Forex trading strategies for using the Harmonic Deep Crab 5-0 pattern: Techniques for trading with the Harmonic Deep Crab 5-0 pattern.

In the world of forex trading, success often hinges on the ability to identify and effectively utilize patterns within price charts. One such pattern that has gained popularity among experienced traders is the Harmonic Deep Crab 5-0 pattern. This intricate formation offers traders unique opportunities to capitalize on market movements. In this article, we will delve into the techniques and strategies for trading with the Harmonic Deep Crab 5-0 pattern.

Table Content

I. Understanding the Harmonic Deep Crab 5-0 Pattern

II. Trading Strategies with the Harmonic Deep Crab 5-0 Pattern

1. Pattern Confirmation

2. Confluence of Factors

3. Entry and Stop Loss Placement

4. Risk Management

5. Multiple Timeframes

6. Patience and Discipline

7. Back testing and Practice

III. Footnote

Understanding the Harmonic Deep Crab 5-0 Pattern

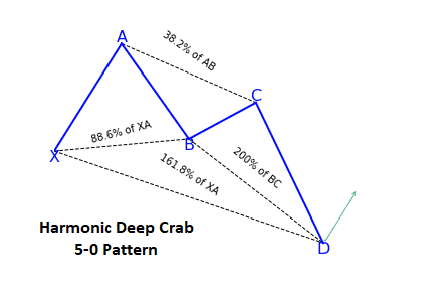

Before diving into the trading strategies, it's essential to grasp the fundamentals of the Harmonic Deep Crab 5-0 pattern. This pattern is a variation of the broader harmonic pattern family, which seeks to predict potential price reversals by identifying specific geometric shapes within price charts.

The Harmonic Deep Crab 5-0 pattern is characterized by the following key points:

- Structure: The pattern consists of five legs (hence the name "5-0") and is defined by distinct Fibonacci levels. It combines elements of the Crab and the 5-0 patterns. The key Fibonacci levels involved are 0%, 38.2%, 61.8%, and 88.6%.

- Point D: This is the completion point of the pattern. It's often located around the 88.6% Fibonacci retracement level of the XA leg. Point D is crucial as it serves as the potential reversal point.

- BC Leg: The BC leg typically retraces between 38.2% and 88.6% of the XA leg. This leg helps confirm the pattern and provides traders with a reference point to anticipate potential price movements.

- CD Leg: This leg extends beyond the XA leg and usually reaches the 2.24% to 3.618% Fibonacci extension of the XA leg. It defines the potential reversal zone where traders look for entry opportunities.

- Stop Loss and Take Profit: Traders typically place their stop loss orders beyond the completion point (Point D) to allow for some market volatility. The take profit level can be set at various Fibonacci extension levels of the CD leg.

Trading Strategies with the Harmonic Deep Crab 5-0 Pattern

Mastering the Harmonic Deep Crab 5-0 pattern requires a combination of technical analysis, risk management, and patience. Here are some effective trading strategies to consider when working with this pattern:

1. Pattern Confirmation

Before placing any trades, it's essential to ensure that the pattern is valid and not a false signal. Wait for clear and distinct price action that confirms the presence of the Harmonic Deep Crab 5-0 pattern. This confirmation includes the proper alignment of Fibonacci levels and the adherence of price movement to the pattern's structure.

2. Confluence of Factors

Increase the probability of successful trades by seeking confluence with other technical indicators. Look for additional signals such as support and resistance levels, trendlines, moving averages, or other harmonic patterns that align with the anticipated reversal point of the Harmonic Deep Crab 5-0 pattern.

3. Entry and Stop Loss Placement

Identify an optimal entry point near the completion point (Point D) of the pattern. This is where the potential reversal is expected to occur. Place a stop loss order beyond Point D to account for possible price fluctuations. The distance of the stop loss should be determined by considering market volatility and risk tolerance.

4. Risk Management

Effective risk management is paramount in forex trading. Never risk more than a small percentage of your trading capital on a single trade. A common rule of thumb is to risk no more than 1-2% of your capital on any given trade. This practice ensures that a series of losing trades doesn't significantly deplete your account balance.

5. Multiple Timeframes

Analyzing the Harmonic Deep Crab 5-0 pattern across multiple timeframes can provide valuable insights. A pattern that aligns on both shorter and longer timeframes carries more weight and is likely to be more reliable. This practice also helps filter out false signals and increases the accuracy of your trades.

6. Patience and Discipline

Exercising patience and discipline is crucial when trading with harmonic patterns. Not every pattern will result in a successful trade, and impulsive trading can lead to losses. Stick to your trading plan, and only execute trades when all the necessary criteria are met.

7. Back testing and Practice

Before implementing the Harmonic Deep Crab 5-0 pattern in a live trading environment, consider back testing the pattern on historical data. This practice allows you to assess the pattern's effectiveness and refine your trading strategy. Additionally, consider starting with a demo account to practice and gain confidence before committing real funds.

Footnote

The Harmonic Deep Crab 5-0 pattern is a powerful tool in the arsenal of forex traders who specialize in technical analysis. By understanding the pattern's structure, confirming its presence, and applying effective trading strategies, traders can potentially capitalize on market reversals with favorable risk-to-reward ratios. However, it's important to remember that no trading strategy is foolproof, and losses are a natural part of trading. Risk management, patience, and continuous learning are key to long-term success when utilizing the Harmonic Deep Crab 5-0 pattern or any other trading approach.

Discussion