Forex Trading Strategies with Fibonacci: Using Fibonacci Retracement Levels to Identify Potential Turning Points

In the world of Forex trading, successful traders use a wide array of technical tools and strategies to make informed decisions. One such powerful tool is Fibonacci retracement, which helps identify potential turning points in the market. In this article, we will explore how Forex traders can utilize Fibonacci retracement levels to gain a competitive edge in the markets.

Table of Contents

1. What is Fibonacci Retracement?

2. The Golden Ratio and Fibonacci Sequence

3. How to Use Fibonacci Retracement Levels

4. Applying Fibonacci Retracement in Forex Trading

5. Combining Fibonacci with Other Technical Indicators

6. Fibonacci Extensions: Taking Profits to the Next Level

7. Using Fibonacci Time Zones to Predict Market Reversals

8. Fibonacci Fans: Identifying Trendlines with Precision

9. Identifying Price Targets with Fibonacci

10. Common Mistakes to Avoid When Using Fibonacci

11. Advantages and Limitations of Fibonacci Retracement

12. Fibonacci in Action: Real-Life Trading Examples

13. Fibonacci Trading Strategies for Day Traders

14. Swing Trading with Fibonacci Retracement

15. Long-Term Position Trading using Fibonacci Levels

16. Fibonacci and Risk Management in Forex

17. Fibonacci in Conjunction with Candlestick Patterns

18. Psychological Aspects of Fibonacci Trading

19. How to Build a Profitable Forex Trading System with Fibonacci

20. Analyzing Trends and Reversals with Fibonacci

21. The Future of Fibonacci in Forex Trading

22. Frequently Asked Questions (FAQs)

23. Footnote

What is Fibonacci Retracement?

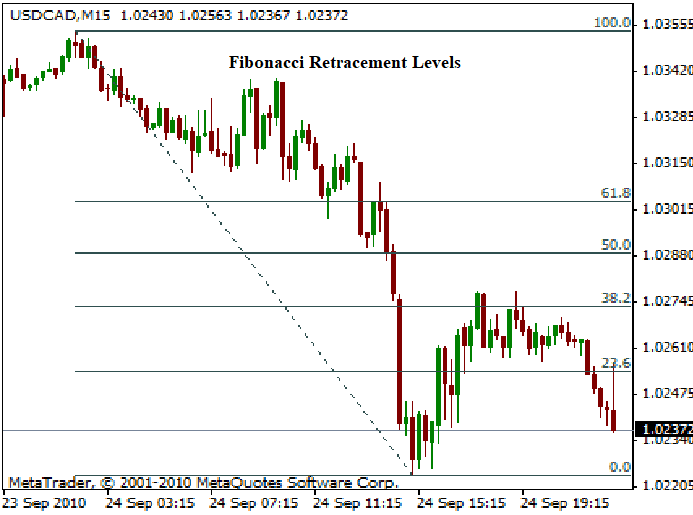

Fibonacci retracement is a mathematical tool based on the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones (e.g., 0, 1, 1, 2, 3, 5, 8, 13, ...). Traders use these ratios to identify potential support and resistance levels in the market.

The Golden Ratio and Fibonacci Sequence

The Golden Ratio, approximately 1.618, is a significant number in the Fibonacci sequence. It has unique mathematical properties that have fascinated mathematicians and traders alike. We will explore its relevance in Forex trading.

How to Use Fibonacci Retracement Levels

Learn how to apply Fibonacci retracement levels effectively in your technical analysis. We will delve into the process of drawing Fibonacci retracement levels on price charts and interpreting their significance.

Applying Fibonacci Retracement in Forex Trading

Discover real-life examples of how professional traders incorporate Fibonacci retracement in their trading strategies to time their entries and exits more accurately.

Combining Fibonacci with Other Technical Indicators

Fibonacci retracement works exceptionally well when used in conjunction with other technical indicators. We will explore how to combine these tools to increase the probability of successful trades.

Fibonacci Extensions: Taking Profits to the Next Level

Fibonacci extensions are an advanced tool used to project potential price targets beyond the standard retracement levels. We will discuss how to utilize Fibonacci extensions to optimize profit-taking strategies.

Using Fibonacci Time Zones to Predict Market Reversals

Fibonacci time zones are another fascinating aspect of this tool. Discover how traders use them to forecast potential market reversals based on time intervals.

Fibonacci Fans: Identifying Trendlines with Precision

Fibonacci fans are powerful tools for identifying trendlines with precision. Learn how to draw Fibonacci fans and utilize them to identify key trend reversal points.

