Forex trading strategies for using the Moving Average Crossover: Techniques for trading with moving average crossover signals.

In the fast-paced world of forex trading, success often hinges upon the ability to identify trends and capitalize on market movements. One popular and effective tool that traders employ for this purpose is the Moving Average Crossover (MAC) strategy. This technique utilizes the intersection of two moving averages to generate buy and sell signals, aiding traders in making informed decisions. In this article, we will delve into the intricacies of the Moving Average Crossover strategy, exploring its various techniques, advantages, and potential pitfalls.

Table Content

I. Understanding Moving Averages and the Crossover Strategy

II. Techniques for Trading with Moving Average Crossover Signals

1. The Golden Cross and Death Cross Strategy

2. Dual Moving Average Strategy

3. Multiple Moving Average Strategy

III. Advantages of the Moving Average Crossover Strategy

1. Simplicity and Accessibility

2. Trend Identification

3. Risk Management

IV. Potential Pitfalls and Considerations

1. Lagging Nature

2. Whipsaw Movements

3. Market Volatility

V. Footnote

Understanding Moving Averages and the Crossover Strategy

Before diving into the strategies, it's important to understand the basic concept of moving averages. A moving average is a technical indicator that smooths out price data by creating a constantly updated average price. It aids in filtering out short-term price fluctuations, revealing the underlying trend of a financial instrument.

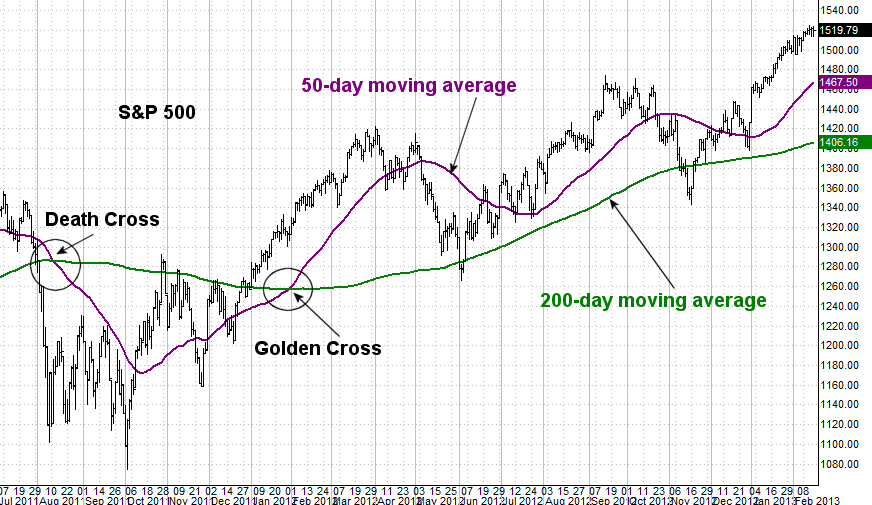

The Moving Average Crossover strategy involves the interaction of two moving averages: a short-term moving average (e.g., 50-day) and a long-term moving average (e.g., 200-day). When these two moving averages intersect, it generates trading signals that traders interpret to make their trading decisions.

