Forex Trading Strategies with Moving Averages: Utilizing Moving Averages to Identify Trends and Entry/Exit Points

In the fast-paced world of forex trading, it is essential to have effective strategies that help you stay ahead of the game. One such strategy is the use of moving averages, a powerful tool that can assist traders in identifying trends and making well-informed decisions on entry and exit points. In this article, we will delve into the concept of moving averages and how they can be employed to enhance your trading success.

Table Content

1. Understanding Moving Averages

2. Identifying Trends with Moving Averages

3. The Golden Cross and Death Cross

4. Utilizing Moving Averages for Entry/Exit Points

5. Avoiding Whipsaws with Moving Averages

6. Setting Stop-Loss and Take-Profit Levels

7. Back-testing Your Strategies

8. Footnote

9. FAQs

Understanding Moving Averages

Moving averages are statistical indicators that calculate the average price of a currency pair over a specific period. They smooth out price data to identify trends effectively. The two most commonly used types of moving averages are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). While the SMA gives equal weight to all data points, the EMA assigns more weight to recent prices, making it more sensitive to price changes.

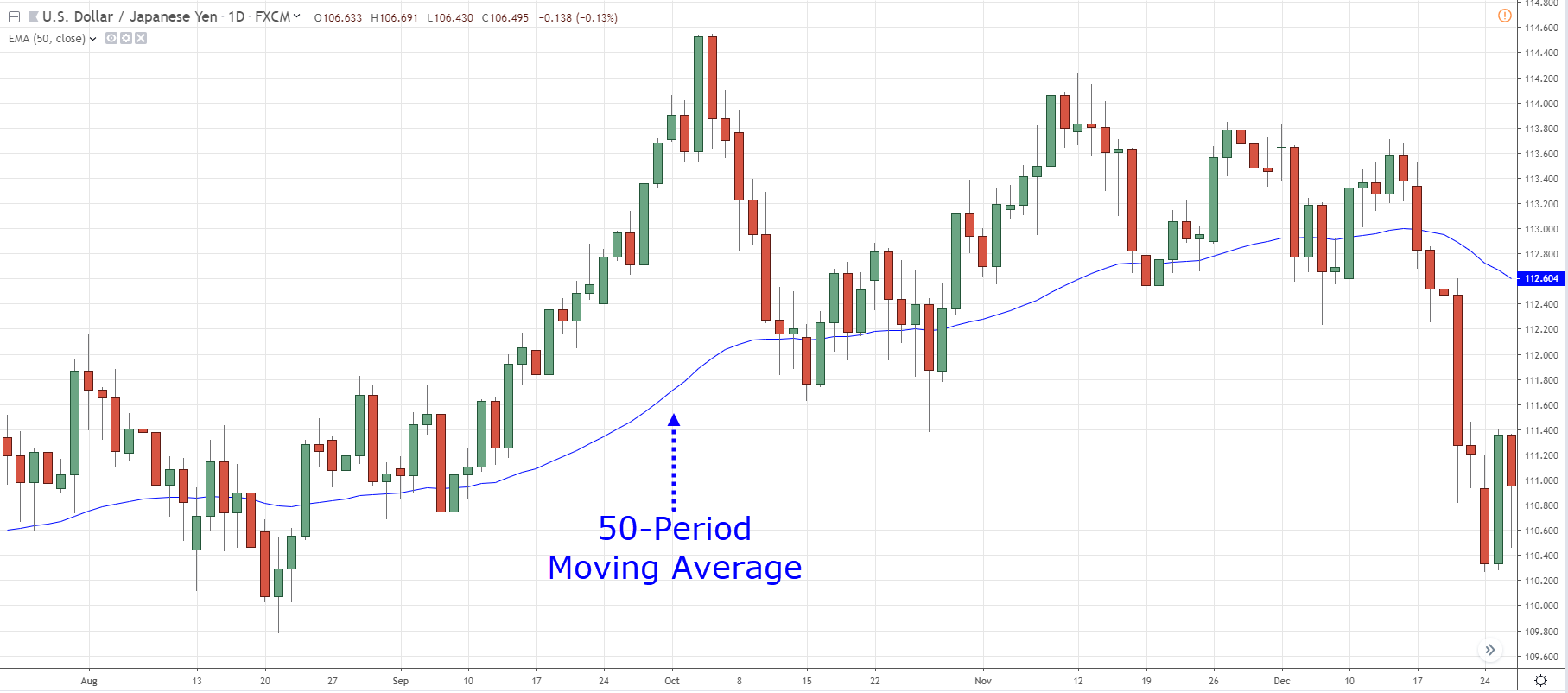

Identifying Trends with Moving Averages

One of the primary applications of moving averages is trend identification. When the price of a currency pair moves above its moving average, it indicates an uptrend. Conversely, when the price falls below the moving average, it signals a downtrend. By observing the direction of the moving average, traders can gain valuable insights into the prevailing market sentiment.

