Forex trading strategies for using the Harmonic Deep Crab pattern: Techniques for trading with the Harmonic Deep Crab pattern.

In the realm of forex trading, success lies in the ability to decode market patterns and trends, and effectively capitalize on them. One such advanced trading technique is the Harmonic Deep Crab pattern, a powerful tool that can significantly enhance a trader's accuracy in predicting market movements. In this article, we will delve into the intricacies of the Harmonic Deep Crab pattern, understand its structure, and explore practical strategies for effectively utilizing it in forex trading.

Table Content

I. Understanding the Harmonic Deep Crab Pattern

II. Trading Strategies for the Harmonic Deep Crab Pattern

1. Pattern Identification and Confirmation

2. Entry and Stop-Loss Placement

3. Risk Management and Position Sizing

4. Utilizing Confluence Zones

5. Target Profits and Exit Strategies

6. Combine with Other Strategies

7. Practice and Back testing

III. Footnote

Understanding the Harmonic Deep Crab Pattern

Before diving into trading strategies, let's grasp the essence of the Harmonic Deep Crab pattern. This pattern belongs to the family of harmonic trading patterns, which aim to identify potential reversal points in the market. The Harmonic Deep Crab pattern is a variation of the standard Crab pattern, characterized by its specific Fibonacci ratios and proportions.

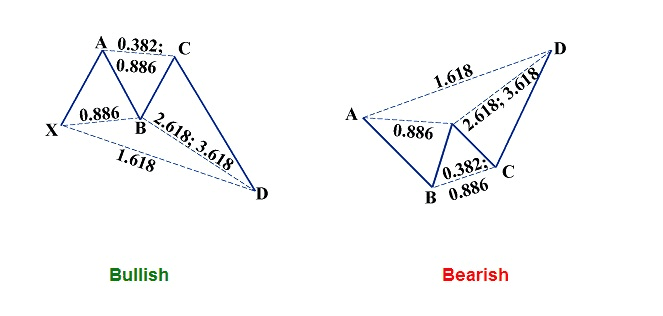

The structure of the Harmonic Deep Crab pattern involves four key price swings, denoted as XA, AB, BC, and CD. These price swings are defined by Fibonacci ratios that help traders identify potential entry and exit points. The Harmonic Deep Crab pattern is recognized by its extended BC leg, usually exceeding the XA leg's length. The critical Fibonacci levels that determine the pattern are 0.382 for the XA retracement, 2.24 for the AB extension, 0.886 for the BC retracement, and 3.618 for the CD extension.

Trading Strategies for the Harmonic Deep Crab Pattern

1. Pattern Identification and Confirmation: The first step in effectively using the Harmonic Deep Crab pattern is accurately identifying it on the price chart. Utilizing reliable charting software and tools can aid in spotting the pattern. Once identified, it's essential to confirm the pattern using other technical indicators like oscillators, trendlines, or support and resistance levels. Confirmation enhances the pattern's reliability and reduces false signals.

2. Entry and Stop-Loss Placement: After confirming the Harmonic Deep Crab pattern, traders need to determine optimal entry points. Entry is usually planned at the completion of the CD leg, anticipating a reversal. Traders can consider entering the trade once the price starts moving in the opposite direction after completing the CD leg. To manage risk, placing a stop-loss slightly beyond the recent swing high/low can protect capital from unexpected market movements.

3. Risk Management and Position Sizing: Effective risk management is crucial in forex trading. Traders should not risk more than a small percentage of their trading capital on a single trade. Position sizing should be calculated based on the stop-loss distance and the trader's risk tolerance. This approach ensures that a series of losses doesn't lead to significant capital depletion.

4. Utilizing Confluence Zones: To increase the probability of a successful trade, traders can look for confluence zones, where multiple technical factors align. These could include support/resistance levels, trendlines, moving averages, or other harmonic patterns forming simultaneously. Confluence zones act as strong validation points for potential reversals.

5. Target Profits and Exit Strategies: Determining where to take profits is as crucial as identifying entry points. Fibonacci extensions provide potential profit targets for the Harmonic Deep Crab pattern. Traders often take partial profits at these levels and allow a portion of the trade to run if the price continues moving favorably. It's wise to use trailing stops or move the stop-loss to breakeven once the trade starts generating profits.

6. Combine with Other Strategies: Successful forex trading often involves combining multiple strategies to gain a holistic perspective. Traders can integrate the Harmonic Deep Crab pattern with other technical or fundamental analysis tools to reinforce their trading decisions. This synergy can result in more accurate predictions and better risk management.

7. Practice and Back testing: Like any trading strategy, mastering the Harmonic Deep Crab pattern requires practice and refinement. Traders can back test the pattern on historical data to gauge its effectiveness. Back testing helps in understanding how the pattern behaves in different market conditions and refines the trader's ability to identify and act on it.

Footnote

In the dynamic world of forex trading, strategies rooted in technical analysis play a pivotal role in achieving consistent profitability. The Harmonic Deep Crab pattern stands as a testament to the power of pattern recognition and Fibonacci ratios in predicting market reversals. Traders who can effectively identify and utilize this pattern gain a distinct advantage in the market.

However, it's important to remember that no trading strategy guarantees success. Prudent risk management, continuous learning, and adapting to changing market conditions are essential components of a successful trader's journey. So, whether you're a novice or an experienced trader, consider incorporating the Harmonic Deep Crab pattern into your arsenal of trading tools, and always be prepared to refine your approach as you navigate the exciting world of forex trading.

Discussion