Forex trading strategies for using the Harmonic Bullish Shark pattern: Approaches for trading with the Harmonic Bullish Shark pattern.

In the dynamic world of forex trading, success often hinges on a trader's ability to identify and effectively utilize various chart patterns. One such pattern that has gained popularity among experienced traders is the Harmonic Bullish Shark pattern. This unique pattern provides traders with opportunities to enter the market with a well-defined risk-reward ratio. In this article, we will delve into the intricacies of the Harmonic Bullish Shark pattern and explore different approaches to trading it successfully.

Table Content

I. Understanding the Harmonic Bullish Shark Pattern

II. Approaches for Trading with the Harmonic Bullish Shark Pattern

1. Identifying the Pattern

2. Confirmation with Additional Indicators

3. Entry and Stop-Loss Placement

4. Target Levels and Take-Profit Strategies

5. Combining Multiple Timeframes

6. Risk Management and Position Sizing

7. Practice and Back testing

III. Footnote

Understanding the Harmonic Bullish Shark Pattern

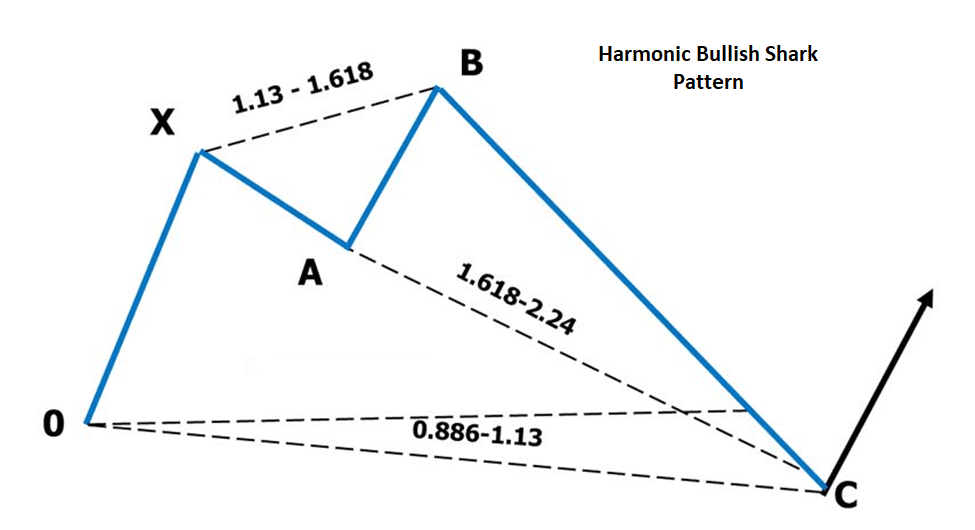

The Harmonic Bullish Shark pattern is a relatively rare but powerful chart formation that falls under the broader category of harmonic price patterns. It is characterized by its distinct shape, which resembles a shark's dorsal fin. The pattern typically occurs after a price has experienced a significant bullish move and indicates a potential reversal or correction in the ongoing trend.

The primary components of the Harmonic Bullish Shark pattern include:

- X to A Leg: The initial leg of the pattern is the X to A leg, which is the first impulse move in the direction of the prevailing trend.

- A to B Leg: This is a retracement of the X to A leg. It generally retraces between 61.8% and 88.6% of the X to A leg.

- B to C Leg: The B to C leg is an extension of the A to B leg and usually retraces around 113% of the A to B leg.

- C to D Leg: The final leg of the pattern, C to D, is an extension of the B to C leg. It typically retraces around 161.8% of the B to C leg and is the area where traders look to enter trades.

Approaches for Trading with the Harmonic Bullish Shark Pattern

Trading the Harmonic Bullish Shark pattern requires a systematic approach that combines technical analysis, risk management, and a keen understanding of market behavior. Here are several strategies that traders can employ to effectively utilize this pattern:

1. Identifying the Pattern

The first step in trading the Harmonic Bullish Shark pattern is to identify it on a price chart. This involves a combination of Fibonacci retracement and extension tools. Once the X to A, A to B, B to C, and C to D legs have been identified, traders can draw trendlines connecting the various points to form the distinct shark-like shape. Automated trading platforms often include tools that help traders locate and draw harmonic patterns accurately.

2. Confirmation with Additional Indicators

While the Harmonic Bullish Shark pattern can provide strong reversal signals on its own, traders often look for confirmation from other technical indicators. Commonly used indicators include the Relative Strength Index (RSI), Moving Averages, and MACD (Moving Average Convergence Divergence). The convergence of multiple indicators indicating a potential reversal can significantly enhance the probability of a successful trade.

3. Entry and Stop-Loss Placement

Entering a trade based on the Harmonic Bullish Shark pattern requires precision. Traders typically enter a long position (buy) when the price reaches the D point, which is the completion of the pattern. Stop-loss orders are often placed slightly below the D point to minimize potential losses if the pattern fails to play out as expected. This placement helps traders define their risk effectively.

4. Target Levels and Take-Profit Strategies

Determining the appropriate target levels is a crucial aspect of trading any pattern. For the Harmonic Bullish Shark pattern, traders often use Fibonacci extensions of the entire X to D leg to identify potential price targets. Common extension levels include 38.2%, 61.8%, and 100%. Implementing a trailing stop or scaling out of positions as the price moves in the desired direction can help traders capture maximum profits while managing risk.

5. Combining Multiple Timeframes

To increase the robustness of their trading decisions, traders often analyze the Harmonic Bullish Shark pattern on multiple timeframes. For instance, if the pattern is identified on the daily chart, traders can zoom in to lower timeframes like the 4-hour or 1-hour chart to fine-tune their entry points. Multiple timeframe analysis helps traders gain a comprehensive view of market dynamics and price trends.

6. Risk Management and Position Sizing

Effective risk management is the backbone of successful trading. Before executing a trade based on the Harmonic Bullish Shark pattern, traders should determine the amount of capital they are willing to risk on the trade. Position sizing should be adjusted accordingly to ensure that even a series of losing trades does not deplete a significant portion of the trading account.

7. Practice and Back testing

As with any trading strategy, practice and back testing are essential for refining one's approach. Traders can use historical price data to identify instances of the Harmonic Bullish Shark pattern and practice their entry and exit strategies without risking real capital. Back testing helps traders gain confidence in their strategy and identify any potential weaknesses before trading it in a live environment.

Footnote

The Harmonic Bullish Shark pattern is a powerful tool in a forex trader's arsenal, offering the potential for well-defined risk-reward ratios and timely trend reversals. By understanding the pattern's components, confirming signals with additional indicators, and employing prudent risk management techniques, traders can enhance their chances of success. However, it's important to remember that no trading strategy is foolproof, and losses are an inherent part of trading. As such, continuous learning, adaptability, and disciplined execution are the cornerstones of a trader's journey toward mastering the art of trading the Harmonic Bullish Shark pattern.

Discussion