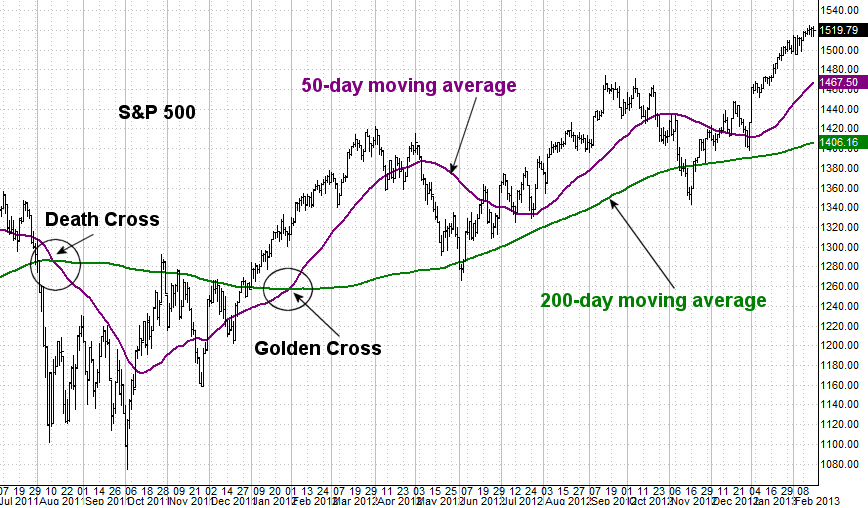

The Golden Cross and Death Cross

The Golden Cross and Death Cross are essential concepts for traders using moving averages. The Golden Cross occurs when the short-term moving average (e.g., 50-day SMA) crosses above the long-term moving average (e.g., 200-day SMA). This crossover suggests a potential bullish trend. On the other hand, the Death Cross happens when the short-term moving average crosses below the long-term moving average, indicating a possible bearish trend.

