Forex trading strategies for using the Harmonic Bullish Deep Crab 5-0 pattern: Approaches for trading with the Harmonic Bullish Deep Crab 5-0 pattern.

In the world of forex trading, traders employ a myriad of technical analysis tools and patterns to gain a competitive edge. One such pattern that has gained popularity among traders is the Harmonic Bullish Deep Crab 5-0 pattern. This intricate pattern provides traders with opportunities to identify potential price reversals and capitalize on profitable trades. In this article, we will delve into the depths of the Harmonic Bullish Deep Crab 5-0 pattern, understand its components, and explore effective trading strategies for its application.

Table Content

I. Understanding the Harmonic Bullish Deep Crab 5-0 Pattern

II. Approaches for Trading with the Harmonic Bullish Deep Crab 5-0 Pattern

1. Identifying the Pattern

2. Confirming with Confluence

3. Wait for Price Confirmation

4. Manage Risk Effectively

5. Use a Multi-Timeframe Approach

6. Combine with Price Action

7. Practice on Demo Accounts

8. Stay Informed and Continuously Learn

III. Footnote

Understanding the Harmonic Bullish Deep Crab 5-0 Pattern

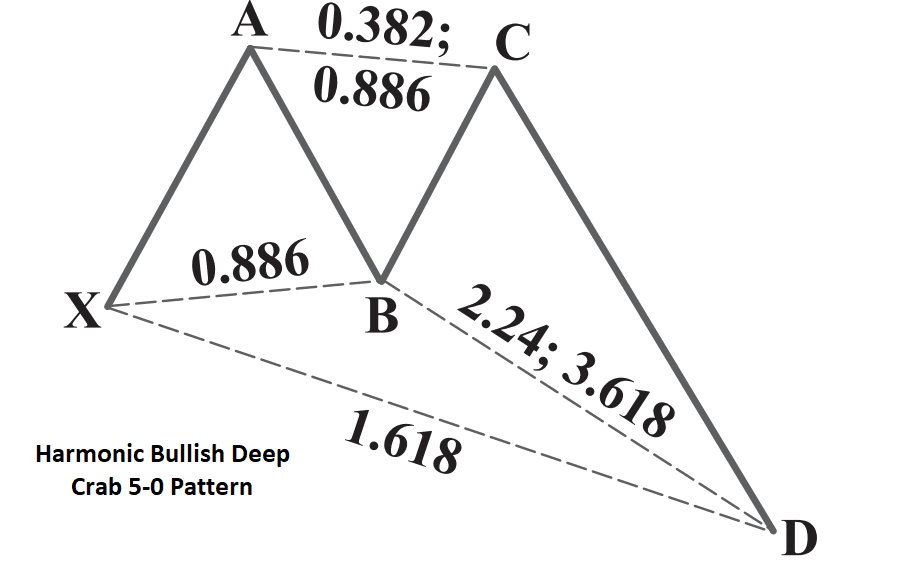

The Harmonic Bullish Deep Crab 5-0 pattern is a complex and advanced harmonic price pattern that combines various Fibonacci retracement and extension levels to identify potential reversal points in the market. It is formed by a sequence of price movements that follow specific ratios, aligning with Fibonacci ratios of 0.786, 1.13, 1.618, and more. The pattern consists of five key points: X, A, B, C, and D.

- Point X: This is the starting point of the pattern and represents a significant high or low in the price movement.

- Point A: This point marks the retracement from X to A and usually retraces to the 0.786 Fibonacci level.

- Point B: Point B is an extension from A and typically reaches the 1.618 Fibonacci level.

- Point C: Point C is the retracement from B to C, often retracing to the 0.382 or 0.886 Fibonacci level.

- Point D: This is the terminal point of the pattern, indicating the completion of the price movement. It aligns with the 0.886 Fibonacci retracement of XA.

Approaches for Trading with the Harmonic Bullish Deep Crab 5-0 Pattern

Trading with the Harmonic Bullish Deep Crab 5-0 pattern requires a comprehensive understanding of its components and a disciplined approach. Here are some effective strategies to consider when trading with this pattern:

1. Identifying the Pattern

The first step is to accurately identify the Harmonic Bullish Deep Crab 5-0 pattern on a price chart. This involves recognizing the sequence of points X, A, B, C, and D, along with the alignment of Fibonacci retracement and extension levels. Traders can use specialized charting software that automatically detects these patterns, making the identification process more efficient.

2. Confirming with Confluence

To enhance the reliability of the pattern, it's advisable to look for confluence with other technical indicators. This could include support and resistance levels, trendlines, moving averages, or other chart patterns. When the Harmonic Bullish Deep Crab 5-0 pattern aligns with other indications of a potential reversal, it adds weight to the trading signal.

3. Wait for Price Confirmation

A common mistake traders make is prematurely entering a trade based on a pattern's projection. Instead, it's prudent to wait for price confirmation. This could involve waiting for the price to close above or below a certain level that validates the pattern. Patience is key, as false signals can result in losses.

4. Manage Risk Effectively

Like any trading strategy, risk management is crucial when trading the Harmonic Bullish Deep Crab 5-0 pattern. Traders should determine their risk tolerance and set appropriate stop-loss orders to limit potential losses. Additionally, position sizing should be calculated based on the trader's capital and risk per trade.

5. Use a Multi-Timeframe Approach

To gain a broader perspective, consider analyzing the pattern across multiple timeframes. A pattern that forms on a higher timeframe, such as the daily or weekly chart, carries more significance than one on a lower timeframe. However, using a lower timeframe for entry and exit decisions can provide more precise entry points.

6. Combine with Price Action

Integrating price action analysis with the Harmonic Bullish Deep Crab 5-0 pattern can lead to powerful trading decisions. Price action patterns, such as bullish engulfing, hammer, or morning star, can act as confirming signals for the anticipated reversal indicated by the harmonic pattern.

7. Practice on Demo Accounts

Before implementing the Harmonic Bullish Deep Crab 5-0 pattern in a live trading environment, it's wise to practice on a demo account. This allows traders to become familiar with the pattern's behavior, refine their entry and exit strategies, and gain confidence in their trading decisions without risking real capital.

8. Stay Informed and Continuously Learn

The forex market is dynamic, and staying informed about economic events, geopolitical developments, and market sentiment is essential. Continuous learning about trading strategies and technical analysis can help traders adapt to changing market conditions and refine their approach over time.

Footnote

The Harmonic Bullish Deep Crab 5-0 pattern is a powerful tool in a forex trader's arsenal, offering the potential to identify high-probability trade setups. However, it's important to approach trading with this pattern with caution and discipline. Successful implementation requires a solid understanding of the pattern's components, confirmation through confluence, and effective risk management. By integrating these strategies into your trading approach and practicing patience, traders can harness the potential of the Harmonic Bullish Deep Crab 5-0 pattern to enhance their trading results in the competitive forex market.

Discussion