Forex Trading Strategies for Using the Harmonic Gartley Pattern: Approaches for Trading with the Harmonic Gartley Pattern

The world of forex trading is intricate and dynamic, characterized by a myriad of strategies and patterns that traders employ to gain an edge in the market. One such strategy that has gained popularity among seasoned traders is the Harmonic Gartley pattern. This pattern, rooted in Fibonacci ratios and geometric patterns, offers traders the opportunity to identify potential reversal points with a high degree of accuracy. In this article, we will delve into the intricacies of the Harmonic Gartley pattern and explore various approaches for effectively integrating it into your forex trading strategy.

Table Content

I. Understanding the Harmonic Gartley Pattern

II. Approaches for Trading with the Harmonic Gartley Pattern

1. Identification and Confirmation

2. Combine with Additional Indicators

3. Wait for Confluence

4. Trade Execution and Risk Management

5. Pattern Variations

6. Back testing and Practice

III. Footnote

Understanding the Harmonic Gartley Pattern:

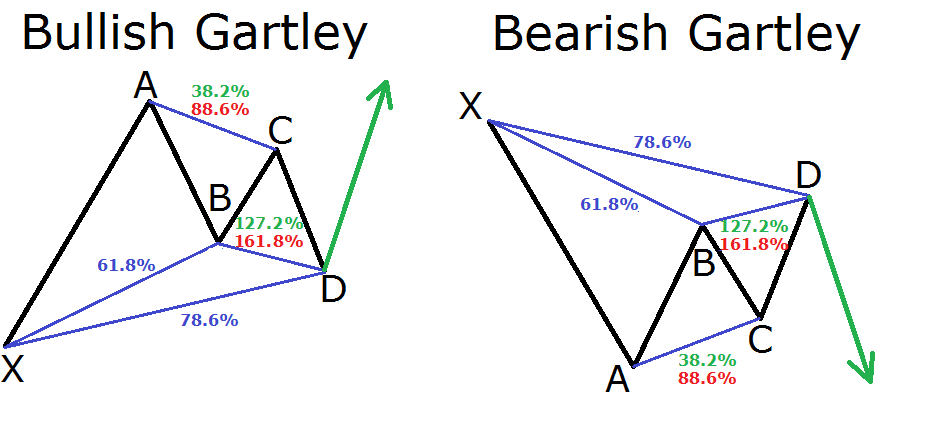

The Harmonic Gartley pattern is a specific formation that derives its name from H.M. Gartley, who introduced the concept in his book "Profits in the Stock Market" in 1935. This pattern is a variation of the classic ABCD pattern, but with additional Fibonacci ratios that enhance its reliability. The pattern consists of a series of price movements, forming a distinct structure that resembles the letter 'M' or 'W' on the price chart.

The key ratios that define the Harmonic Gartley pattern are 0.618 and 0.786, which correspond to the Fibonacci retracement levels. The pattern comprises four legs, each marked by specific price movements and ratios. These are labeled XA, AB, BC, and CD. The pattern is considered valid when the CD leg completes at or near the 0.786 Fibonacci level of the XA leg, creating a potential reversal zone.

Approaches for Trading with the Harmonic Gartley Pattern:

1. Identification and Confirmation: The first step in trading with the Harmonic Gartley pattern is to accurately identify it on the price chart. This involves carefully plotting the XA, AB, BC, and CD legs and confirming that they adhere to the prescribed Fibonacci ratios. This step can be greatly aided by the use of specialized charting tools and software that automatically identify and highlight potential Gartley patterns.

2. Combine with Additional Indicators: While the Harmonic Gartley pattern itself is a potent tool, its effectiveness can be augmented by combining it with other technical indicators. Traders often incorporate momentum indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) to validate the potential reversal points suggested by the Gartley pattern.

3. Wait for Confluence: One of the key principles in successful forex trading is waiting for confluence, where multiple factors align to support a trading decision. When utilizing the Harmonic Gartley pattern, it's advisable to wait for confluence with other technical or fundamental factors. This could include support or resistance levels, trendlines, or key economic announcements that might impact the currency pair being traded.

4. Trade Execution and Risk Management: Once the Harmonic Gartley pattern is identified and confirmed, the next step is to execute the trade. Traders usually place a buy or sell order at the completion of the CD leg, with a stop-loss set just beyond the extreme point of the pattern. The take-profit level can be set at a predetermined price point, often determined by the length of the BC leg projected from the completion of the CD leg. Risk management is crucial, and traders should adhere to proper position sizing to limit potential losses.

5. Pattern Variations: While the traditional Gartley pattern is widely recognized, there are variations that traders can explore. These include the Bullish Gartley (which indicates a potential bullish reversal) and the Bearish Gartley (indicating a potential bearish reversal). Understanding these variations and how they fit into the broader market context can enhance trading decisions.

6. Back testing and Practice: As with any trading strategy, practice makes perfect. Traders should dedicate time to back testing the Harmonic Gartley pattern on historical price data to assess its efficacy. This process can help refine entry and exit points and provide valuable insights into the pattern's performance across different market conditions.

Footnote:

The Harmonic Gartley pattern is a powerful tool in the arsenal of forex traders, offering the potential to identify significant reversal points with a well-defined structure based on Fibonacci ratios. However, it's important to note that no trading strategy is foolproof, and risk management remains paramount. The efficacy of the Harmonic Gartley pattern lies in its combination with other indicators, the patience to wait for confluence, and consistent practice.

As with any trading approach, mastering the Harmonic Gartley pattern requires dedication, continuous learning, and adaptation to changing market dynamics. Traders who integrate this pattern into their trading strategy with a disciplined approach and an understanding of its strengths and limitations can potentially enhance their ability to make informed trading decisions in the ever-evolving forex market.

Discussion