Forex trading strategies for using the Inverse Head and Shoulders pattern: Approaches for trading with the Inverse Head and Shoulders chart pattern.

In the dynamic world of forex trading, understanding chart patterns can significantly enhance a trader's ability to identify potential price reversals and trends. One such powerful chart pattern is the Inverse Head and Shoulders (IHS). This pattern is revered by traders for its ability to predict trend reversals and provide valuable entry and exit points in the market. In this article, we will delve into the intricacies of the Inverse Head and Shoulders pattern and explore various approaches to effectively trade it.

Table Content

I. Understanding the Inverse Head and Shoulders Pattern

II. Approaches for Trading with the Inverse Head and Shoulders Pattern

1. Pattern Confirmation

2. Entry Points and Stop Loss Placement

3. Measuring Targets

4. Volume Analysis

5. Retest of the Neckline

6. Combining with Other Indicators

7. Timeframes and Patience

8. Risk Management

III. Footnote

Understanding the Inverse Head and Shoulders Pattern

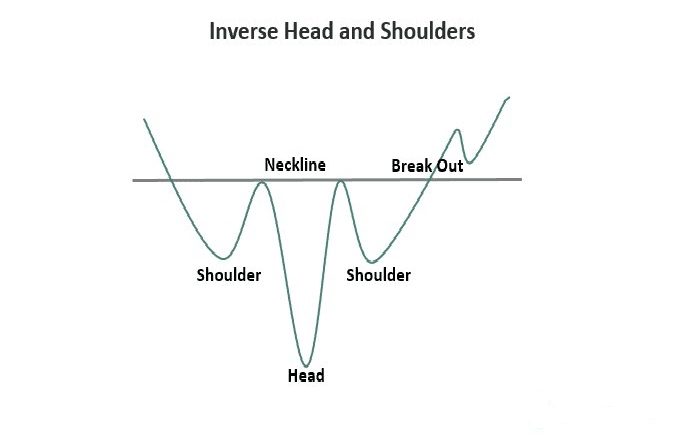

The Inverse Head and Shoulders pattern is a reversal pattern that typically forms after a downtrend. It is composed of three distinct parts: the left shoulder, the head, and the right shoulder. The left shoulder occurs as a result of a price decline, followed by a short-lived rally. The head is formed by a more profound decline, often accompanied by higher selling pressure. Finally, the right shoulder is marked by a rally in price, usually not reaching the same height as the head, followed by a decline that is not as deep as the head's decline.

The significance of the Inverse Head and Shoulders pattern lies in its indication of a potential trend reversal from bearish to bullish. The formation signifies that selling pressure is waning, and buyers are gaining control, thereby presenting traders with an opportunity to enter the market at an advantageous point.

Approaches for Trading with the Inverse Head and Shoulders Pattern

1. Pattern Confirmation: One of the most crucial aspects of trading the Inverse Head and Shoulders pattern is waiting for confirmation. Traders often make the mistake of jumping the gun and entering trades prematurely. Confirmation involves waiting for the pattern to fully form, usually marked by the breakout of the neckline—a level that connects the highs of the two shoulders. This breakout is accompanied by a surge in volume, signaling a strong shift in market sentiment.

2. Entry Points and Stop Loss Placement: Once the breakout has occurred and the pattern is confirmed, traders can consider their entry points. Many traders choose to enter the trade slightly above the neckline to ensure that the breakout is legitimate. As for stop loss placement, it's common practice to set it just below the neckline. This level acts as a safety net in case the price retraces after the breakout.

3. Measuring Targets: To estimate the potential price movement after the breakout, traders often use a measuring technique. This involves measuring the distance from the head to the neckline and projecting it upward from the breakout point. However, it's important to note that while this technique provides a rough target, market conditions can vary, and the actual price movement may differ.

4. Volume Analysis: Analyzing volume is a crucial component of trading the Inverse Head and Shoulders pattern. An increase in volume during the breakout adds credibility to the pattern's validity. It indicates that there is substantial interest from traders to push the price higher, further affirming the potential reversal.

5. Retest of the Neckline: After the breakout, it's not uncommon for the price to retest the neckline. This retest can be seen as a second chance for traders who might have missed the initial entry. If the retest holds and the price bounces back up, it reinforces the bullish sentiment and can be seen as an additional entry opportunity.

6. Combining with Other Indicators: While the Inverse Head and Shoulders pattern can be powerful on its own, combining it with other technical indicators can enhance its effectiveness. Traders often use indicators like Moving Averages, Relative Strength Index (RSI), and MACD to confirm the potential reversal.

7. Timeframes and Patience: Different timeframes can yield varying results with the Inverse Head and Shoulders pattern. While the pattern can be spotted on shorter timeframes, it's generally considered more reliable on higher timeframes like the daily or weekly charts. Additionally, patience is key. Not every potential pattern will materialize into a valid reversal. Waiting for the right pattern with strong confirmation is crucial for consistent success.

8. Risk Management: As with any trading strategy, risk management is paramount. Traders should never risk more than a small portion of their trading capital on a single trade. Utilizing proper position sizing and adhering to a risk-reward ratio helps protect traders from substantial losses.

Footnote

The Inverse Head and Shoulders pattern is a potent tool in a forex trader's arsenal. Its ability to predict trend reversals and provide clear entry and exit points can be highly rewarding. However, it's important to remember that no trading strategy is foolproof. Market conditions can change rapidly, and there's always a degree of risk involved in trading. Therefore, it's recommended to practice the pattern on demo accounts and gain a solid understanding before deploying it in live trading. By combining patience, proper risk management, and a thorough understanding of the pattern, traders can harness the potential of the Inverse Head and Shoulders pattern to navigate the complex world of forex trading with increased confidence.

Discussion