Identifying Price Targets with Fibonacci

Explore how to identify potential price targets in your trades using Fibonacci retracement and extension levels.

Common Mistakes to Avoid When Using Fibonacci

While Fibonacci retracement is a valuable tool, it's essential to avoid common pitfalls and errors that traders often make. We will discuss these mistakes and how to steer clear of them.

Advantages and Limitations of Fibonacci Retracement

No tool is perfect, and Fibonacci retracement is no exception. Discover its advantages and limitations to use it more effectively in your trading.

Fibonacci in Action: Real-Life Trading Examples

See how professional traders have successfully applied Fibonacci retracement in their real-life trading scenarios. Learn from their experiences and strategies.

Fibonacci Trading Strategies for Day Traders

Day traders have unique needs when it comes to using Fibonacci retracement. We will explore tailored strategies for day trading using this tool.

Swing Trading with Fibonacci Retracement

Swing traders can benefit greatly from Fibonacci retracement. We will discuss how to use it effectively in swing trading strategies.

Long-Term Position Trading using Fibonacci Levels

Long-term position traders have a different approach, and Fibonacci retracement can be an invaluable ally. Learn how to use this tool in long-term trading strategies.

Fibonacci and Risk Management in Forex

Risk management is crucial in Forex trading. Discover how Fibonacci retracement can help you manage risk and protect your capital.

Fibonacci in Conjunction with Candlestick Patterns

Candlestick patterns provide valuable insights into market sentiment. We will explore how to combine these patterns with Fibonacci retracement for more reliable trade setups.

Psychological Aspects of Fibonacci Trading

Explore the psychological aspects of trading with Fibonacci retracement. Learn how to stay disciplined and control emotions during trading.

How to Build a Profitable Forex Trading System with Fibonacci

Building a robust trading system is essential for consistent profits. We will guide you through incorporating Fibonacci retracement into your trading system effectively.

Analyzing Trends and Reversals with Fibonacci

Learn how to analyze trends and potential reversals using Fibonacci retracement, allowing you to stay ahead of market movements.

The Future of Fibonacci in Forex Trading

As technology advances, the use of Fibonacci retracement in Forex trading is evolving. We will discuss the future prospects of this tool and its relevance in the ever-changing markets.

Frequently Asked Questions (FAQs)

Q1: What makes Fibonacci retracement an essential tool for Forex traders?

Ans: Fibonacci retracement helps identify key support and resistance levels, assisting traders in making informed decisions.

Q2: Can Fibonacci retracement be applied to different timeframes?

Ans: Yes, Fibonacci retracement can be used on various timeframes, from intraday charts to long-term charts.

Q3: Is Fibonacci retracement suitable for all types of financial instruments?

Ans: Fibonacci retracement can be applied to various financial instruments, including Forex pairs, stocks, commodities, and cryptocurrencies.

Q4: How accurate is Fibonacci retracement in predicting market reversals?

Ans: While not infallible, Fibonacci retracement can provide valuable insights into potential market turning points.

Q5: Should Fibonacci retracement be used in isolation?

Ans: It's best to combine Fibonacci retracement with other technical indicators for more reliable trading signals.

Q6: How do I draw Fibonacci retracement levels on my trading platform?

Ans: Most trading platforms offer tools to draw Fibonacci retracement levels easily. Check your platform's user guide for instructions.

Q7: Can I automate Fibonacci retracement on my trading platform?

Ans: Some trading platforms offer automated Fibonacci retracement tools, while others may require manual drawing.

Q8: Does Fibonacci retracement work in all market conditions?

Ans: Fibonacci retracement can be effective in trending and ranging markets, but its performance may vary depending on the conditions.

Q9: How do I identify the most relevant Fibonacci retracement levels?

Ans: Focus on significant price swings and major highs and lows to identify the most relevant retracement levels.

Q10: Can Fibonacci retracement be used with other chart patterns?

Ans: Yes, Fibonacci retracement can complement chart patterns like head and shoulders, double tops, and triangles.

Footnote

Fibonacci retracement is a potent tool that enhances a trader's ability to analyze the markets and make strategic decisions. By combining this tool with other technical indicators and trading strategies, Forex traders can improve their success rates and gain a competitive edge in the dynamic world of currency trading. As you embark on your trading journey, remember to stay disciplined, manage your risk, and continuously learn and adapt your strategies for long-term success.

Discussion