Forex trading strategies for using the Harmonic Bullish Cypher 5-0 pattern: Techniques for trading with the Harmonic Bullish Cypher 5-0 pattern.

In the fast-paced world of forex trading, successful traders are constantly on the lookout for patterns that can provide them with a competitive edge. One such pattern that has gained popularity among technical analysts is the Harmonic Bullish Cypher 5-0 pattern. This intricate formation is a fusion of geometry, Fibonacci ratios, and market psychology, offering traders an opportunity to capitalize on potential price reversals. In this article, we will delve into the intricacies of the Harmonic Bullish Cypher 5-0 pattern and explore effective techniques for trading with this powerful tool.

Table Content

I. Understanding the Harmonic Bullish Cypher 5-0 Pattern

II. Techniques for Trading with the Harmonic Bullish Cypher 5-0 Pattern

1. Pattern Recognition and Confirmation

2. Fibonacci Ratios and Confluence

3. Risk Management and Position Sizing

4. Timeframe Analysis

5. Patience and Discipline

6. Back testing and Practice

7. Continuous Learning

II. Footnote

Understanding the Harmonic Bullish Cypher 5-0 Pattern

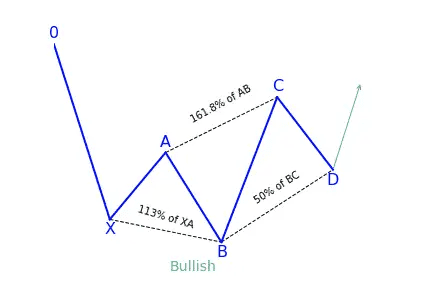

The Harmonic Bullish Cypher 5-0 pattern is a specific price configuration that signifies potential trend reversals in forex markets. It's a blend of Fibonacci retracement and extension levels along with harmonic price formations. This pattern consists of five key points: X, A, B, C, and D. The sequence of these points is crucial in identifying the formation.

- X Point: This marks the beginning of the pattern and represents the initial price move. It's followed by a corrective move, which brings us to point A.

- A Point: This is the end of the XA move and the start of the AB move. It retraces a certain percentage of the initial XA move.

- B Point: After the A point, the market resumes its initial trend, creating the BC move. This move usually surpasses the XA move.

- C Point: The BC move is followed by a correction that leads to the CD move. The C point is where this correction ends, usually at a Fibonacci extension level of the AB move.

- D Point: This is the final point and the completion of the pattern. The CD move ends at a Fibonacci extension level of the XA move, and it typically aligns with the BC move's extension.

The formation is complete when the D point is formed. It is at this stage that traders anticipate a reversal of the previous trend and the emergence of a bullish move.

Techniques for Trading with the Harmonic Bullish Cypher 5-0 Pattern

Trading with the Harmonic Bullish Cypher 5-0 pattern requires a combination of technical skill, disciplined execution, and a thorough understanding of market dynamics. Here are some techniques that traders can consider integrating into their strategies:

1. Pattern Recognition and Confirmation:

Successful trading begins with accurate pattern recognition. To identify the Harmonic Bullish Cypher 5-0 pattern, traders should diligently plot the X, A, B, C, and D points on their price charts. The alignment of these points will give a visual representation of the pattern. However, pattern recognition alone isn't sufficient. Traders should wait for additional confirmation signals before entering a trade. These confirmation signals could include bullish candlestick patterns, trendline breaks, or the convergence of other technical indicators.

2. Fibonacci Ratios and Confluence:

Fibonacci retracement and extension levels play a crucial role in the formation of the Harmonic Bullish Cypher 5-0 pattern. Traders should closely observe how the pattern's points align with these levels. A confluence of Fibonacci ratios at the D point can increase the pattern's reliability. Traders often look for alignment between the CD move's extension level and the BC move's extension level, which strengthens the pattern's potential as a reversal point.

3. Risk Management and Position Sizing:

No trading strategy is complete without effective risk management. Before entering a trade based on the Harmonic Bullish Cypher 5-0 pattern, traders should define their risk tolerance and set appropriate stop-loss orders. Position sizing should be aligned with the trader's overall risk management strategy, ensuring that a single trade does not expose their account to excessive risk.

4. Timeframe Analysis:

The Harmonic Bullish Cypher 5-0 pattern can be identified across various timeframes, from intraday to longer-term charts. Traders should consider the timeframe that aligns with their trading goals and preferences. Short-term traders might focus on intraday patterns for quick profits, while swing traders may prefer patterns on daily or weekly charts for larger price moves.

5. Patience and Discipline:

Patience and discipline are virtues that every trader should possess. It's important not to rush into a trade as soon as a potential pattern is identified. Waiting for confirmation signals, verifying alignment with Fibonacci levels, and considering broader market trends are all part of a disciplined approach to trading.

6. Back testing and Practice:

As with any trading strategy, practice makes perfect. Traders should conduct thorough back testing on historical data to evaluate the effectiveness of the Harmonic Bullish Cypher 5-0 pattern on different currency pairs and timeframes. This practice helps traders gain confidence in the pattern's reliability and understand its limitations.

7. Continuous Learning:

The forex market is dynamic and subject to changing trends and behaviors. Traders should stay updated with market news, economic indicators, and technical analysis techniques. Continuous learning and adaptation are essential for long-term success in trading.

Footnote

The Harmonic Bullish Cypher 5-0 pattern is a potent tool in a forex trader's arsenal, offering the potential to identify trend reversals and capitalize on new bullish trends. By combining technical analysis, Fibonacci ratios, and a deep understanding of market dynamics, traders can increase their chances of success when trading this pattern. However, it's important to remember that no trading strategy is foolproof. Traders should always exercise caution, implement effective risk management practices, and remain adaptable in the face of changing market conditions. With patience, practice, and a commitment to continuous learning, traders can harness the power of the Harmonic Bullish Cypher 5-0 pattern to enhance their trading strategies and achieve their financial goals.

Discussion