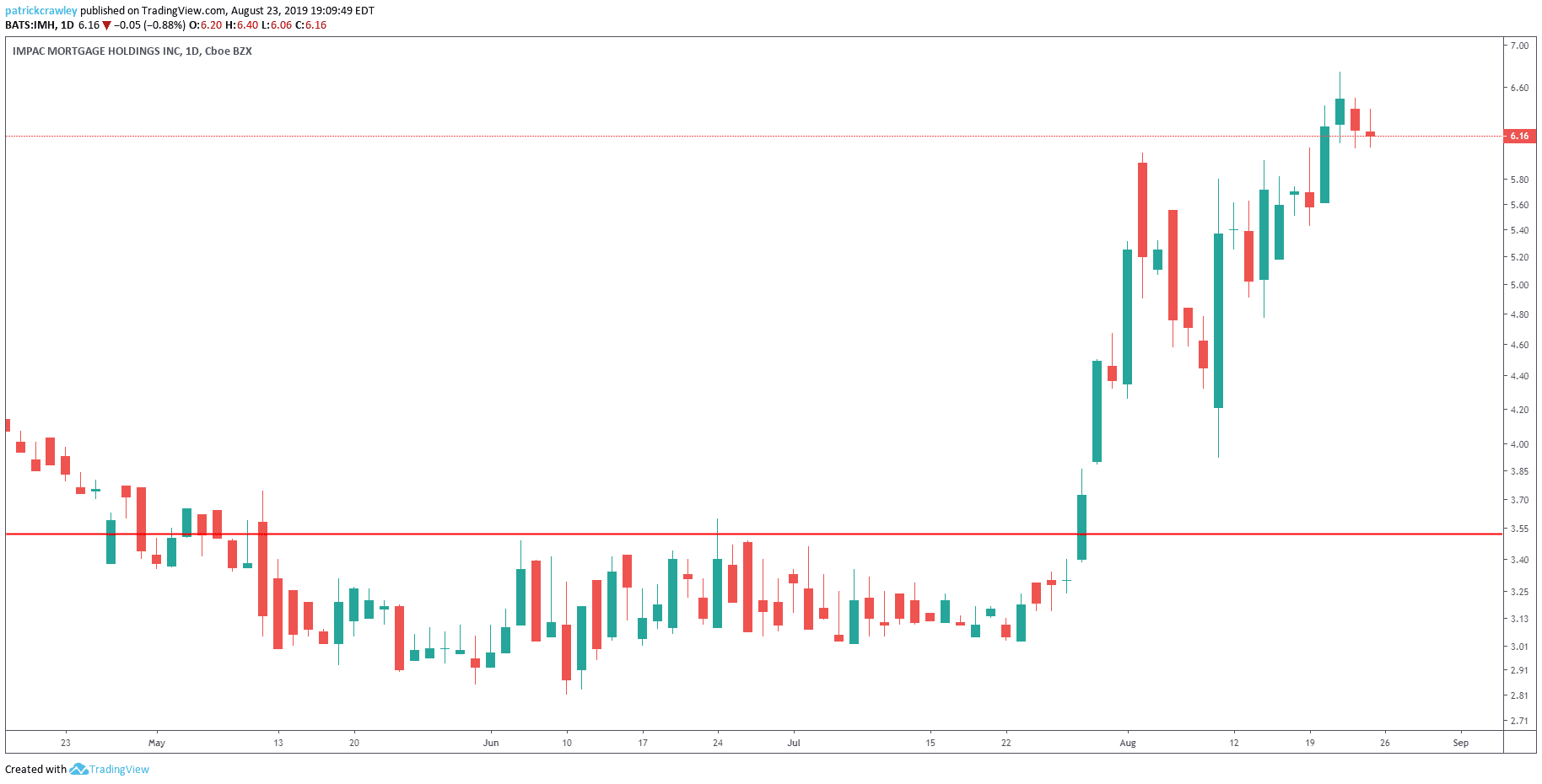

Breakout trading is about identifying important levels of support and resistance and then entering into trades whenever the price breaks from these levels. This strategy takes advantage of significant changes in price.

Source from trading view

3. Scalping

The process involves performing multiple daily trading sessions, trying to make small gains through short-term price changes.

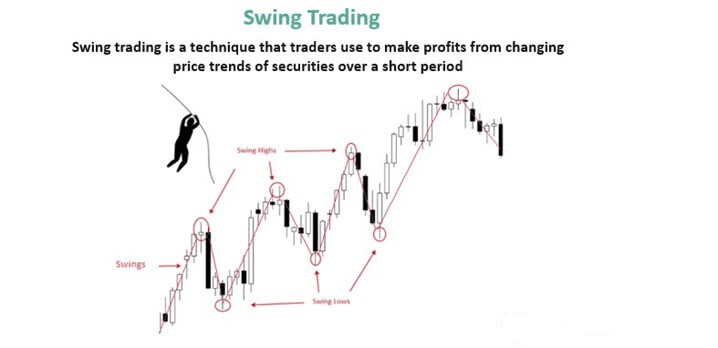

4. Swing Trading

The practice of holding the positions for days or even weeks in order to profit on medium-term price movements.

The Importance of Risk Management

Whatever level of experience you grow, Forex trading always carries inherent risk. Using effective risk management techniques could protect your money and guarantee longevity in trading.

1. Setting Stop-Loss Orders

Stop-loss orders close an account when the value is at a certain level and limit the risk of losing.

2. Utilizing Take-Profit Orders

Buy-and-hold orders secure profits when a trade is closed once the price has reached a certain price target.

3. Diversification

The ability to diversify your portfolio by incorporating different currencies and asset classes will help reduce the risk of exposure.

Footnote

Trading in forex is an exciting and lucrative venture that provides huge opportunities for profiting from the world's forex market. By mastering the basic concepts, exploring more advanced strategies, and implementing effective methods of managing risk and strategies, you will be able to embark on an enjoyable trading experience. Keep yourself informed about market trends, adjust to changing conditions, and continuously enhance your trading skills. Enjoy trading!

FAQs

1. How much is the minimum amount needed to be made for Forex trading?

The investment minimum required for Forex trading differs based on the type of account and broker. Some brokerages offer micro accounts starting as low as $50. In contrast, standard accounts might have a minimum requirement of $1,000 or greater.

2. Are Forex trading suitable for novices?

Absolutely, Forex trading is appropriate for novices. However, it takes dedication, knowledge, and the desire to take the time. Beginning traders need to start by using an account on a demo to test prior to moving on into live trading.

3. What amount of hours do I have to devote to Forex trading?

The time needed to complete Forex trading varies based on your preferred type. The traders who are scalpers can spend many hours per day trading, whereas people who are trading swings may study the market for just a couple of hours every week.

4. Can I trade Forex on my mobile device?

Many brokerages offer mobile-friendly trading platforms that permit users to trade Forex using tablets and smartphones. This allows flexibility and ease of use to traders who are on the move.

5. When is the ideal time for trading Forex?

The Forex market is available 24/5; however, certain periods offer greater risk and opportunities for trading. The overlap of trading times, like the New York-London session, generally provides an opportunity to trade in a favorable environment.

Discussion