Techniques for Trading with Moving Average Crossover Signals

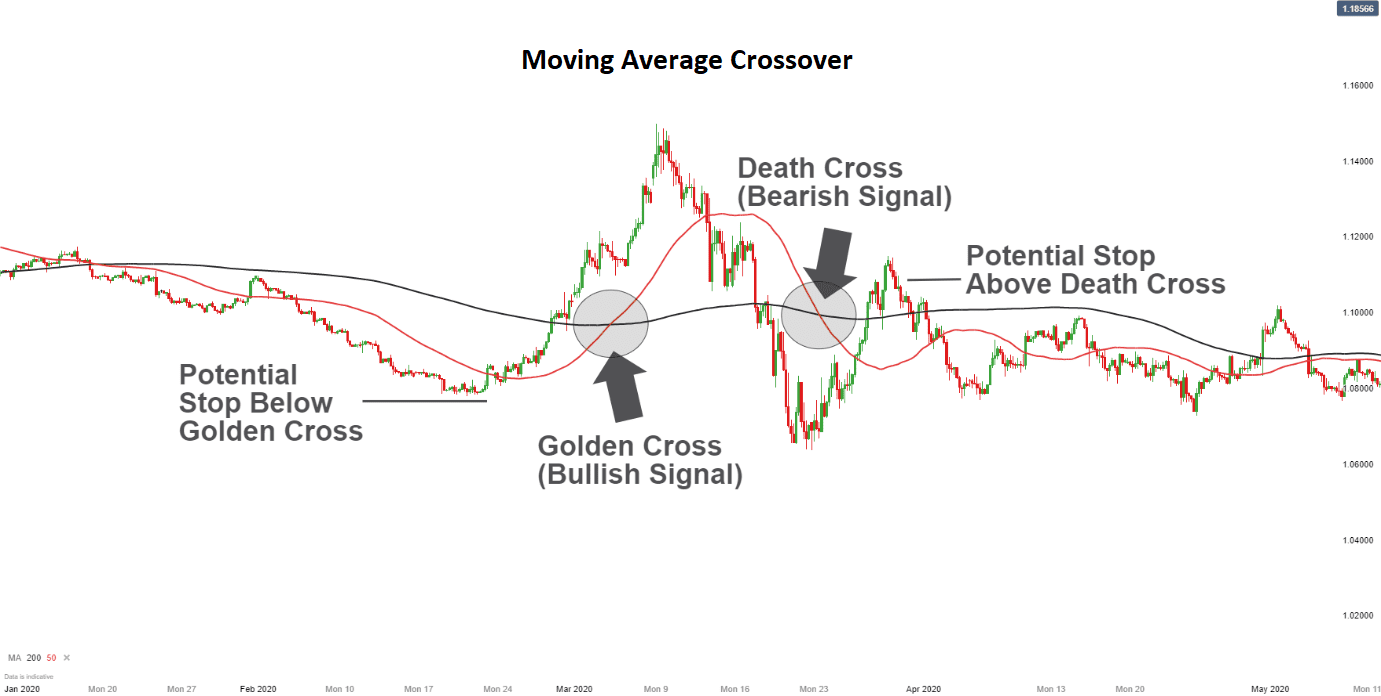

1. The Golden Cross and Death Cross Strategy: The most widely recognized signals within the Moving Average Crossover strategy are the "Golden Cross" and the "Death Cross." The Golden Cross occurs when the short-term moving average crosses above the long-term moving average. This signifies a potential bullish trend reversal or the continuation of an existing uptrend, and traders often see it as a buy signal.

Conversely, the Death Cross materializes when the short-term moving average crosses below the long-term moving average. This signals a possible bearish trend reversal or continuation of a downtrend, prompting traders to consider it a sell signal.

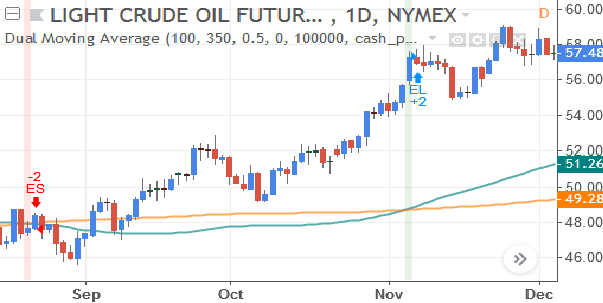

2. Dual Moving Average Strategy: Another approach is the Dual Moving Average strategy, which focuses on two moving averages of different periods. Traders watch for crossovers between these two moving averages to determine entry and exit points. When the short-term moving average crosses above the long-term moving average, traders may consider it a signal to enter a long position. Conversely, if the short-term moving average crosses below the long-term moving average, it might indicate a signal to exit or even consider a short position.

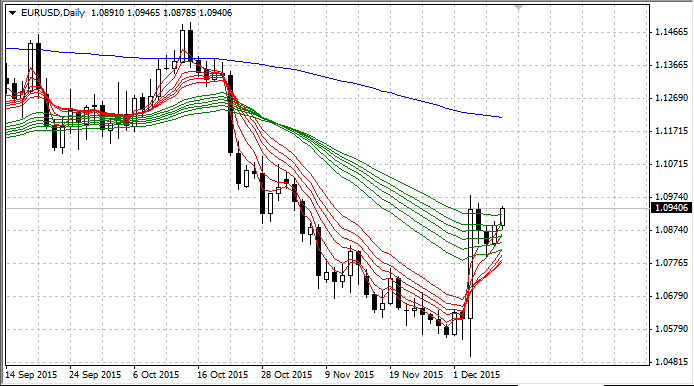

3. Multiple Moving Average Strategy: This technique involves incorporating multiple moving averages with varying periods. The aim is to create a more nuanced view of the trend and its potential strength. Traders observe crossovers between the different moving averages to confirm trend reversals and assess the overall momentum.

Advantages of the Moving Average Crossover Strategy

1. Simplicity and Accessibility: One of the key advantages of the Moving Average Crossover strategy is its simplicity. Traders of all experience levels can grasp the concept and apply it to their trading activities. This accessibility makes it an appealing choice for beginners entering the world of forex trading.

2. Trend Identification: Moving averages help traders identify trends by smoothing out the noise in price movements. The crossover signals serve as valuable indicators of potential trend changes or continuations, aiding traders in making informed decisions.

3. Risk Management: By employing moving average crossovers, traders can establish clear entry and exit points. This aids in defining risk levels and setting up stop-loss and take-profit orders, essential components of risk management in forex trading.

Potential Pitfalls and Considerations

1. Lagging Nature: One notable drawback of moving averages is their inherent lagging nature. They may not provide real-time information about sudden price movements or rapid trend changes. Traders need to be aware of this lag and use other indicators to complement their analysis.

2. Whipsaw Movements: Whipsaw movements refer to instances where the price repeatedly crosses back and forth around a moving average, generating false signals. These false signals can result in losses and frustrate traders who rely solely on moving average crossovers.

3. Market Volatility: The effectiveness of the Moving Average Crossover strategy can vary based on market conditions. During periods of high volatility, crossover signals might not be as reliable, as they could be triggered by short-lived price spikes rather than significant trend shifts.

Footnote

The Moving Average Crossover strategy is a powerful tool in a forex trader's arsenal, enabling them to identify trends, establish entry and exit points, and manage risk effectively. While it offers numerous advantages, such as simplicity and trend identification, traders must also be aware of its limitations, such as lagging signals and vulnerability to market volatility.

As with any trading strategy, the Moving Average Crossover technique should not be used in isolation. Combining it with other technical indicators, fundamental analysis, and a comprehensive understanding of market dynamics can enhance its accuracy and reliability. Moreover, traders should practice prudent risk management and continually refine their approach through research and experience.

In summary, the Moving Average Crossover strategy, when applied thoughtfully and in conjunction with other tools, can provide traders with valuable insights into the forex market's trends and movements. By mastering this technique and adapting it to changing market conditions, traders can potentially increase their chances of making successful trading decisions.

Discussion