Forex Trading Strategies for Using the Rising Wedge Pattern: Techniques for Trading with the Rising Wedge Chart Pattern

The foreign exchange (forex) market is known for its dynamic nature and the variety of trading strategies it offers to traders. One such strategy involves the use of chart patterns, which are visual representations of price movements that can help traders identify potential market trends and reversals. The rising wedge pattern is one such chart pattern that traders often use to make informed trading decisions. In this article, we'll explore the rising wedge pattern, its characteristics, and effective trading techniques that can be employed when trading forex using this pattern.

Table Content

I. Understanding the Rising Wedge Pattern

II. Characteristics of a Rising Wedge Pattern

1. Slope

2. Convergence

3. Duration

4. Volume

5. Breakout

III. Trading Techniques for the Rising Wedge Pattern

1. Identifying the Pattern

2.Confirmation with Indicators

3. Entry and Stop-Loss

4. Target Price

5. Volume Analysis

6. Multiple Timeframes

IV. FAQs about Rising Wedge Pattern

V. Footnote

Understanding the Rising Wedge Pattern:

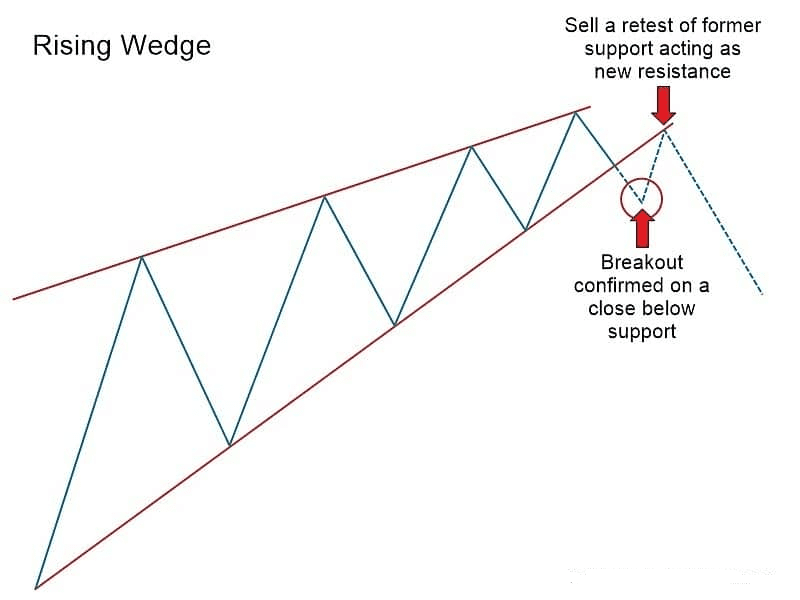

The rising wedge pattern is a technical analysis chart pattern that signals a potential reversal in the price trend of a forex pair. It is considered a bearish pattern, indicating that the price is likely to move downward after the pattern completes. The pattern is formed when the price forms higher highs and higher lows within two converging trendlines. The upper trendline, which represents the highs, has a steeper slope than the lower trendline, which represents the lows.

Characteristics of a Rising Wedge Pattern:

1. Slope: The upper trendline has a steeper slope compared to the lower trendline.

2. Convergence: Both trendlines converge, forming a wedge-like shape.

3. Duration: The pattern typically develops over a period of several weeks to a few months.

4. Volume: Volume tends to decrease as the pattern forms, indicating diminishing enthusiasm among buyers.

5. Breakout: The price usually breaks out below the lower trendline, confirming the pattern's completion.

Trading Techniques for the Rising Wedge Pattern:

Trading forex using the rising wedge pattern requires careful analysis and strategic execution. Here are some effective techniques that traders can consider:

1. Identifying the Pattern: The first step is to accurately identify the rising wedge pattern on the forex chart. Traders should draw trendlines along the highs and lows to visualize the converging pattern. This can be done using charting software or platforms.

2.Confirmation with Indicators: Traders can use technical indicators to confirm the potential reversal signaled by the rising wedge pattern. Indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) can help identify overbought conditions and bearish momentum, respectively.

3. Entry and Stop-Loss: To enter a trade, traders often wait for the price to break below the lower trendline. This is considered confirmation of the pattern's completion. A stop-loss order can be placed slightly above the upper trendline to manage risk in case the price does not follow the anticipated direction.

4. Target Price: The projected target price for the trade can be estimated by measuring the height of the back of the wedge (starting from the initial breakout point) and subtracting it from the breakout point. This provides an approximate target where the price might reach after the pattern completion.

5. Volume Analysis: Monitoring trading volume is crucial when trading the rising wedge pattern. A decrease in volume as the pattern forms suggests weakening buying interest and supports the bearish bias of the pattern.

6. Multiple Timeframes: It's beneficial to analyze the rising wedge pattern across multiple timeframes. A pattern that is visible on both shorter and longer timeframes carries more significance and increases the probability of a successful trade.

FAQs about Rising Wedge Pattern:

Q1: Can the rising wedge pattern also be bullish?

A: While the rising wedge is typically a bearish pattern, there are instances where it can act as a bullish continuation pattern. However, in the context of forex trading, it is predominantly considered bearish.

Q2: Is the rising wedge pattern suitable for day trading?

A: The rising wedge pattern is more suitable for swing trading due to its formation over a longer period. Day traders might find it challenging to capture the full potential of the pattern's move within a single trading session.

Q3: What other patterns should traders be aware of?

A: Traders should also familiarize themselves with other chart patterns such as the falling wedge, head and shoulders, double tops, and double bottoms, as they can provide valuable insights into market trends.

Q4: Do all breakout signals lead to profitable trades?

A: Breakout signals, including those from the rising wedge pattern, are not foolproof. Risk management, proper analysis, and confirming indicators are essential to increase the probability of successful trades.

Q5: Can the rising wedge pattern be used in conjunction with other strategies?

A: Absolutely. Traders often combine the rising wedge pattern with other technical analysis tools, such as Fibonacci retracements or support/resistance levels, to strengthen their trading decisions.

Footnote:

The rising wedge pattern is a valuable tool in a forex trader's arsenal, offering insights into potential market reversals. By understanding its characteristics and employing effective trading techniques, traders can make informed decisions when entering and exiting trades based on this pattern. As with any trading strategy, risk management and continuous learning remain essential components for success in the dynamic world of forex trading.

Discussion