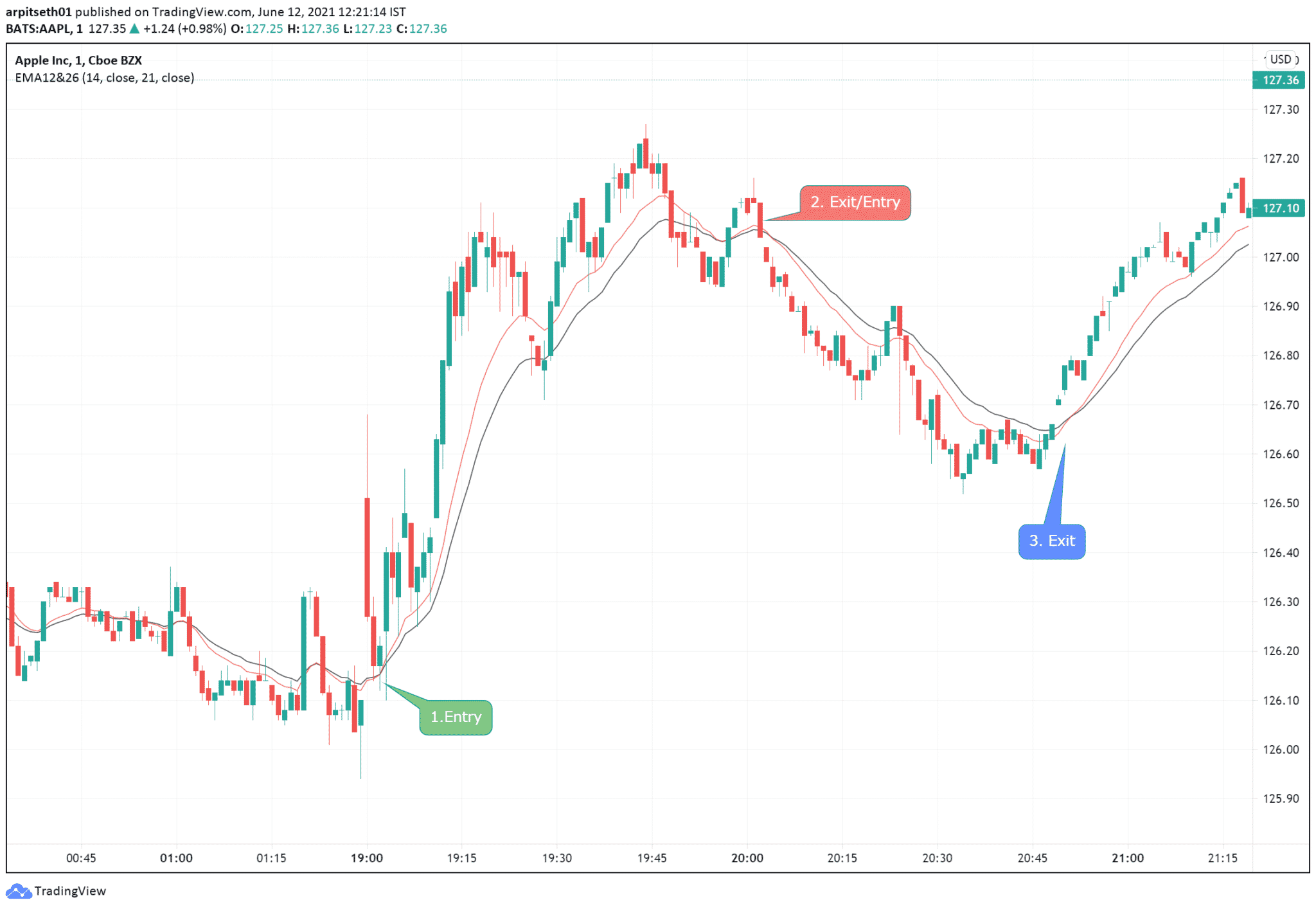

Utilizing Moving Averages for Entry/Exit Points

Moving averages can also act as dynamic support and resistance levels. Traders often use them to identify potential entry and exit points. For instance, when the price retraces to the moving average during an uptrend, it might be an opportune moment to enter a long position. Conversely, during a downtrend, a bounce off the moving average could be an exit signal for a short trade.

Sources form TradingView

Avoiding Whipsaws with Moving Averages

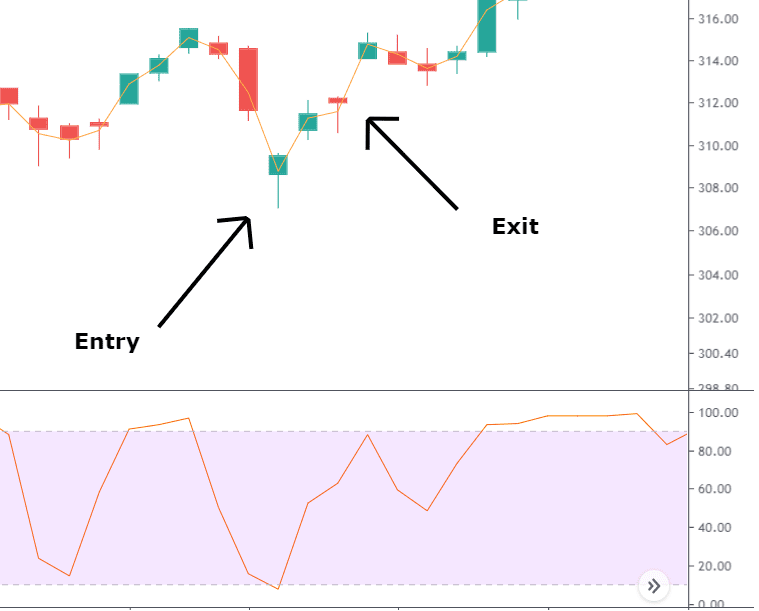

Whipsaws occur when the price moves back and forth across the moving average, leading to false signals. To minimize whipsaw trades, traders can combine moving averages with other technical indicators, such as the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD). These additional tools can help confirm trends before executing trades.

Setting Stop-Loss and Take-Profit Levels

Another vital aspect of forex trading with moving averages is risk management. Traders should always set appropriate stop-loss and take-profit levels to protect their capital and lock in profits. Stop-loss orders can be placed below the moving average during long positions and above it during short positions.

Back-testing Your Strategies

Before implementing any trading strategy, it is essential to back-test it thoroughly. Back-testing involves applying your strategy to historical market data to see how it would have performed in the past. This process can help you identify potential flaws and improve the effectiveness of your moving average-based strategy.

Footnote

In summary, forex trading strategies with moving averages are valuable tools for traders looking to identify trends and make well-timed decisions on entry and exit points. By understanding the different types of moving averages and their applications, traders can gain a competitive edge in the forex market. Remember to combine moving averages with other indicators, practice risk management, and back-test your strategies for optimal results.

FAQs

Q1. How do I choose the right moving average period?

A: Selecting the appropriate moving average period depends on your trading style and the time frame you are trading. Short-term traders may prefer shorter periods (e.g., 20 or 50), while long-term traders may use longer periods (e.g., 100 or 200).

Q2. Can I use moving averages in conjunction with other technical indicators?

A: Yes, combining moving averages with other indicators, such as the MACD or RSI, can enhance the accuracy of your trading signals.

Q3. What is the best way to avoid whipsaw trades?

A: To avoid whipsaw trades, consider using a combination of moving averages and additional technical indicators to confirm trends before executing trades.

Q4. Should I use the SMA or EMA for forex trading?

A: Both SMA and EMA have their merits. The SMA is more straightforward, while the EMA reacts more quickly to recent price changes. Test both types and see which one suits your trading strategy better.

Q5. How often should I update my moving averages?

A: The frequency of updating your moving averages depends on your trading time frame. Daily traders may update them once a day, while long-term traders may do so once a week or once a month.

Discussion